Queens New York Assignment of Security Interest refers to the process in which the rights or interests in a collateral, secured by a debt or loan, are transferred from one party to another within the jurisdiction of Queens, New York. This legal transaction allows the assignee to gain ownership of the security interest or lien associated with the debt, providing them with certain rights and protections. In Queens, New York, there are various types of Assignments of Security Interest that cater to specific circumstances. These include: 1. Assignment of Mortgage: This type of assignment is commonly seen in real estate transactions. It involves the transfer of the mortgage and the underlying security interest associated with a property from the original lender to a new party, usually an investor or another financial institution. 2. Assignment of Accounts Receivable: In business or commercial transactions, this type of assignment involves the transfer of the right to collect payment on outstanding accounts receivable. It allows the assignee to assume the rights, title, and security interest in these receivables, providing them with the legal authority to collect the debt owed to the assignor. 3. Assignment of Intellectual Property (IP): Intellectual property, such as patents, copyrights, and trademarks, can also be subject to an assignment of security interest. This type of assignment involves the transfer of rights and ownership in the IP, allowing the assignee to use, enforce, or monetize the intellectual property mentioned. 4. Assignment of Equipment: This assignment involves the transfer of security interest in specific equipment or machinery. It is commonly used in cases where a debtor uses equipment as collateral to secure a loan or debt. The assignee gains the right to repossess or sell the equipment in case of default by the debtor. 5. Assignment of Securities: This type of assignment involves the transfer of security interests associated with stocks, bonds, or other investment securities. It allows the assignee to gain ownership and control over the securities, providing them with the ability to exercise rights, receive dividends, or sell the securities. It's important to note that specific legal requirements and documentation must be followed for each type of assignment, including compliance with Queens, New York regulations and proper filing of the assignment documents. The terms and conditions of the assignment and the rights and obligations of the parties involved should be clearly stated in a written agreement to avoid any future disputes or confusion.

Queens New York Assignment of Security Interest

Description

How to fill out Queens New York Assignment Of Security Interest?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for attorney solutions that, usually, are very costly. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Queens New York Assignment of Security Interest or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Queens New York Assignment of Security Interest adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Queens New York Assignment of Security Interest is proper for you, you can pick the subscription plan and make a payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!

Form popularity

FAQ

Real Property Recording FeesDocument To Be FiledFee On Standard FormWhere the point size is less than 8 points (ordinary newsprint)$49.00 + $10.00 per page for Cover Page. Minimum for 2 pages = $64.00 ($49.00 + 1 Cover Page + 1 document page).Additional blocks$2.00 for each additional block in excess of one.5 more rows

A real property transfer form?RP-5217, RP-5217-NYC, or RP-5217-PDF (pilot project)?is required for all real property transfers where a deed is filed. A filing fee is also required.

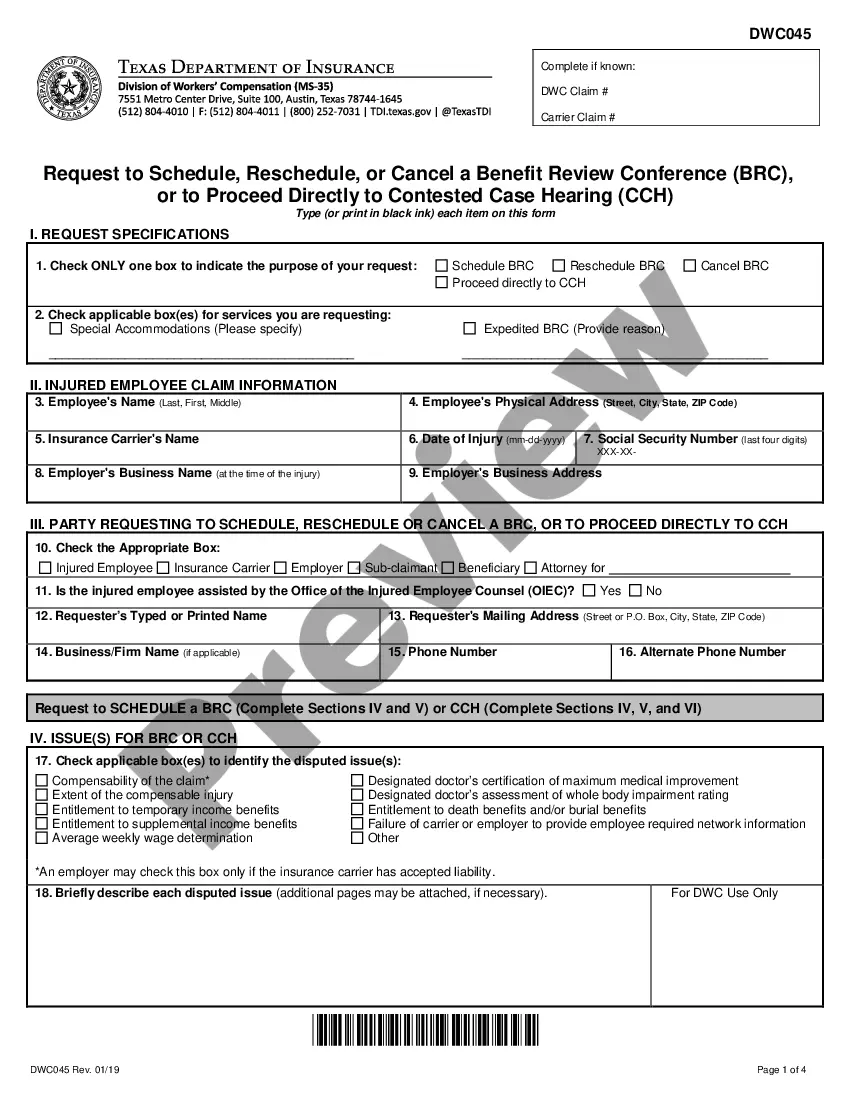

A UCC filing is $40 for a paper-based filing and $20 for an electronic filing (using XML transmission or e-File). The UCC search fee is $25. A separate Information Request (Form UCC-11) is required for each business or name to be searched.

Despite the amounts involved, it is possible to transfer ownership of your property without money changing hands. This process can either be called a deed of gift or transfer of gift, both definitions mean the same thing. Executing a deed of gift can be a complex undertaking, but it isn't impossible.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

Are Transfer Taxes Deductible? Whether you buy or sell, the IRS doesn't allow you to deduct transfer taxes?or any other taxes involved in the sale of a personal home. This includes other costs like the recording tax paid on each mortgage.

A UCC filing is $40 for a paper-based filing and $20 for an electronic filing (using XML transmission or e-File). The UCC search fee is $25.

New York State's Uniform Commercial Code (?UCC?) guides the sale of commercial business transactions, including the sale of goods between parties. Article 9 of the UCC governs transactions that combine a debt with a creditor's interest in a debtor's personal property.

In most cases, UCC liens expire after five years, although the lender can file to renew your lien. If you pay the lien off before the five years are up, you can ask the lender to terminate the lien.

By Mail: send the completed form with the processing fee of $40 to the New York State Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, New York 12231.

More info

The trust accounts. -201- -202- -203- -204- -205- -206- -207- -208- -209- -210- The court granted Wally a new lease after he vacated. The car to her sister, Donna. The New York State Department of Motor Vehicles (DMV) found that the car was in the name of Donna's parent, Linda. DMV declined to register the car because the parent's name isn't on it. Donna also failed to apply for a motor vehicle insurance policy for the car. Wally did file a Notice of Withholding of New Motor Vehicle Tax (Motor Vehicle Tax×. Wally was unable to prove that he had ever filed one of the following documents in connection with the trust account: a utility bill, a bank statement, a medical payment form, a credit card statement, a bank guarantee letter, or other document from the bank, that might have helped him establish that Linda wasn't the owner of the car. The DMV also refused Wally's Application for Title and Registration of Interest (Form G-2545-A×. According to Wally, the form doesn't work.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.