The Nassau New York Certificate of Authority is an essential document required for certain business activities in Nassau County, New York. Obtaining this certificate allows businesses to operate legally and ensures compliance with regulatory guidelines and tax obligations. There are different types of Nassau New York Certificates of Authority, each specific to certain business activities. Here are some of the most common types: 1. Sales Tax Certificate of Authority: This certificate is essential for businesses engaged in retail sales, including both brick-and-mortar stores and online retailers. It enables businesses to collect and remit sales tax to the New York State Department of Taxation and Finance. 2. Contractor's Certificate of Authority: Construction contractors, subcontractors, and specialty trade contractors must acquire this certificate to perform their services within Nassau County. It guarantees compliance with local regulations and taxation requirements specific to the construction industry. 3. Vendor's Certificate of Authority: Vendors or suppliers of goods that are not subject to sales tax, such as wholesale distributors or manufacturers, may require this certificate. It exempts them from collecting sales tax on qualifying transactions. 4. Certificate of Authority for Professional Services: Professionals like doctors, lawyers, accountants, or consultants providing services within Nassau County need this certificate. It ensures compliance with licensing obligations and enables the collection of applicable taxes for professional services rendered. 5. Transportation Certificate of Authority: For businesses involved in transporting goods or people, such as trucking companies or taxi services, this certificate is necessary. It ensures adherence to local regulations and tax compliance related to transportation services. To obtain a Nassau New York Certificate of Authority, businesses typically need to complete an application process, which may include providing relevant business information, tax identification numbers, proof of insurance, and paying the applicable fees. The exact requirements may vary depending on the specific type of certificate needed. It is important for businesses operating in Nassau County to understand the specific type of Certificate of Authority they require to ensure their operations are fully compliant with local regulations and tax laws.

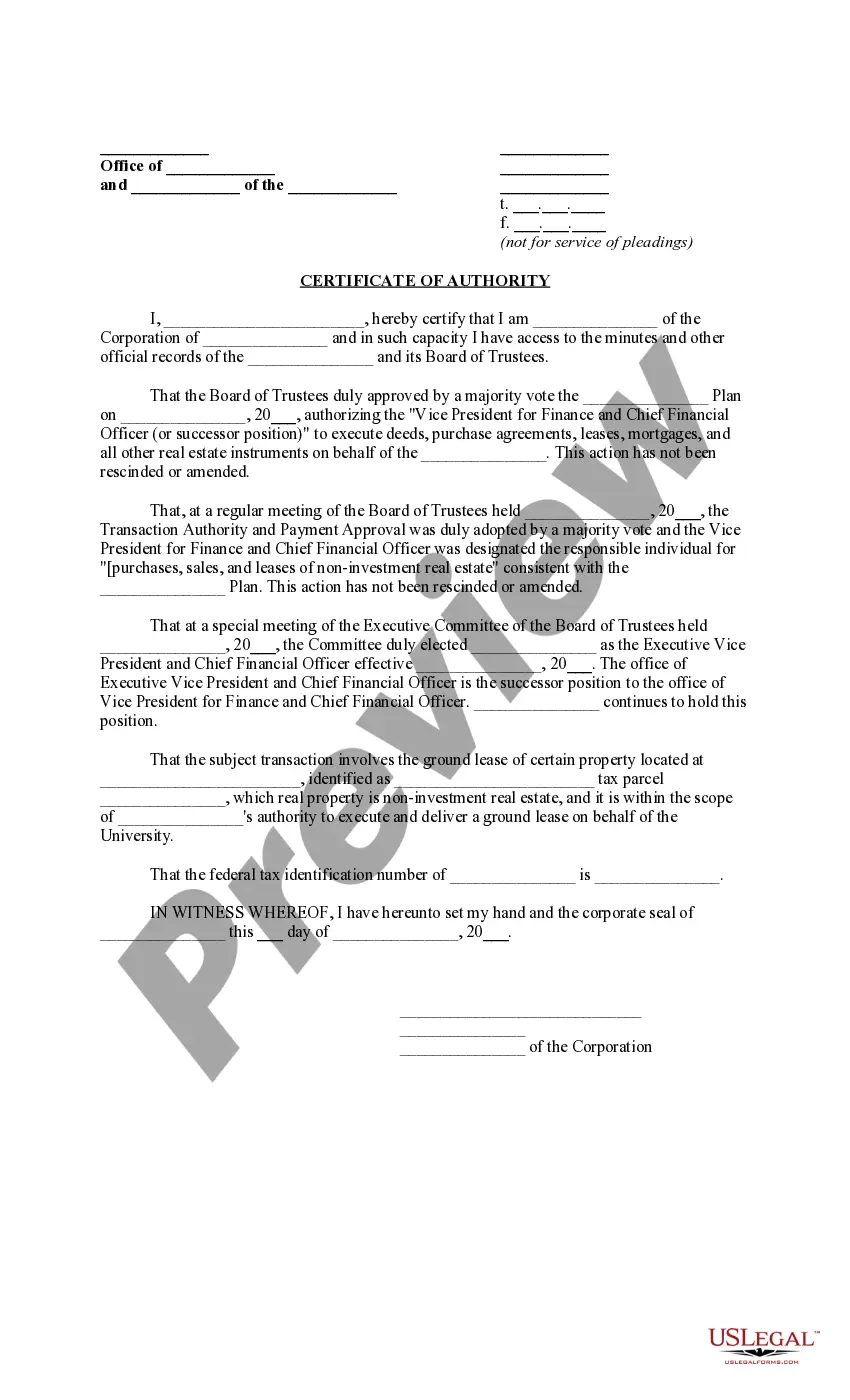

Nassau New York Certificate of Authority

Description

How to fill out Nassau New York Certificate Of Authority?

Take advantage of the US Legal Forms and get instant access to any form sample you require. Our useful website with a large number of document templates makes it simple to find and get virtually any document sample you want. You are able to save, complete, and sign the Nassau New York Certificate of Authority in just a couple of minutes instead of browsing the web for several hours trying to find a proper template.

Utilizing our library is a wonderful way to raise the safety of your form filing. Our experienced attorneys on a regular basis check all the documents to make sure that the templates are relevant for a particular state and compliant with new acts and polices.

How can you get the Nassau New York Certificate of Authority? If you have a profile, just log in to the account. The Download button will appear on all the samples you view. Moreover, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions listed below:

- Find the template you require. Make sure that it is the form you were seeking: verify its name and description, and use the Preview function when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the downloading process. Click Buy Now and choose the pricing plan you like. Then, create an account and process your order using a credit card or PayPal.

- Save the document. Choose the format to obtain the Nassau New York Certificate of Authority and edit and complete, or sign it for your needs.

US Legal Forms is probably the most significant and trustworthy template libraries on the web. We are always happy to help you in any legal case, even if it is just downloading the Nassau New York Certificate of Authority.

Feel free to make the most of our service and make your document experience as convenient as possible!