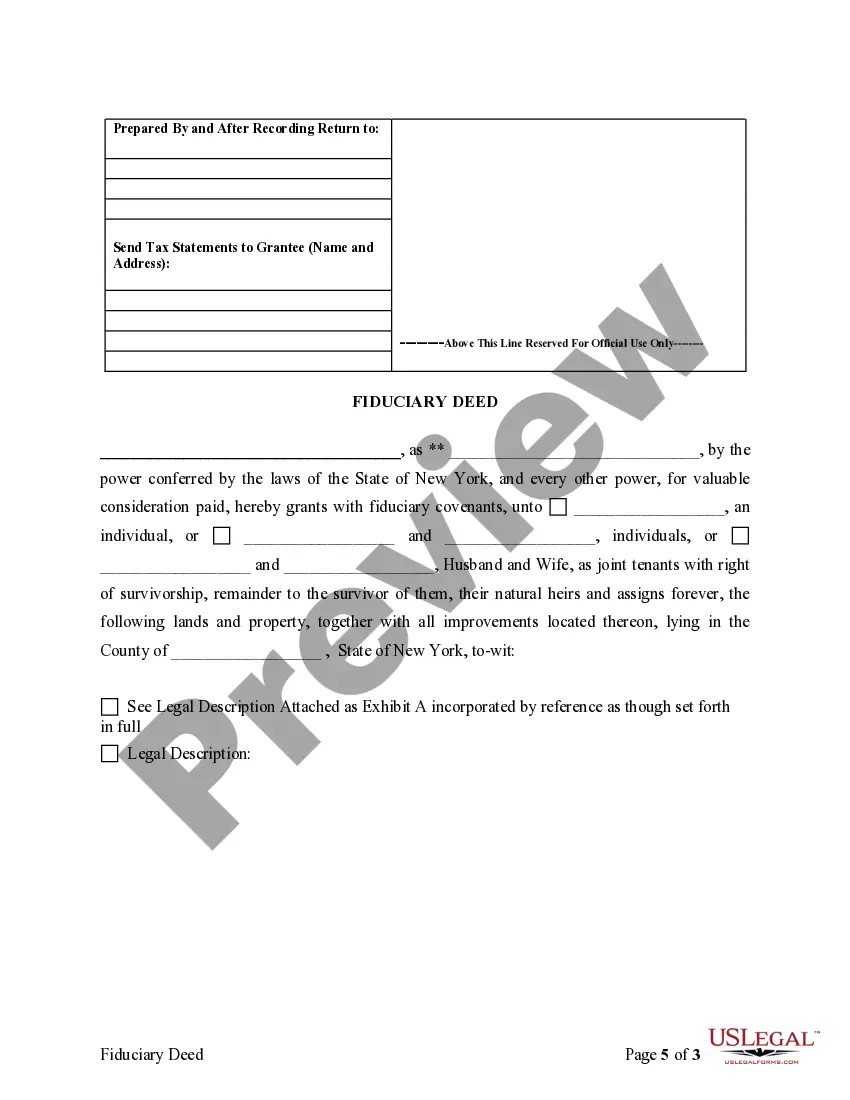

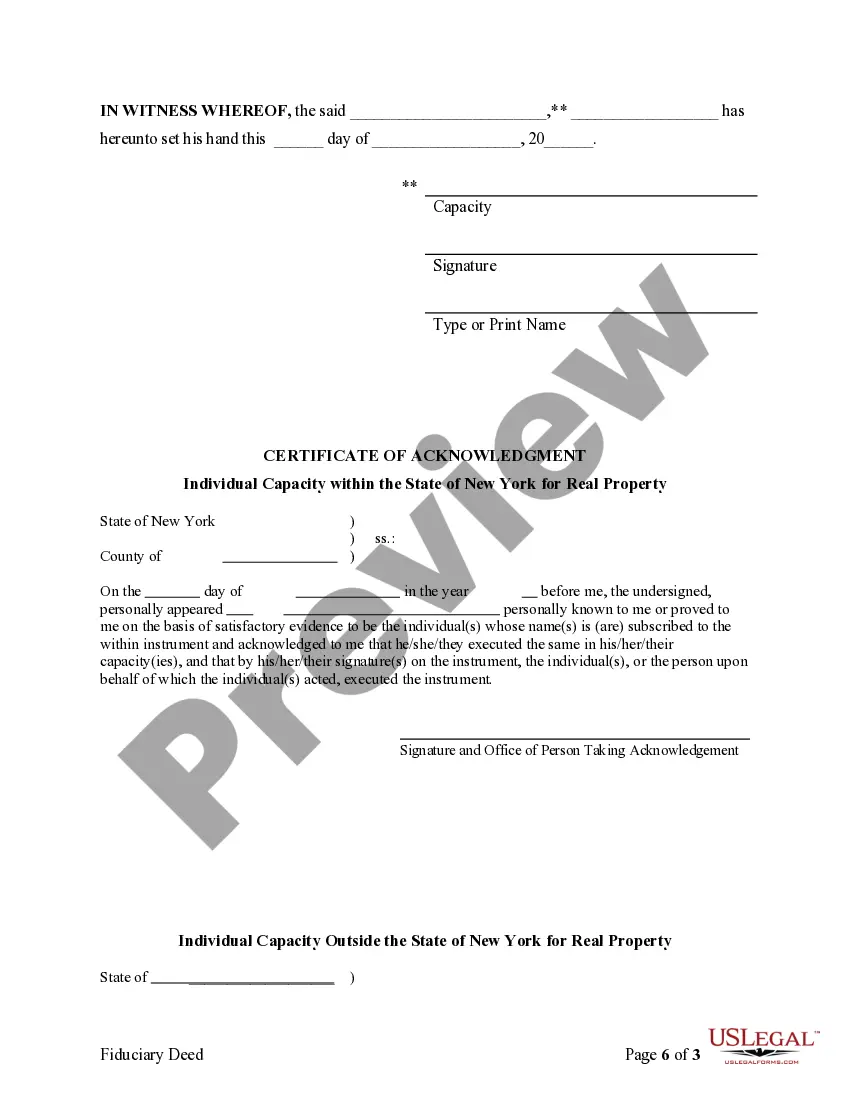

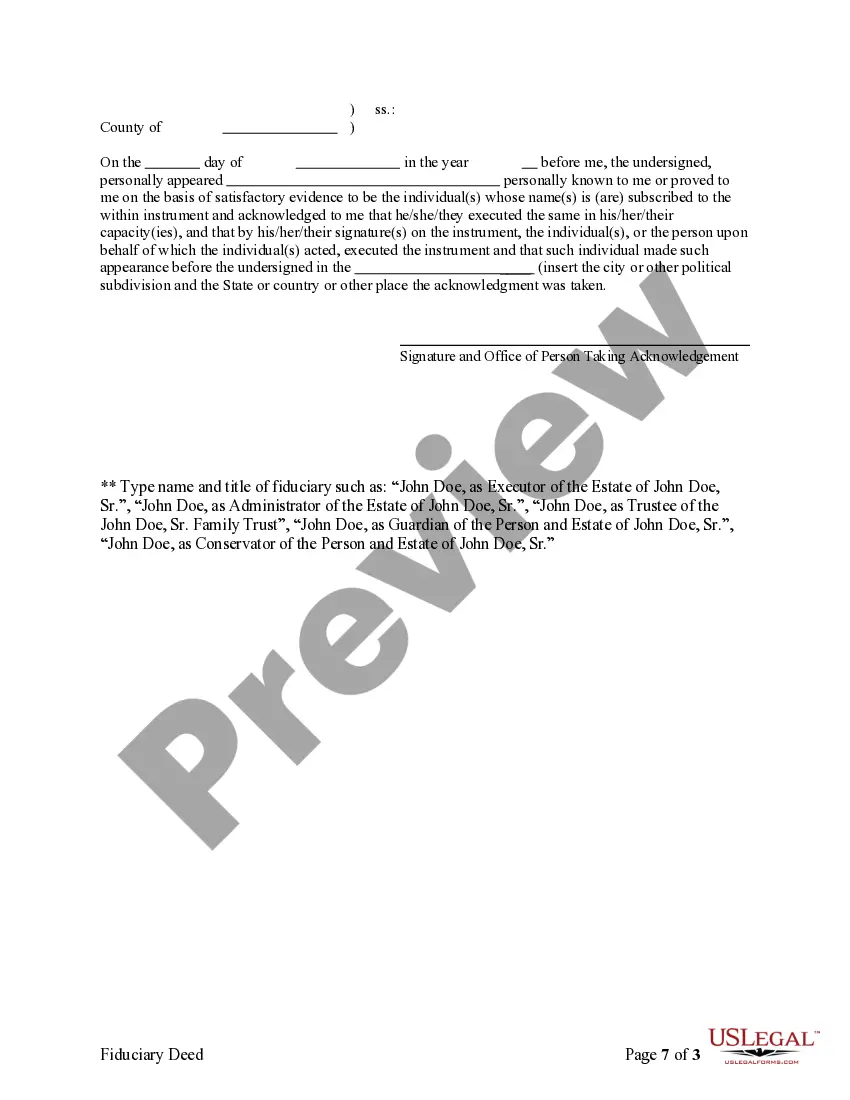

Queens New York Fiduciary Deed for Executors, Trustees, Trustees, Administrators, and other Fiduciaries A Queens New York Fiduciary Deed is a legally binding document used by individuals acting in fiduciary roles, such as Executors, Trustees, Trustees, Administrators, and other Fiduciaries, to transfer property ownership in Queens County, New York. This deed ensures the proper transfer of property assets according to the wishes of the decedent or trust or and complies with the legal requirements outlined in New York state laws. There are several types of Queens New York Fiduciary Deeds tailored to specific roles and scenarios: 1. Executor's Fiduciary Deed: This type of deed is executed by an appointed Executor named in the Last Will and Testament of a deceased individual. The Executor is responsible for managing and distributing the deceased's estate following the stated wishes in the will. 2. Trustee's Fiduciary Deed: A Trustee is entrusted with managing assets held within a trust on behalf of the beneficiaries named in the trust document. This deed is used by Trustees to convey property within the trust to its intended recipient as outlined in the trust agreement. 3. Trust or's Fiduciary Deed: A Trust or, also known as a Settler or Granter, is the individual who establishes a trust. This type of deed refers to the transfer of property into the trust by the Trust or, ensuring it becomes part of the trust's assets to be managed by appointed Trustees. 4. Administrator's Fiduciary Deed: In cases where an individual passes away without a valid will, an Administrator is appointed by the Surrogate's Court to oversee the distribution of the deceased's assets. This deed is used by an Administrator to transfer the property of the decedent's estate to the rightful beneficiaries. Regardless of the specific type, a Queens New York Fiduciary Deed includes essential elements such as the legal description of the property, the names and contact information of the parties involved, the consideration being exchanged (if any), and the signatures of the fiduciary and any other necessary parties. Notarization and recording with the Queens County Clerk's Office are typically required for the deed's validity and public record purposes. It is critical for Executors, Trustees, Trustees, Administrators, and other Fiduciaries to seek legal guidance from experienced professionals, such as estate attorneys or legal advisors, to ensure compliance with applicable laws and to understand the specific requirements and variations of Queens New York Fiduciary Deeds based on their roles and circumstances.

Queens New York Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Queens New York Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Queens New York Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Queens New York Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Queens New York Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!