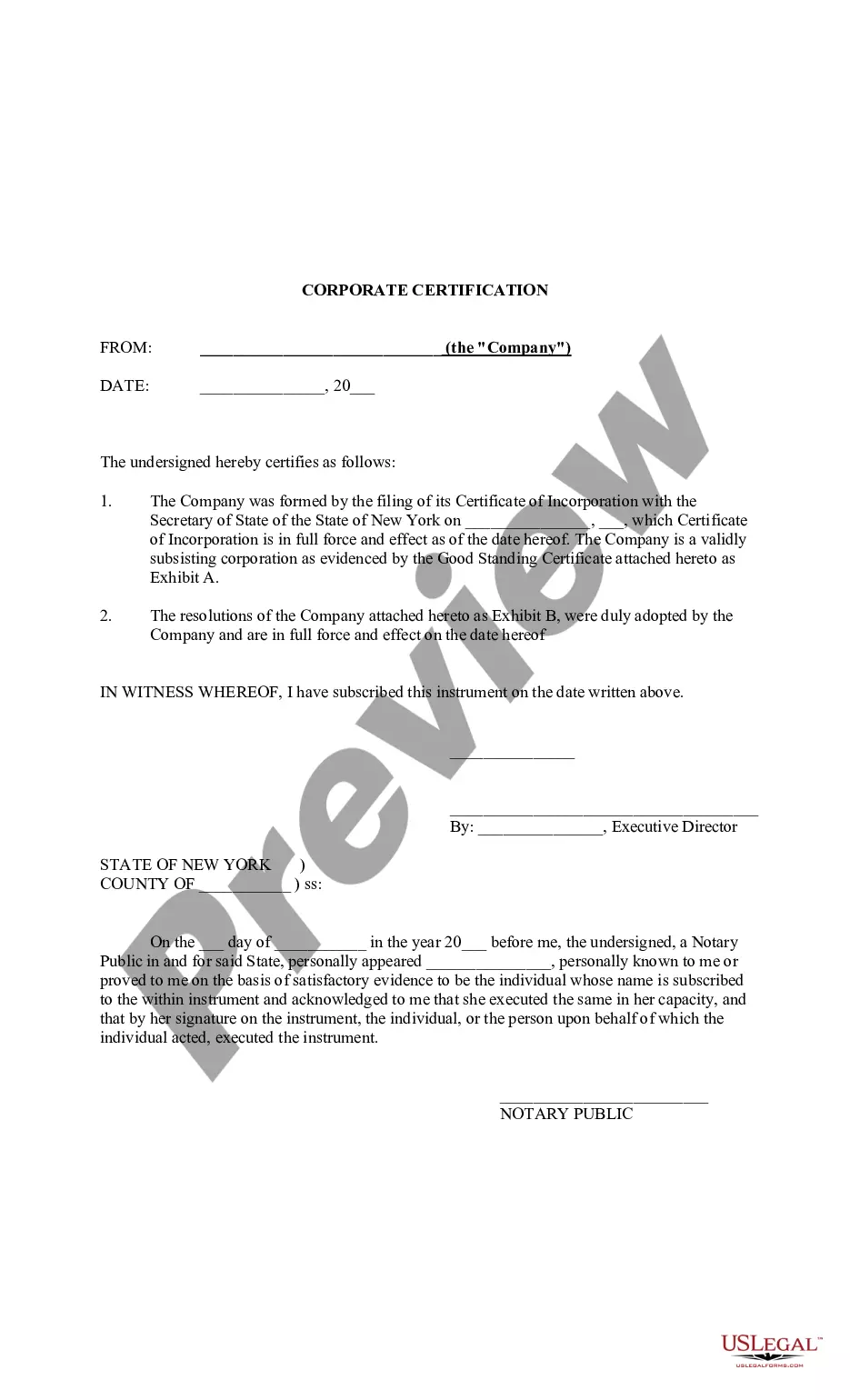

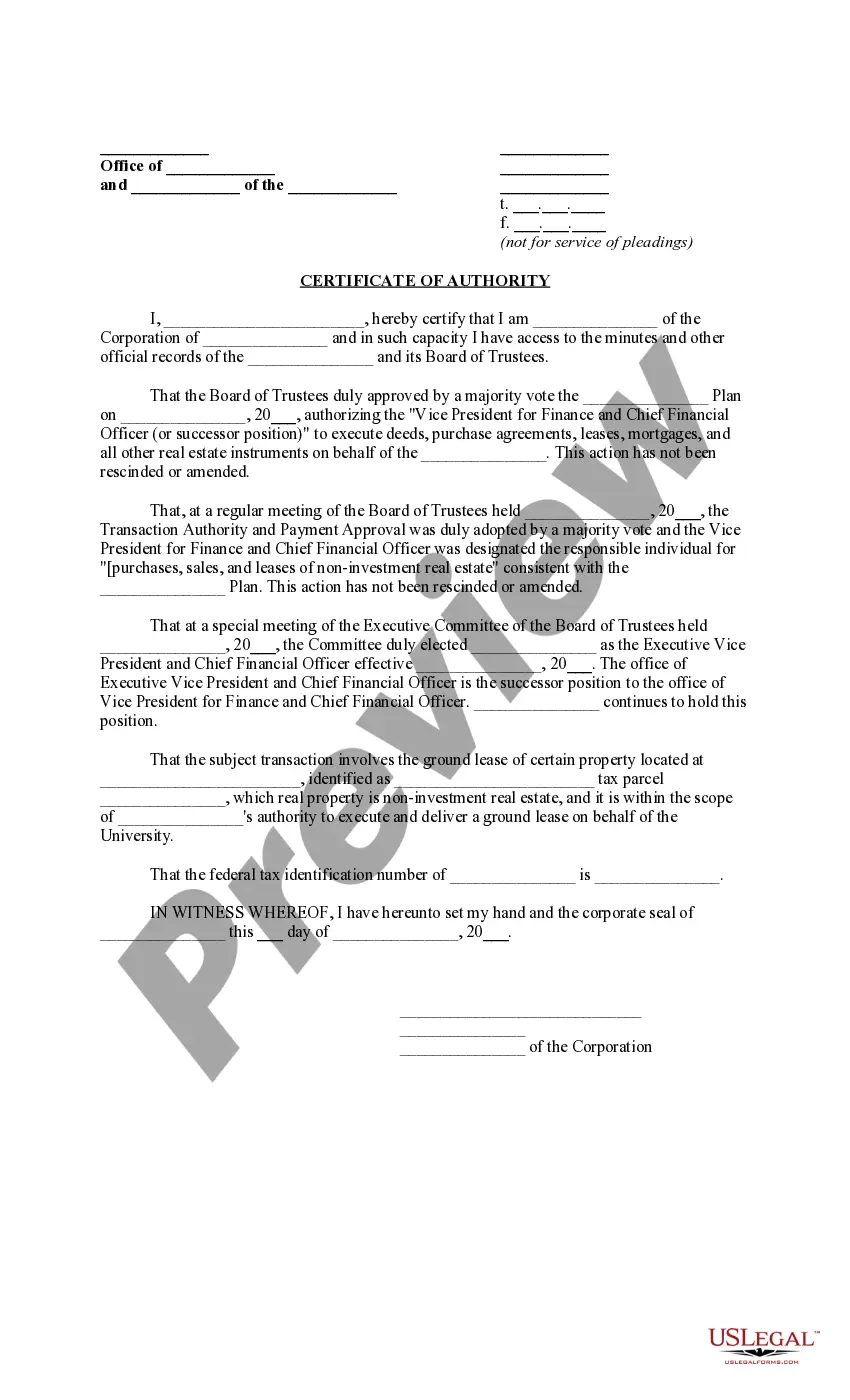

Kings New York Certificate of Authority

Description

How to fill out New York Certificate Of Authority?

Take advantage of the US Legal Forms and gain instant access to any form template you require.

Our user-friendly platform with a vast array of document samples streamlines the process of finding and obtaining nearly any document you may need.

You can export, fill out, and validate the Kings New York Certificate of Authority in just a few minutes instead of spending hours online looking for a suitable template.

Utilizing our collection is an excellent method to enhance the security of your document submissions. Our knowledgeable legal experts routinely review all documents to ensure that the templates are suitable for a specific jurisdiction and meet current laws and regulations.

US Legal Forms is one of the largest and most trustworthy document libraries available online.

Our company is always eager to assist you in any legal procedure, even if it’s merely downloading the Kings New York Certificate of Authority. Feel free to take advantage of our form archive and optimize your document experience!

- How can you obtain the Kings New York Certificate of Authority.

- If you currently have a subscription, simply Log In to your account. The Download option will be visible on all the templates you access. Furthermore, you can locate all previously saved documents in the My documents section.

- If you haven’t created an account yet, follow the steps below.

- Locate the template you need. Ensure that it is the template you intended to find: check its title and description, and utilize the Preview feature if it’s available. Otherwise, use the Search bar to find the required one.

- Initiate the saving process. Click Buy Now and select the pricing tier you prefer. Then, set up an account and complete your order using a credit card or PayPal.

- Export the document. Pick the format to download the Kings New York Certificate of Authority and modify and complete, or sign it according to your requirements.

Form popularity

FAQ

To apply for a Kings New York Certificate of Authority, you need to complete the appropriate application form available from the New York State Department of Taxation and Finance. Make sure to provide required business information and documentation when submitting your application. The process can be simplified by using USLegalForms, which offers guidance and resources to ensure your application is accurate and complete. Once approved, you'll be authorized to collect sales tax in New York.

No, a Kings New York Certificate of Authority is not the same as a tax ID. The certificate allows businesses to collect sales tax in New York, while a tax ID is used for tracking income and tax payments. Both are essential for compliant business operations, but they serve different purposes. If you need assistance with obtaining your certificate of authority, consider using USLegalForms for a streamlined application process.

To obtain a Kings New York Certificate of Authority, begin by determining if your business needs this certificate for tax purposes. Next, complete the application form, which can typically be found on the New York State Department of Taxation and Finance website. After you provide the necessary documentation and submit the application, you will receive your certificate in the mail if approved. Using a resource like USLegalForms can streamline this process, helping you gather the required information and ensuring all your paperwork is accurate.

To obtain a Kings New York Certificate of Authority, you must complete an application through the New York State Department of Taxation and Finance. This process involves filling out Form ST-1 and providing necessary details about your business. Once your application is approved, you will receive your certificate, enabling you to collect sales tax legally. For a streamlined experience, you can find helpful templates and guidance on uslegalforms.

A Kings New York Certificate of Authority is different from an Employer Identification Number (EIN). The certificate of authority is focused on sales tax registration for your business, while an EIN serves as a unique identifier for tax purposes. Both are essential, but they serve different functions. If you want to navigate these requirements easily, uslegalforms can provide clarity and support.

You can obtain a copy of your Kings New York Certificate of Authority online through the New York State Department of Taxation and Finance website. Look for the specific section that deals with certificate requests or duplicates. After verifying your business details, you can request a copy, ensuring you have the necessary documentation for tax collection.

An EIN is not the same as the Kings New York Certificate of Authority. The EIN serves primarily for federal tax purposes, while the Certificate of Authority allows you to collect state sales tax. Understanding the distinction is crucial for compliance in both federal and state regulations, as each serves a unique role in business operations.

Filling out a Kings New York Certificate of Authority requires careful attention to detail. First, ensure you have the correct form, which is typically available online. Complete the necessary fields, providing accurate business information, and clearly state the purpose of your exemption. Don't forget to include any additional documentation if required by the state.

To obtain the Kings New York Certificate of Authority, you need to complete the application available on the New York State Department of Taxation and Finance website. This process involves providing information about your business and any partners or owners. Once the application is processed, you will receive your certificate, allowing you to legally collect sales tax in New York.

No, the Kings New York Certificate of Authority is not the same as a business license. A business license is a general permit allowing a business to operate within a specific jurisdiction. On the other hand, the Certificate of Authority specifically permits a business to collect sales tax, which is a different requirement necessary for tax compliance.