Syracuse New York Notice of Levy and Assessment: A Comprehensive Overview In Syracuse, New York, the Notice of Levy and Assessment is a crucial legal document that serves as a formal communication between the government and property owners regarding the assessment and potential levy of various taxes, fees, or liens related to the property. This notice is intended to inform property owners about any changes in their assessment value or impending tax obligations. There are several types of Syracuse New York Notice of Levy and Assessment, each serving a specific purpose: 1. Property Tax Assessment: This notice provides property owners with information about the assessed value of their property for tax purposes. It outlines the valuation methods used, details on exemptions, and any changes in assessment for the upcoming tax year. 2. Tax Levy Notice: Property owners receive this notice to notify them of the taxes they owe to the city, county, and state. It includes detailed information about tax rates, additional levies, due dates, and payment options. 3. Special Assessment Notice: This notice is specific to property owners who may have additional assessments imposed on their property by the government for specific purposes, such as road improvements, sewer projects, or other infrastructure developments. It outlines the project details and provides information on the assessment amount and payment schedule. 4. Water and Sewer Assessment: Property owners who receive water and sewer services from the city get this notice to inform them of any changes in rates, billing cycles, and charges related to these services. 5. Notice of Tax Lien: If a property owner fails to pay their taxes, the local government may place a tax lien on the property. This Notice of Tax Lien informs the property owner about the outstanding tax balance, penalties, interest, and the potential consequences of failing to pay the overdue amount, which may include foreclosure or seizure of the property. Understanding these different types of Syracuse New York Notice of Levy and Assessment is crucial for property owners. It ensures they can effectively manage their tax obligations, stay informed about changes in taxes and assessments, and take the necessary actions to comply with local tax laws and regulations. It is recommended for property owners to carefully review these notices, seek professional advice if needed, and promptly address any concerns or discrepancies to avoid potential penalties or legal issues.

Syracuse New York Notice of Levy and Assessment

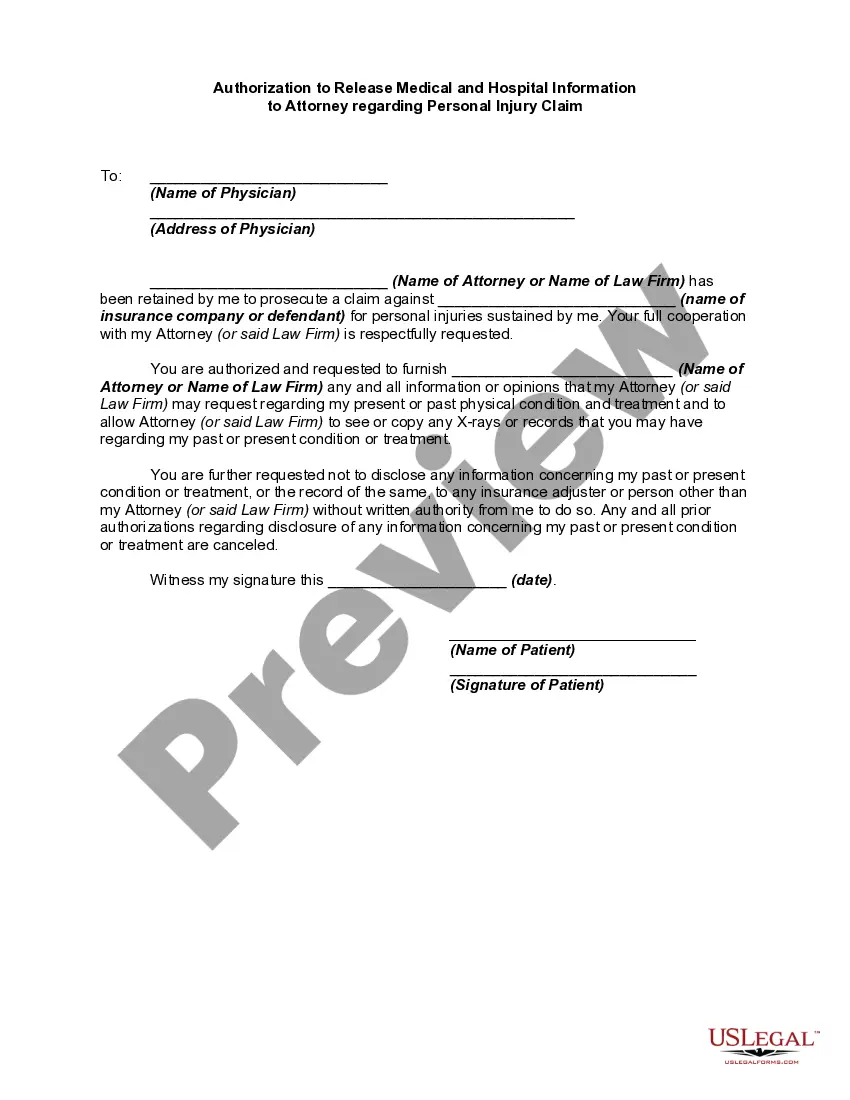

Description

How to fill out Syracuse New York Notice Of Levy And Assessment?

Are you looking for a reliable and inexpensive legal forms provider to buy the Syracuse New York Notice of Levy and Assessment? US Legal Forms is your go-to choice.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of specific state and county.

To download the form, you need to log in account, find the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Syracuse New York Notice of Levy and Assessment conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the form is intended for.

- Start the search over if the template isn’t good for your specific scenario.

Now you can create your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Syracuse New York Notice of Levy and Assessment in any available file format. You can get back to the website at any time and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time learning about legal paperwork online once and for all.