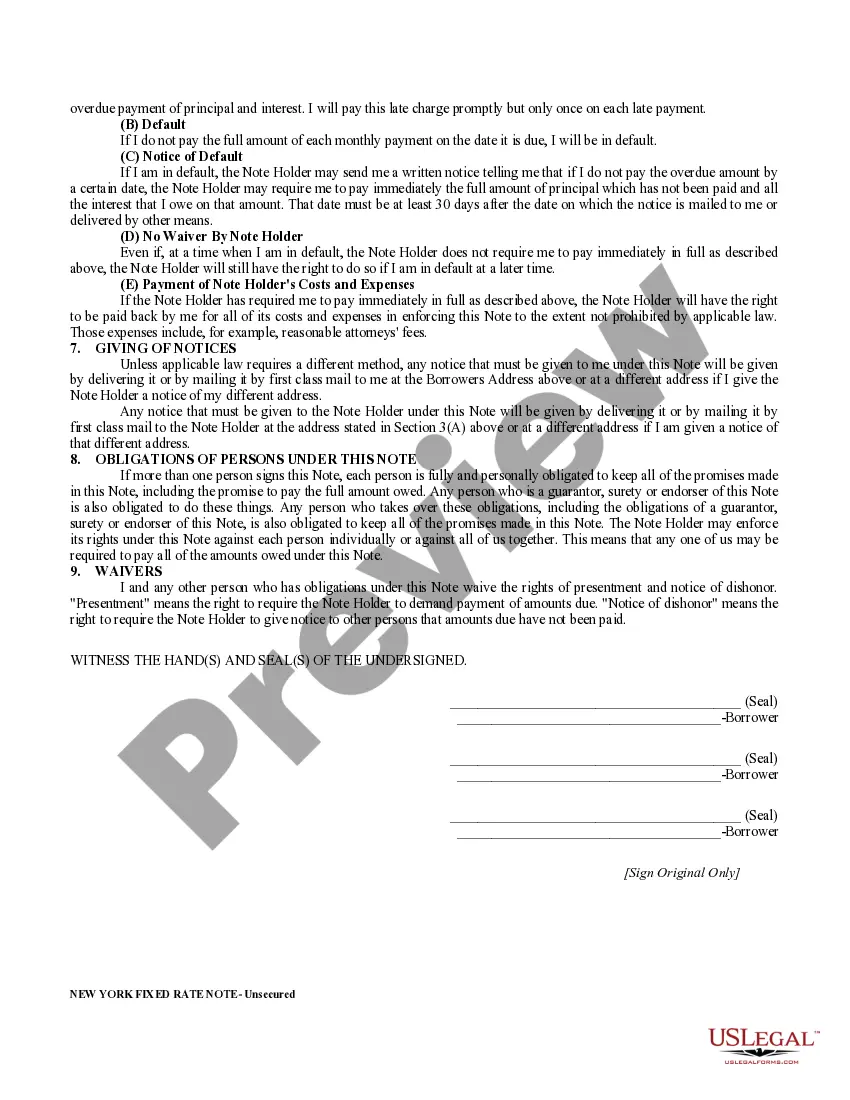

A Queens New York Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Queens, New York. This type of promissory note is specifically designed for unsecured loans, meaning it does not require any collateral from the borrower. The repayment of the loan is structured through regular, predetermined installment payments, with a fixed interest rate applied throughout the loan term. Key features of a Queens New York Unsecured Installment Payment Promissory Note for Fixed Rate include the principal loan amount, repayment schedule, interest rate, late payment penalties, and borrower's obligations and responsibilities. It provides security to lenders by establishing the borrower's promise to repay the loan. This promissory note serves as evidence of the loan agreement and helps protect the rights of both parties involved. Different types of Queens New York Unsecured Installment Payment Promissory Notes for Fixed Rate may include variations based on the loan amount, interest rate, and term length. For instance, there can be promissory notes for small loans, medical loans, educational loans, personal loans, or business loans. Each type may have specific terms and conditions tailored to meet the requirements of different borrowers and lenders. When using a Queens New York Unsecured Installment Payment Promissory Note for Fixed Rate, it is crucial to carefully review and understand all aspects of the document before signing. Borrowers should ensure they can meet the financial obligations, while lenders must ensure the terms and conditions protect their investment. Consulting with a legal professional is recommended to ensure compliance with applicable laws and regulations in Queens, New York. It is important to note that laws and regulations may vary, so seeking professional advice is essential when drafting or entering into such agreements.

Queens New York Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Queens New York Unsecured Installment Payment Promissory Note For Fixed Rate?

If you are searching for a valid form template, it’s extremely hard to choose a more convenient service than the US Legal Forms site – probably the most considerable libraries on the web. Here you can find a huge number of templates for organization and personal purposes by types and regions, or keywords. With our advanced search option, getting the most recent Queens New York Unsecured Installment Payment Promissory Note for Fixed Rate is as easy as 1-2-3. In addition, the relevance of every record is confirmed by a group of expert lawyers that on a regular basis review the templates on our platform and update them in accordance with the newest state and county laws.

If you already know about our system and have a registered account, all you should do to get the Queens New York Unsecured Installment Payment Promissory Note for Fixed Rate is to log in to your account and click the Download button.

If you use US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have found the sample you require. Check its information and make use of the Preview function to check its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to get the needed file.

- Confirm your choice. Click the Buy now button. Following that, choose the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your credit card or PayPal account to complete the registration procedure.

- Get the template. Indicate the file format and download it to your system.

- Make modifications. Fill out, modify, print, and sign the received Queens New York Unsecured Installment Payment Promissory Note for Fixed Rate.

Each template you save in your account does not have an expiry date and is yours forever. You always have the ability to access them via the My Forms menu, so if you want to have an extra copy for editing or creating a hard copy, feel free to return and export it once more at any moment.

Take advantage of the US Legal Forms professional collection to get access to the Queens New York Unsecured Installment Payment Promissory Note for Fixed Rate you were seeking and a huge number of other professional and state-specific templates in one place!