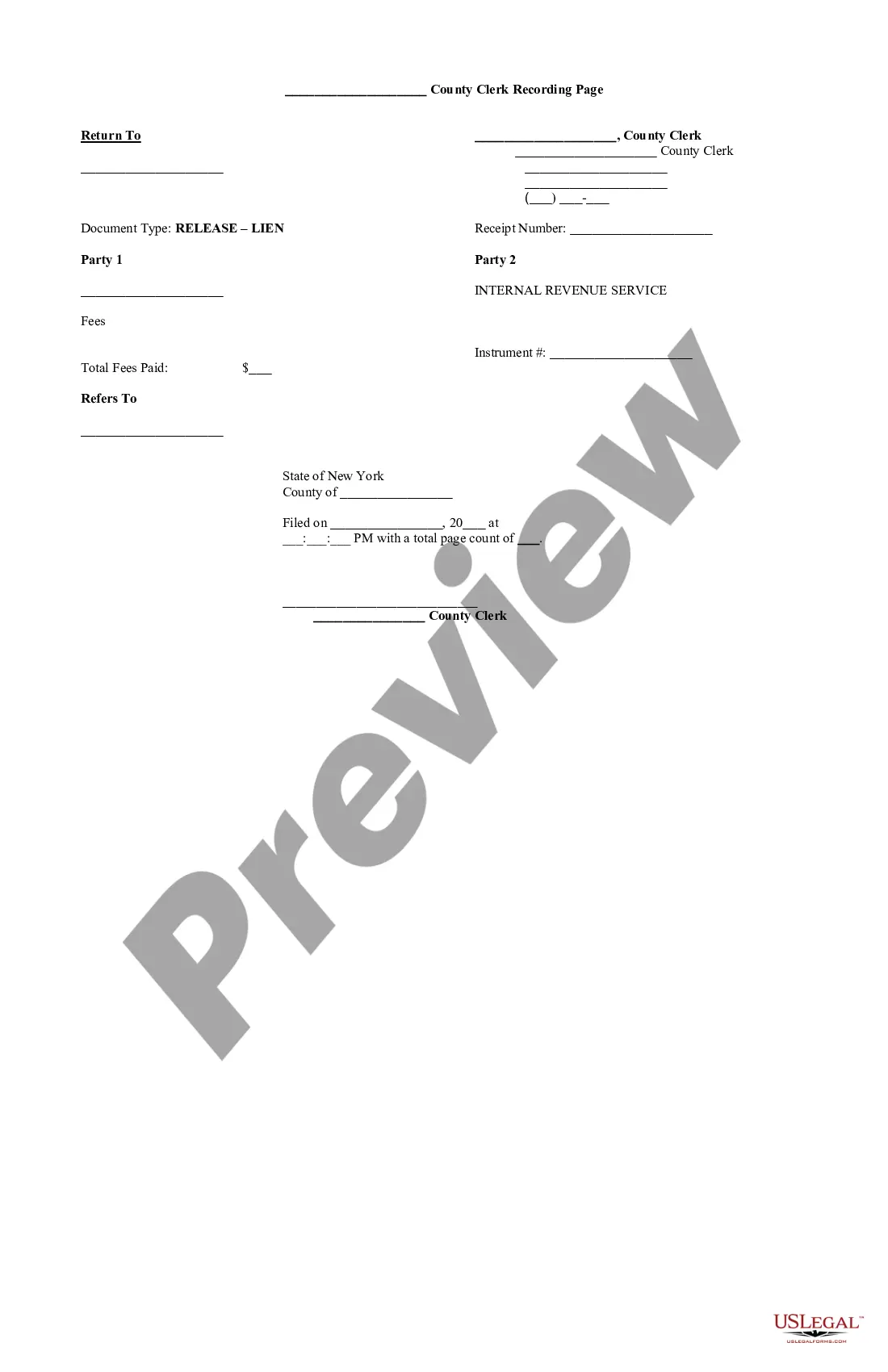

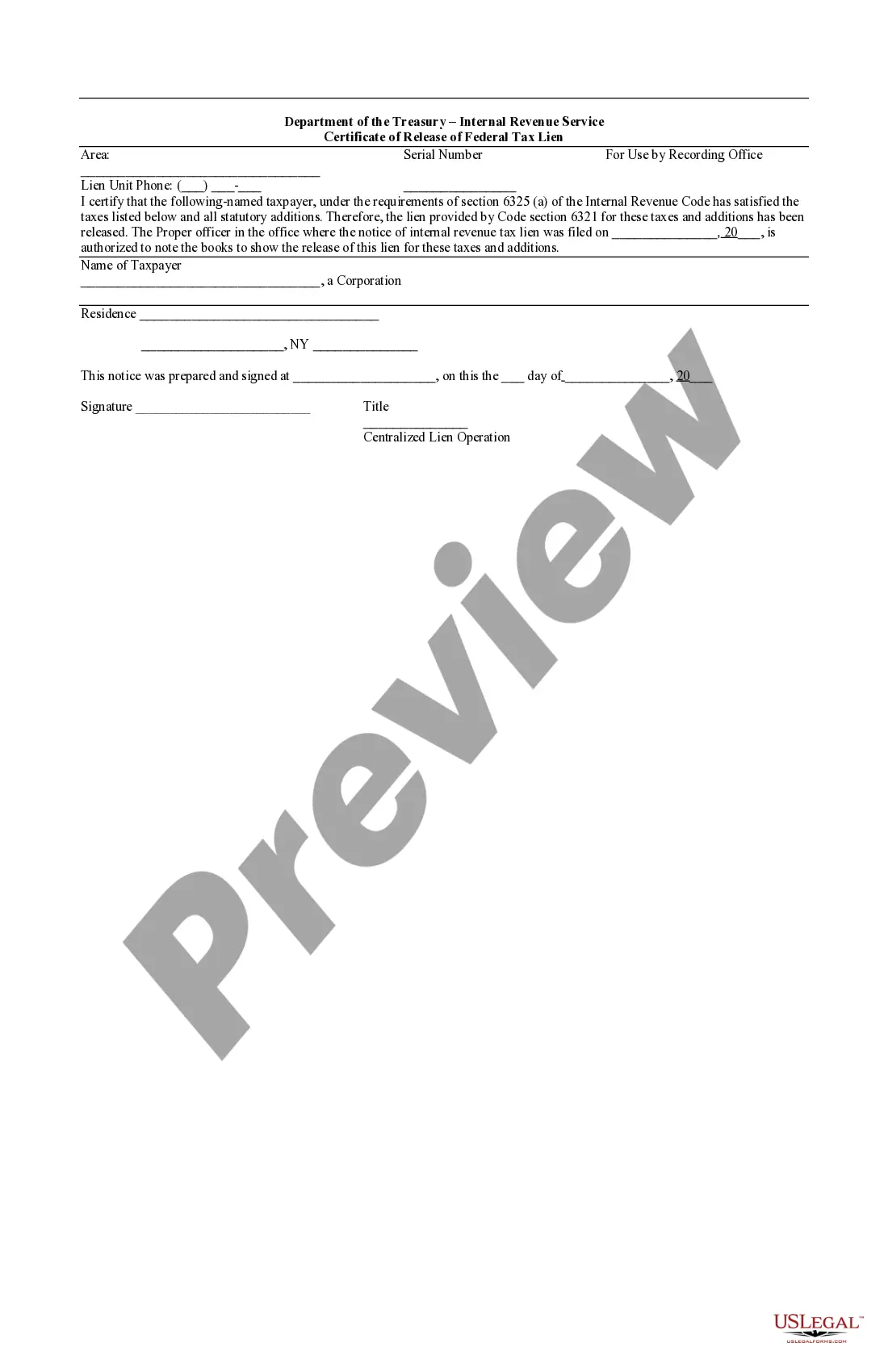

The Bronx, located in New York City, is a diverse borough known for its vibrant culture, neighborhoods, and historic landmarks. When it comes to financial matters, individuals and businesses may encounter a Bronx New York Certificate of Release of Federal Tax Lien. This document serves as proof that a federal tax lien placed on a property or assets located in the Bronx has been released. A federal tax lien is a legal claim imposed by the Internal Revenue Service (IRS) due to unpaid federal taxes. It is a way for the government to secure its interest in collecting the outstanding tax debt. Once the IRS determines that a lien is no longer needed, a Certificate of Release of Federal Tax Lien is issued. In the Bronx, there are different types of Certificates of Release of Federal Tax Lien, each with its own purpose and characteristics. These variations include: 1. Standard Certificate of Release: This is the most common type of release issued by the IRS. It is provided when the outstanding tax debt has been paid in full or when a formal agreement, such as an installment plan or offer in compromise, has been reached between the taxpayer and the IRS. 2. Withdrawal of Notice of Federal Tax Lien: In certain circumstances, the IRS may withdraw the notice of federal tax lien, effectively removing it from public records. This withdrawal is typically granted when the taxpayer has entered into a Direct Debit Installment Agreement or when the lien's filing was filed in error. Obtaining a Bronx New York Certificate of Release of Federal Tax Lien involves a series of steps. Firstly, the taxpayer needs to resolve their outstanding tax debt by either paying it in full or arranging an appropriate payment plan with the IRS. Once the tax liability has been successfully addressed, the IRS will process the release and send the Certificate of Release, stating that the lien is no longer valid. It is important to note that while the Certificate of Release of Federal Tax Lien removes the lien from public records, it does not erase the taxpayer's obligation to pay the underlying tax debt. Additionally, the release may take time to reflect on credit reports, impacting the individual or business's creditworthiness. In summary, a Bronx New York Certificate of Release of Federal Tax Lien is a crucial document that indicates the successful resolution of a federal tax lien placed on property or assets within the borough. Different types of releases may be issued depending on the specific circumstances of the tax debt. By obtaining this certificate, individuals and businesses can demonstrate their compliance with tax obligations and regain financial freedom.

Bronx New York Certificate of Release of Federal Tax Lien

Description

How to fill out Bronx New York Certificate Of Release Of Federal Tax Lien?

No matter the social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person without any law background to create such paperwork from scratch, mostly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes in handy. Our service provides a huge library with more than 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you require the Bronx New York Certificate of Release of Federal Tax Lien or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Bronx New York Certificate of Release of Federal Tax Lien quickly employing our reliable service. In case you are already a subscriber, you can proceed to log in to your account to download the appropriate form.

However, if you are new to our platform, ensure that you follow these steps before downloading the Bronx New York Certificate of Release of Federal Tax Lien:

- Be sure the form you have chosen is specific to your area considering that the rules of one state or county do not work for another state or county.

- Preview the form and go through a quick outline (if available) of cases the document can be used for.

- In case the form you chosen doesn’t meet your requirements, you can start over and search for the suitable document.

- Click Buy now and pick the subscription option you prefer the best.

- Access an account {using your login information or register for one from scratch.

- Pick the payment method and proceed to download the Bronx New York Certificate of Release of Federal Tax Lien as soon as the payment is completed.

You’re all set! Now you can proceed to print out the form or fill it out online. In case you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.

Form popularity

FAQ

The easiest and fastest way to get a tax lien released is to pay the tax debt in full. Once the tax debt is paid in full, the tax lien will be released within 30 days.

A federal tax lien is the government's legal claim against your property when you neglect or fail to pay a tax debt. The lien protects the government's interest in all your property, including real estate, personal property and financial assets.

The New York State Department of Taxation and Finance has 20 years from the date that the tax warrant not 20 years from the date of the tax liability was filed to collect on the tax liability.

Two counties on Long Island, Nassau County and Suffolk County, sell tax lien certificates at a rate of up to 12% interest. The boroughs of New York, like Manhattan and the Bronx, also sell tax liens, but they only sell them to institutions, not to individuals.

IRS Definition When all the liabilities shown on the Notice of Federal Tax Lien are satisfied, the IRS will issue a Certificate of Release of Federal Tax Lien for filing in the same location where the notice of lien was filed.

Tax Lien Sale A tax lien is a legal claim against real property for unpaid municipal charges, such as property taxes, housing maintenance, water, sewer, demolition, etc. An owner whose property is subject to a tax lien sale will receive a lien sale notice and the lien sale list will be published publicly.

More info

Phone: or Fax:. State Tax Rates Taxes are determined by the amount in the bank account; however, we understand that a tax credit might be available for taxpayers who have more than one state taxable entity. For 2018, the state of New York has enacted new tax rates for New York City, New York State and the village of New Hyde Park.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.