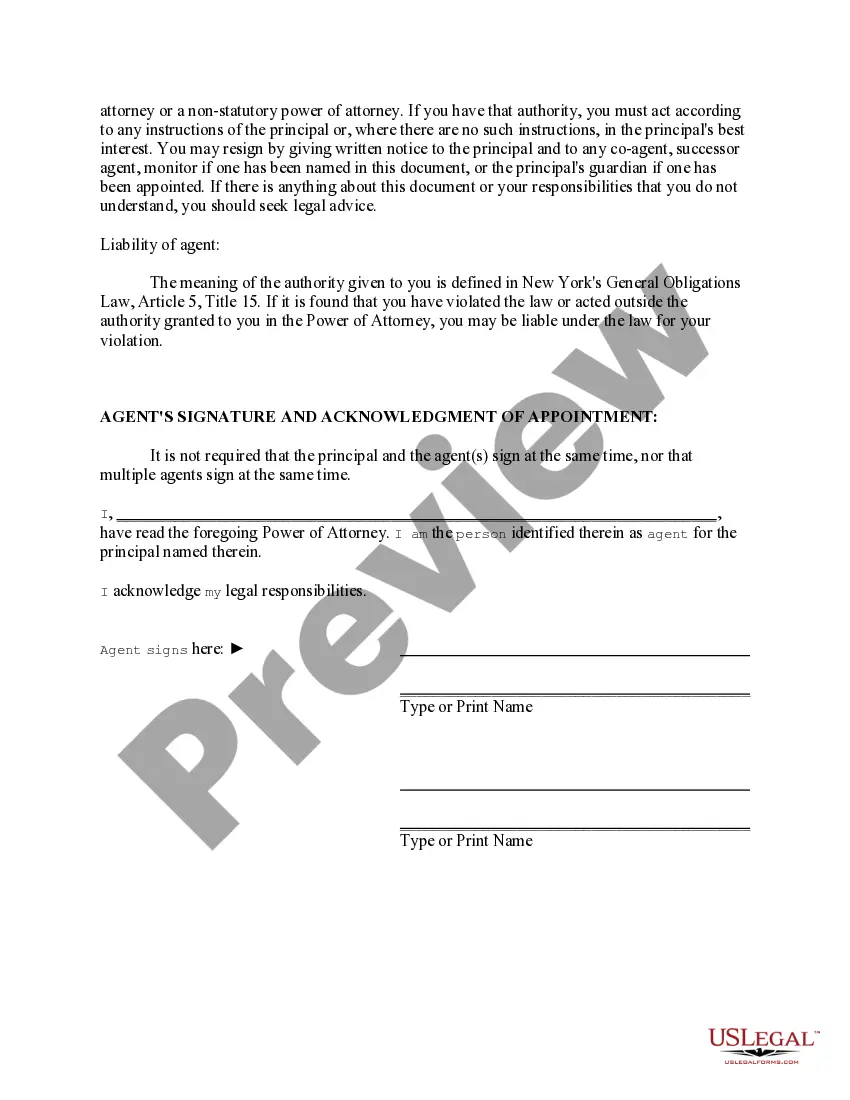

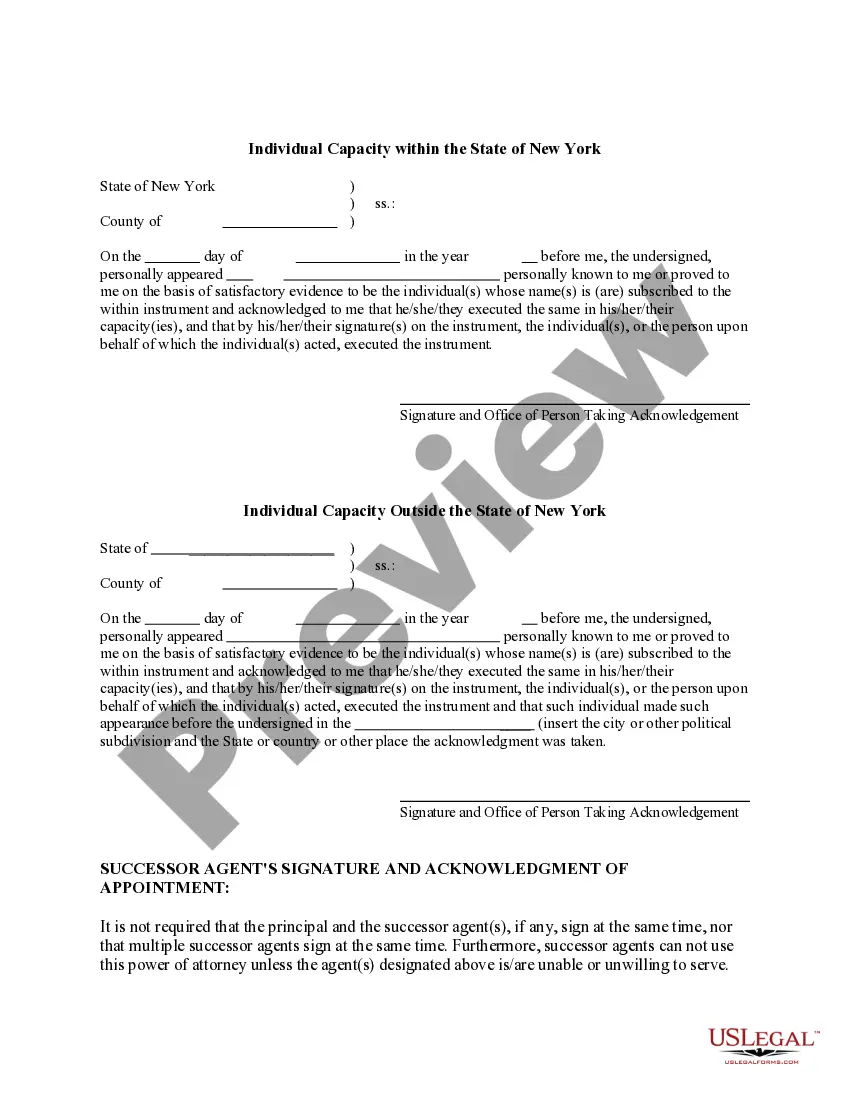

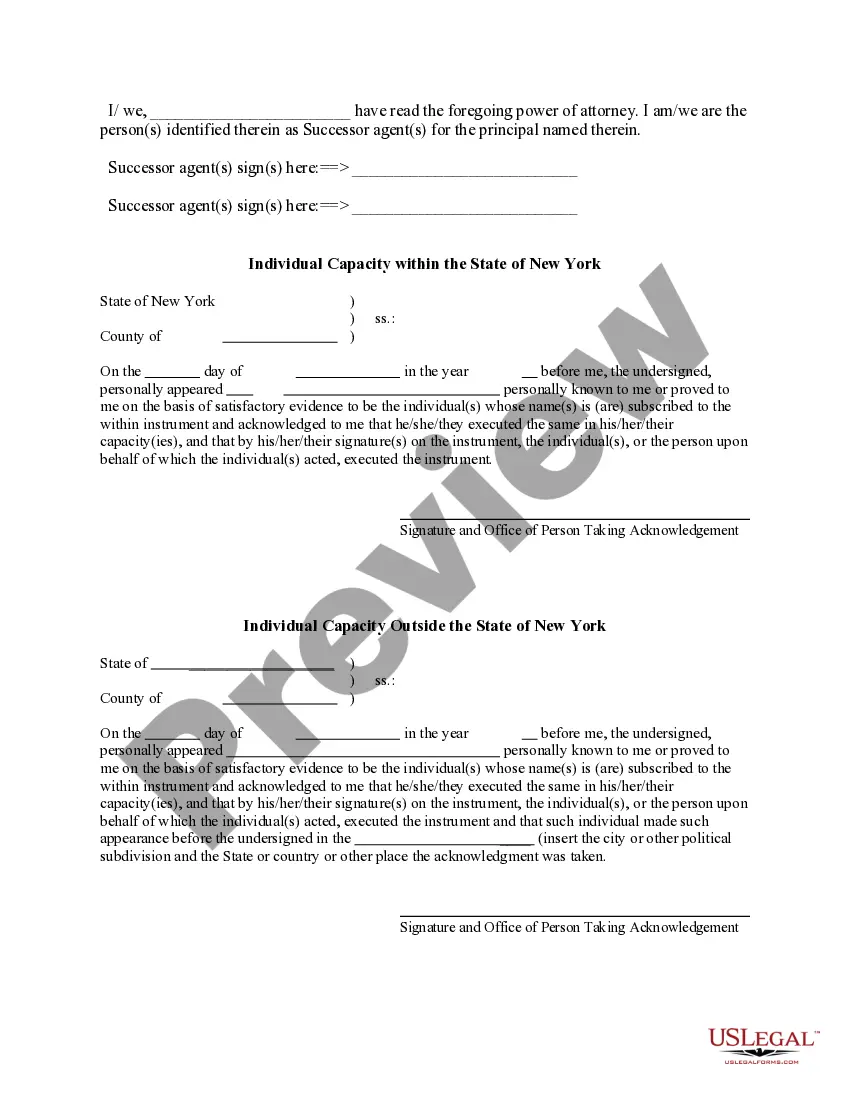

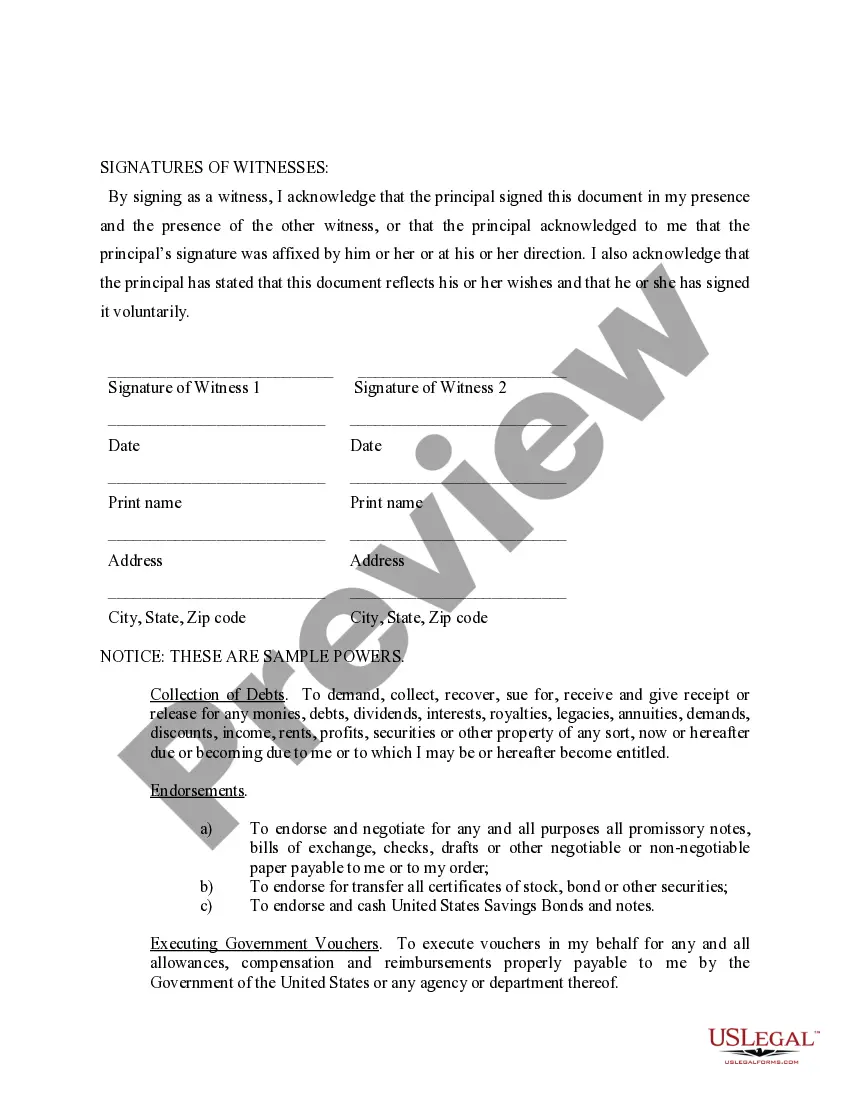

Nassau New York Limited Power of Attorney is a legal document that grants an individual, referred to as the "principal," the ability to appoint another person, known as the "agent" or "attorney-in-fact," to handle specific financial or legal matters on their behalf. This type of power of attorney restricts the agent's powers to only the specified areas mentioned in the document. It is essential to clearly outline the powers granted to the agent to avoid any misunderstandings or misuse of authority. Here are some sample powers that can be specified in a Nassau New York Limited Power of Attorney: 1. Real estate transactions: This power allows the agent to make decisions regarding the principal's property, such as buying, selling, or leasing real estate. The agent may also handle property management tasks, including collecting rent, making repairs, and signing lease agreements. 2. Bank account management: This power allows the agent to access the principal's bank accounts, handle deposits and withdrawals, pay bills, and manage financial transactions. It may also include the power to open or close accounts if specified. 3. Stock and bond transactions: This power authorizes the agent to buy, sell, or transfer the principal's stocks, bonds, and other securities. It may also grant the authority to make investment decisions on their behalf. 4. Tax matters: With this power, the agent can prepare and file the principal's tax returns, represent them before tax authorities, and engage in tax planning strategies. 5. Insurance matters: This power allows the agent to handle the principal's insurance policies, including making claims, paying premiums, and modifying coverage as needed. 6. Legal proceedings: The power to represent the principal in legal matters enables the agent to hire an attorney, initiate or respond to lawsuits, and make legal decisions related to their interests. 7. Government benefits: This power grants the agent the authority to apply for and manage government benefits, such as Social Security, Medicare, or Medicaid, on behalf of the principal. It is important to note that these are just sample powers that can be included in a Nassau New York Limited Power of Attorney. The actual powers granted will depend on the specific needs and preferences of the principal. Different types of limited powers of attorney exist based on the scope and duration of the powers granted, such as a healthcare power of attorney, financial power of attorney, or specific power of attorney.

Nassau New York Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description

How to fill out Nassau New York Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

No matter what social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone without any legal background to create this sort of papers cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform provides a huge library with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you require the Nassau New York Limited Power of Attorney where you Specify Powers with Sample Powers Included or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Nassau New York Limited Power of Attorney where you Specify Powers with Sample Powers Included quickly using our reliable platform. If you are presently an existing customer, you can proceed to log in to your account to get the needed form.

However, in case you are new to our library, make sure to follow these steps prior to obtaining the Nassau New York Limited Power of Attorney where you Specify Powers with Sample Powers Included:

- Ensure the template you have found is specific to your area considering that the rules of one state or area do not work for another state or area.

- Review the form and read a brief outline (if available) of cases the paper can be used for.

- If the form you picked doesn’t suit your needs, you can start again and look for the suitable document.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account login information or register for one from scratch.

- Select the payment gateway and proceed to download the Nassau New York Limited Power of Attorney where you Specify Powers with Sample Powers Included as soon as the payment is completed.

You’re all set! Now you can proceed to print the form or fill it out online. In case you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.