Queens New York Federal Estate Tax Affidavit is a legal document that is filed with the Internal Revenue Service (IRS) to report and calculate any estate tax owed by an individual or entity upon their demise in Queens, New York. The Queens New York Federal Estate Tax Affidavit serves the purpose of determining the value of the deceased's assets, including their real estate, financial accounts, investments, personal property, and businesses, in order to calculate the federal estate tax liability. It helps to ensure compliance with federal tax laws and facilitates the transfer of assets to the rightful beneficiaries or heirs. There are two main types of Queens New York Federal Estate Tax Affidavit: 1. Form 706: This form is used for estates that exceed the federal estate tax exemption threshold, which is currently set at $11.7 million (as of 2021). It requires detailed information about the deceased's assets, liabilities, deductions, and other relevant financial details. Executors or personal representatives responsible for administering large estates must complete this form accurately and submit it to the IRS within nine months of the individual's date of death. 2. Form 706-NA (Nonresident Alien): This form applies to non-U.S. citizens or nonresident aliens who owned assets located in the United States at the time of their death. Similar to Form 706, it necessitates the determination of the value of the assets and calculation of any federal estate tax due. Executors or personal representatives handling the estates of nonresident aliens in Queens, New York, must file this form if the estate's value exceeds the applicable exemption threshold. It is essential to consult experienced estate planning attorneys or tax professionals to ensure the accurate completion and filing of the Queens New York Federal Estate Tax Affidavit. They can provide guidance throughout the process, assist with valuing assets, and help minimize tax burdens through available deductions and exemptions. Note: The federal estate tax laws and exemption thresholds are subject to changes over time. It is crucial to verify the updated information and requirements on the official IRS website or consult a tax professional for the most recent regulations.

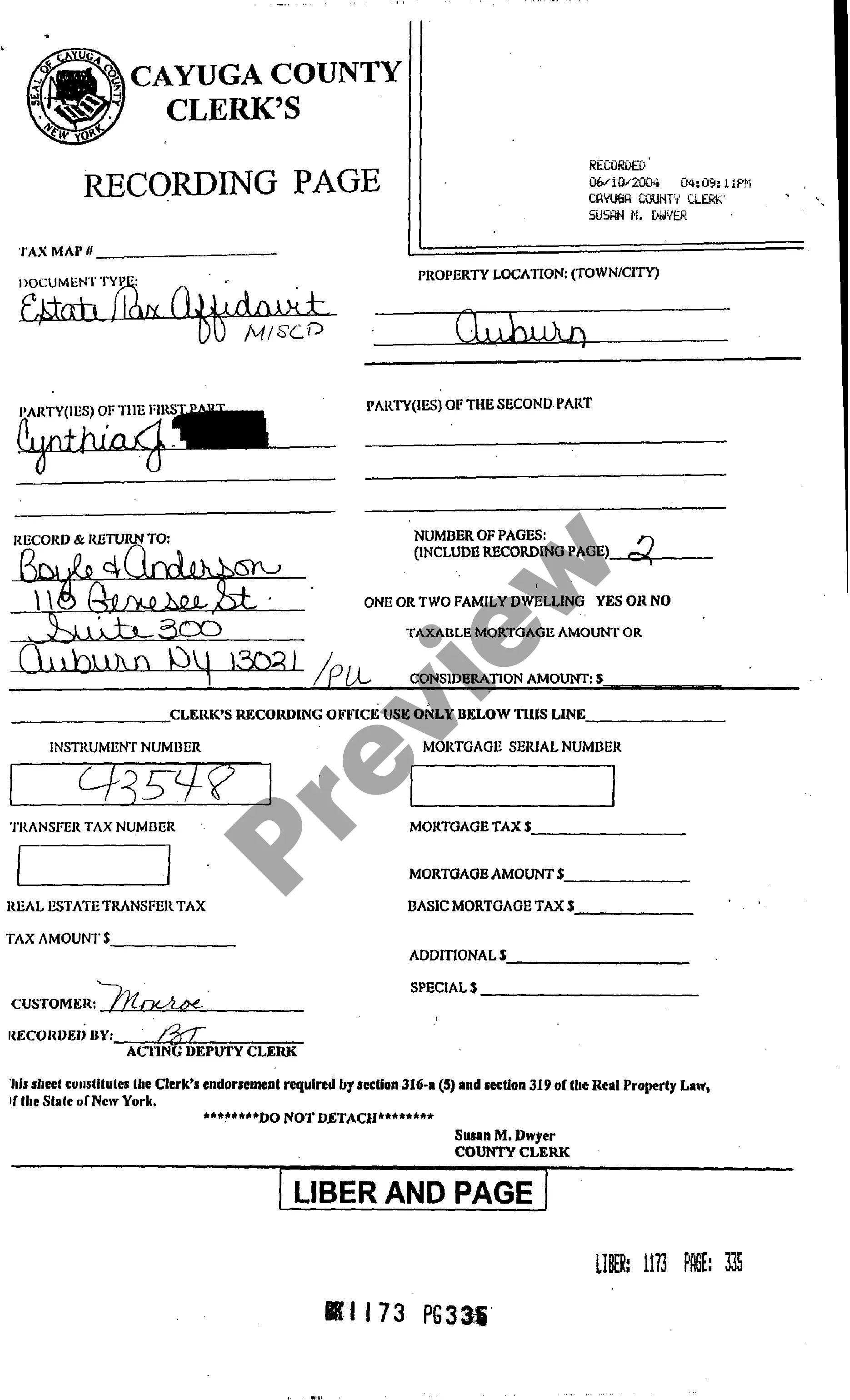

Queens New York Federal Estate Tax Affidavit

Description

How to fill out Queens New York Federal Estate Tax Affidavit?

Are you looking for a reliable and affordable legal forms provider to get the Queens New York Federal Estate Tax Affidavit? US Legal Forms is your go-to option.

Whether you require a basic agreement to set regulations for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked based on the requirements of separate state and area.

To download the form, you need to log in account, locate the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Queens New York Federal Estate Tax Affidavit conforms to the laws of your state and local area.

- Go through the form’s details (if available) to learn who and what the form is good for.

- Start the search over in case the template isn’t good for your specific scenario.

Now you can create your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the Queens New York Federal Estate Tax Affidavit in any available format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal paperwork online for good.