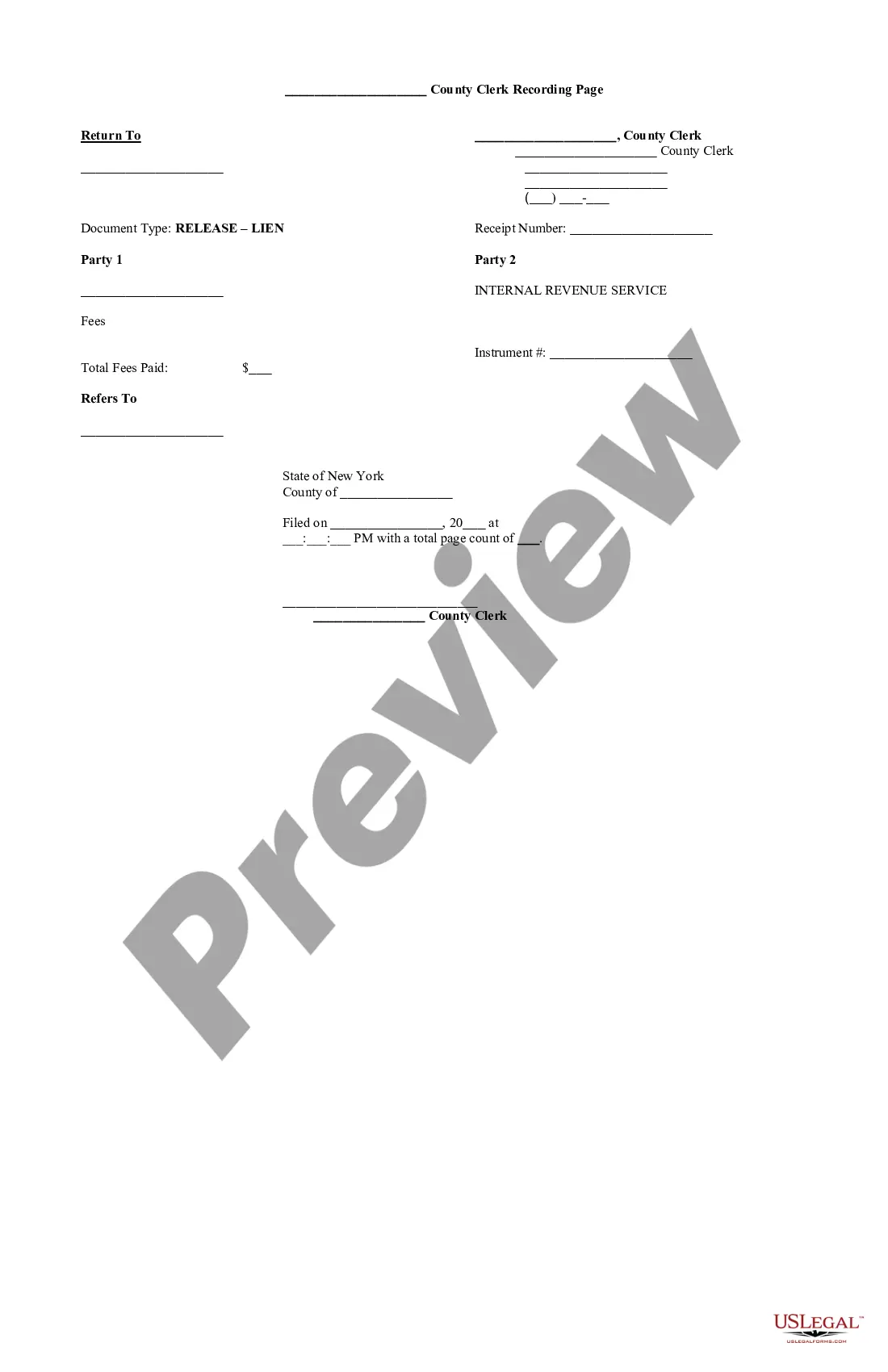

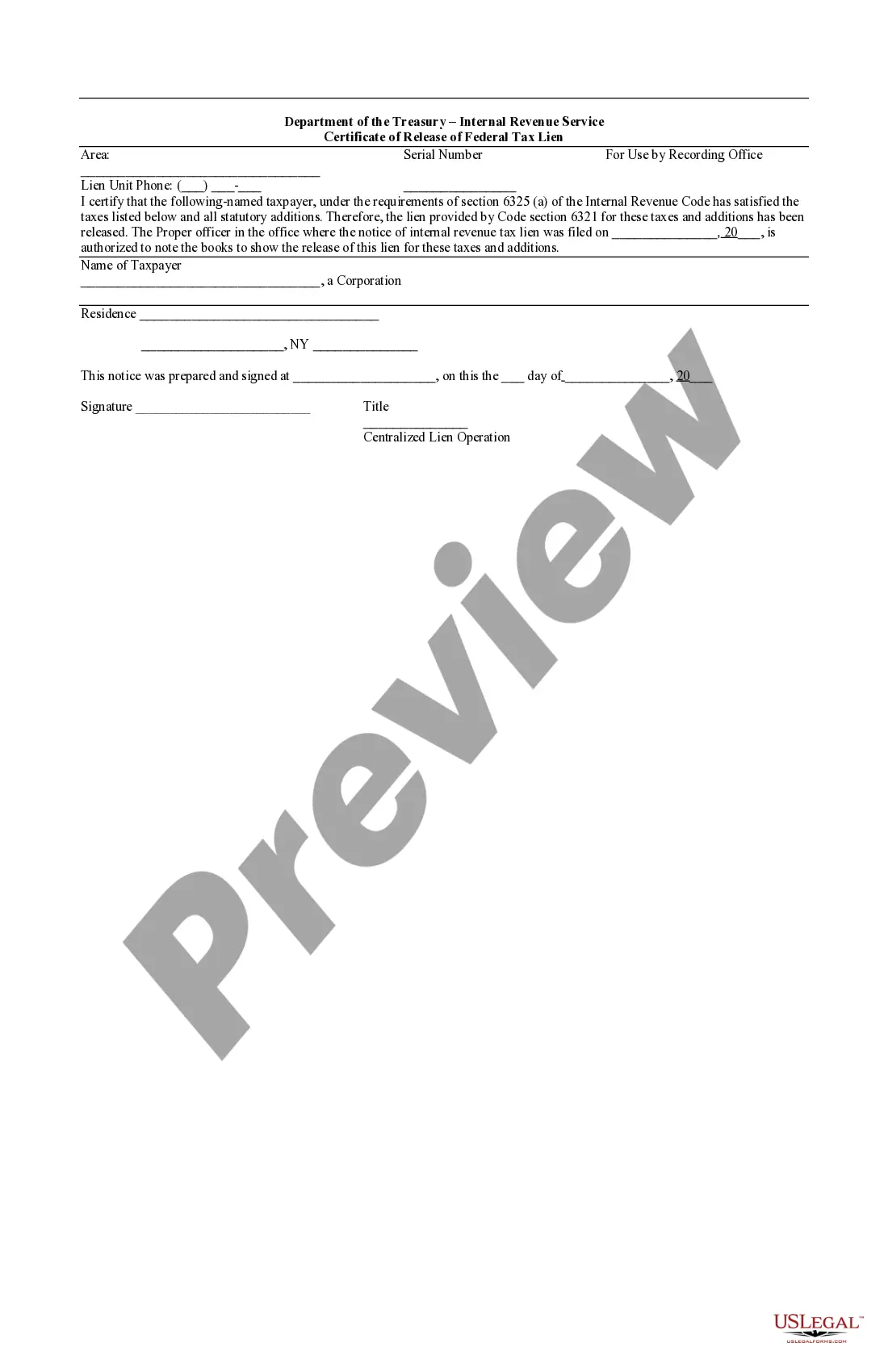

The Kings New York Certificate of Release of Federal Tax Lien is an important document that signifies the release of a federal tax lien imposed on a taxpayer's property in Kings County, New York. This certificate serves as proof that the taxpayer has settled their tax liability and allows them to regain control of their assets, such as real estate, vehicles, or other personal property. A Federal Tax Lien is usually filed by the Internal Revenue Service (IRS) when a taxpayer fails to pay their federal taxes. However, once the taxpayer has satisfied their tax debt, the IRS releases the lien by issuing a Certificate of Release, giving the taxpayer a fresh start. The Certificate of Release of Federal Tax Lien is a legal document that includes various details and is relevant to individuals and businesses in Kings County, New York, who have faced federal tax liens. There are different types of Kings New York Certificate of Release of Federal Tax Liens that can be named based on their specific purpose or circumstance, including: 1. Full Release Certificate: This type of certificate indicates that the taxpayer has paid their federal tax debt in full, and the lien has been removed entirely. It releases the lien on all the taxpayer's properties. 2. Partial Release Certificate: If a taxpayer has multiple properties with a federal tax lien, a Partial Release Certificate may be issued. This certificate releases the lien on specific properties that have been resolved or settled while maintaining the lien on other properties until further resolution. 3. Bonded Certificate of Release: In certain cases where the taxpayer cannot satisfy the tax debt immediately, they may apply for a bonded certificate. This certificate is obtained by providing a bond that guarantees payment of the debt to the IRS. Once the bond is secured, the lien is released, allowing the taxpayer to sell or transfer the property. It is crucial for taxpayers to keep copies of the Kings New York Certificate of Release of Federal Tax Lien as it acts as evidence confirming the clearance of their tax liabilities. This certificate should be safely stored as it may be required when dealing with financial transactions or applying for credit in the future. In conclusion, the Kings New York Certificate of Release of Federal Tax Lien is an essential document that signifies the taxpayer's successful resolution of their federal tax debt. Whether it is a Full Release, Partial Release, or Bonded Certificate, obtaining this document provides individuals and businesses in Kings County, New York, with the legal proof needed to regain control of their assets and move forward financially.

Kings New York Certificate of Release of Federal Tax Lien

Description

How to fill out Kings New York Certificate Of Release Of Federal Tax Lien?

Are you looking for a reliable and inexpensive legal forms supplier to get the Kings New York Certificate of Release of Federal Tax Lien? US Legal Forms is your go-to choice.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of particular state and area.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Kings New York Certificate of Release of Federal Tax Lien conforms to the laws of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is intended for.

- Start the search over in case the form isn’t good for your legal scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the Kings New York Certificate of Release of Federal Tax Lien in any available file format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time learning about legal paperwork online for good.