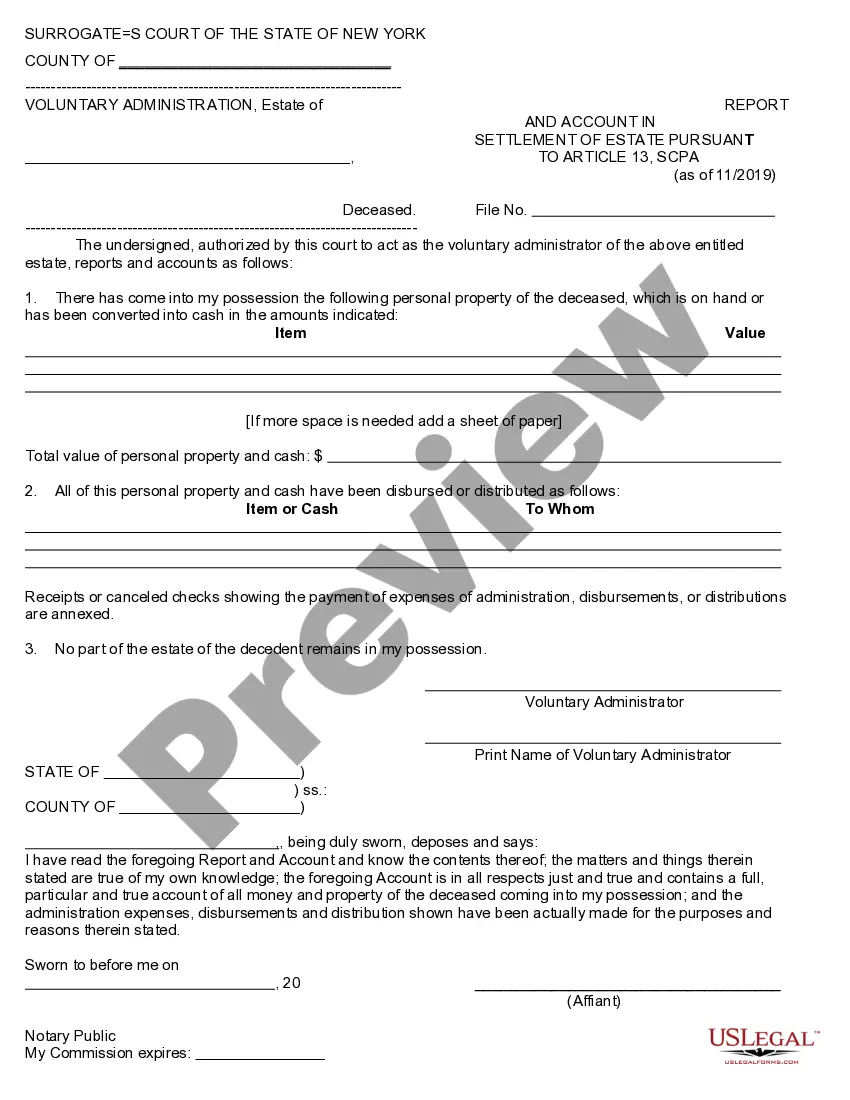

This is an official form from the New York State Unified Court, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by New York statutes and law.

Suffolk New York Report of Estate Not Fully Distributed (22 NYCRR 207.42)

Description

How to fill out New York Report Of Estate Not Fully Distributed (22 NYCRR 207.42)?

Utilize the US Legal Forms and gain immediate access to any document sample you require.

Our helpful website, featuring a vast array of templates, streamlines the process of locating and acquiring nearly any document sample you may need.

You can save, complete, and sign the Suffolk New York Report of Estate Not Fully Distributed in just minutes rather than spending hours scouring the internet for a suitable template.

Employing our collection is an excellent method to enhance the security of your form submissions.

If you don’t have an account yet, follow the steps outlined below.

Locate the form you need. Confirm that it is the correct form you were searching for: check its title and description, and use the Preview option if available. If not, utilize the Search box to find the right one.

- Our experienced legal experts consistently review all records to ensure that the templates are pertinent to a specific state and compliant with current laws and regulations.

- How do you obtain the Suffolk New York Report of Estate Not Fully Distributed.

- If you have a profile, simply Log In to your account. The Download option will be available for all documents you view.

- Additionally, you can access all your previously saved records in the My documents section.

Form popularity

FAQ

Section 207.4 outlines the requirements for filing a report when an estate is not fully distributed in New York. This section helps to ensure transparency and accountability among executors and beneficiaries. Understanding this rule is crucial if you are dealing with the Suffolk New York Report of Estate Not Fully Distributed (22 NYCRR 207.42).

An executor typically has up to one year to settle the estate in New York. However, if the estate involves considerable assets or complexities, this period can extend. It is advisable to submit the Suffolk New York Report of Estate Not Fully Distributed (22 NYCRR 207.42) if full distribution has not occurred within the expected timeframe.

Probate without a will in New York can take several months to over a year, depending on the complexity of the estate and if disputes arise. The absence of a will often leads to additional legal proceedings to determine how the estate is distributed. To simplify the process, you may consider filing the Suffolk New York Report of Estate Not Fully Distributed (22 NYCRR 207.42) after the initial probate actions.

In New York, you generally have nine months to close an estate after the appointment of the executor. This time could be extended if there are complications or disputes among beneficiaries. It’s essential to file the Suffolk New York Report of Estate Not Fully Distributed (22 NYCRR 207.42) if you have not fully distributed the estate within the required timeframe.

Surrogate courts and probate courts serve similar functions in administering estates; however, the term 'surrogate court' is specific to New York. In other states, probate courts fulfill the same role, handling wills and estate matters. If you need to file a Suffolk New York Report of Estate Not Fully Distributed (22 NYCRR 207.42), you will be dealing with the surrogate court in New York to address estate-related issues appropriately.

At the surrogate court, various proceedings occur, including the validation of wills, appointment of executors, and distribution of estate assets. This court also addresses disputes that may arise among heirs or beneficiaries. If you have a Suffolk New York Report of Estate Not Fully Distributed (22 NYCRR 207.42), this court will review it to ensure compliance with state regulations and efficient estate administration.

An estate can remain open in New York for as long as necessary to resolve debts, distribute assets, and ensure all matters are settled. However, if the estate remains open beyond 2 years without valid reasons, you may face scrutiny from the surrogate court. To manage this effectively, you may need to file a Suffolk New York Report of Estate Not Fully Distributed (22 NYCRR 207.42) to provide updates on the estate's status.

You generally have 2 years to close an estate in New York after the individual’s death. While there are specific deadlines to address creditors and beneficiaries, finalizing the estate may vary based on complexities involved. If you encounter situations requiring a Suffolk New York Report of Estate Not Fully Distributed (22 NYCRR 207.42), taking timely action assists in meeting these deadlines.

Settling an estate in New York typically takes 9 to 18 months, depending on various factors like asset complexity and potential disputes among beneficiaries. Efficient handling can reduce this timeframe, but complications can extend the process significantly. In cases requiring a Suffolk New York Report of Estate Not Fully Distributed (22 NYCRR 207.42), expect to adhere to additional requirements that may prolong the settlement.

The jurisdiction of New York's surrogate court covers matters of probate and administration of estates, guardian appointments, and adoptions. This court also has the ability to address contests to wills and determine heirs when disputes arise. Should you need to complete or clarify your Suffolk New York Report of Estate Not Fully Distributed (22 NYCRR 207.42), bringing your case to the surrogate court is essential.