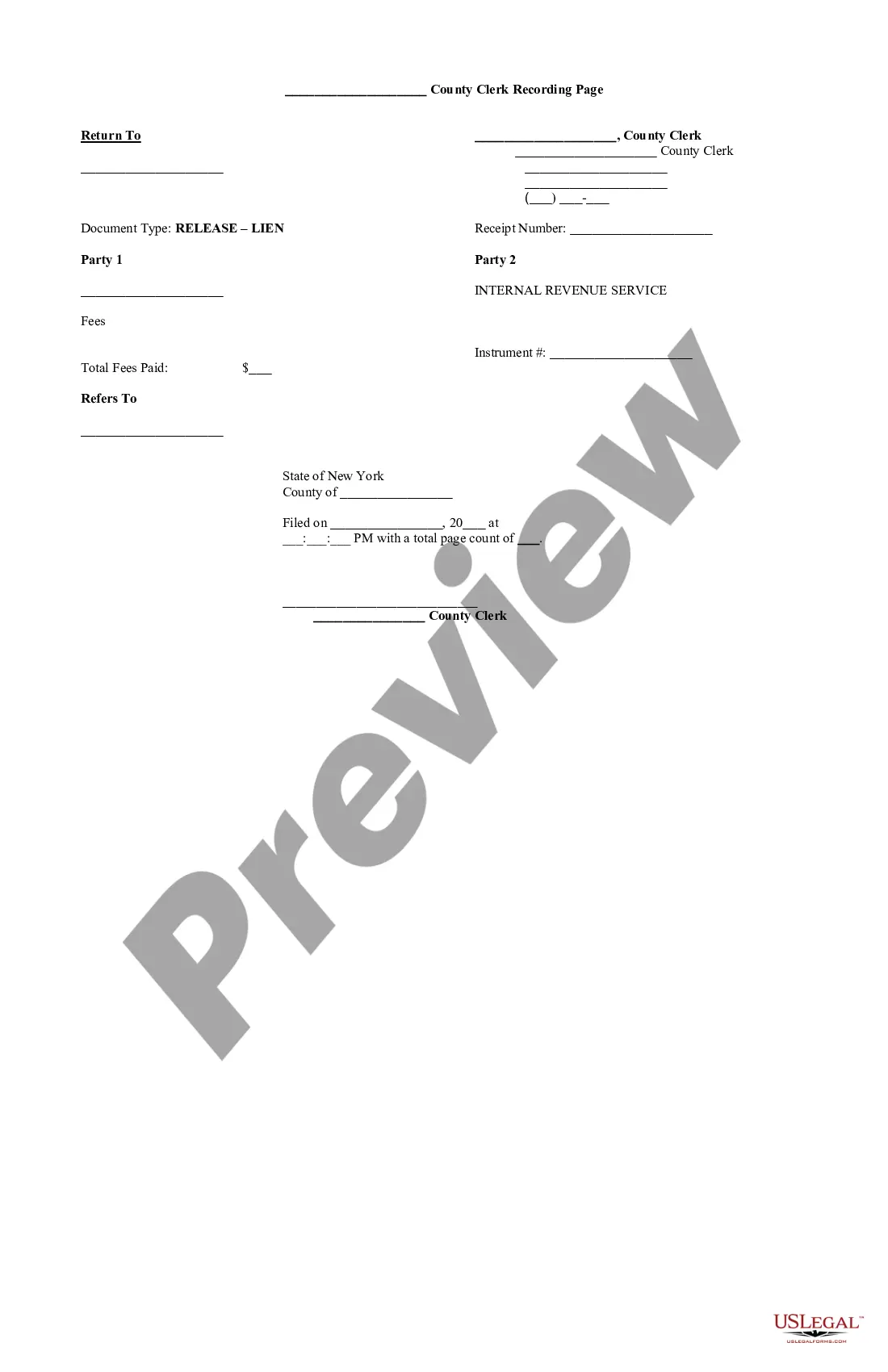

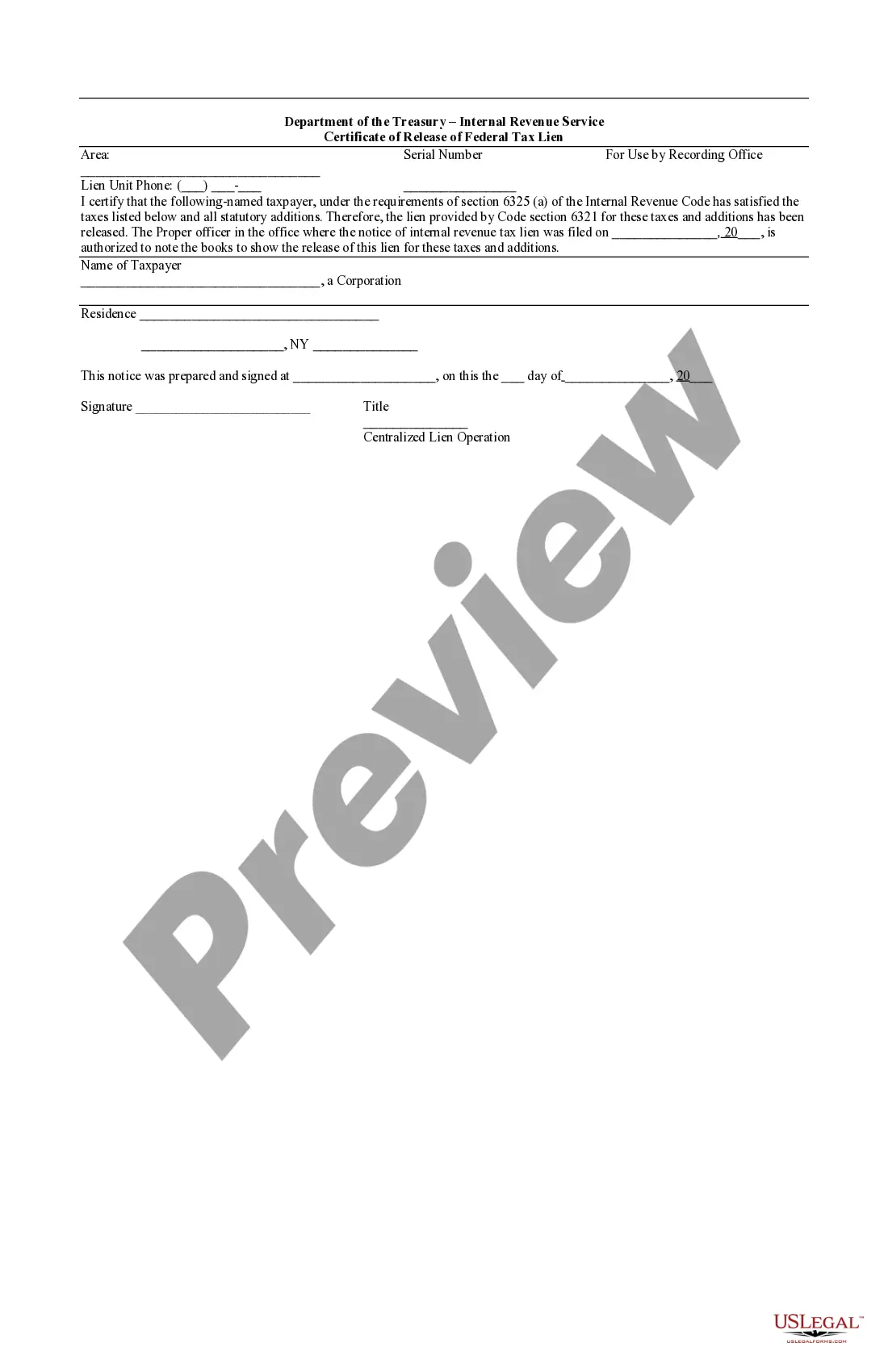

The Syracuse New York Certificate of Release of Federal Tax Lien is an important document that serves as proof of the release of a federal tax lien on a property or asset in Syracuse, New York. This certificate is obtained after paying off the tax debt or meeting the conditions set by the Internal Revenue Service (IRS). It provides individuals or businesses with the legal right to transfer, sell, or refinance their property without any hindrance from the previous tax lien. The Syracuse New York Certificate of Release of Federal Tax Lien is crucial as it ensures that individuals or businesses regain their financial freedom and are no longer encumbered by the tax lien. It is a vital step towards resolving tax issues and can have a significant impact on one's creditworthiness, making it easier to obtain loans or mortgages in the future. There are different types of Syracuse New York Certificate of Release of Federal Tax Lien depending on the specific circumstances: 1. Full Release: This is the most common type of certificate that is issued when the entire tax debt has been paid in full, including any interest, penalties, or additional fees. A full release indicates that the lien has been completely removed and the property is no longer encumbered. 2. Partial Release: In certain situations, the IRS may issue a partial release when a portion of the tax debt has been paid, or when a specific asset or property has been released from the tax lien. This allows individuals or businesses to retain some control over their assets while still addressing their tax obligations. 3. Release on Deposit: In cases where individuals or businesses cannot immediately pay off their tax debt, the IRS may allow for a release on deposit. This means that a specific amount of money is deposited with the IRS as a guarantee for the tax debt, resulting in the release of the lien on a particular asset or property. Obtaining a Syracuse New York Certificate of Release of Federal Tax Lien is a crucial step towards resolving tax issues and regaining financial freedom. It is advisable to consult with a tax professional or seek legal advice to ensure all requirements are met and to navigate the process smoothly.

Syracuse New York Certificate of Release of Federal Tax Lien

Category:

State:

New York

City:

Syracuse

Control #:

NY-LR151T

Format:

Word;

Rich Text

Instant download

Description

The IRS issues a realease of lien placed on real property to secure payment of income taxes that are owed.

The Syracuse New York Certificate of Release of Federal Tax Lien is an important document that serves as proof of the release of a federal tax lien on a property or asset in Syracuse, New York. This certificate is obtained after paying off the tax debt or meeting the conditions set by the Internal Revenue Service (IRS). It provides individuals or businesses with the legal right to transfer, sell, or refinance their property without any hindrance from the previous tax lien. The Syracuse New York Certificate of Release of Federal Tax Lien is crucial as it ensures that individuals or businesses regain their financial freedom and are no longer encumbered by the tax lien. It is a vital step towards resolving tax issues and can have a significant impact on one's creditworthiness, making it easier to obtain loans or mortgages in the future. There are different types of Syracuse New York Certificate of Release of Federal Tax Lien depending on the specific circumstances: 1. Full Release: This is the most common type of certificate that is issued when the entire tax debt has been paid in full, including any interest, penalties, or additional fees. A full release indicates that the lien has been completely removed and the property is no longer encumbered. 2. Partial Release: In certain situations, the IRS may issue a partial release when a portion of the tax debt has been paid, or when a specific asset or property has been released from the tax lien. This allows individuals or businesses to retain some control over their assets while still addressing their tax obligations. 3. Release on Deposit: In cases where individuals or businesses cannot immediately pay off their tax debt, the IRS may allow for a release on deposit. This means that a specific amount of money is deposited with the IRS as a guarantee for the tax debt, resulting in the release of the lien on a particular asset or property. Obtaining a Syracuse New York Certificate of Release of Federal Tax Lien is a crucial step towards resolving tax issues and regaining financial freedom. It is advisable to consult with a tax professional or seek legal advice to ensure all requirements are met and to navigate the process smoothly.

Free preview

How to fill out Syracuse New York Certificate Of Release Of Federal Tax Lien?

If you’ve already used our service before, log in to your account and download the Syracuse New York Certificate of Release of Federal Tax Lien on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Syracuse New York Certificate of Release of Federal Tax Lien. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!