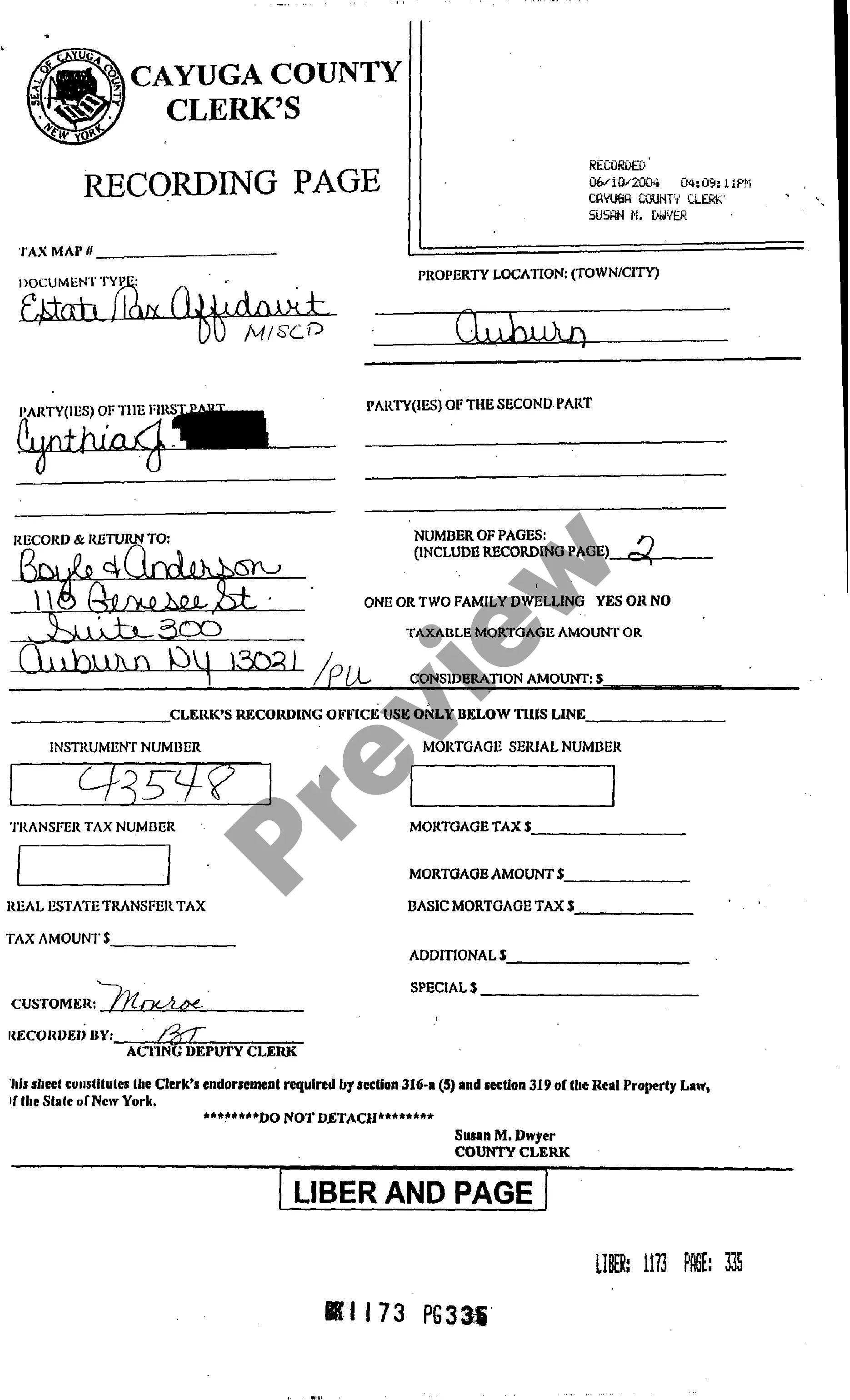

The Suffolk New York Federal Estate Tax Affidavit is a legal document that is required to be filed with the Internal Revenue Service (IRS) in order to determine and assess federal estate taxes owed for an individual who has passed away. This affidavit provides detailed information about the deceased person's assets, liabilities, and other relevant financial information. The purpose of the Suffolk New York Federal Estate Tax Affidavit is to enable the government to calculate the estate tax that is due and ensure that it is paid in a timely manner. By submitting this affidavit, the executor or administrator of the deceased person's estate can provide a comprehensive overview of the estate's financial situation, including the value of the assets, any outstanding debts or liabilities, and any relevant deductions or exemptions. There are several types of Suffolk New York Federal Estate Tax Affidavits that may be required, depending on the specific circumstances of the deceased person's estate. These include: 1. Basic Federal Estate Tax Affidavit: This is the standard affidavit that is used to provide a detailed breakdown of the deceased person's assets, liabilities, and other financial information. It is typically required for estates that exceed the federal estate tax exemption threshold. 2. Simplified Federal Estate Tax Affidavit: This affidavit is available for estates that have a total value below the federal estate tax exemption threshold. It allows for a less complex and streamlined reporting process, requiring less detailed information compared to the basic affidavit. 3. Portability Federal Estate Tax Affidavit: This affidavit is specifically used to claim the unused portion of a deceased spouse's federal estate tax exemption. It allows a surviving spouse to transfer any unused exemption to their own estate, potentially reducing or eliminating federal estate taxes upon their death. Filing the Suffolk New York Federal Estate Tax Affidavit is a crucial step in the estate administration process. The information provided in this document is used by the IRS to determine the estate tax liability and ensure compliance with federal tax regulations. Executors or administrators of estates in Suffolk, New York must carefully gather and report accurate financial information in order to fulfill their legal obligations and prevent potential penalties or disputes.

Suffolk New York Federal Estate Tax Affidavit

Description

How to fill out Suffolk New York Federal Estate Tax Affidavit?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone with no law background to draft this sort of papers cfrom the ground up, mostly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes in handy. Our service provides a huge catalog with more than 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time using our DYI forms.

Whether you need the Suffolk New York Federal Estate Tax Affidavit or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Suffolk New York Federal Estate Tax Affidavit quickly employing our trustworthy service. If you are already a subscriber, you can go on and log in to your account to download the appropriate form.

However, if you are new to our library, make sure to follow these steps before downloading the Suffolk New York Federal Estate Tax Affidavit:

- Be sure the template you have found is good for your location since the regulations of one state or area do not work for another state or area.

- Review the document and read a quick description (if provided) of scenarios the paper can be used for.

- If the form you chosen doesn’t suit your needs, you can start again and look for the necessary document.

- Click Buy now and choose the subscription plan you prefer the best.

- utilizing your login information or register for one from scratch.

- Select the payment method and proceed to download the Suffolk New York Federal Estate Tax Affidavit as soon as the payment is completed.

You’re all set! Now you can go on and print the document or complete it online. Should you have any issues getting your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.