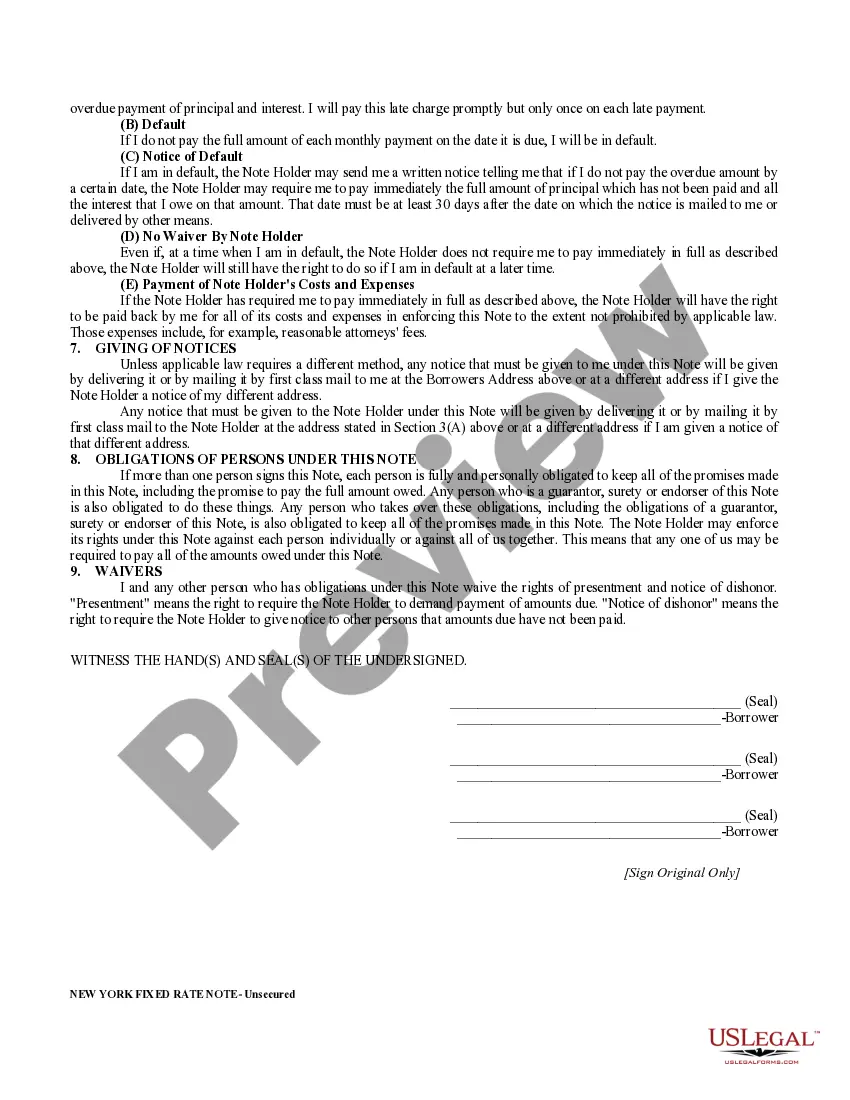

Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement in the Bronx, New York. This promissory note serves as a binding contract between a lender and a borrower, specifying the repayment details of the loan. The purpose of this promissory note is to establish a fixed-rate loan wherein a borrower agrees to repay the lender in regularly scheduled installments. The note is "unsecured," meaning it does not require any collateral or security from the borrower, making it suitable for individuals who do not possess substantial assets or are unable to provide collateral. Common types of Bronx New York Unsecured Installment Payment Promissory Notes for Fixed Rate include: 1. Personal Loan Promissory Note: This type of promissory note applies to loans between individuals, friends, or family members, typically used to finance personal expenses, educational costs, or emergency needs. It outlines the agreed-upon interest rate, repayment schedule, and consequences of default. 2. Business Loan Promissory Note: This promissory note is specific to loans obtained by businesses or entrepreneurs in the Bronx, New York. It includes details on the loan amount, interest rate, repayment terms, and can be customized to accommodate the unique requirements of the business. 3. Student Loan Promissory Note: Designed specifically to address the financial needs of students pursuing higher education in the Bronx. This type of promissory note outlines the loan amount, interest rate, deferment options, repayment terms, and consequences for late or missed payments. 4. Medical Loan Promissory Note: Aimed at covering medical expenses, this promissory note secures loans for health-related procedures or treatments. It specifies the loan amount, interest rate, and conditions for repayment, considering the potential financial strain associated with medical expenses. In conclusion, the Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that establishes the terms of a loan agreement in the Bronx, New York. Different types of promissory notes, such as personal loans, business loans, student loans, and medical loans, cater to specific borrowing needs while adhering to a fixed-rate repayment structure.

Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Bronx New York Unsecured Installment Payment Promissory Note For Fixed Rate?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!