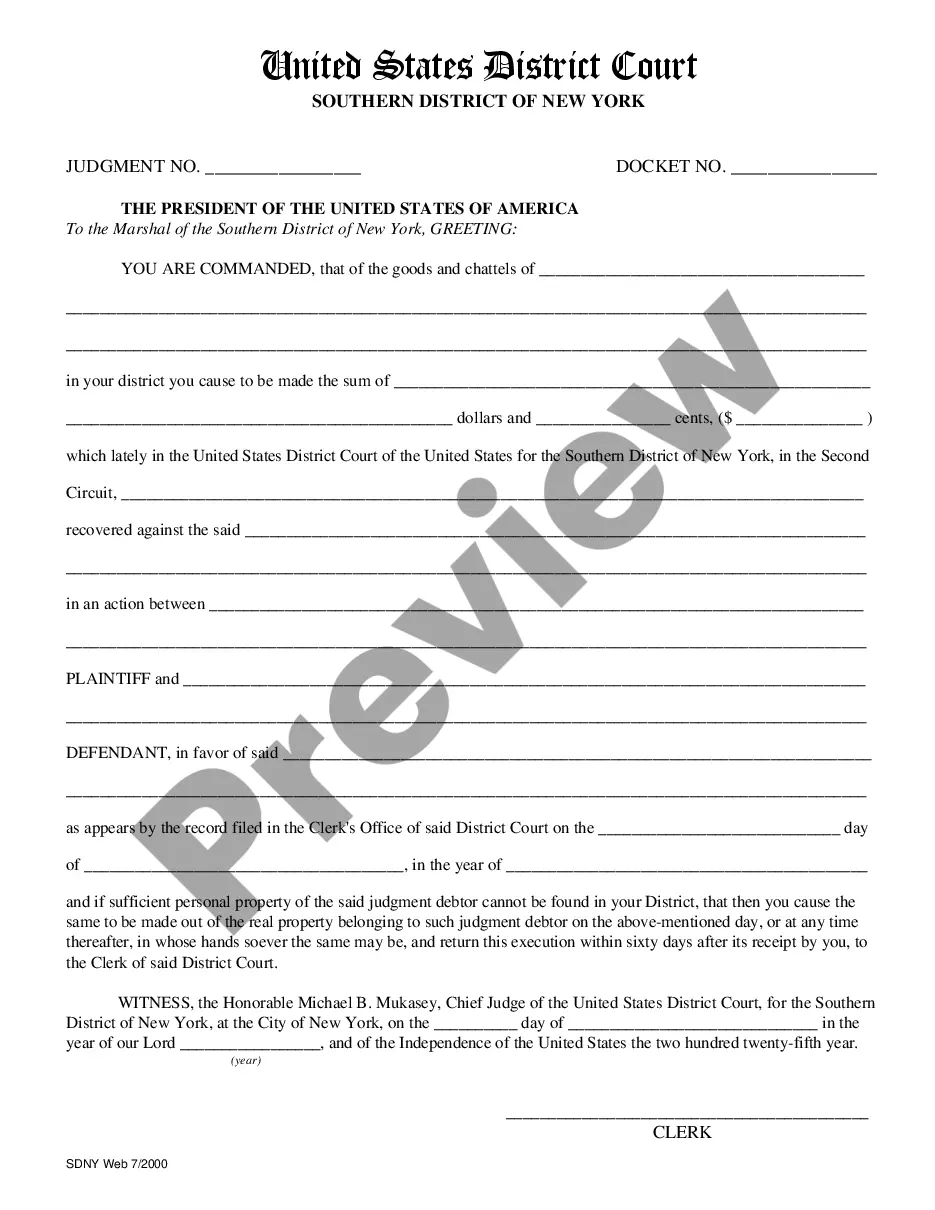

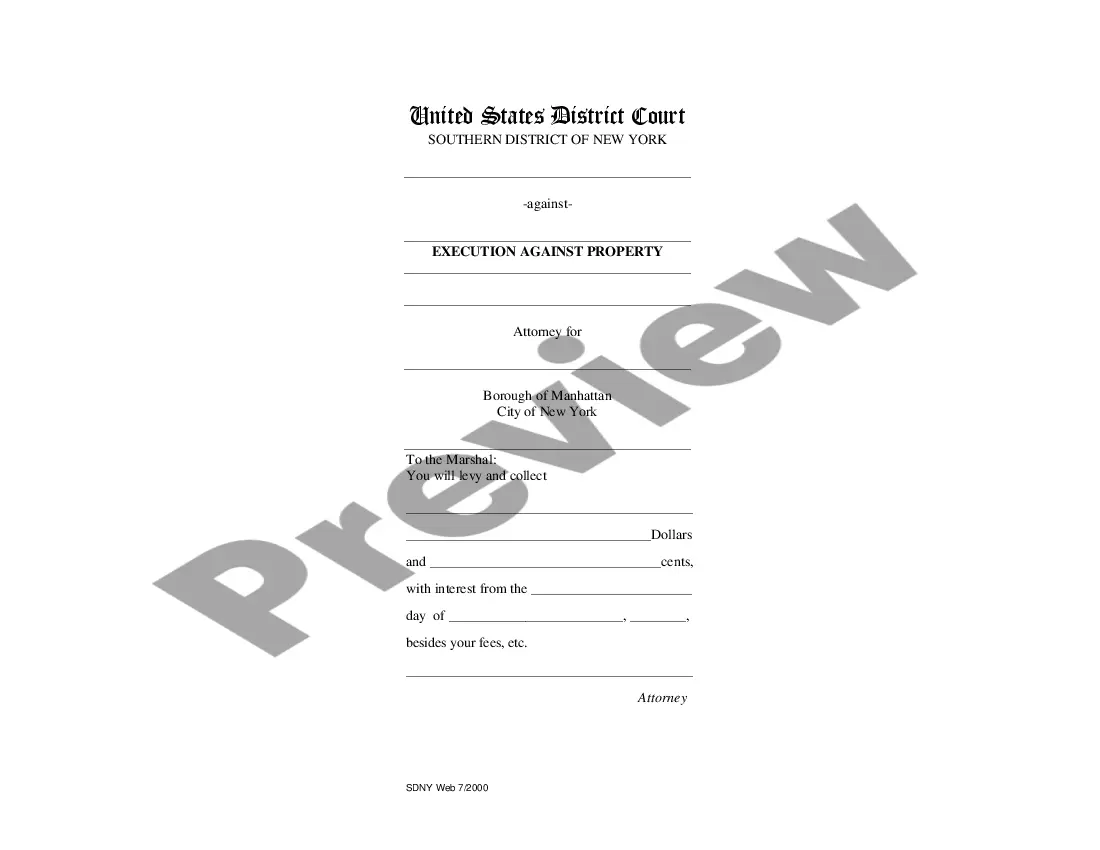

Queens New York Execution Against Property is a legal process initiated by creditors to recover outstanding debts from property owners in Queens, New York. This process enables creditors to enforce their rights and obtain payment by seizing and auctioning off the debtor's property. Keywords: Queens New York, execution against property, legal process, creditors, outstanding debts, property owners, enforce rights, payment, seizing, auctioning. There are different types of Queens New York Execution Against Property, each with its own specificities. These types include: 1. Property Lien: This is a common form of execution against property where a creditor places a lien on the debtor's property, typically real estate. The lien acts as a legal claim against the property and serves as security for the debt owed to the creditor. If the debtor fails to settle the debt, the property may be foreclosed and sold to satisfy the outstanding amount. 2. Writ of Execution: A writ of execution is a court order obtained by the creditor, which authorizes the sheriff or a marshal to seize and sell the debtor's property to satisfy the debt. This type of execution Against Property may involve personal assets like vehicles, jewelry, or other valuable possessions if they are not exempt under state laws. 3. Bank Levy: In some cases, creditors may opt for a bank levy, where they work with the court to freeze the debtor's bank accounts and seize funds to fulfill the outstanding debt. The money seized from the accounts is generally used to repay the creditor, and the debtor may be left with limited access to their funds until the debt is settled. 4. Garnishment: Garnishment involves obtaining a court order to deduct a certain portion of the debtor's wages or income directly from their employer. This process allows the creditor to collect the debt incrementally over time until the outstanding amount is paid off, often resulting in a court-mandated payment plan. 5. Auction Sales: To recover the debt, creditors may resort to auctioning off the seized property to interested buyers. These auctions are commonly advertised to the public, and interested parties can bid on the property. The proceeds from the sale are first used to cover any associated costs, such as legal fees and auction expenses, with the remaining amount going towards satisfying the debt owed. Queens New York Execution Against Property is a powerful tool for creditors in Queens, New York, to collect outstanding debts from property owners. It is crucial for debtors to seek legal advice if facing execution against their property to understand their rights and potential options for debt resolution.

Queens New York Execution Against Property

Description

How to fill out Queens New York Execution Against Property?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone without any law education to create this sort of paperwork from scratch, mostly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes in handy. Our platform offers a huge library with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you need the Queens New York Execution Against Property or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Queens New York Execution Against Property quickly employing our trusted platform. In case you are presently a subscriber, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, if you are a novice to our platform, make sure to follow these steps prior to obtaining the Queens New York Execution Against Property:

- Ensure the form you have chosen is specific to your location considering that the rules of one state or area do not work for another state or area.

- Review the document and read a quick outline (if available) of cases the document can be used for.

- In case the one you selected doesn’t suit your needs, you can start over and search for the suitable form.

- Click Buy now and choose the subscription plan you prefer the best.

- with your login information or create one from scratch.

- Select the payment gateway and proceed to download the Queens New York Execution Against Property as soon as the payment is done.

You’re all set! Now you can go ahead and print out the document or fill it out online. In case you have any issues locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.