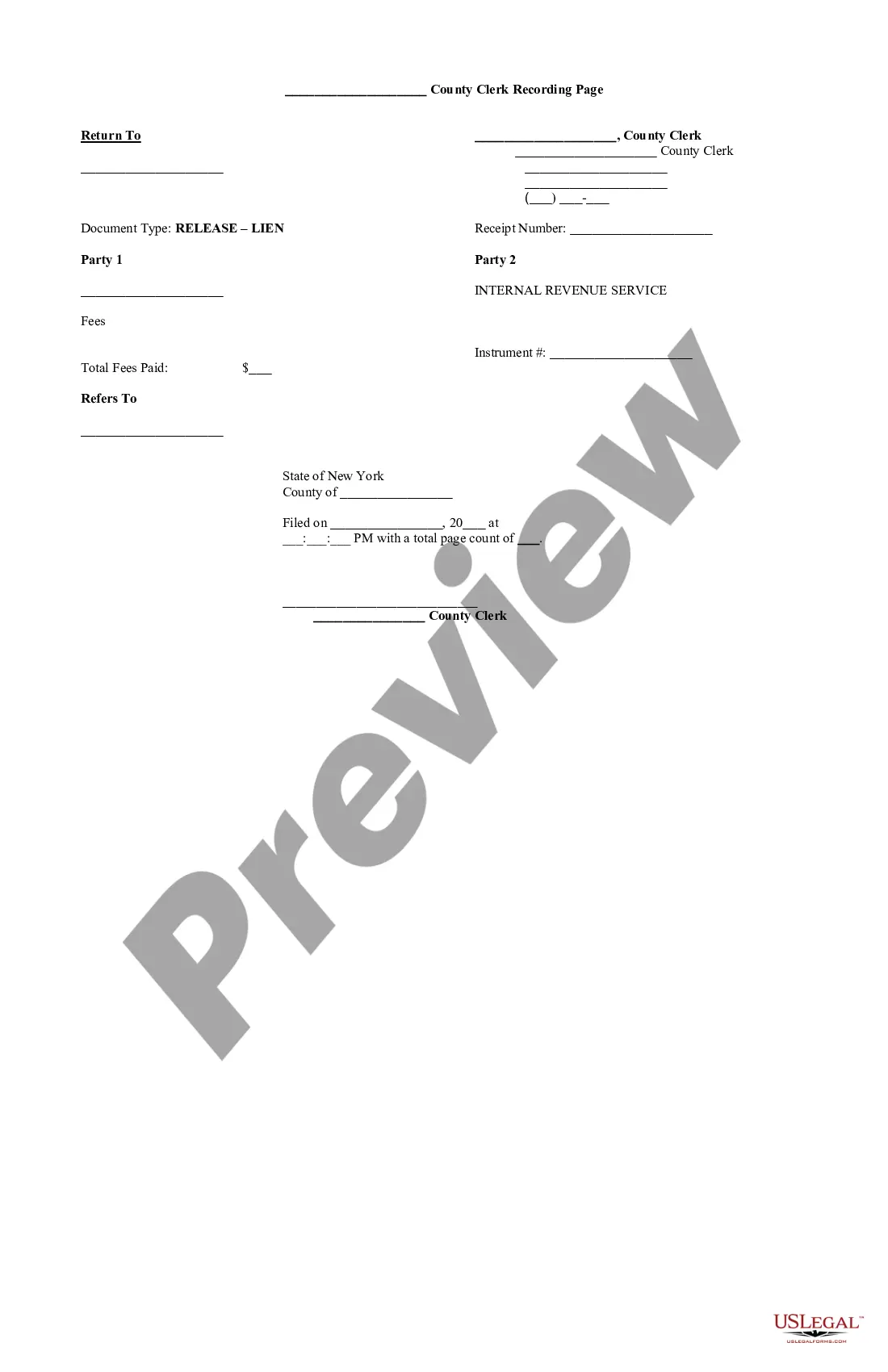

Queens New York Certificate of Release of Federal Tax Lien

Description

How to fill out New York Certificate Of Release Of Federal Tax Lien?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our efficient platform boasting a plethora of templates makes it easy to locate and acquire nearly any document sample you desire.

You can export, complete, and validate the Queens New York Certificate of Release of Federal Tax Lien in just a few minutes instead of spending hours online searching for a suitable template.

Using our catalog is an excellent way to enhance the security of your document submissions.

If you have not yet created a profile, follow the steps outlined below.

Locate the form you require. Ensure that it is the correct form: check its name and description, and use the Preview option if available. Otherwise, utilize the Search feature to find the necessary one.

- Our skilled legal experts routinely assess all records to guarantee that the forms are pertinent for a specific state and comply with current laws and regulations.

- How can you obtain the Queens New York Certificate of Release of Federal Tax Lien.

- If you have a subscription, simply Log In to your account.

- The Download button will be visible on all documents you view.

- Furthermore, you can access all your previously saved documents in the My documents section.

Form popularity

FAQ

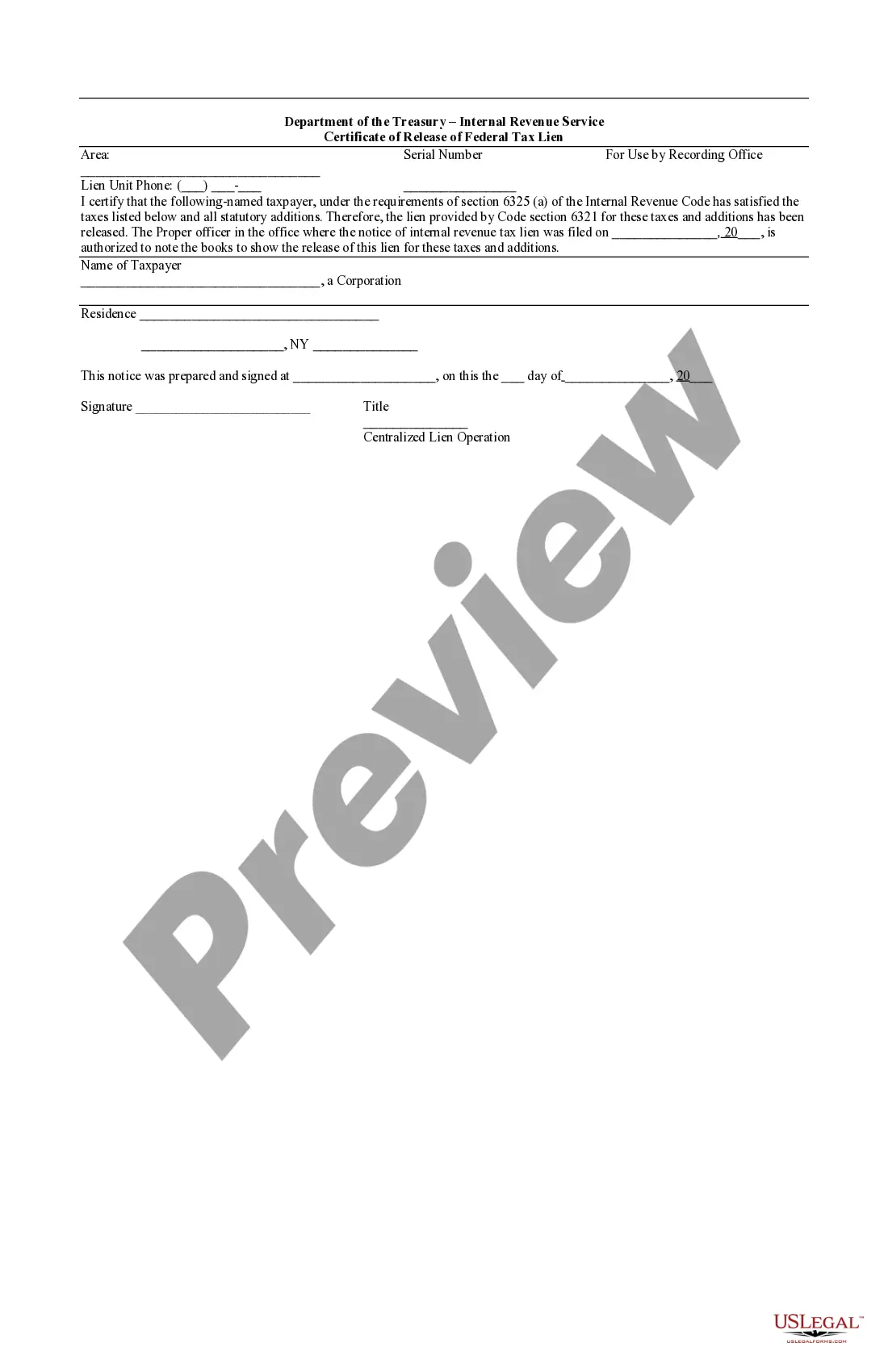

When you receive a certificate of release of federal tax lien, it signifies that the federal government has removed its claim against your property due to unpaid taxes. This document, specifically a Queens New York Certificate of Release of Federal Tax Lien, is crucial because it clears your title and allows you to sell, refinance, or otherwise handle your property without the previous lien. By obtaining this certificate, you can move forward with financial transactions more freely and with less hindrance. If you need help navigating the process, consider using US Legal Forms to obtain the necessary documents efficiently.

Removing a federal tax lien involves paying off the tax debt or negotiating a settlement with the IRS. After clearing your obligation, the IRS will issue a Queens New York Certificate of Release of Federal Tax Lien, confirming that the lien has been officially removed. This process helps you regain control over your assets and improve your financial standing.

To request a lien discharge from the IRS, you must submit Form 12277, Application for the Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien. This form allows you to explain the circumstances warranting the discharge. Upon approval, you will receive the Queens New York Certificate of Release of Federal Tax Lien, indicating that the lien does not impact specified property.

To obtain proof of an IRS lien release, you should request the certificate directly from the IRS after the lien has been released. The document you need is the Queens New York Certificate of Release of Federal Tax Lien, which serves as official verification of the lien's removal. This proof is crucial for clearing your credit report and potential property issues.

When a federal tax lien is released, it signifies that the IRS has removed its claim against your property for unpaid taxes. This release occurs after you settle your tax debt or provide documentation that satisfies the IRS. Essentially, obtaining a Queens New York Certificate of Release of Federal Tax Lien shows that you are no longer under the weight of that lien, allowing you to move forward without that burden.

To obtain a payoff amount for a federal tax lien, you need to contact the IRS directly and request your current balance. This request can be made via phone, mail, or through the IRS website. Once you receive the payoff amount, you can proceed with the payment to secure a Queens New York Certificate of Release of Federal Tax Lien. US Legal Forms offers resources that may assist you in understanding this process better.

To apply for a certificate of discharge from a federal tax lien, you must complete Form 12277 to formally request the discharge. This form allows you to provide necessary details about the lien and your case. Once you submit this form to the IRS, they will review your request and determine if you qualify for a Queens New York Certificate of Release of Federal Tax Lien. Consider using US Legal Forms for guidance on completing this form accurately.

A certificate of lien release is an official document provided by the IRS confirming that a federal tax lien has been released. This document validates that you have settled your tax debt and that the government's claim against your property is removed. Obtaining your Queens New York Certificate of Release of Federal Tax Lien is essential for regaining full rights to your property.

A federal tax lien is a serious matter, as it indicates that the IRS has a legal claim against your assets due to unpaid taxes. This can affect your credit and your ability to sell or refinance property. Taking prompt action to address the lien can alleviate its impact and lead to obtaining your Queens New York Certificate of Release of Federal Tax Lien, which is crucial for moving forward financially.

You can apply for a certificate of discharge from a federal tax lien by filing IRS Form 14135, along with any supporting documentation required. This form will help the IRS assess your situation and determine if they can discharge the lien. Utilizing services like USLegalForms can simplify this process, ensuring that you follow the correct steps to secure your Queens New York Certificate of Release of Federal Tax Lien.