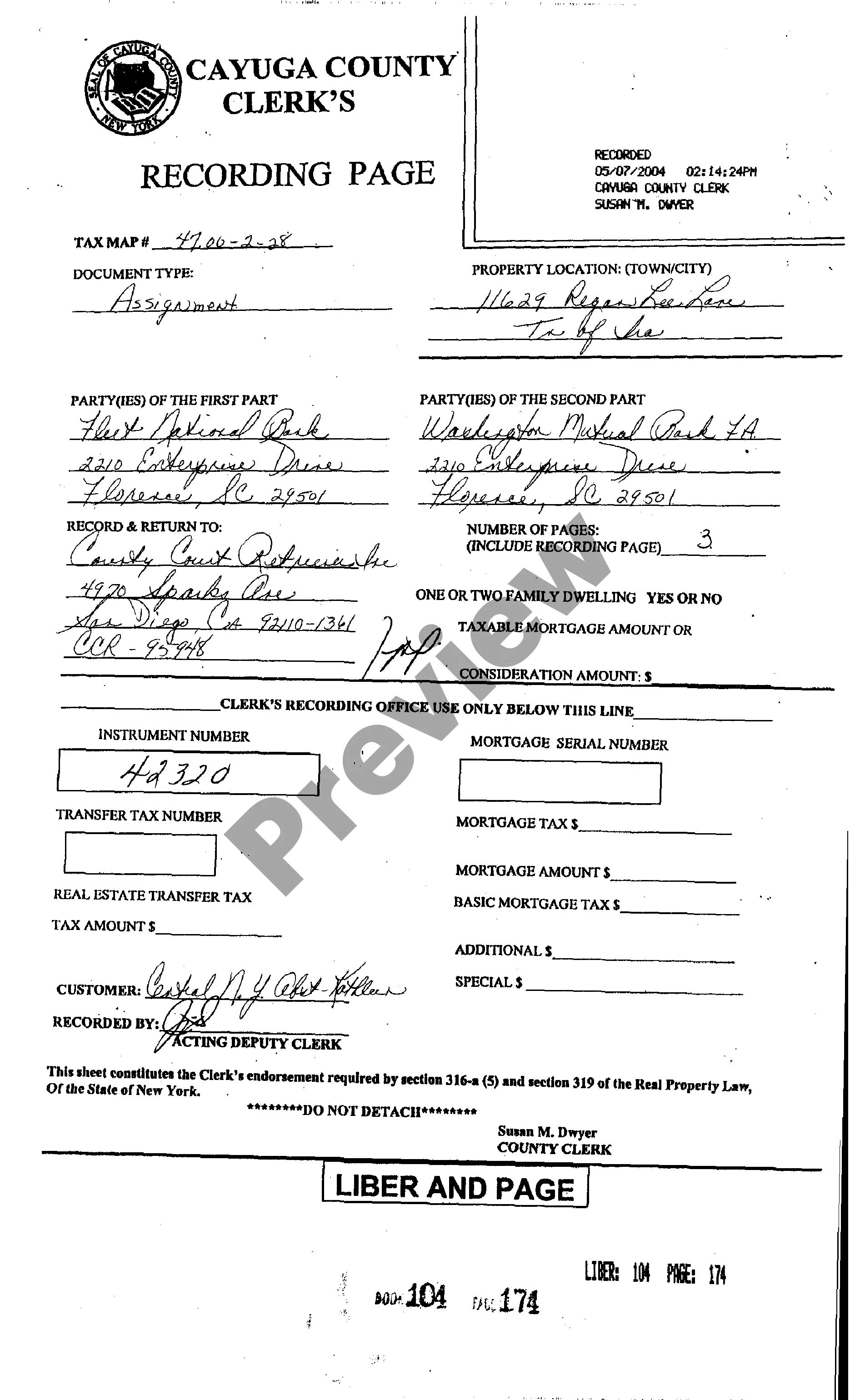

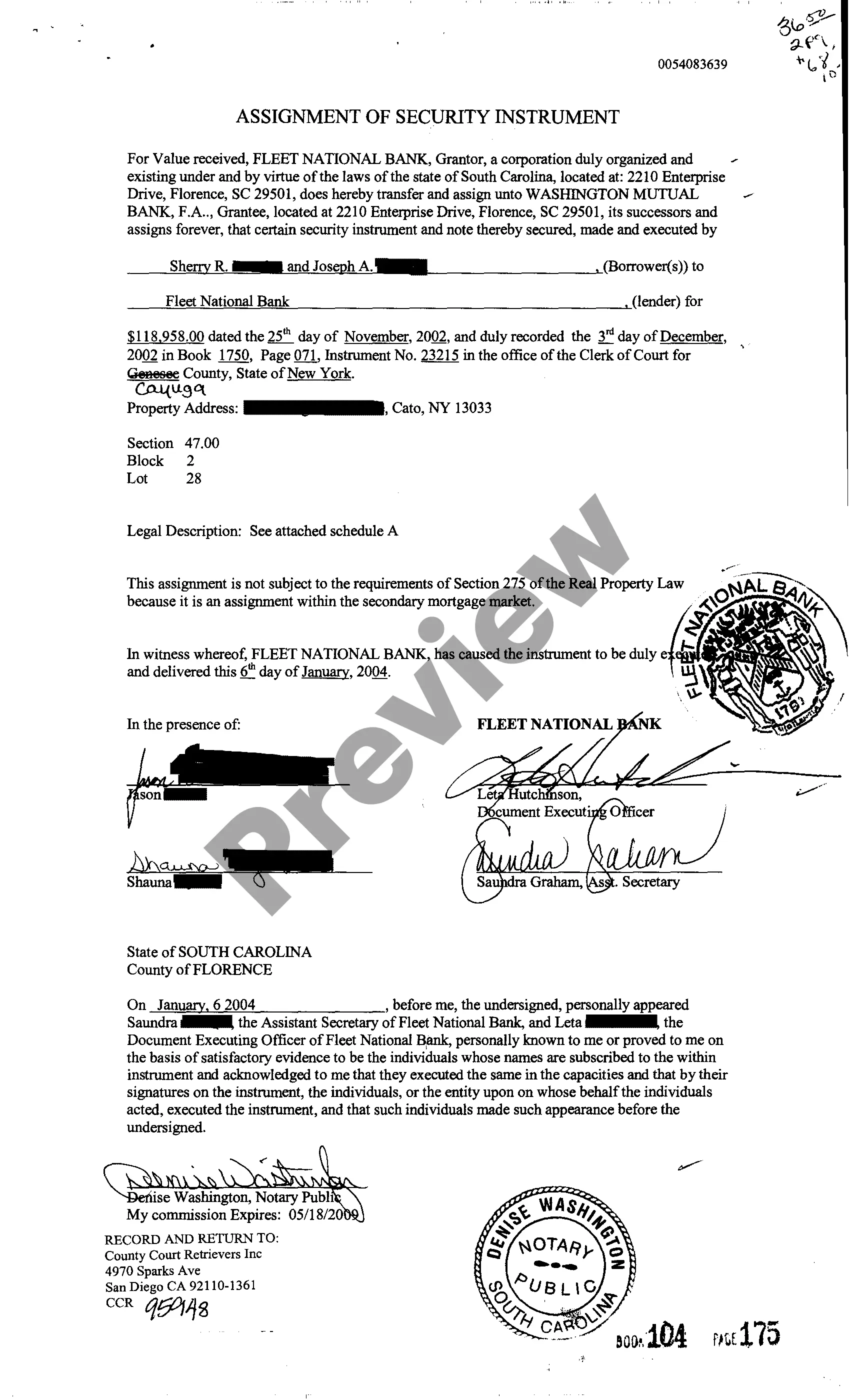

Kings New York Assignment of Security Interest is a legal document used to transfer the rights of a security interest from one party to another. This assignment is mainly applicable in New York and is often used in commercial transactions involving secured loans or the sale of goods. The Kings New York Assignment of Security Interest allows the creditor, known as the assignor, to assign their interest in the collateral to another party, known as the assignee. The collateral can consist of various assets like real estate, personal property, stocks, or even intellectual property. By assigning the security interest, the assignor transfers all their rights and privileges associated with the collateral to the assignee. This assignment of security interest is an essential legal tool in securing loans. When an individual or business entity borrows money, the lender often requires collateral to safeguard their investment. The collateral is subject to a security interest, which provides the lender with a legal claim in case the borrower defaults. Different types of Kings New York Assignment of Security Interest may include: 1. Real Estate Assignment of Security Interest: This type of assignment involves the transfer of security interest in real property, such as land, buildings, or real estate assets. 2. Chattel Assignment of Security Interest: Chattel refers to movable personal property, and this type of assignment involves the transfer of security interest in assets like machinery, vehicles, equipment, or inventory. 3. Intellectual Property Assignment of Security Interest: In cases where intellectual property rights, such as patents, copyrights, or trademarks, serve as collateral, this type of assignment is used to transfer the security interest. 4. Stock Assignment of Security Interest: This assignment pertains to the transfer of security interest in stocks, shares, or other securities held by a borrower. 5. Accounts Receivable Assignment of Security Interest: When a business assigns its security interest in accounts receivable, it means they transfer their rights to the payments owed by customers or clients to the assignee. When executing a Kings New York Assignment of Security Interest, it is crucial to include specific details in the document, such as identifying the parties involved, describing the collateral in detail, stating the amount of the loan or underlying obligation, and outlining the rights and responsibilities of both the assignor and assignee. In conclusion, the Kings New York Assignment of Security Interest is a crucial legal document used in various commercial transactions to transfer the rights of a security interest from one party to another. The types of assignments can vary depending on the nature of the collateral involved, such as real estate, chattel, intellectual property, stock, or accounts receivable.

Kings New York Assignment of Security Interest

Description

How to fill out Kings New York Assignment Of Security Interest?

We always strive to reduce or avoid legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for attorney services that, as a rule, are very expensive. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Kings New York Assignment of Security Interest or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is equally easy if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Kings New York Assignment of Security Interest adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Kings New York Assignment of Security Interest would work for your case, you can select the subscription plan and make a payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

Article 9 is a section under the UCC governing secured transactions including the creation and enforcement of debts. Article 9 spells out the procedure for settling debts, including various types of collateralized loans and bonds.

Despite the amounts involved, it is possible to transfer ownership of your property without money changing hands. This process can either be called a deed of gift or transfer of gift, both definitions mean the same thing. Executing a deed of gift can be a complex undertaking, but it isn't impossible.

In most cases, UCC liens expire after five years, although the lender can file to renew your lien. If you pay the lien off before the five years are up, you can ask the lender to terminate the lien.

Real Property Recording FeesDocument To Be FiledFee On Standard FormWhere the point size is less than 8 points (ordinary newsprint)$49.00 + $10.00 per page for Cover Page. Minimum for 2 pages = $64.00 ($49.00 + 1 Cover Page + 1 document page).Additional blocks$2.00 for each additional block in excess of one.5 more rows

A UCC filing is $40 for a paper-based filing and $20 for an electronic filing (using XML transmission or e-File). The UCC search fee is $25.

New York State's Uniform Commercial Code (?UCC?) guides the sale of commercial business transactions, including the sale of goods between parties. Article 9 of the UCC governs transactions that combine a debt with a creditor's interest in a debtor's personal property.

A UCC filing is $40 for a paper-based filing and $20 for an electronic filing (using XML transmission or e-File). The UCC search fee is $25. A separate Information Request (Form UCC-11) is required for each business or name to be searched.

By Mail: send the completed form with the processing fee of $40 to the New York State Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, New York 12231.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

A real property transfer form?RP-5217, RP-5217-NYC, or RP-5217-PDF (pilot project)?is required for all real property transfers where a deed is filed. A filing fee is also required.

Interesting Questions

More info

Plaintiff's complaint alleged only general lien. No specific lien existed. See Law § 5202a×a) (McKinney 1978) (citing Bank v. Westchester, 759 101: (New York 1997)(a lien “if. . . . Secured by an inventory”). The complaint alleged general lien for all outstanding debt for goods and chattels of Plaintiff's team, and the amount of debt owed to Merchants Credit. Plaintiff also alleged a claim against Bank for unpaid account (bond×. See Rule of the Federal Rules of Bankruptcy Procedure. Plaintiffs' first argument: the Bank has never obtained any specific lien for the amount (s) owed to Merchants Credit; therefore, the Bank cannot be held liable for its actions. The Bank contends that, even if the claim is general, a specific lien is required.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.