Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out New York Unsecured Installment Payment Promissory Note For Fixed Rate?

We consistently aim to reduce or prevent legal repercussions when navigating intricate legal or financial issues.

To achieve this, we enroll in legal services that are typically quite costly.

Nevertheless, not every legal situation is equally complicated. Many can be handled independently.

US Legal Forms is an online repository of current DIY legal templates addressing everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you happen to lose the document, you can always re-download it in the My documents tab. The procedure is just as straightforward if you're unfamiliar with the website! You can establish your account in just a few minutes. Ensure that the Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate adheres to the laws and regulations of your region. Additionally, it is crucial that you review the form’s description (if available), and if you detect any differences from what you initially sought, search for an alternative form. Once you’ve confirmed that the Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate is suitable for you, you can select the subscription plan and make a payment. Then you can download the document in any appropriate format. For over 24 years, we’ve assisted millions by offering ready-to-customize and up-to-date legal forms. Leverage US Legal Forms now to conserve time and resources!

- Our platform empowers you to manage your issues without consulting an attorney.

- We provide access to legal document templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Utilize US Legal Forms whenever you need to obtain and download the Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate or any other document with ease and security.

Form popularity

FAQ

You can obtain a promissory note from various sources, including legal websites and financial institutions. Alternatively, using a reliable legal form platform like uslegalforms is a great option. They offer a Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate, which is ready to use and ensures accuracy.

An installment note is a type of promissory note that requires repayment in regular installments. While all installment notes are promissory notes, not all promissory notes specifically outline installment payments. If you need a structured payment schedule, look for a Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate to meet your needs.

To write a promissory note for payment, begin by including the date and names of both the borrower and lender. Clearly outline the amount owed, the interest rate, and the payment schedule. Additionally, specify any collateral or conditions, if applicable. For a tailored document, consider using a Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate from uslegalforms.

In New York, a promissory note does not need to be notarized to be enforceable. However, notarization can strengthen the document’s validity and help prevent disputes later on. It’s wise to ensure that the Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate is well-drafted and clear to all parties involved.

The primary difference between a secured and unsecured promissory note lies in collateral. A secured note is backed by an asset that the lender can seize if the borrower defaults. In contrast, a Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate does not involve collateral, making it riskier for lenders but easier for borrowers to obtain.

To collect on a Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate, you typically start by contacting the borrower to discuss the missed payment. If that doesn't resolve the issue, you can send a formal demand letter requesting payment. If necessary, you may take legal action, such as filing a claim in small claims court, to recover the owed amount.

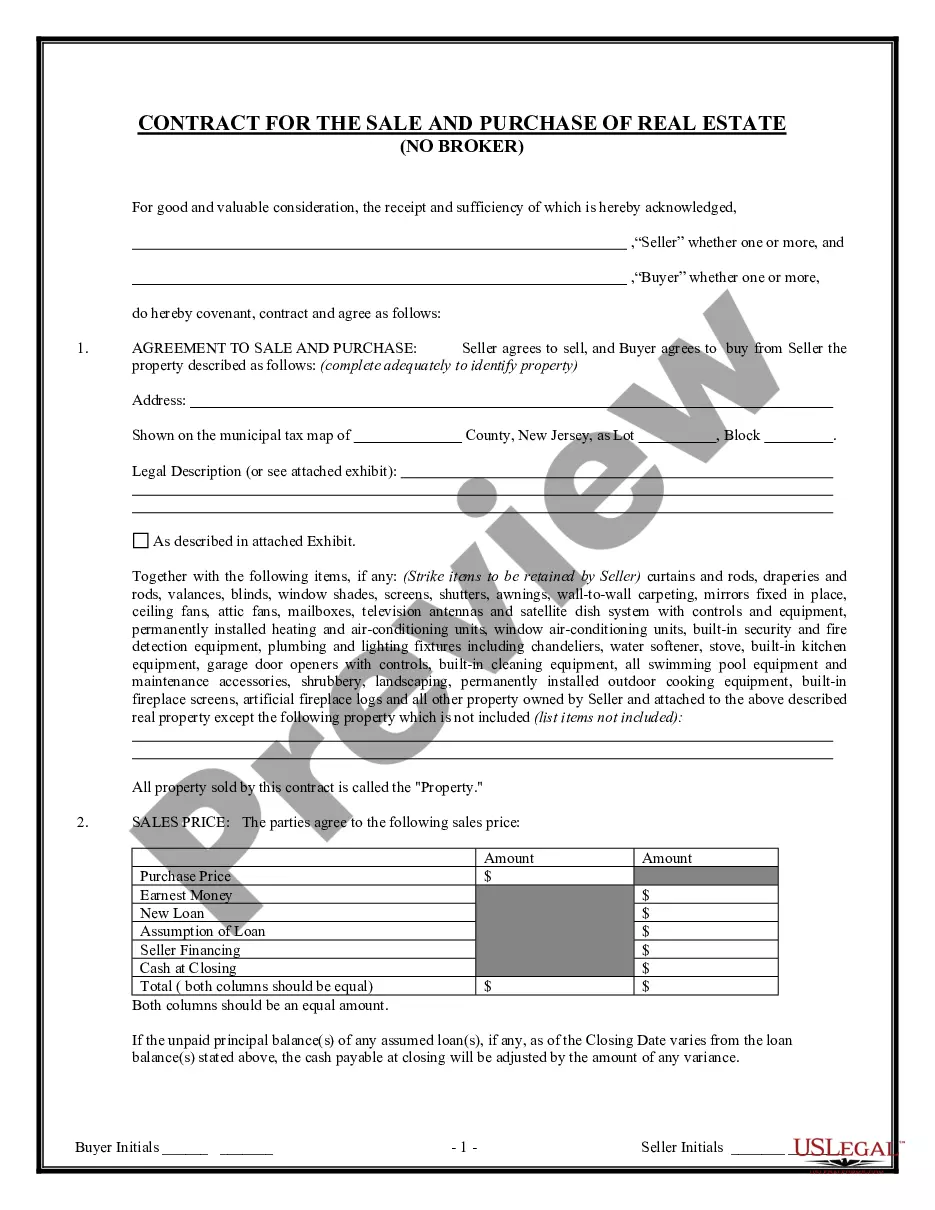

For a UCC fixture filing in New York, you must file a financing statement in the appropriate county where the fixtures are located. This filing helps secure your interests in specific pieces of property that are considered fixtures. Whether you are using it alongside your Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate or separately, ensure all documentation is properly completed to protect your assets.

To file a UCC in New York, go to the New York Department of State's office or its website. You can also check with local counties for specific requirements if the debtor operates locally. Filing correctly is essential for your financial relationships, especially when dealing with a Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate.

In New York, you can file a UCC financing statement with the New York Department of State in Albany. Additionally, for local filings, you might need to check with county clerks. Ensuring proper filing of your UCC will help you maintain secure interest in your Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate, protecting your financial rights.

Yes, the UCC applies in New York and governs various commercial transactions. It provides a standardized set of rules that enhance business operations across the state. When you create financial agreements, including those associated with a Syracuse New York Unsecured Installment Payment Promissory Note for Fixed Rate, understanding the UCC can greatly benefit you.