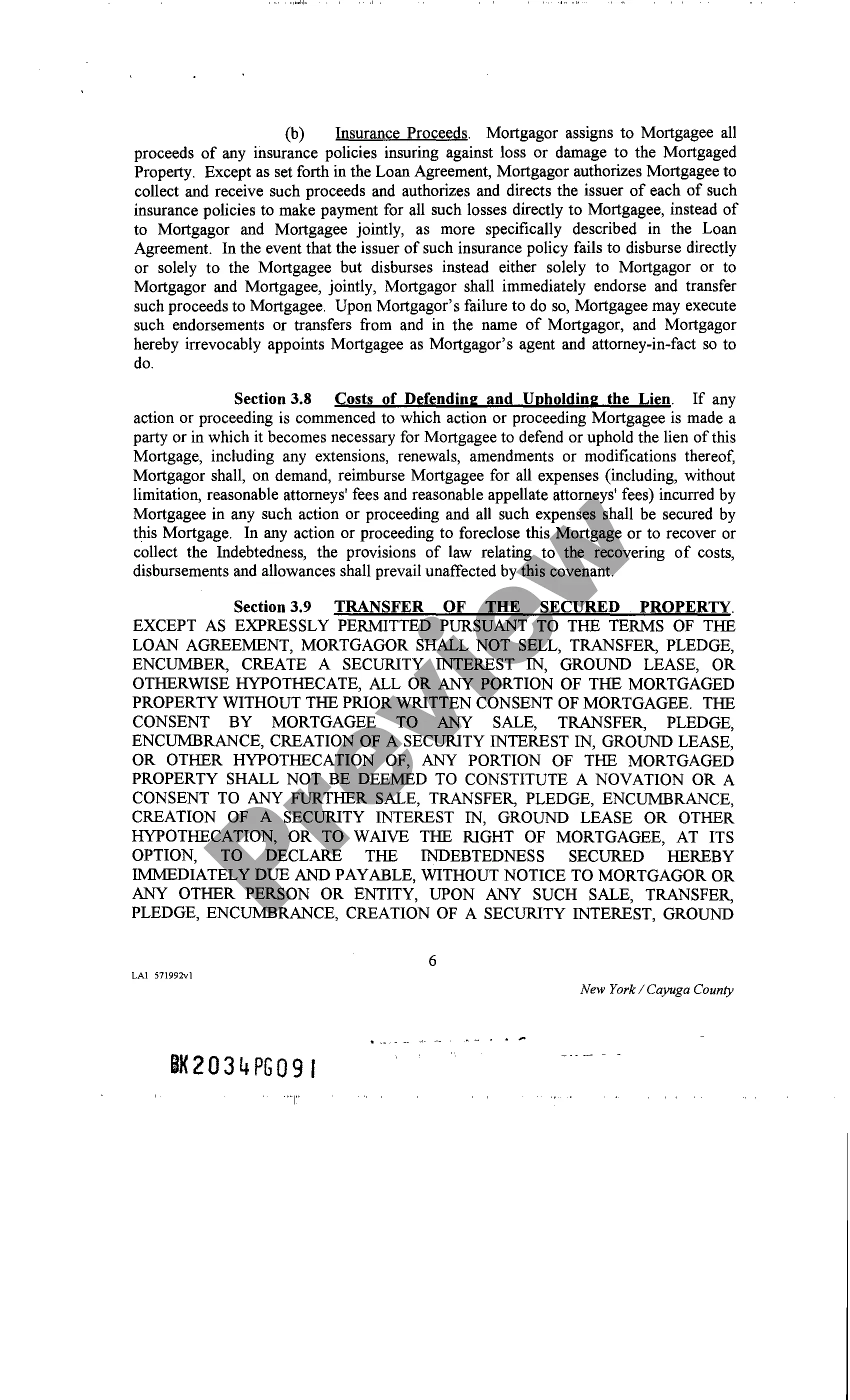

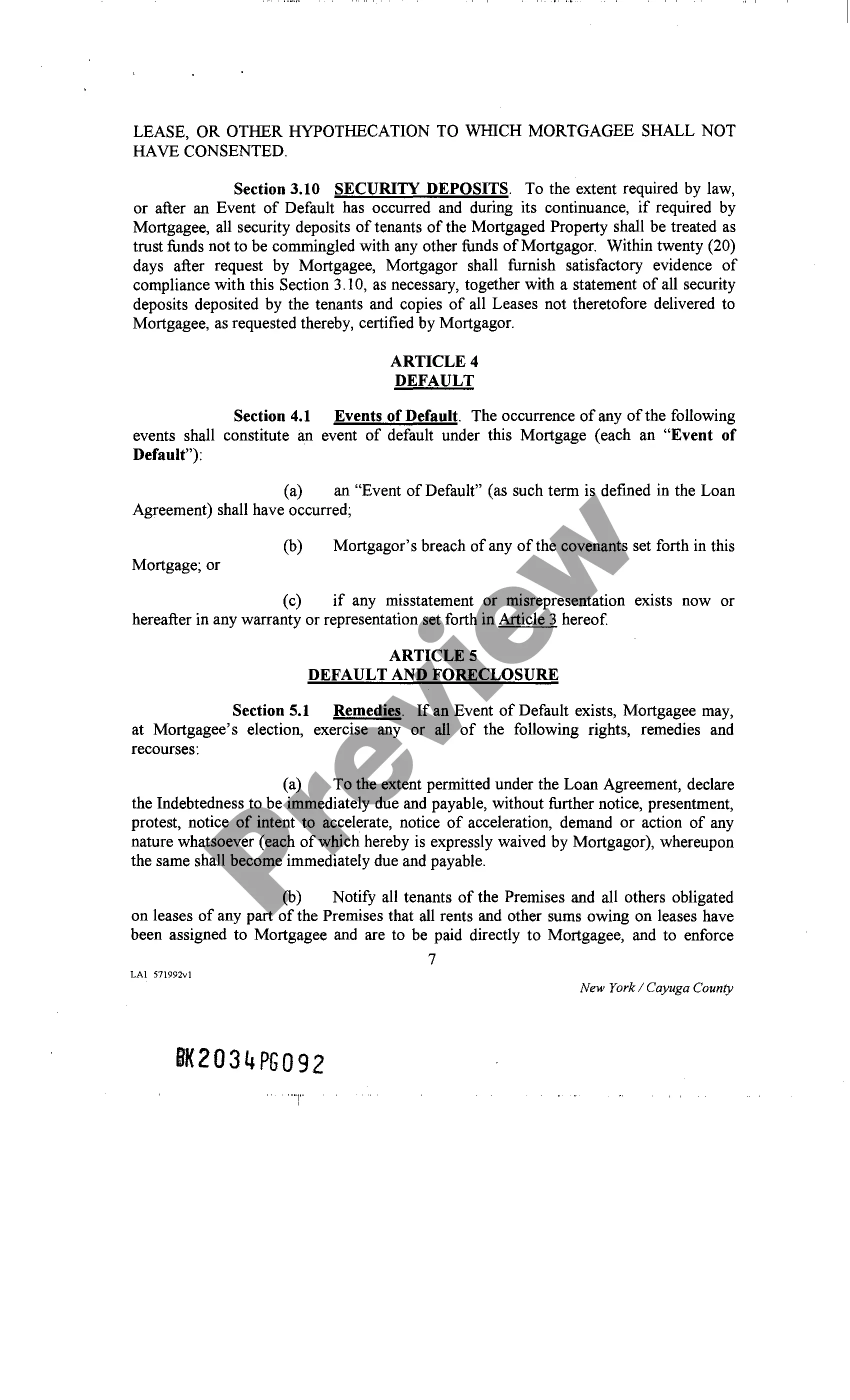

The Suffolk New York Assignment of Rents and Leases is a legal document that transfers the rights to receive rental income from a property owner to another party, typically a lender or a creditor. This arrangement allows the lender to collect rent directly from tenants if the property owner defaults on their loan or fails to meet their obligations. In Suffolk County, New York, there are two main types of Assignment of Rents and Leases: 1. Voluntary Assignment: This type of assignment is entered into willingly by the property owner to provide additional security for a loan or as a part of a mortgage agreement. By voluntarily assigning their rents and leases, property owners offer their rental income as collateral to secure a loan, providing lenders with a source of repayment. 2. Involuntary Assignment: In some cases, when a property owner defaults on a loan or fails to fulfill their financial obligations, the lender may initiate an involuntary assignment of rents and leases. This allows the lender to gain control over the rental income to recover the outstanding debt. Typically, this occurs through a foreclosure process where the lender takes possession of the property and assumes control over its rental operations. It is important to note that by executing an Assignment of Rents and Leases, the property owner's rights to collect rental income are temporarily transferred to the designated party. However, the property owner usually retains other rights, such as the ability to manage the property and make other important decisions regarding the lease agreements. The Suffolk New York Assignment of Rents and Leases document includes essential information, such as the names and addresses of the property owner, the assignee (lender or creditor), and any relevant property details. It also outlines the terms, conditions, and duration of the assignment, ensuring both parties have a clear understanding of their rights and obligations. By employing an Assignment of Rents and Leases in Suffolk County, property owners and lenders alike benefit from an added layer of security. Lenders gain assurance that rental income can be used to satisfy outstanding debts in the event of default, while property owners can access funding and potentially secure better loan terms.

Suffolk New York Assignment of Rents and Leases

Description

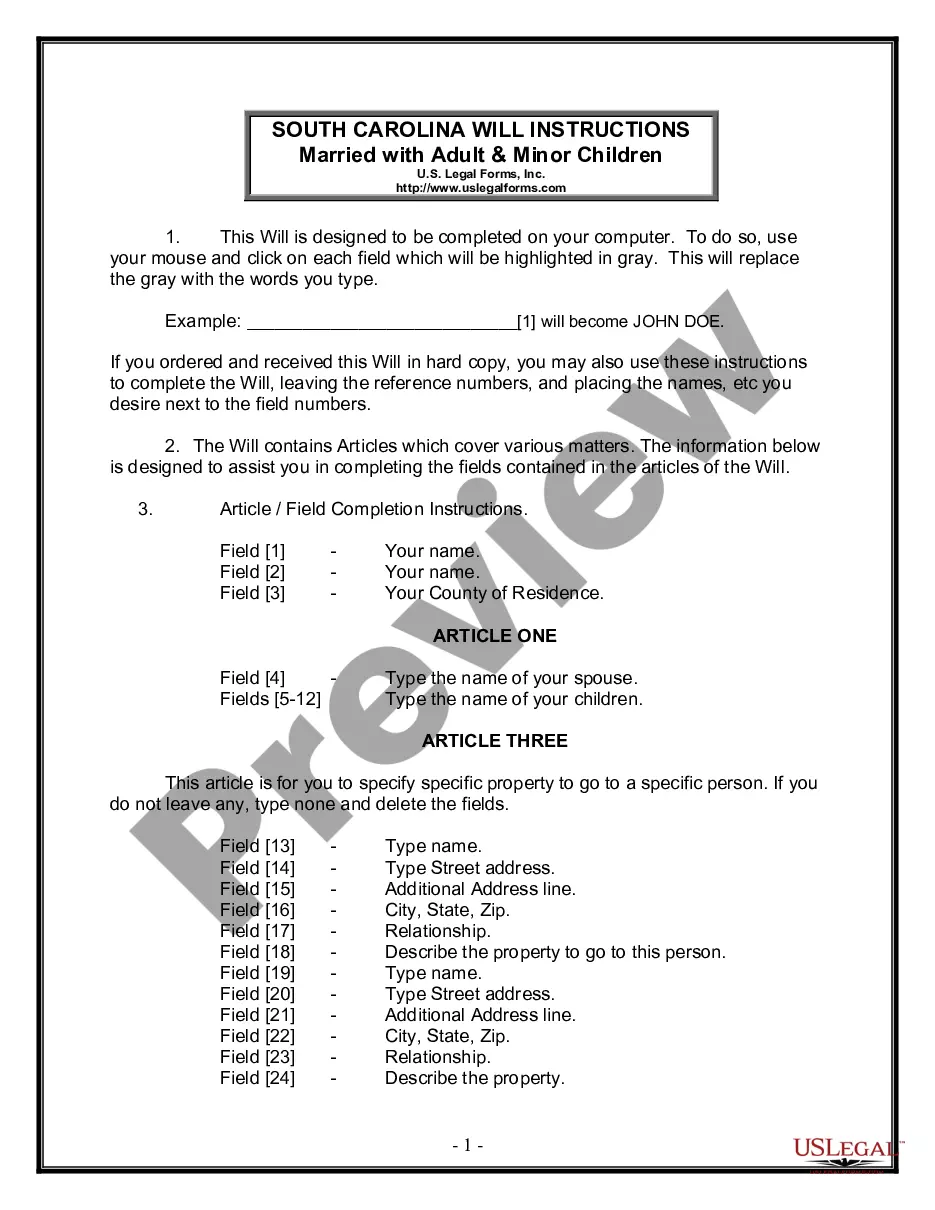

How to fill out Suffolk New York Assignment Of Rents And Leases?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for attorney solutions that, as a rule, are extremely costly. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Suffolk New York Assignment of Rents and Leases or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Suffolk New York Assignment of Rents and Leases complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Suffolk New York Assignment of Rents and Leases is proper for your case, you can choose the subscription option and make a payment.

- Then you can download the document in any available format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!

Form popularity

More info

See Mobile Apps Skip main navigation Sign in Join Homepage Check out this apartment for rent at 52 Barrow St Apt 1B, New York, NY, 10014. Whether you are looking for a new home to rent or have one you need to rent out and want to remove the stress of the process, we have the services you need. Gatehouse Apartments provides apartments for rent in the Edgewater Park, NJ area. See Mobile Apps Skip main navigation Sign in Join Homepage Check out this apartment for rent at 52 Barrow St Apt 1B, New York, NY, 10014. Whether you are looking for a new home to rent or have one you need to rent out and want to remove the stress of the process, we have the services you need. Gatehouse Apartments provides apartments for rent in the Edgewater Park, NJ area. See Mobile Apps Skip main navigation Sign in Join Homepage Check out this apartment for rent at 52 Barrow St Apt 1B, New York, NY, 10014.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.