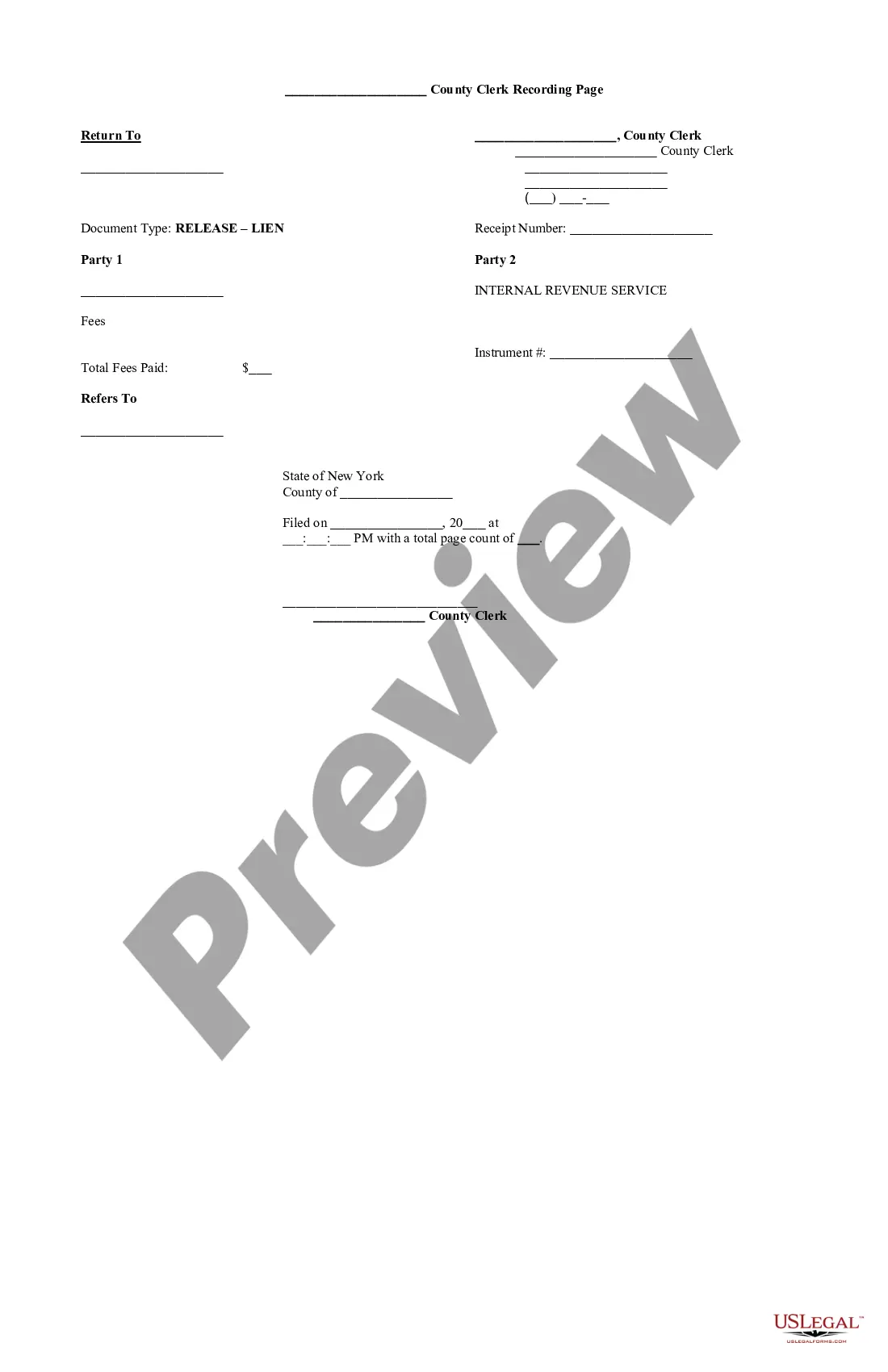

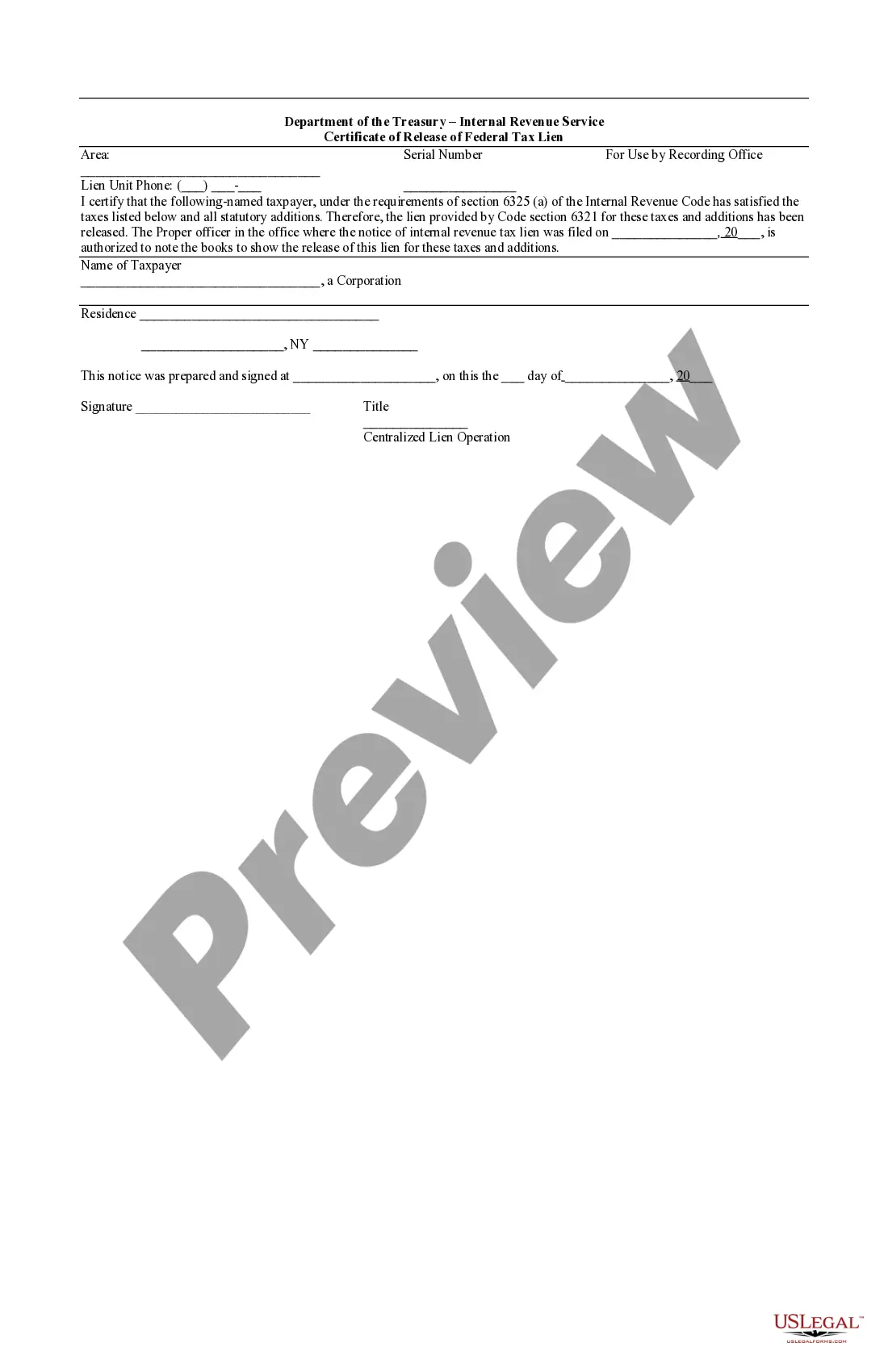

The Nassau New York Certificate of Release of Federal Tax Lien is an important legal document that signifies the removal of a federal tax lien on a property located in Nassau County, New York. It confirms that the lien has been fully satisfied, releasing the property from any previous claims or encumbrances related to unpaid federal tax debts. This certificate serves as proof that the taxpayer has fulfilled their tax obligations and has satisfied the debt in full, allowing them to regain control and ownership of their property. The release of a federal tax lien is a significant step in the process of resolving tax issues and reclaiming financial stability. The Nassau New York Certificate of Release of Federal Tax Lien can be divided into two primary types: 1. Voluntary Release: This type of release is issued by the Internal Revenue Service (IRS) when a taxpayer has successfully paid off their tax debt or has entered into a suitable agreement like an installment plan or an Offer in Compromise. It acknowledges the taxpayer's compliance and releases the lien, restoring their property rights. 2. Certificate of Discharge: In certain cases, the IRS may issue a Certificate of Discharge to release a federal tax lien from a specific property. This typically occurs when the taxpayer intends to sell the property and the proceeds from the sale will be used to fully satisfy the tax debt. The Certificate of Discharge ensures that the property can be transferred to a new owner without any legal complications arising from the unpaid tax debt. Both types of certificates provide legal documentation signifying that the taxpayer has resolved their federal tax obligations, allowing them to move forward with their financial and real estate affairs. The Nassau New York Certificate of Release of Federal Tax Lien is a crucial document for individuals, businesses, and professionals involved in real estate transactions or who may need to demonstrate their tax compliance to lenders, financial institutions, or other interested parties. If you find yourself in a situation where a federal tax lien has been filed against your property in Nassau County, New York, it is essential to address the issue promptly. Seeking professional assistance from qualified tax experts, attorneys, or certified public accountants can provide guidance on navigating the lien release process and ensuring compliance with all necessary requirements.

Nassau New York Certificate of Release of Federal Tax Lien

Description

How to fill out Nassau New York Certificate Of Release Of Federal Tax Lien?

We always want to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal services that, usually, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Nassau New York Certificate of Release of Federal Tax Lien or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Nassau New York Certificate of Release of Federal Tax Lien complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Nassau New York Certificate of Release of Federal Tax Lien would work for your case, you can choose the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!