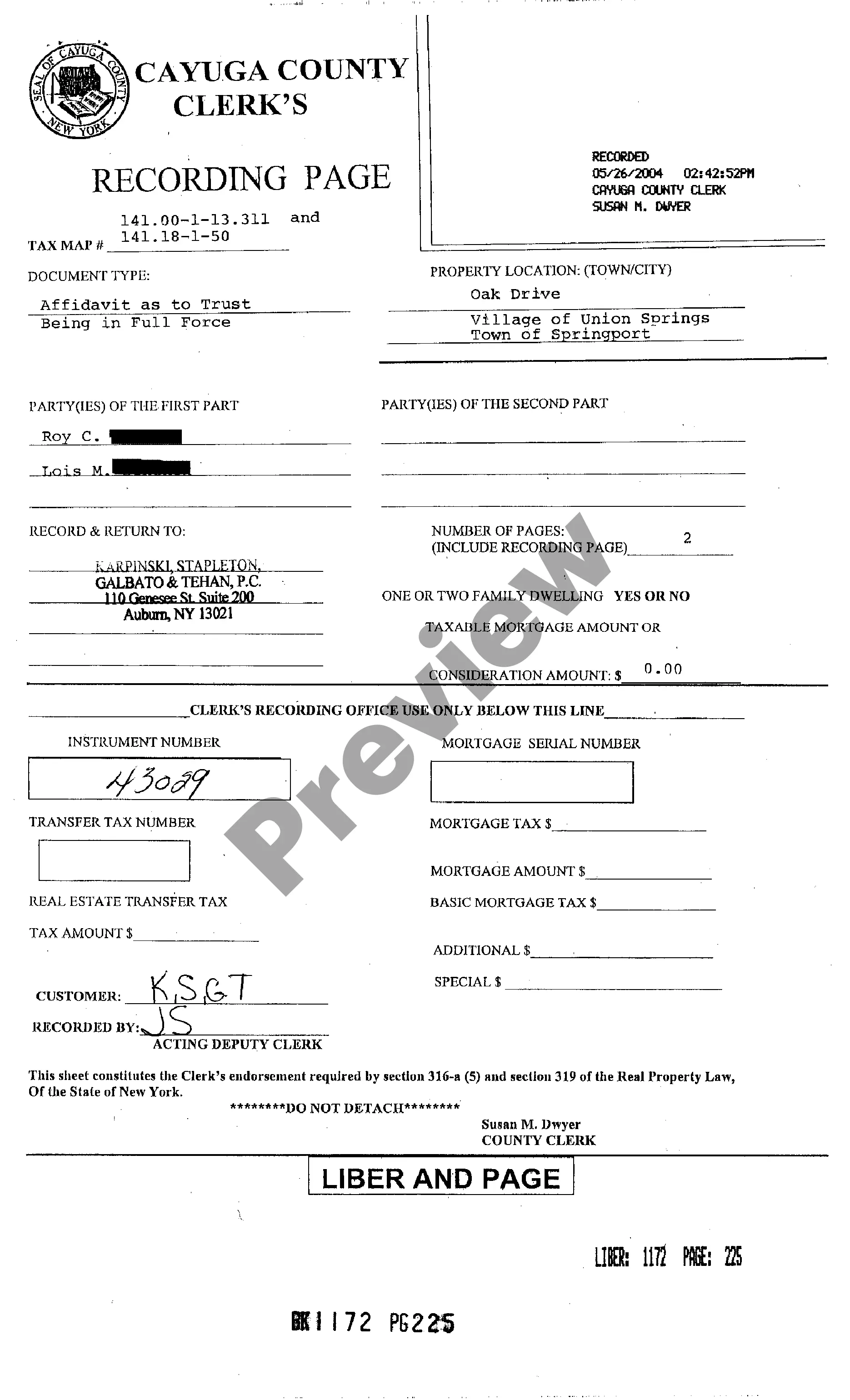

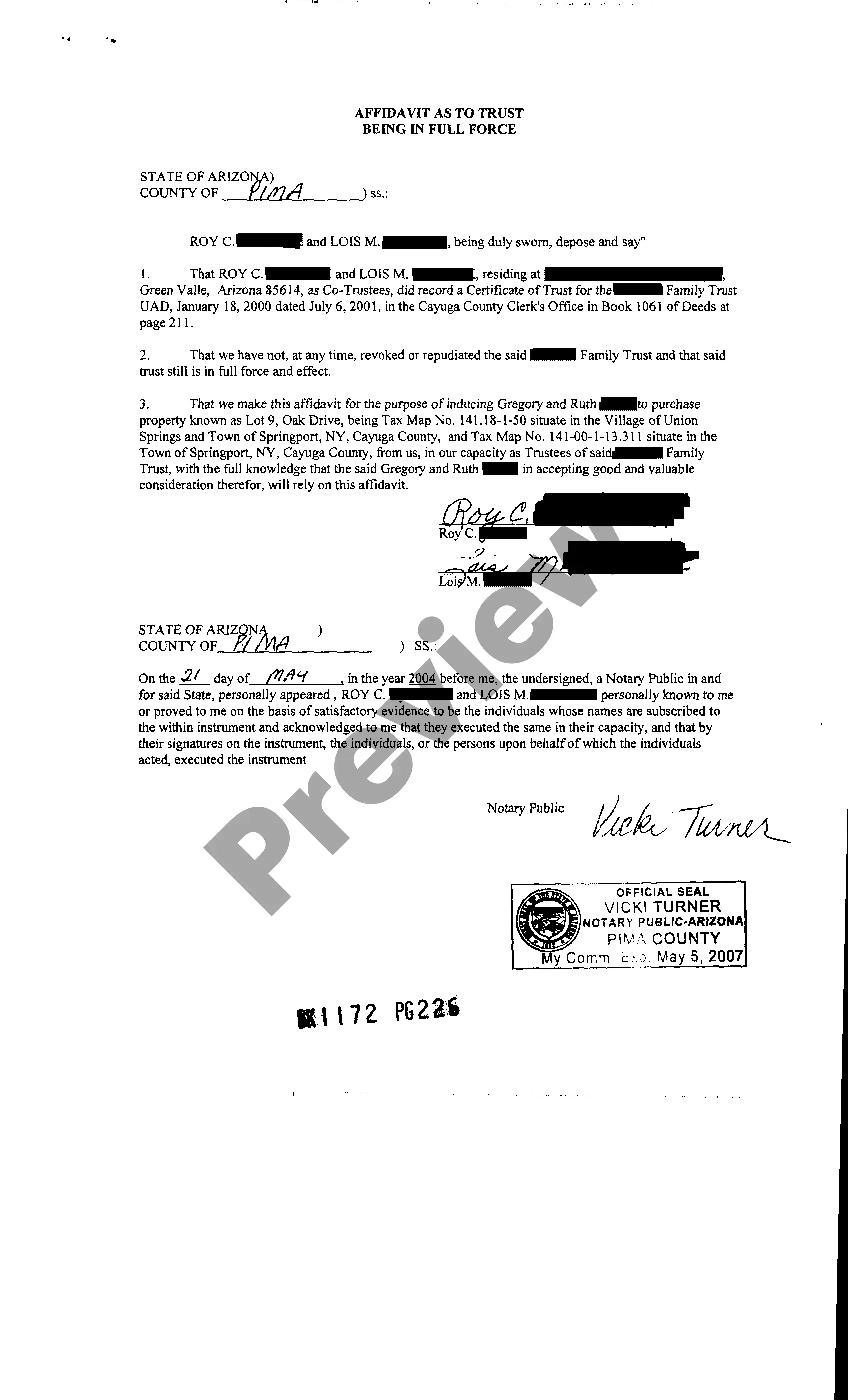

Yonkers New York Trust Affidavit is a legally binding document that serves as evidence or proof of the authenticity and validity of a trust in the city of Yonkers, New York. This affidavit is commonly required as part of the legal process for executing a trust in Yonkers. The Yonkers New York Trust Affidavit contains crucial information about the trust, including the names and contact details of the trust settler (creator), beneficiaries, and trustees. It also includes details about the purpose and goals of the trust, as well as any assets or properties held within the trust. There are two main types of Yonkers New York Trust Affidavits: 1. Revocable Trust Affidavit: This type of affidavit is used when the trust settler has the ability to modify or revoke the trust agreement during their lifetime. The revocable trust provides flexibility and control for the settler, allowing them to make changes to the trust as needed. 2. Irrevocable Trust Affidavit: In contrast, an irrevocable trust affidavit is used when the trust settler relinquishes all control and ownership rights to the trust's assets and properties. Once an irrevocable trust is established, it cannot be altered or revoked without the consent of all beneficiaries involved. The Yonkers New York Trust Affidavit plays a crucial role in ensuring that the trust is legally recognized and enforced in the city of Yonkers. It provides a formal declaration of the trust's existence and outlines the responsibilities and obligations of the trustees. This document is frequently required during real estate transactions, wealth management, estate planning, or any other scenario involving a trust in Yonkers, New York. When preparing a Yonkers New York Trust Affidavit, it is essential to consult an experienced attorney knowledgeable in trust law to ensure accuracy and compliance with local regulations.

Yonkers New York Trust Affidavit

Description

How to fill out Yonkers New York Trust Affidavit?

We consistently aim to lessen or avert legal complications when handling intricate legal or financial matters.

To achieve this, we seek legal assistance that, generally speaking, is quite pricey.

However, not every legal concern is so intricate; many can be resolved by ourselves.

US Legal Forms is a digital directory of current do-it-yourself legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log Into your account and click the Get button beside it. If you misplace the form, you can easily download it again from the My documents section. The process is equally uncomplicated for those unfamiliar with the website; you can register your account within minutes. Ensure the Yonkers New York Trust Affidavit complies with your state's laws and regulations. Additionally, it is vital to review the form's structure (if provided), and if you notice any inconsistencies with your initial expectations, look for an alternative template. Once you've confirmed that the Yonkers New York Trust Affidavit is suitable for your situation, you can select the subscription plan and move forward with the payment. Afterwards, you'll be able to download the form in any preferred file format. For over 24 years, we have assisted millions by providing ready-to-customize and current legal documents. Take advantage of US Legal Forms today to conserve your time and resources!

- Our service enables you to take control of your affairs without needing legal representation.

- We provide access to legal document templates that may not always be readily available.

- Our templates are tailored to specific states and regions, which significantly streamlines the search process.

- Utilize US Legal Forms whenever you require to locate and acquire the Yonkers New York Trust Affidavit or any other document swiftly and securely.

Form popularity

FAQ

The Yonkers exit tax applies to residents who sell their property and move out of the city, imposing a withholding requirement on the proceeds. This tax is designed to ensure that all owed taxes are settled before you leave. If you are drafting a Yonkers New York Trust Affidavit, you should consider this exit tax in your financial planning.

Yonkers tax can refer to several local taxes, including property and income taxes. The city applies different rates depending on ownership and income levels. Managing your obligations becomes crucial if you are filing a Yonkers New York Trust Affidavit, as these taxes may impact your assets.

No, the New York State sales tax rate is 4%, but various local jurisdictions, including Yonkers, add their own rates. In Yonkers, the combined rate reaches 8.875%. If you're involved in a Yonkers New York Trust Affidavit, understanding these tax rates will help you navigate financial implications effectively.

The current sales tax rate in Yonkers, New York, is 8.875%. This rate is comprised of the New York State sales tax and additional local taxes. If you're dealing with matters related to a Yonkers New York Trust Affidavit, it's essential to include this tax consideration when assessing property or asset transfers.

Mail NYS Form IT-205 to the specific address indicated on the form. Addresses may differ depending on whether you are filing for a new estate or a continuing one. For clarity regarding your Yonkers New York Trust Affidavit and proper submission, always refer to the most recent instructions provided by the state.

You must send your New York state tax extension request to the address provided on the extension form. Ensure that you do so before the due date to avoid penalties. If you are dealing with issues related to a Yonkers New York Trust Affidavit, consider the extension's implications on filing your trust's returns.

Any trust that generates income must file a New York trust return, particularly if the income is taxable. This return outlines the income earned by the trust, eligible deductions, and distributions to beneficiaries. For those handling a Yonkers New York Trust Affidavit, understanding these requirements ensures compliance with NY regulations.

Yes, most trusts must file a tax return, especially if they have taxable income. The requirement often depends on the type of trust and its income levels. Therefore, for a Yonkers New York Trust Affidavit, it's crucial to assess if your trust's situation necessitates filing a tax return.

To file a trust, you generally need to complete Form IT-205. This form is intended for New York trusts and details the income, deductions, and distributions made by the trust. Utilizing guidance available through platforms like USLegalForms can help simplify the process for your Yonkers New York Trust Affidavit.

Mail your NY state amended tax return to the address indicated in the form's instructions. It is advisable to double-check the latest guidelines, as changes can occur. If your amended return pertains to a trust, especially one associated with a Yonkers New York Trust Affidavit, be mindful of any specific instructions regarding documentation.