Suffolk New York Renunciation of Voluntary Administration is a legal process used in estate administration, allowing an individual to waive their right to serve as an administrator of an estate. This renunciation is a crucial step in the distribution of assets and settlement of debts after a person's death. In Suffolk County, New York, there are two main types of renunciation of voluntary administration: formal renunciation and informal renunciation. 1. Formal Renunciation: Formal renunciation is a legally binding document filed with the Surrogate's Court in Suffolk County. It involves a formal process where the renounced submits a written statement declaring their intent to renounce their right to be appointed as an administrator. The document must meet specific legal requirements, including being signed and notarized. 2. Informal Renunciation: Informal renunciation is an alternative method where an individual verbally expresses their intention to renounce their role as an administrator. This type of renunciation is typically used when the estate is smaller, and there is no conflict or dispute among the potential beneficiaries. Both types of renunciation are aimed at simplifying the estate administration process by allowing an individual to decline their appointment as an administrator. Renunciation can arise from various reasons, such as the renounced not feeling capable of fulfilling the duties, having other pressing commitments, or simply wanting to avoid the responsibilities and potential liabilities associated with estate administration. Renunciation of voluntary administration in Suffolk County, New York, plays a vital role in the overall estate distribution process. It allows the estate to move forward with an appropriate and willing individual as the administrator, ensuring the efficient handling of assets, debts, and any potential legal matters. It also provides an opportunity for persons not interested in or capable of performing the duties of administration to remove themselves from the responsibility. If you find yourself in a situation where you need to renounce your role as an administrator in Suffolk County, New York, it is advisable to consult with an experienced probate lawyer who can guide you through the entire process. They will help you understand the legal implications, ensure the necessary documentation is prepared correctly, and provide you with the necessary advice to make informed decisions. Remember, renunciation of voluntary administration is a serious step and should be taken after careful consideration and consultation with legal professionals to ensure compliance with the applicable laws and regulations in Suffolk County, New York.

Suffolk New York Renunciation of Voluntary Administration

Description

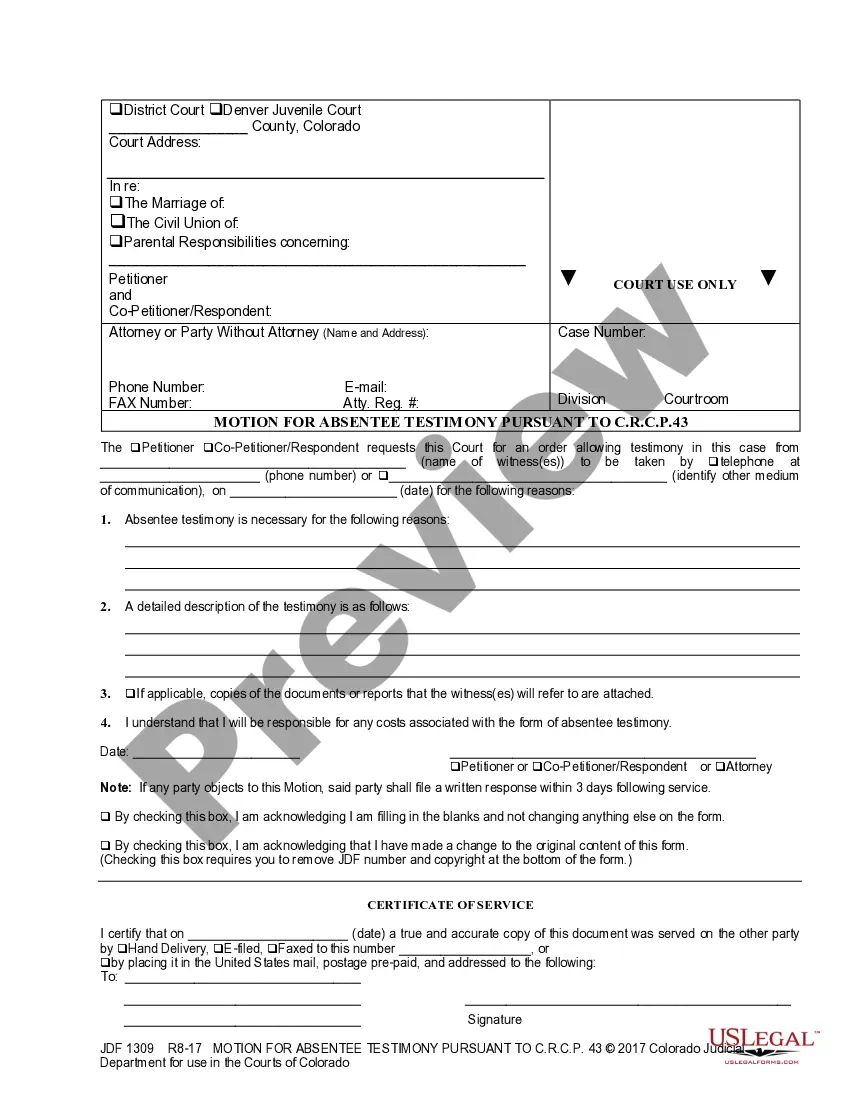

How to fill out Suffolk New York Renunciation Of Voluntary Administration?

If you’ve already utilized our service before, log in to your account and download the Suffolk New York Renunciation of Voluntary Administration on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make certain you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Suffolk New York Renunciation of Voluntary Administration. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!

Form popularity

FAQ

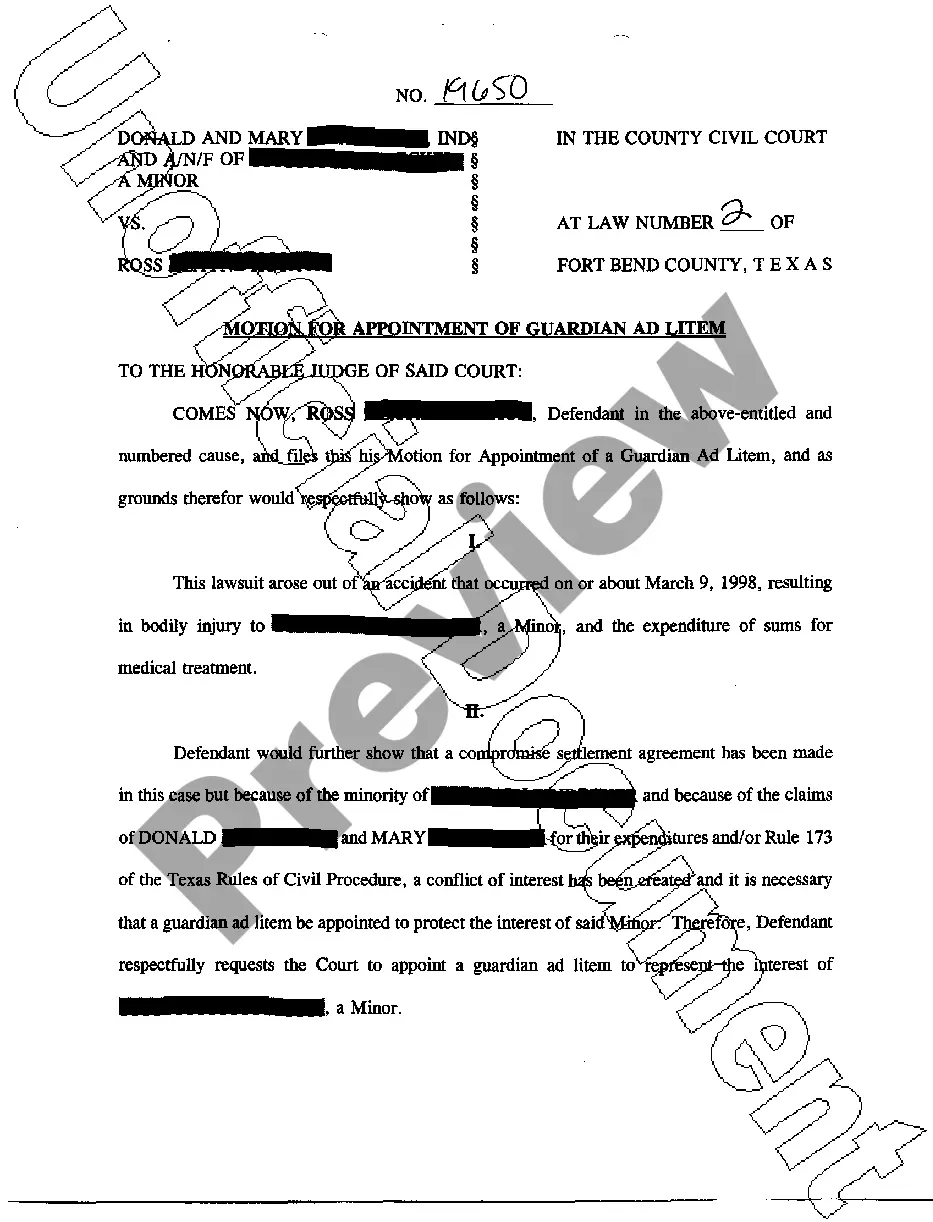

You'll have to file a request in the county where the deceased person lived at the time of their death. The paperwork will ask for you to be officially acknowledged as the legal executor representing the estate. In addition to the petition, you'll need to file a valid will, if one exists, and the death certificate.

CLOSING THE ESTATE: FORM 207.42 must be prepared and executed by the fiduciary and the attorney and filed after 7 months or by the end of 2 years from the date of fiduciary appointment. RELEASES from all beneficiaries of the estate must be executed and filed at this time, if not already filed.

Only an estate valued over $30,000 must be probated when there is a will. The court has a ?small estate proceeding? when the estate is below $30,000. An estate without a will is ?administered,? not probated.

An executor is someone who has been named in the will to manage your estate after you die. An administrator is someone who takes charge of your estate if you die without a will. Keep in mind that estate law is state-specific.

A grant of letters of administration will always be needed to deal with a property owned in the sole name of the person who died or to deal with large amounts of money. If this document is needed then without it no one will be able to access the assets in the estate without it.

To get letters of administration, you will need to submit your application to the probate courts. You will need to obtain a copy of the decedent's death certificate from the funeral home. It's best to request extra copies.

How Long to Settle an Estate in New York? The short answer: from 7 months to 3 years. Typically 9 months. Estate settlement (also known as estate administration) is the phase during which you, as the court-appointed executor, must collect the estate assets, organize and pays debts, and file all final taxes.

Since every estate is different, the time it takes to settle the estate may also differ. Most times, an executor would take 8 to 12 months. But depending on the size and complexity of the estate, it may take up to 2 years or more to settle the estate.

To apply for probate or letters of administration by post, you'll need to fill in a number of forms. You'll need PA1P if the person left a will and PA1A if they didn't. These forms ask for details about the person who died, their surviving relatives and, the personal representative.

In New York there is a rule for who can file the Administration proceeding. In general, the person who is the closest distributee (family member) to the Decedent files for administration. See order of priority of family member distributees who can file the Administration proceeding When There Is No Will.

More info

The form must contain information that may be required by any court and that a person may make known to the testator before the testator dies. This will provide enough information to allow the testator to make an informed decision regarding the disposition of the property he or she may inherit. . This form should be filed or otherwise filed with the court of the county where the testator's will, or such other instrument, will be probated or will have the effect of probating, in lieu of a separate form in the county where the testator resides. . If filed by mail, one copy of the letter of administration must be attached to the testator's will, as prescribed in subsection (3) of section 20 of the Administrative Procedure Law. This rule applies to all persons who die within two years of the filing of such a will or other instrument under subparagraph (B) of paragraph an of subdivision an of section 20, or two years after a will becomes effective, whichever is earlier. .

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.