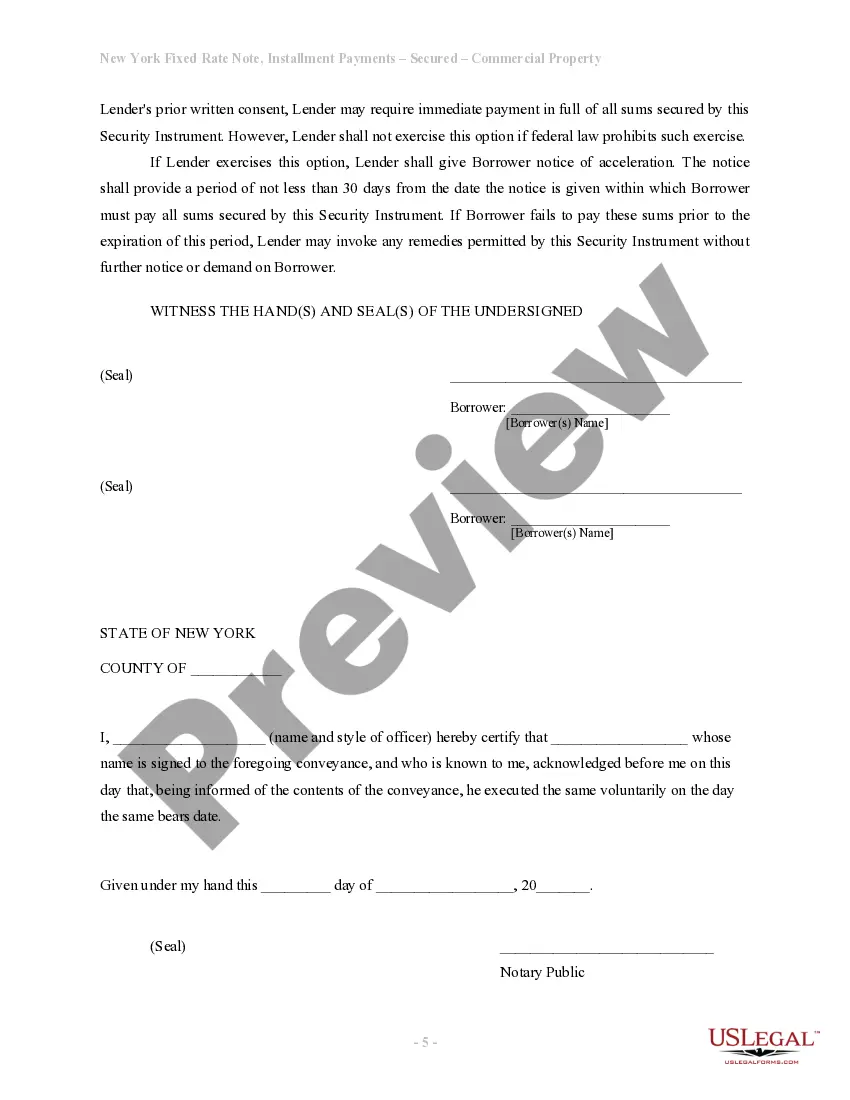

This is a Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

A Bronx New York Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal financial instrument used to document a loan arrangement between two parties, typically a lender and a borrower, in the context of commercial real estate transactions in Bronx, New York. This type of promissory note provides specific details regarding repayment terms and interest rates, ensuring a structured loan process. When it comes to different types of Bronx New York Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate, there can be various categorizations based on specific characteristics or parties involved. Some key variations may include: 1. Borrower-specific Promissory Notes: These are promissory notes tailored to meet the requirements of different borrowers, whether it be individuals, businesses, or organizations seeking financial assistance for commercial real estate investments in Bronx, NY. 2. Property-specific Promissory Notes: These promissory notes are designed to secure loans solely for specific commercial properties in the Bronx, New York area. The notes are tailored to reflect the unique characteristics and details of each property, considering factors such as location, size, and potential valuation. 3. Loan Amount-specific Promissory Notes: These types of promissory notes are suited for different loan amounts, accommodating the financial needs of borrowers engaged in commercial real estate transactions. Whether it's a small loan for a startup venture or a substantial loan for a large-scale development, these notes specify the principal amount provided. 4. Term-specific Promissory Notes: Promissory notes can also be categorized based on specific durations. Some borrowers might require short-term loans for immediate needs, while others may opt for longer-term arrangements. These promissory notes define the repayment schedule and interest rate applicable for the selected loan term. 5. Interest Rate-specific Promissory Notes: Fixed-rate promissory notes provide borrowers with a stable interest rate throughout the loan term, allowing for predictable monthly installments and enhanced budgeting capabilities. Other variations may include adjustable-rate notes or hybrid options, depending on the borrower's preference and market conditions. In summary, a Bronx New York Installments Fixed Rate Promissory Note Secured by Commercial Real Estate serves as an essential financial tool in facilitating commercial real estate transactions. The note ensures that crucial details such as repayment terms, interest rates, and property lateralization are recorded to provide both lenders and borrowers with legal protection and clarity regarding their financial obligations. Various types of promissory notes exist to cater to individual borrower needs, including borrower-specific, property-specific, loan amount-specific, term-specific, and interest rate-specific variations.A Bronx New York Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal financial instrument used to document a loan arrangement between two parties, typically a lender and a borrower, in the context of commercial real estate transactions in Bronx, New York. This type of promissory note provides specific details regarding repayment terms and interest rates, ensuring a structured loan process. When it comes to different types of Bronx New York Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate, there can be various categorizations based on specific characteristics or parties involved. Some key variations may include: 1. Borrower-specific Promissory Notes: These are promissory notes tailored to meet the requirements of different borrowers, whether it be individuals, businesses, or organizations seeking financial assistance for commercial real estate investments in Bronx, NY. 2. Property-specific Promissory Notes: These promissory notes are designed to secure loans solely for specific commercial properties in the Bronx, New York area. The notes are tailored to reflect the unique characteristics and details of each property, considering factors such as location, size, and potential valuation. 3. Loan Amount-specific Promissory Notes: These types of promissory notes are suited for different loan amounts, accommodating the financial needs of borrowers engaged in commercial real estate transactions. Whether it's a small loan for a startup venture or a substantial loan for a large-scale development, these notes specify the principal amount provided. 4. Term-specific Promissory Notes: Promissory notes can also be categorized based on specific durations. Some borrowers might require short-term loans for immediate needs, while others may opt for longer-term arrangements. These promissory notes define the repayment schedule and interest rate applicable for the selected loan term. 5. Interest Rate-specific Promissory Notes: Fixed-rate promissory notes provide borrowers with a stable interest rate throughout the loan term, allowing for predictable monthly installments and enhanced budgeting capabilities. Other variations may include adjustable-rate notes or hybrid options, depending on the borrower's preference and market conditions. In summary, a Bronx New York Installments Fixed Rate Promissory Note Secured by Commercial Real Estate serves as an essential financial tool in facilitating commercial real estate transactions. The note ensures that crucial details such as repayment terms, interest rates, and property lateralization are recorded to provide both lenders and borrowers with legal protection and clarity regarding their financial obligations. Various types of promissory notes exist to cater to individual borrower needs, including borrower-specific, property-specific, loan amount-specific, term-specific, and interest rate-specific variations.