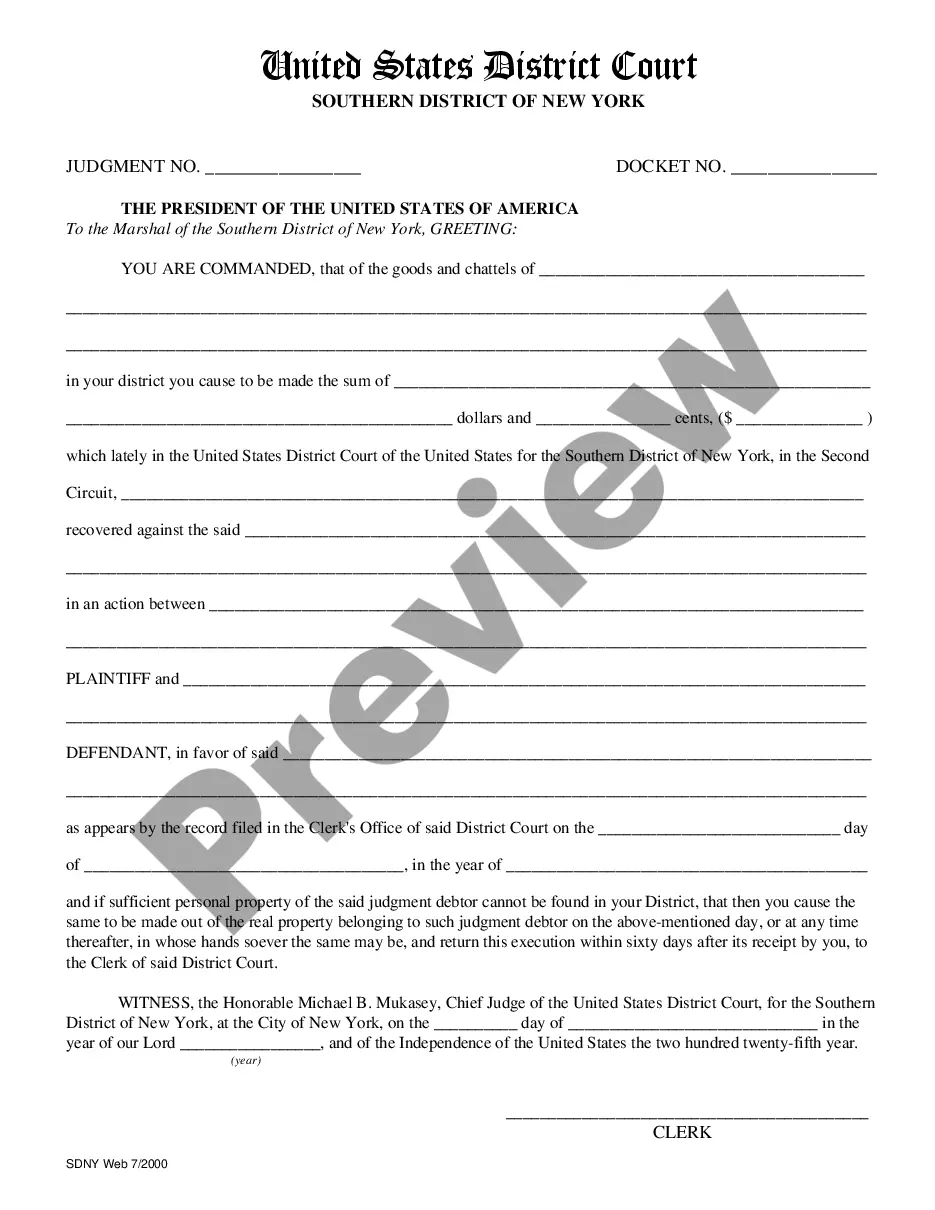

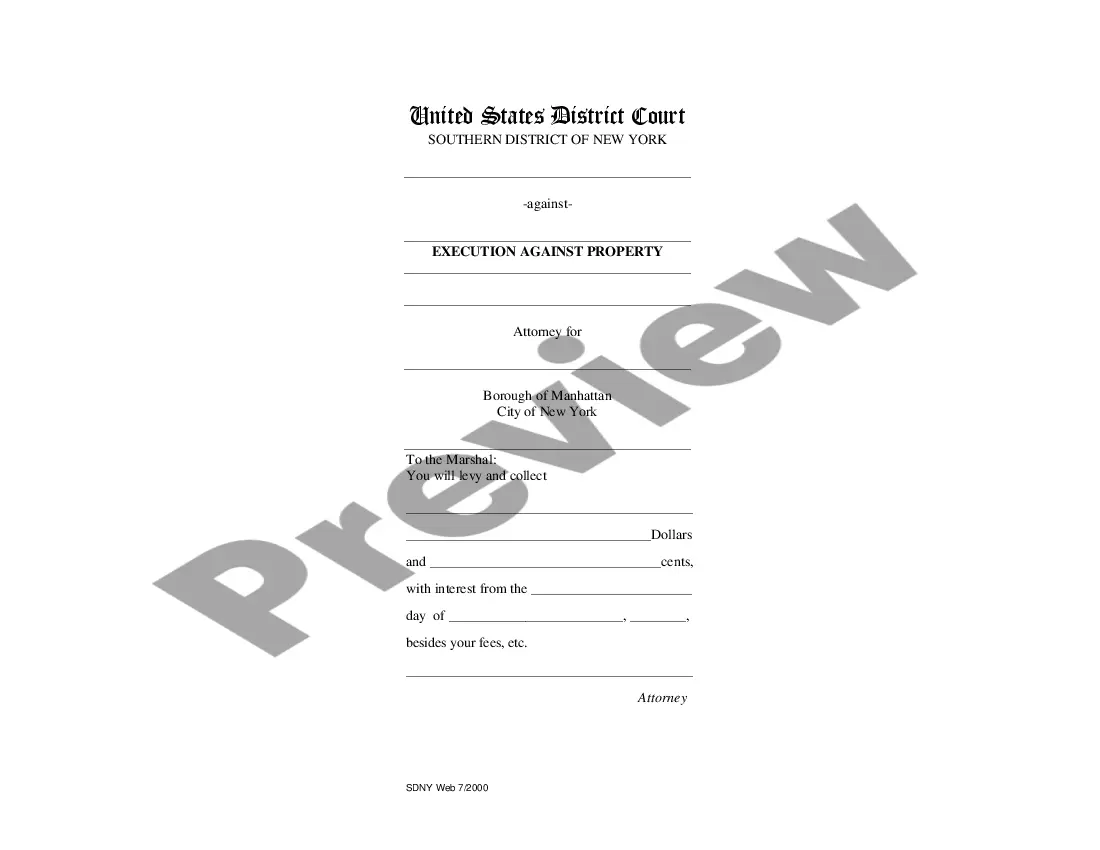

Nassau New York Execution Against Property is a legal process used to enforce a judgment against a property owner who has failed to comply with a lawful court order or debt repayment. This legal action allows the creditor to seize and sell the debtor's property in order to satisfy the outstanding debt. There are several types of Nassau New York Execution Against Property, including: 1. Real Property Execution: This type of execution applies to real estate owned by the debtor. It allows the creditor to place a lien on the property, seize it, and ultimately sell it through a public auction to recover the outstanding debt. The proceeds from the sale are used to satisfy the judgment. 2. Personal Property Execution: Personal Property Execution pertains to tangible goods or assets owned by the debtor, such as vehicles, furniture, equipment, or jewelry. The creditor can seize these items and sell them at auction to recover the owed amount. 3. Bank Account Execution: In this type of execution, the creditor can freeze and seize funds from the debtor's bank accounts to satisfy the debt. This can include savings, checking, or business accounts. The frozen funds are then used to repay the creditor. 4. Wage Garnishment: Wage Garnishment is a type of execution where a portion of the debtor's wages or salary is withheld by their employer and directed to the creditor. This allows the creditor to recover the owed amount over time. 5. Judgment Lien: A Judgment Lien is an encumbrance placed on the debtor's property, typically real estate. This lien ensures that the debtor cannot sell or transfer the property until the judgment is satisfied. The lien may also accrue interest over time. It is important to note that the Nassau New York Execution Against Property should follow relevant laws and regulations to protect the rights and interests of both the creditor and debtor.

Nassau New York Execution Against Property

Description

How to fill out Nassau New York Execution Against Property?

If you’ve already used our service before, log in to your account and save the Nassau New York Execution Against Property on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Nassau New York Execution Against Property. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!

Form popularity

FAQ

Many individuals will be unaware of these CCJs for months, or even years, and quite often will only realise when it comes to applying for a mortgage, loan, or anything else that relies on a credit rating.

A judgment is good for 20 years, but if the plaintiff wants to enforce the judgment against land it is only good for 10 years unless the plaintiff renews it for another 10 years.

Description. A writ of execution is a process issued by the court directing the U.S. Marshal to enforce and satisfy a judgment for payment of money. (Federal Rules of Civil Procedure 69).

A judgment is good for 20 years, but if the plaintiff wants to enforce the judgment against land it is only good for 10 years unless the plaintiff renews it for another 10 years.

A WRIT OF EXECUTION must be submitted to the Clerk's Office in paper form and include an original signature from the attorney. The Writ may be mailed to the Orders and Judgments Clerk with a stamped, self-addressed return envelope, or hand delivered.

The Creditor must either file the Satisfaction of Judgment with the County Clerk, or provide it to the Debtor so that the Debtor may file it with the County Clerk. The Satisfaction of Judgment must also be filed with the City Court. A Satisfaction of Judgment form can be purchased from any stationary store.

After providing proof of identity, the sheriff will ask the debtor to meet the terms of the writ. If unable to do so, the debtor will be obliged to point out any moveable property that can be sold to meet the judgment debt and costs.

The Creditor must either file the Satisfaction of Judgment with the County Clerk, or provide it to the Debtor so that the Debtor may file it with the County Clerk. The Satisfaction of Judgment must also be filed with the City Court. A Satisfaction of Judgment form can be purchased from any stationary store.

You can contact your bank, employer, or credit reporting company to find out which Court made the judgment. You can use the Court Locator on this page to find a Court. Then contact the Court and get a copy of the court file, including the Affidavit of Service for the Summons and Complaint.