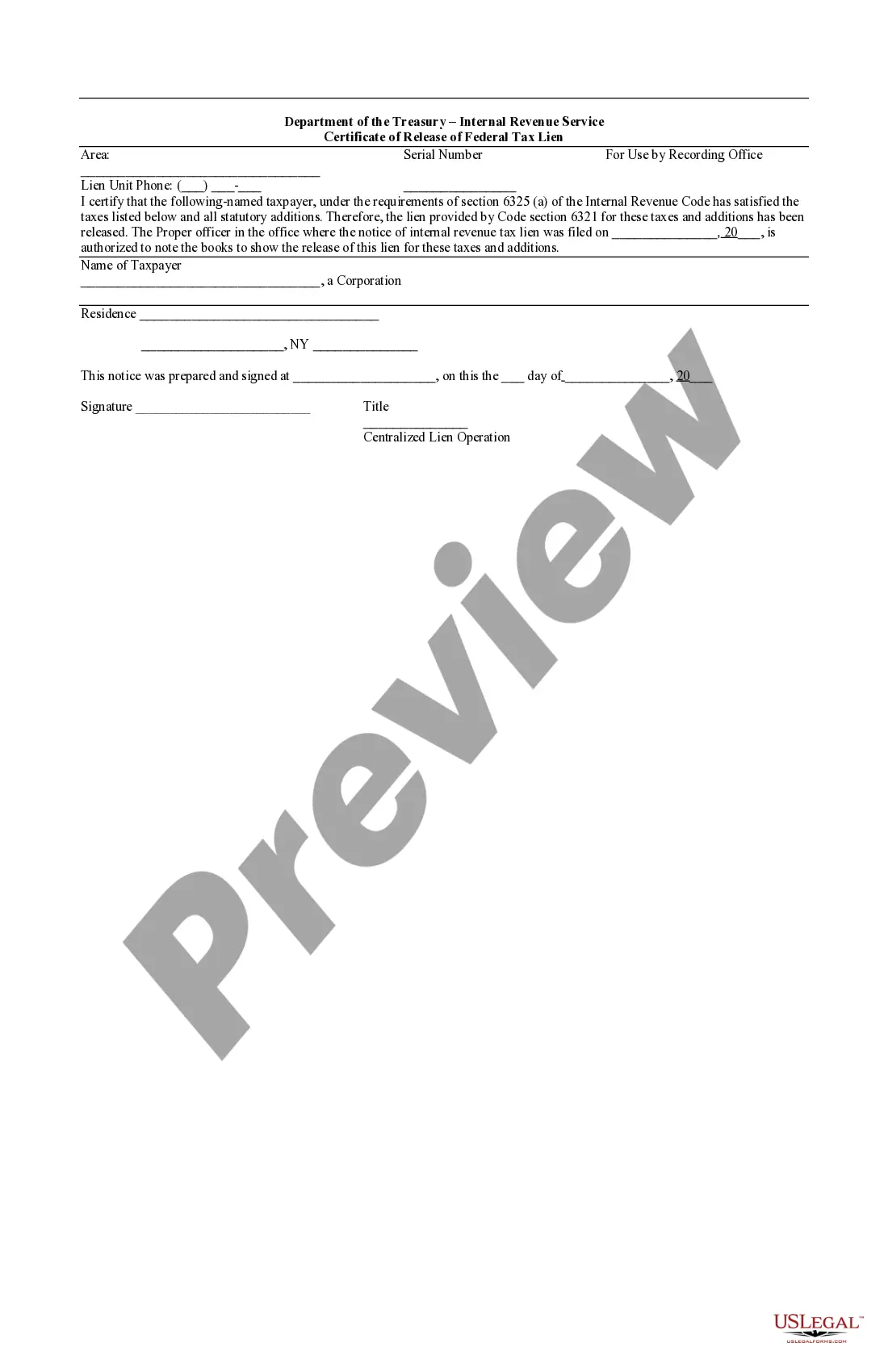

The Rochester New York Certificate of Release of Federal Tax Lien is an important legal document that signifies the removal of a federal tax lien on a property or asset in Rochester, New York. This certificate is crucial for individuals or businesses in Rochester who have successfully resolved their federal tax liabilities and want to clear the lien attached to their property. The issuance of the Rochester New York Certificate of Release of Federal Tax Lien demonstrates that the Internal Revenue Service (IRS) has acknowledged the payment of outstanding tax debt or the satisfactory resolution of a tax-related dispute. Once released, this certificate removes the federal tax lien from the public record, ensuring that the individual or business can transfer or sell the property without any hindrances. Different types of Rochester New York Certificates of Release of Federal Tax Lien may include: 1. Partial Release Certificate: This type of certificate is issued when a federal tax lien is partially released from a property. It typically occurs when a portion of the tax debt is paid off, and the IRS agrees to release the lien on specific assets or parcels of real estate. 2. Full Release Certificate: A full release certificate is issued when the entire federal tax debt has been satisfied or resolved. This certificate confirms that the IRS has released the lien on all the assets or properties previously affected by the lien, allowing the individuals or businesses in Rochester to move forward without any encumbrances. 3. Subordination Certificate: In certain cases, the IRS may issue a subordination certificate instead of a release certificate. This certificate acknowledges that the federal tax lien has been made secondary to another creditor's claim, granting the other party higher priority in the event of foreclosure or asset liquidation. To obtain a Rochester New York Certificate of Release of Federal Tax Lien, individuals or businesses must go through the necessary processes outlined by the IRS for lien release. This typically involves settling the outstanding tax debt, fulfilling any agreed-upon payment plans, or providing evidence of successful negotiations or compromises reached with the IRS. It is essential to consult with tax professionals, such as certified public accountants or tax attorneys, who specialize in tax lien matters to ensure all requirements are met accurately and efficiently. By doing so, individuals and businesses in Rochester can secure their Certificate of Release of Federal Tax Lien, enabling them to regain control of their assets and move forward with their financial endeavors unencumbered by federal tax obligations.

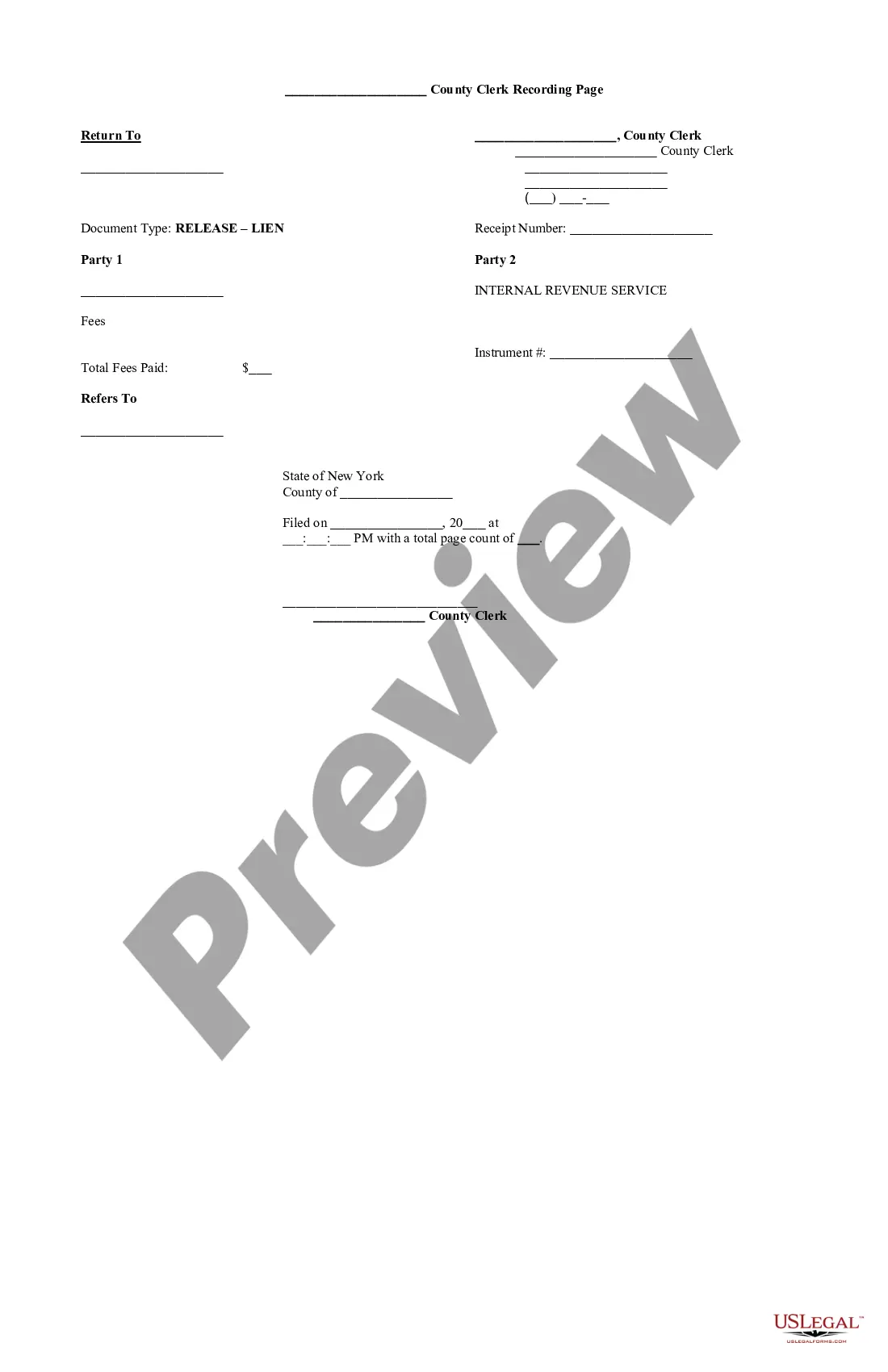

Rochester New York Certificate of Release of Federal Tax Lien

Description

How to fill out Rochester New York Certificate Of Release Of Federal Tax Lien?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal services that, usually, are extremely costly. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of an attorney. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Rochester New York Certificate of Release of Federal Tax Lien or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Rochester New York Certificate of Release of Federal Tax Lien adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Rochester New York Certificate of Release of Federal Tax Lien is proper for you, you can choose the subscription option and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!