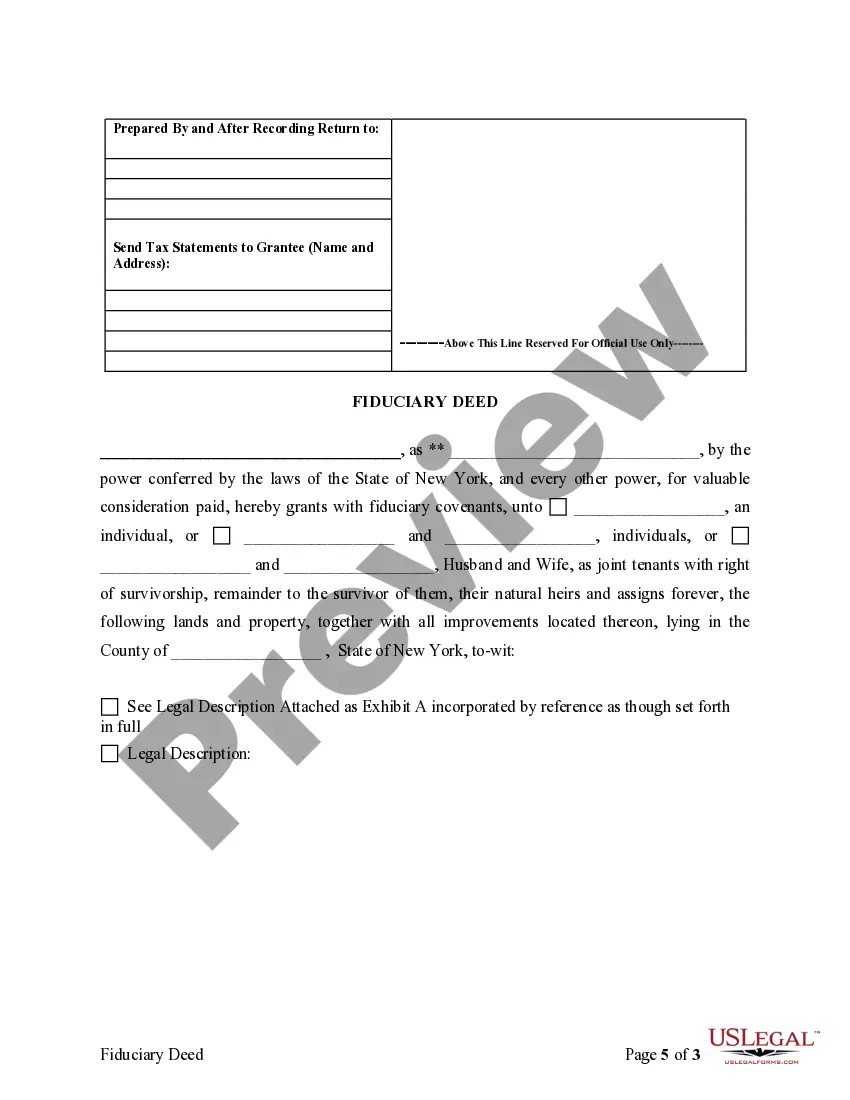

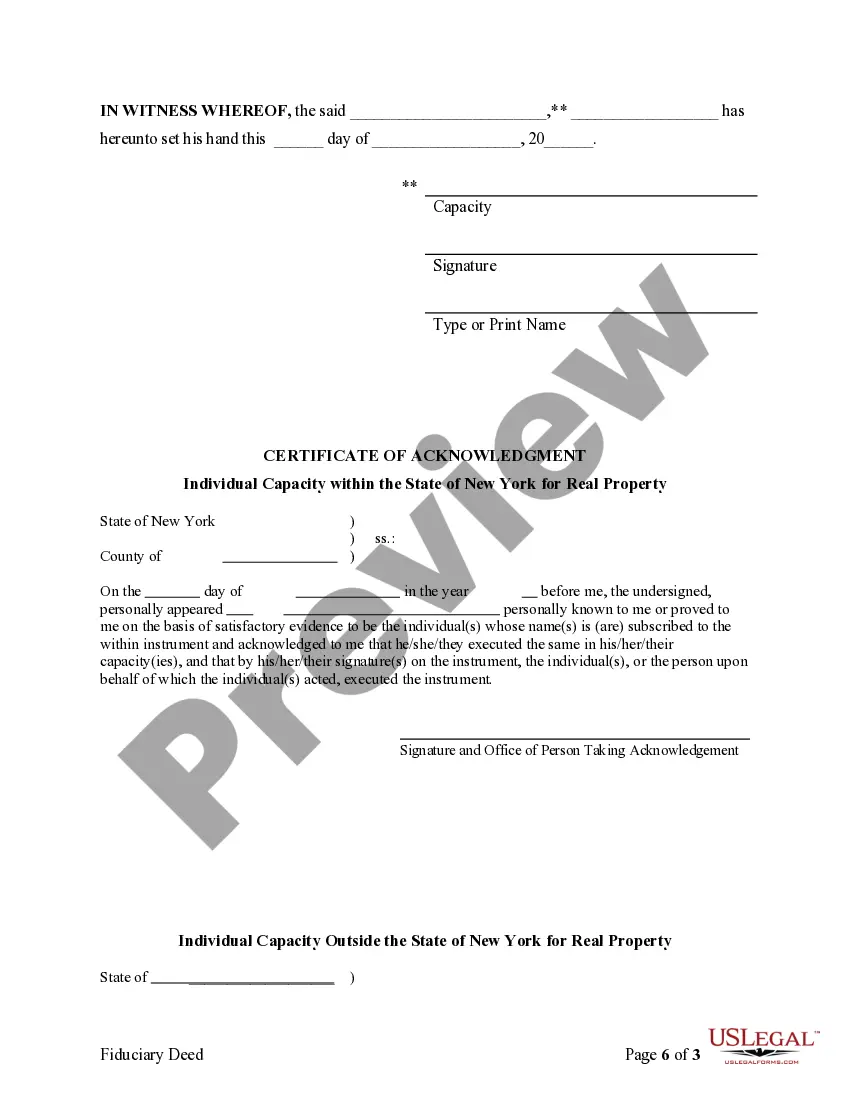

A Nassau New York Fiduciary Deed is a legal document specifically designed for use by Executors, Trustees, Trustees, Administrators, and other Fiduciaries when transferring property ownership within the Nassau County jurisdiction of New York. This deed ensures the smooth transfer of property assets between parties while upholding the fiduciary duties and responsibilities of the authorized individuals or entities. The Nassau New York Fiduciary Deed serves as a crucial tool for fiduciaries in their official capacity as it allows them to convey or sell real estate on behalf of the estate or trust they represent. Executors, who are appointed by a will, Trustees, who manage assets in a trust, Administrators, who handle an estate without a will, and any other Fiduciaries are legally required to adhere to the guidelines outlined in this specific deed to maintain the integrity of the transaction. There are several types of Nassau New York Fiduciary Deeds that may be used depending on the circumstances: 1. Executor's Deed: An Executor's Deed is utilized when the appointed Executor is selling or transferring property from an estate, as mandated by a decedent's will. This type of deed ensures that the deceased's property is managed according to their wishes. 2. Trustee's Deed: A Trustee's Deed is employed when a Trustee, designated by a trust document, must convey a property held within the trust. This type of fiduciary deed enables the Trustee to fulfill their responsibilities while adhering to the terms and conditions of the trust. 3. Administrator's Deed: An Administrator's Deed is utilized when an individual is appointed as the Administrator of an estate without a valid will. This deed allows the Administrator to transfer property assets in accordance with applicable state laws for intestate succession. All Nassau New York Fiduciary Deeds must comply with local laws, regulations, and requirements to ensure the validity of property transfers. Fiduciaries should consult with legal professionals experienced in estate planning and real estate law to draft and execute these deeds correctly. By following proper protocols and utilizing the appropriate type of fiduciary deed, Executors, Trustees, Trustees, Administrators, and other Fiduciaries can confidently fulfill their obligations while safeguarding the interests of the beneficiaries, trustees, and other involved parties.

Nassau New York Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Nassau New York Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we apply for legal solutions that, usually, are very expensive. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Nassau New York Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Nassau New York Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Nassau New York Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries is suitable for your case, you can choose the subscription plan and make a payment.

- Then you can download the document in any available format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!