Title: Bronx New York Federal Estate Tax Affidavit: A Comprehensive Guide and Types Explained Introduction: The Bronx New York Federal Estate Tax Affidavit is a crucial legal document designed to facilitate the seamless transfer of assets and possessions after an individual's demise. This document helps to determine the final state of their financial affairs, including settling any outstanding debts, validating their will, and calculating the applicable federal estate tax fees. In the Bronx, New York, there are different types of Federal Estate Tax Affidavits, each catering to various scenarios and requirements. This article provides a detailed description of this essential document, highlighting its importance and the different types available. I. Understanding the Bronx New York Federal Estate Tax Affidavit: A. Definition and Purpose: 1. Bronx New York Federal Estate Tax Affidavit definition 2. Purpose and significance of the document B. Key Elements: 1. Assets and properties involved 2. Debts and liabilities considered 3. Executors and administrators responsible 4. Tax responsibilities and calculations 5. Legal requirements and documentation needed II. Types of Bronx New York Federal Estate Tax Affidavit: A. Basic Federal Estate Tax Affidavit: 1. Description and eligibility criteria 2. Applicable exemptions and thresholds B. Small Estate Tax Affidavit: 1. Overview and purpose 2. Qualifications and limitations for usage C. Spousal/Qualified Domestic Trust (DOT) Federal Estate Tax Affidavit: 1. Explanation and circumstances for usage 2. Importance of spousal trusts in estate planning 3. Legal requirements and conditions D. Charitable Estate Tax Affidavit: 1. Exploring charitable deductions 2. Eligibility and prerequisites 3. Tax benefits and considerations E. Estate Tax Waiver Affidavit: 1. Situations necessitating an estate tax waiver 2. Steps and procedure to obtain a waiver 3. Supporting documentation required III. Process and Requirements: A. Filing the Affidavit: 1. Submission and acceptance protocol 2. Timeframes and deadlines to be aware of B. Obtaining Legal Assistance: 1. Importance of engaging an estate attorney 2. Professional guidance for accurate filing C. Tax Payments and Penalties: 1. Understanding Federal Estate Tax requirements 2. Implications of non-compliance and penalties Conclusion: The Bronx New York Federal Estate Tax Affidavit is an indispensable legal instrument that ensures a smooth transition of property and assets according to a deceased individual's wishes. Understanding the different types of affidavits available, such as Basic, Small Estate, Spousal/DOT, Charitable, and Estate Tax Waiver, enables individuals, executors, and administrators to determine the appropriate option for their unique circumstances. Adhering to proper filing processes and requirements, including seeking legal assistance, safeguards against potential penalties and ensures compliance with federal estate tax obligations.

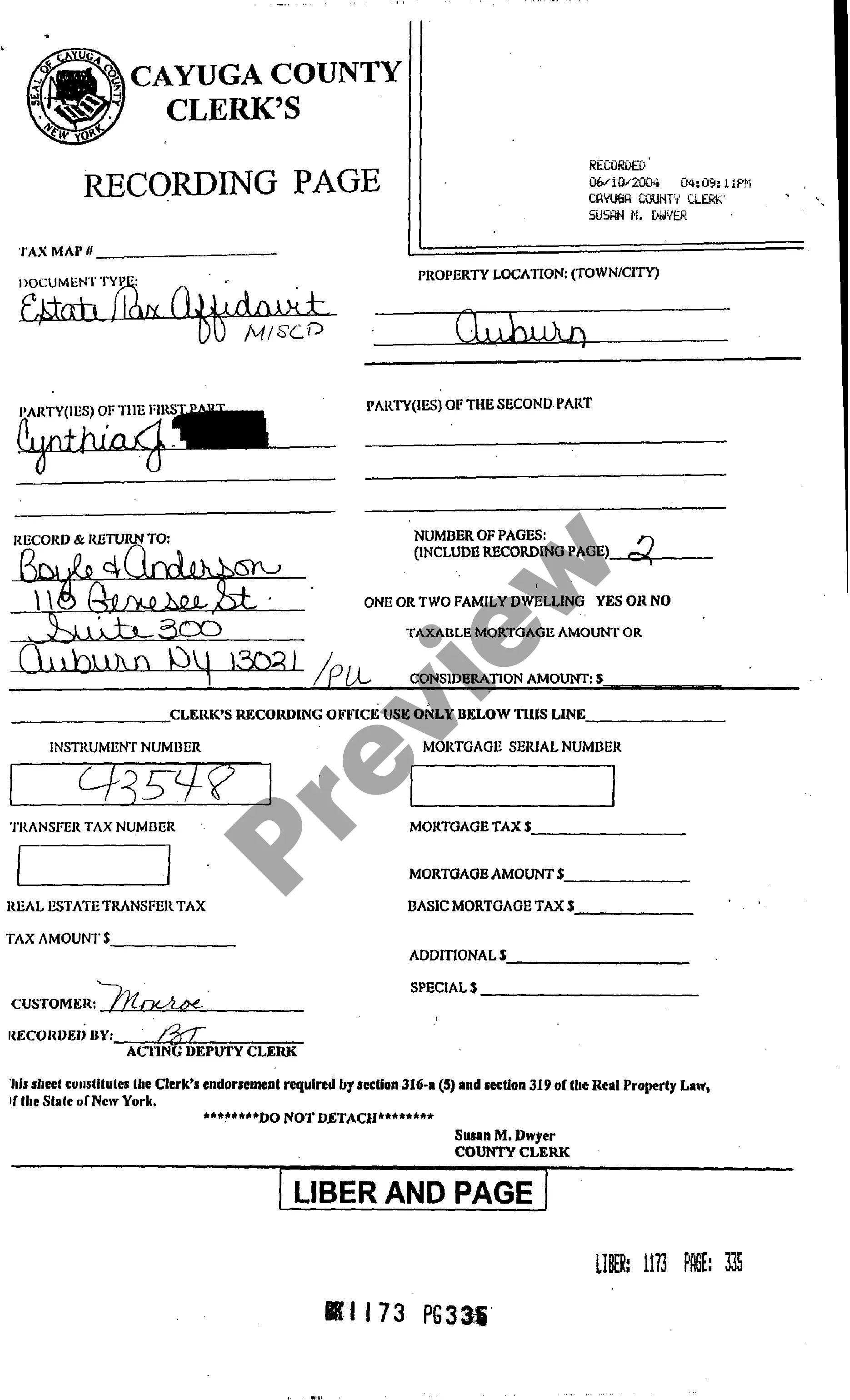

Bronx New York Federal Estate Tax Affidavit

Description

How to fill out Bronx New York Federal Estate Tax Affidavit?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone with no legal background to create this sort of papers cfrom the ground up, mainly due to the convoluted jargon and legal nuances they entail. This is where US Legal Forms can save the day. Our service offers a massive library with more than 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you need the Bronx New York Federal Estate Tax Affidavit or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Bronx New York Federal Estate Tax Affidavit quickly employing our trustworthy service. In case you are presently an existing customer, you can go on and log in to your account to get the needed form.

Nevertheless, in case you are new to our library, ensure that you follow these steps prior to obtaining the Bronx New York Federal Estate Tax Affidavit:

- Be sure the template you have found is suitable for your location because the rules of one state or area do not work for another state or area.

- Preview the form and read a quick description (if available) of cases the paper can be used for.

- If the form you picked doesn’t meet your requirements, you can start again and look for the suitable document.

- Click Buy now and pick the subscription option you prefer the best.

- Access an account {using your login information or create one from scratch.

- Choose the payment gateway and proceed to download the Bronx New York Federal Estate Tax Affidavit once the payment is completed.

You’re good to go! Now you can go on and print out the form or fill it out online. If you have any problems locating your purchased forms, you can quickly find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.