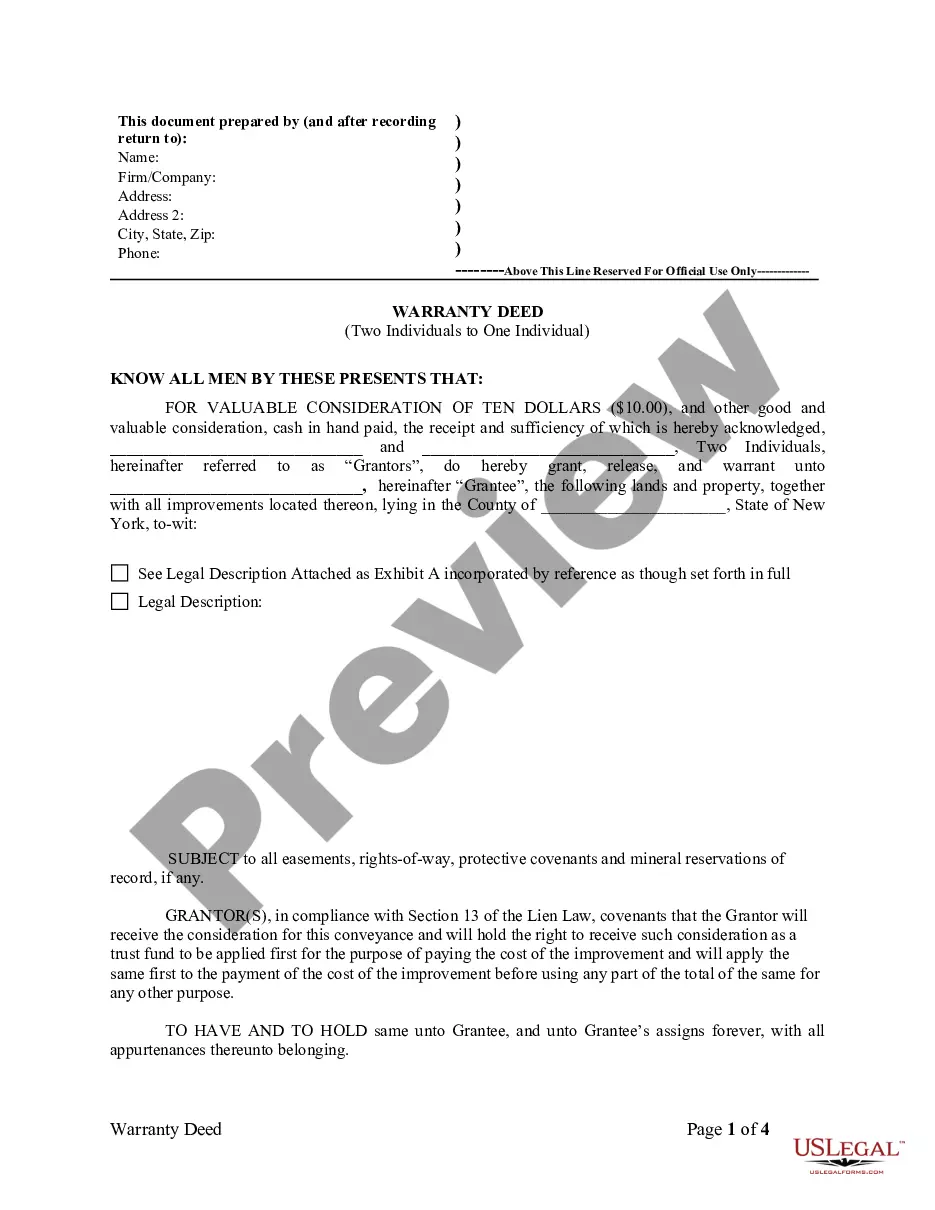

Kings New York Warranty Deed from two Individuals to One Individual

Description

How to fill out New York Warranty Deed From Two Individuals To One Individual?

We consistently seek to reduce or avert legal complications when addressing subtle legal or financial issues. To achieve this, we seek out legal services that are typically very costly.

However, not every legal matter is particularly intricate. Many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library empowers you to handle your issues without needing to consult a lawyer.

We offer access to legal form templates that are not always readily available. Our templates are tailored to specific states and regions, which significantly simplifies the search process.

Ensure to verify if the Kings New York Warranty Deed from two Individuals to One Individual adheres to the laws and regulations of your state and area. Additionally, it is vital that you review the form’s outline (if provided), and if you notice any inconsistencies with what you were initially seeking, look for an alternative form. Once you confirm that the Kings New York Warranty Deed from two Individuals to One Individual is suitable for your situation, you can select the subscription option and process the payment. Afterward, you can download the form in any preferred format. For over 24 years, we have assisted millions by providing customizable and current legal documents. Utilize US Legal Forms now to save time and resources!

- Take advantage of US Legal Forms whenever you need to obtain and download the Kings New York Warranty Deed from two Individuals to One Individual or any other form swiftly and securely.

- Simply Log In to your account and click the Get button next to it.

- If you misplace the form, you can always re-download it in the My documents tab.

- The procedure is equally straightforward if you’re new to the website! You can establish your account in just a few minutes.

Form popularity

FAQ

To transfer ownership of property in New York, you typically need to file a new deed with the local county clerk’s office. The process involves creating a Kings New York Warranty Deed from two Individuals to One Individual, which details the transfer and confirms the new ownership. It's important to ensure all legal requirements are met for the transfer to be valid and recognized.

Yes, it is entirely possible for someone to be on the deed but not on the mortgage. This situation can arise when the property is gifted or inherited, leading to a Kings New York Warranty Deed from two Individuals to One Individual. The person on the deed holds ownership rights while the mortgage debt is linked to a different individual.

If your husband passed away and your name is not on the mortgage, you may still have rights to the property depending on how it is titled. However, without your name on the mortgage, the lender may proceed with foreclosure if the payments are not made. Seeking a Kings New York Warranty Deed from two Individuals to One Individual can help clarify ownership and establish your rights to the property.

To add a name to your warranty deed, you will need to create a new deed that reflects the change in ownership. This process typically requires drafting a Kings New York Warranty Deed from two Individuals to One Individual, where the existing owner adds the new individual as a co-owner. You should ensure the new deed is properly executed and recorded with the local clerk’s office.

To remove someone from a deed in New York State, you should first understand the process involved. Typically, you will need to execute a Kings New York Warranty Deed from two Individuals to One Individual, which must be signed by the individuals listed in the original deed. This process often requires filing the new deed with the county clerk’s office where the property is located. If you're unsure about the steps, consider using a platform like US Legal Forms, which provides templates and guidance tailored to your needs.

Yes, a warranty deed can be transferred. The process involves drafting a new deed for the transfer, which is then signed and recorded with the local authorities. If you are considering a Kings New York Warranty Deed from two Individuals to One Individual, proper documentation and compliance with local laws are key, and using a service like U.S. Legal Forms can facilitate this procedure.

Selling a property with a warranty deed is entirely feasible, as it provides strong assurance to the buyer about the title's validity. This deed type assures that the seller is liable for any issues that come up after the sale. If you plan to transition from two individuals to one, understanding your rights through a Kings New York Warranty Deed is crucial, and platforms like U.S. Legal Forms can provide the necessary templates.

Yes, two individuals can indeed be listed on a warranty deed. This arrangement allows both parties to have equal rights to the property. However, when transitioning to a Kings New York Warranty Deed from two Individuals to One Individual, careful planning and documentation are essential to ensure a smooth process.

To transfer ownership in New York, you typically need to prepare a deed, have it signed, and record it at the county clerk's office. If you are completing a Kings New York Warranty Deed from two Individuals to One Individual, ensure that the deed reflects the accurate names and addresses. Engaging with a property lawyer or utilizing U.S. Legal Forms can streamline this process for you.

Transferring a warranty deed commonly involves preparing a new deed and signing it in front of a notary. You will need to record this deed with the local land records office to make it official. If you are dealing with a Kings New York Warranty Deed from two Individuals to One Individual, ensure that all parties understand their rights and responsibilities before completing the transfer. Utilizing platforms like U.S. Legal Forms can simplify the process.