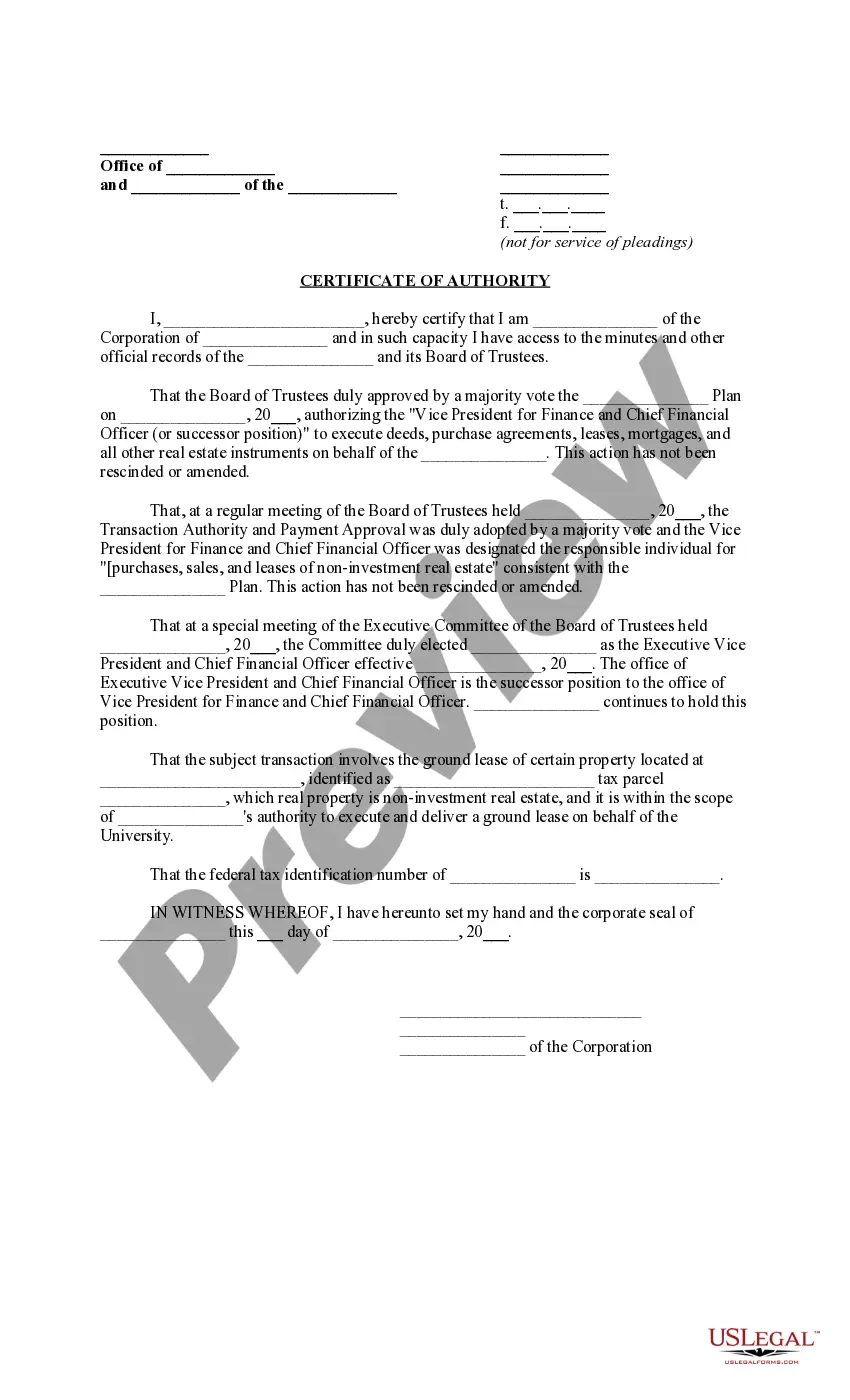

Bronx New York Certificate of Authority

Description

How to fill out New York Certificate Of Authority?

Do you require a reliable and economical supplier of legal forms to obtain the Bronx New York Certificate of Authority? US Legal Forms is your ultimate answer.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of documents to facilitate your separation or divorce through the court, we have you covered. Our site offers over 85,000 current legal document templates for personal and business use. All templates we provide are not generic and are tailored based on the needs of specific states and regions.

To retrieve the form, you must Log In to your account, locate the required form, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates anytime from the My documents section.

Is this your first visit to our website? No problem. You can set up an account in no time, but before that, ensure to do the following: Check if the Bronx New York Certificate of Authority aligns with the laws of your state and local area. Review the form’s description (if available) to determine who and what the form is meant for. Restart the search if the form is unsuitable for your particular circumstances.

Locating current legal documents has never been simpler. Try US Legal Forms today and stop wasting your precious time trying to understand legal paperwork online for good.

- Now you can create your account.

- Select the subscription plan and proceed to payment.

- Once the payment process is finished, retrieve the Bronx New York Certificate of Authority in any provided file format.

- You can return to the site when necessary and redownload the form at no additional cost.

Form popularity

FAQ

To fill out a sales tax exemption certificate, start by obtaining the form from the New York State Department of Taxation and Finance. Complete the sections that require your information, including the buyer’s details, type of exemption, and description of the property or services purchased. For help with the process, consider using online platforms like uslegalforms, which provide guidance on completing documents accurately. After filling it out, ensure it is signed and dated before submission.

Getting a certificate of authority in New York can generally take between 1 to 2 weeks if all paperwork is correctly submitted. It is essential to include accurate business information to avoid any unnecessary delays. For those in the Bronx, New York Certificate of Authority may offer local assistance to expedite your application. Be proactive by following up with the appropriate office once you submit your application.

The application process for a New York State certificate of authority usually takes around 1 to 2 weeks. However, factors such as local processing times and the accuracy of your application can affect how long it takes. Utilizing online services can streamline the process significantly. Ensure that you have all necessary information ready when you apply.

In New York State, obtaining a certificate of good conduct typically takes about 6 to 8 weeks. This timeframe depends on the processing times of the Department of Corrections and Community Supervision. If you apply through the Bronx New York Certificate of Authority office, processing might be faster due to local support. It is advisable to gather all required documents beforehand to avoid delays.

To secure a Bronx New York Certificate of Authority, you must complete an application and submit it to the New York State Department of Taxation and Finance. You can file this application online or via mail, depending on your preference. Make sure to include relevant business information, such as your EIN and business structure. Utilizing resources from US Legal Forms can help guide you through this process and ensure you meet all requirements.

A Bronx New York Certificate of Authority is issued by the New York State Department of Taxation and Finance. This certificate allows businesses to collect sales tax on behalf of the state. It's crucial for any business selling tangible goods or certain services in New York. By obtaining this certificate, you ensure compliance with state laws and avoid potential penalties.

Yes, a Bronx New York Certificate of Authority can be considered a form of business license. It grants permission to operate and collect sales tax legally. However, depending on your specific business type and location, you may need additional licenses or permits.

No, the certificate of authority number is not the same as the EIN. The latter is used for tax identification, while the certificate of authority number specifically authorizes you to collect sales tax in New York. Make sure to keep these identifiers distinct to avoid confusion when filing taxes or conducting business.

Another name for a certificate of authority is a sales tax registration certificate. This document indicates your permission to collect sales tax on sales made within New York. Knowing the alternate names for this certificate can help streamline your business registration.

A certificate of authority is also known as a sales tax certificate or a business license, depending on the context. This document is required for businesses to legally operate in New York and collect sales tax. Being informed about its various names can help during your application process.