Included in your package are the following forms:

1. Satisfaction, Release or Cancellation of a Deed of Trust by a Corporation;

2. Satisfaction, Release or Cancellation of a Deed of Trust by an Individual;

3. Letter of Notice to Borrower of Status of Mortgage;

4. Letter to Recording Office for Recording Satisfaction of a Mortgage

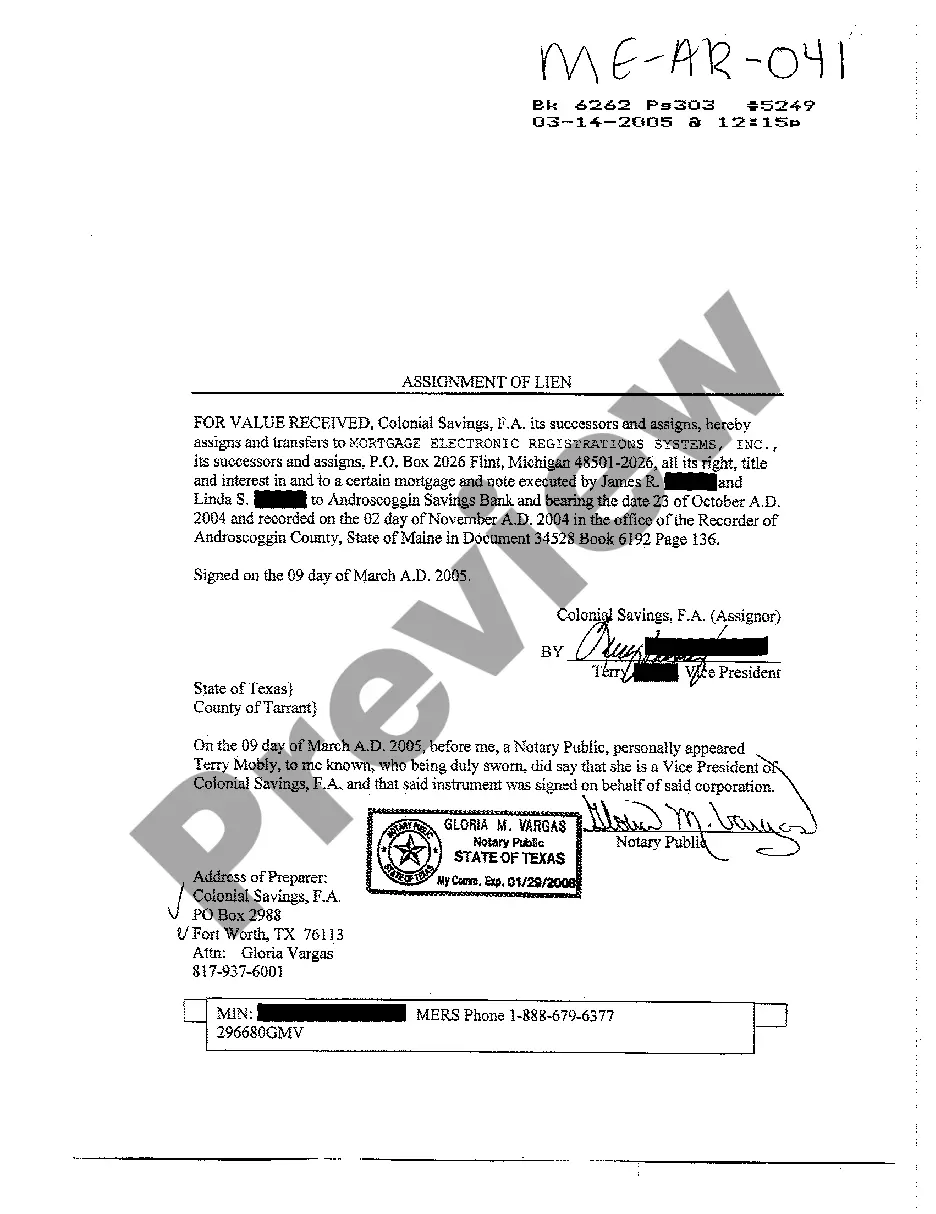

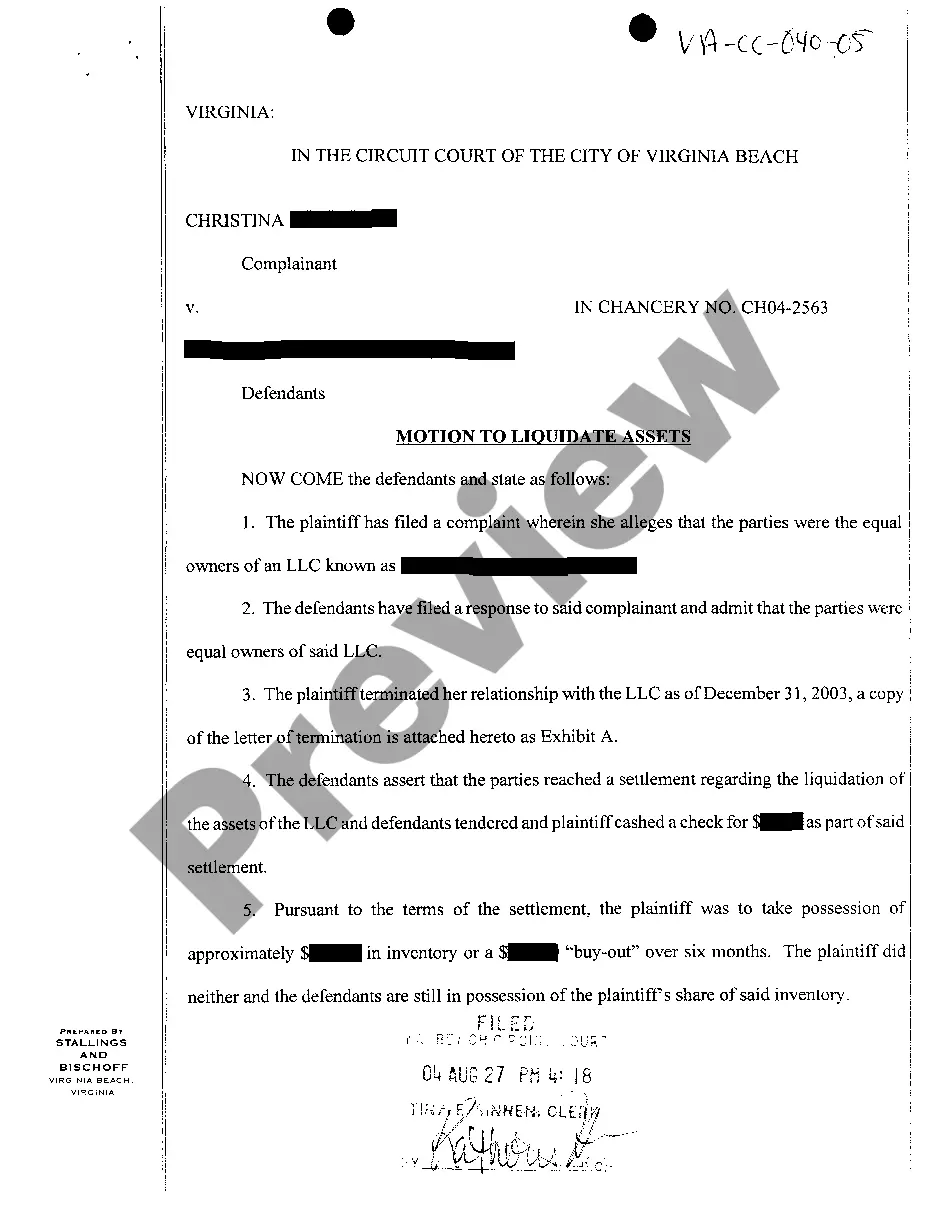

Rochester, New York Satisfaction, Cancellation or Release of Mortgage Package is a collection of documents and forms required to declare the successful fulfillment, termination, or release of a mortgage in Rochester, New York. This package is crucial for homeowners, lending institutions, and other involved parties to legally release the mortgage lien on a property and ensure a clean title transfer process. Keywords: Rochester New York, Satisfaction, Cancellation, Release, Mortgage Package The Rochester New York Satisfaction, Cancellation, or Release of Mortgage Package typically consists of the following documents: 1. Satisfaction of Mortgage Form: This form is a legal document declaring that the borrower has repaid the mortgage debt in full. It contains details such as the borrower's name, lender information, property description, loan amount, and date of repayment. 2. Affidavit of Satisfaction: An affidavit is a sworn statement attesting that the mortgage has been satisfied and the lien is released. It is usually signed by the lender or a representative thereof, confirming that the debt has been fully paid. 3. Certificate of Satisfaction: This document is issued by the lender or the relevant authorities to officially declare that the mortgage has been satisfied and the property is free from any lien. It acts as proof of the release of the mortgage and is crucial for future property transactions. 4. Release of Mortgage: The Release of Mortgage is a legally binding document that releases the mortgage lien from the property. It is signed by the lender or their authorized representative, acknowledging that the debt has been paid in full and the property is now free from any encumbrances. 5. Notary Acknowledgment: This form is used to verify the authenticity of the signatures appearing on the documents within the package. It is vital to have the signatures notarized to ensure legal compliance. Different types of Rochester New York Satisfaction, Cancellation, or Release of Mortgage Packages may vary based on specific requirements or circumstances. For instance, there might be variations if the mortgage is being released due to foreclosure, refinancing, or a deed in lieu of foreclosure. Each situation may necessitate additional forms or supporting documents to complete the package comprehensively. In conclusion, a Rochester New York Satisfaction, Cancellation, or Release of Mortgage Package is a comprehensive set of documents comprising the necessary paperwork for legally releasing a mortgage lien in Rochester, New York. By satisfying, canceling, or releasing the mortgage, this package plays a crucial role in facilitating the transfer of property ownership and ensuring a clean title for both the buyer and seller involved in the transaction.

Rochester, New York Satisfaction, Cancellation or Release of Mortgage Package is a collection of documents and forms required to declare the successful fulfillment, termination, or release of a mortgage in Rochester, New York. This package is crucial for homeowners, lending institutions, and other involved parties to legally release the mortgage lien on a property and ensure a clean title transfer process. Keywords: Rochester New York, Satisfaction, Cancellation, Release, Mortgage Package The Rochester New York Satisfaction, Cancellation, or Release of Mortgage Package typically consists of the following documents: 1. Satisfaction of Mortgage Form: This form is a legal document declaring that the borrower has repaid the mortgage debt in full. It contains details such as the borrower's name, lender information, property description, loan amount, and date of repayment. 2. Affidavit of Satisfaction: An affidavit is a sworn statement attesting that the mortgage has been satisfied and the lien is released. It is usually signed by the lender or a representative thereof, confirming that the debt has been fully paid. 3. Certificate of Satisfaction: This document is issued by the lender or the relevant authorities to officially declare that the mortgage has been satisfied and the property is free from any lien. It acts as proof of the release of the mortgage and is crucial for future property transactions. 4. Release of Mortgage: The Release of Mortgage is a legally binding document that releases the mortgage lien from the property. It is signed by the lender or their authorized representative, acknowledging that the debt has been paid in full and the property is now free from any encumbrances. 5. Notary Acknowledgment: This form is used to verify the authenticity of the signatures appearing on the documents within the package. It is vital to have the signatures notarized to ensure legal compliance. Different types of Rochester New York Satisfaction, Cancellation, or Release of Mortgage Packages may vary based on specific requirements or circumstances. For instance, there might be variations if the mortgage is being released due to foreclosure, refinancing, or a deed in lieu of foreclosure. Each situation may necessitate additional forms or supporting documents to complete the package comprehensively. In conclusion, a Rochester New York Satisfaction, Cancellation, or Release of Mortgage Package is a comprehensive set of documents comprising the necessary paperwork for legally releasing a mortgage lien in Rochester, New York. By satisfying, canceling, or releasing the mortgage, this package plays a crucial role in facilitating the transfer of property ownership and ensuring a clean title for both the buyer and seller involved in the transaction.