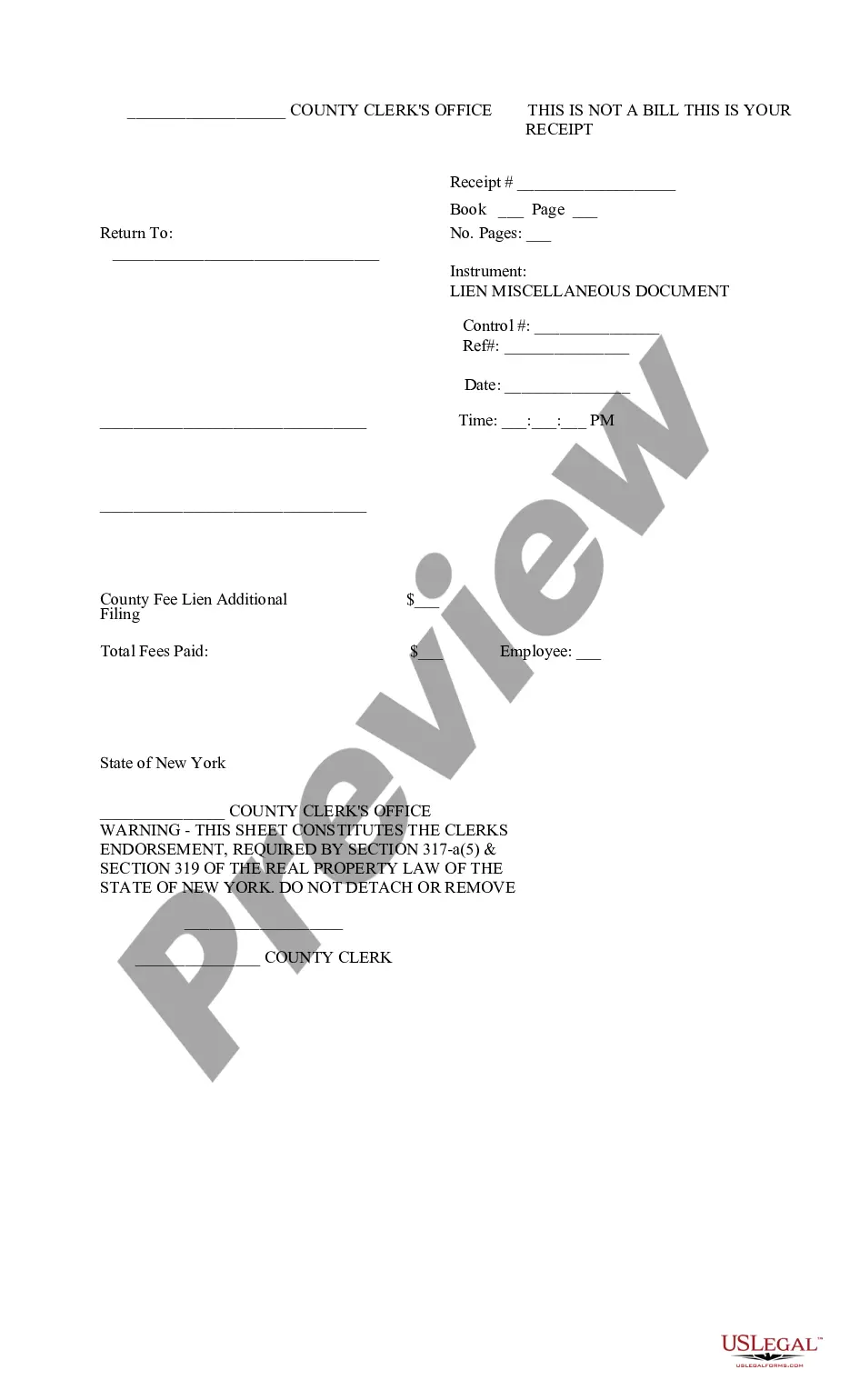

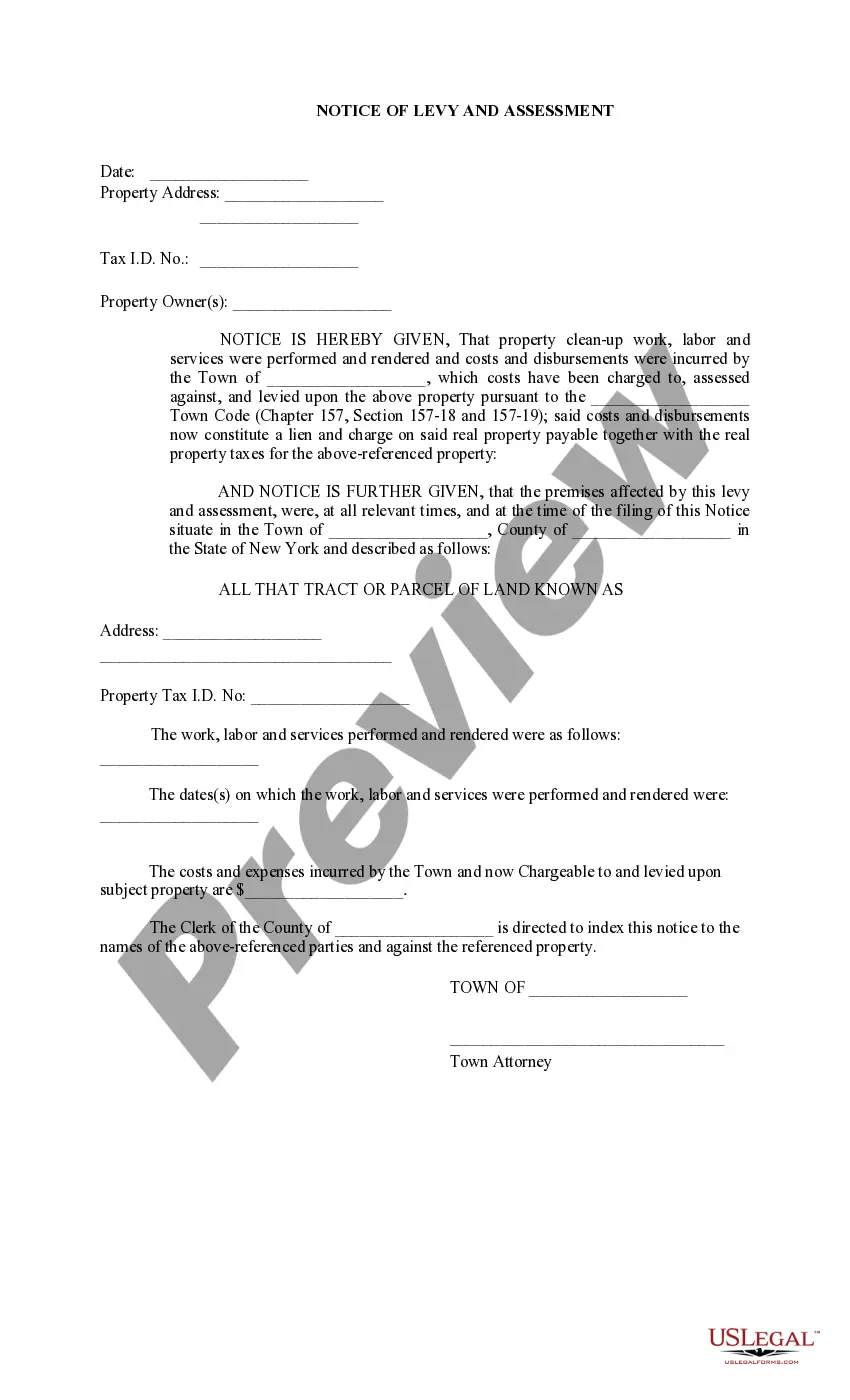

The Suffolk New York Notice of Levy and Assessment is an important legal document that serves to notify individuals or businesses in Suffolk County, New York about outstanding tax liabilities. It is issued by the Suffolk County Department of Finance and serves as a formal demand for payment of taxes owed or an assessment of tax liability. When a taxpayer fails to fulfill their tax obligations, such as paying property taxes or income taxes, the Suffolk County Department of Finance has the authority to issue a Notice of Levy and Assessment. This notice is typically sent by mail to the taxpayer's last known address and outlines the specific amount of tax owed, along with any penalties and interest that may have accrued. The Suffolk New York Notice of Levy and Assessment must comply with state and local laws and includes detailed information regarding the unpaid tax obligations. It typically includes the taxpayer's name, address, and taxpayer identification number, as well as a breakdown of the amount owed for each specific tax type, such as property taxes, sales taxes, or income taxes. In addition to providing information about the outstanding tax liabilities, the notice also provides essential instructions on how to settle the debt. It specifies the acceptable methods of payment, such as online payment, mail, or in-person at the Suffolk County Department of Finance offices. The notice may also mention the possibility of installment plans or other options for individuals facing financial hardship. It is important to note that there are different types of Suffolk New York Notice of Levy and Assessment, depending on the specific tax obligations involved. Some common types include: 1. Property Tax Levy: This notice is issued when a property owner fails to pay their property taxes on time. It outlines the amount of unpaid property taxes and provides a deadline for payment. 2. Income Tax Levy: This notice is sent to individuals or businesses with outstanding income tax liabilities. It details the amount owed based on the individual's tax return and provides instructions on how to settle the debt. 3. Sales Tax Levy: This notice is issued to businesses or individuals who have not remitted the necessary sales taxes collected from customers. It identifies the amount owed and specifies the actions required to resolve the debt. It is vital for recipients of the Suffolk New York Notice of Levy and Assessment to take immediate action upon receiving it. Ignoring or neglecting to address the notice may lead to further penalties, interest, or even the seizure of assets by the county to satisfy the outstanding tax obligations. Therefore, it is strongly advised to consult with a tax advisor, attorney, or contact the Suffolk County Department of Finance directly to understand the options available for resolving the debt and avoid any adverse consequences.

Suffolk New York Notice of Levy and Assessment

Description

How to fill out Suffolk New York Notice Of Levy And Assessment?

If you’ve already utilized our service before, log in to your account and save the Suffolk New York Notice of Levy and Assessment on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Suffolk New York Notice of Levy and Assessment. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!

Form popularity

FAQ

Filing the grievance form Use Form RP-524, Complaint on Real Property Assessment to grieve your assessment. The form can be completed by yourself or your representative or attorney. File the grievance form with the assessor or the board of assessment review (BAR) in your city or town.

Expiration of Statute of Limitations Generally, the IRS only has 10 years to collect taxes owed. After that time period, the tax owed expires. If you can make it to the collection statute expiration date (CSED), the IRS cannot legally collect on the taxes owed anymore and must remove the levy.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle(s), real estate and other personal property.

Contact the IRS immediately to resolve your tax liability and request a levy release. The IRS can also release a levy if it determines that the levy is causing an immediate economic hardship. If the IRS denies your request to release the levy, you may appeal this decision.

Contact the IRS immediately to resolve your tax liability and request a levy release. The IRS can also release a levy if it determines that the levy is causing an immediate economic hardship. If the IRS denies your request to release the levy, you may appeal this decision.

How to resolve. You must pay your debt in full to end the income execution payments. You can make payments: online from your bank account using Quick Pay (individuals only, no Online Services account needed);

To resolve a levy, you will need to call us at 518-457-5893 during regular business hours and speak with a representative. Be sure to enter your taxpayer ID when prompted.

In Suffolk County, the average tax rate is 2.37%, according to SmartAsset. If your market value is $500,000, the local assessment office will assess your property value at a percentage of market value. If assessments in the community are at 90% market value, then the house is assessed at $450,000.

A levy is a legal seizure of your property to satisfy a tax debt. Levies are different from liens. A lien is a legal claim against property to secure payment of the tax debt, while a levy actually takes the property to satisfy the tax debt.

You can avoid a levy by filing returns on time and paying your taxes when due. If you need more time to file, you can request an extension. If you can't pay what you owe, you should pay as much as you can and work with the IRS to resolve the remaining balance.

Interesting Questions

More info

The state budget is set annually by the New York State Assembly and Senate and signed by the governor. It is the primary means for state policymaking, public funding and budget development in New York City. The city budget is set annually by the New York City Council. The annual budget is reviewed by a Board of Budget and Finance which consists of the mayor, the city comptroller, the New York City councilman and three at-large members. The budget, along with all other city financial and governmental documents such as business plans, budget maps for specific projects, and the budget itself, is available for public inspection during regular business hours. On November 3, 2009, the General Assembly adopted a budget for the financial year 2009 with an increase in the state's General Fund by 35 billion for the fiscal year through June 30, 2009.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.