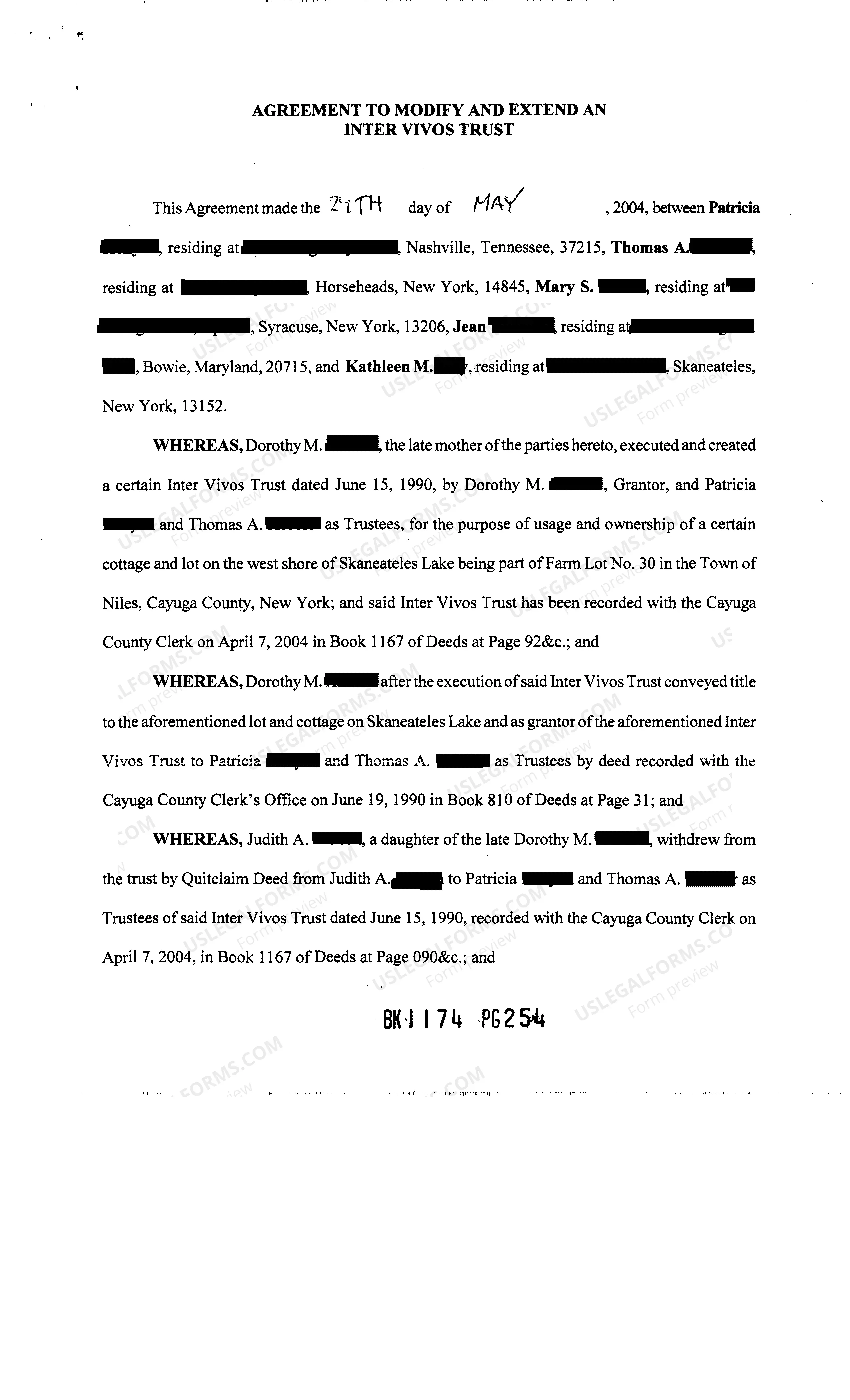

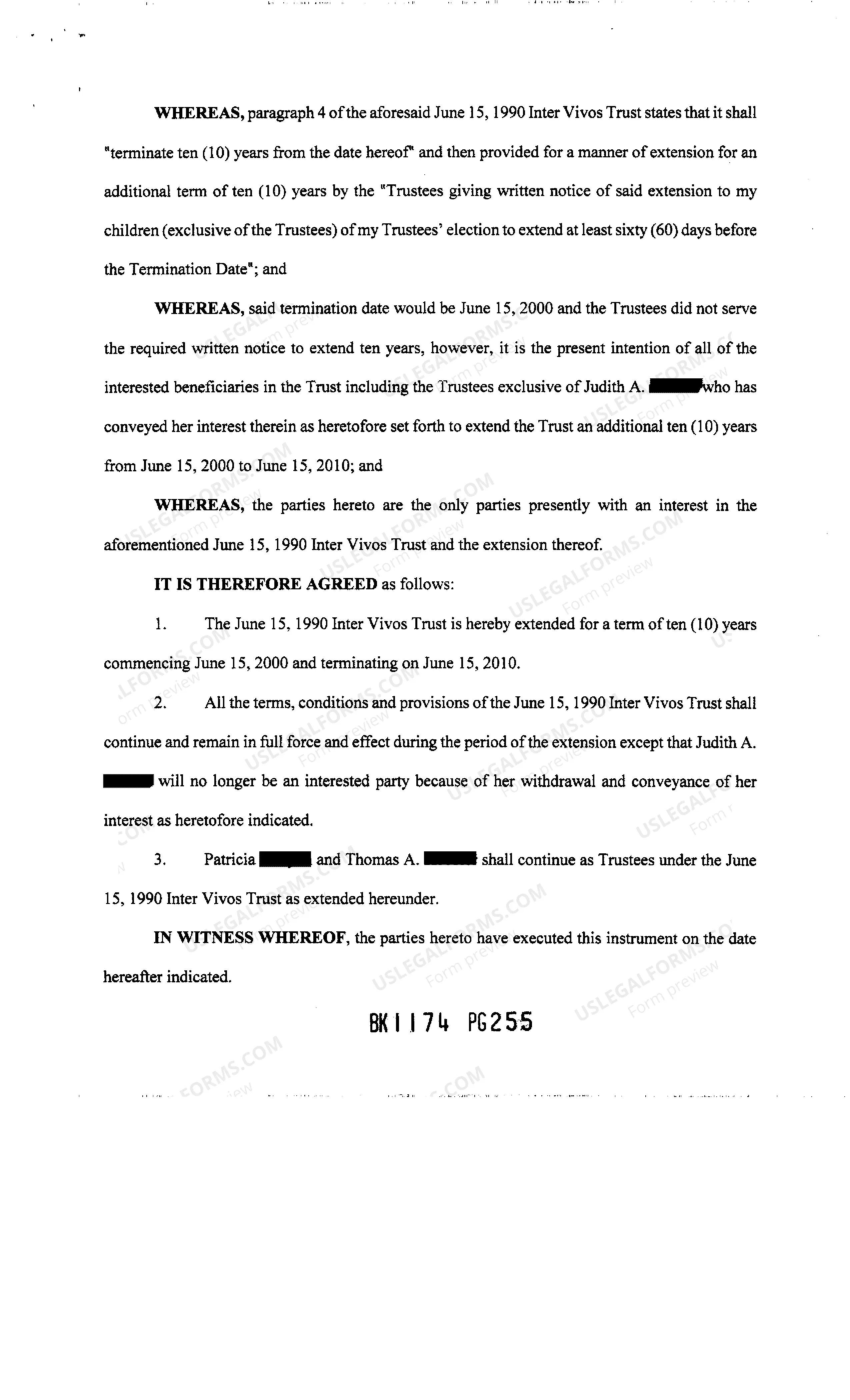

The Nassau New York Inter Vivos Trust Agreement is a legally binding document that allows individuals (known as granters or trustees) to transfer their assets into a trust during their lifetime. This agreement specifically applies to residents of Nassau County, New York, and it adheres to the laws and regulations specific to the state. The purpose of an Inter Vivos Trust Agreement is to protect and manage assets for the benefit of designated beneficiaries while the trust or is alive. It enables individuals to have control over their assets, choose how they are distributed, and minimize estate taxes and probate costs. There are several types of Nassau New York Inter Vivos Trust Agreements available, each tailored to meet specific needs and circumstances: 1. Revocable Living Trust Agreement: This is the most common type of Inter Vivos Trust Agreement, allowing the trust or to maintain control and make changes to the trust during their lifetime. Assets transferred into this trust avoid probate upon the trust or's death, ensuring a smoother and private transfer of assets to the beneficiaries. 2. Irrevocable Living Trust Agreement: With this type of trust, the trust or relinquishes control over the assets transferred. Once established, the trust terms cannot be modified, ensuring that assets are protected and not subject to estate taxes upon the trust or's death. This type of trust is often used for Medicaid planning or to minimize taxes. 3. Granter Retained Annuity Trust Agreement (GREAT): This trust allows the trust or to transfer assets while retaining an annuity payment for a specified period. At the end of the term, the assets pass on to the beneficiaries without incurring gift or estate taxes. Grants are commonly utilized for estate tax planning and asset protection. 4. Qualified Personnel Residence Trust Agreement (PRT): This type of trust specifically aims to transfer ownership of a primary residence or vacation home to the beneficiaries while allowing the trust or to continue living on the property for a predetermined period. This trust provides estate tax savings and asset protection benefits. Each type of Nassau New York Inter Vivos Trust Agreement has its own advantages and considerations, making it crucial for individuals to consult with a qualified attorney or estate planner to determine the most suitable type of trust for their unique circumstances.

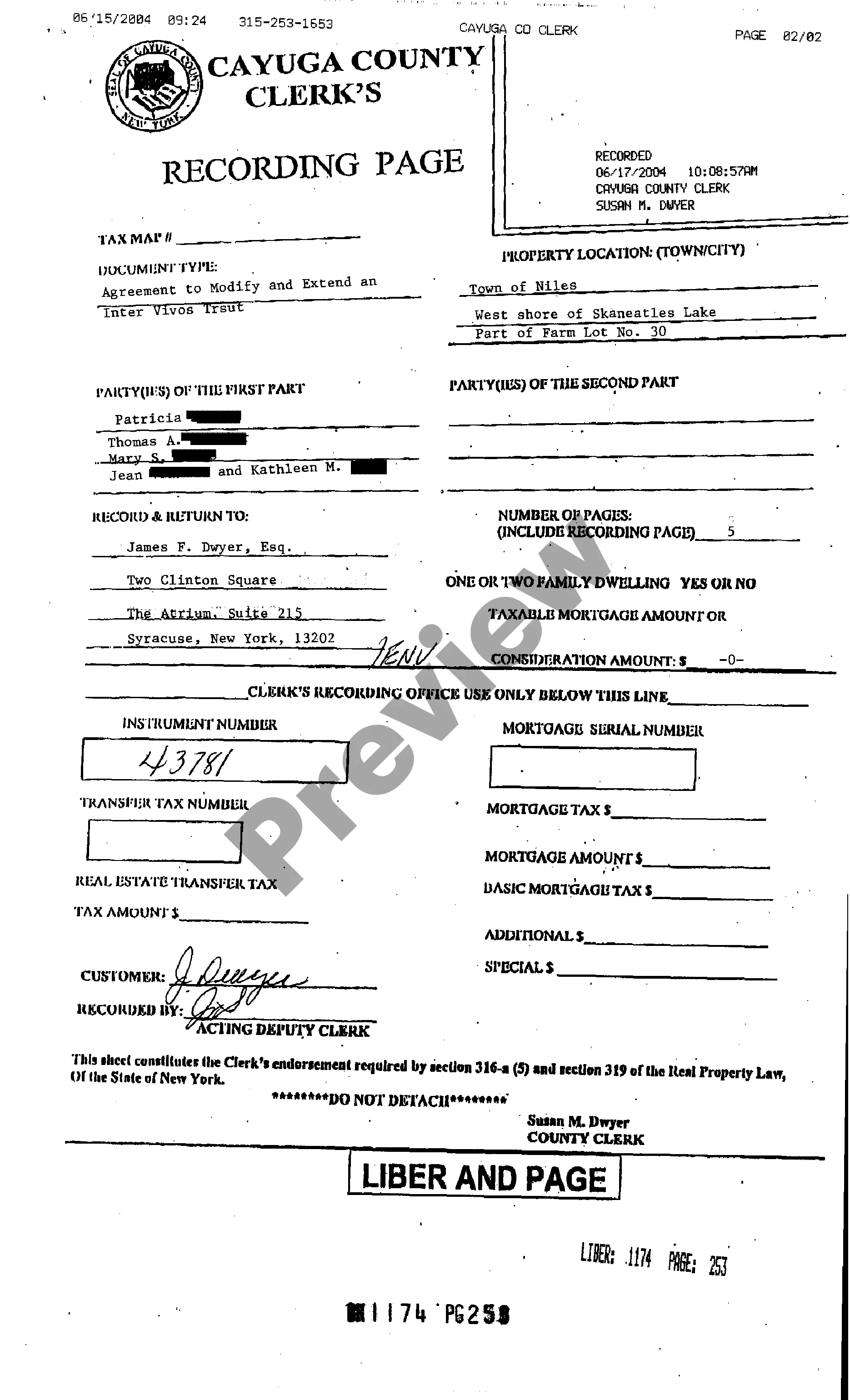

Nassau New York Inter Vivos Trust Agreement

State:

New York

County:

Nassau

Control #:

NY-T0106

Format:

PDF

Instant download

This form is available by subscription

Description

Inter Vivos Trust Agreement

The Nassau New York Inter Vivos Trust Agreement is a legally binding document that allows individuals (known as granters or trustees) to transfer their assets into a trust during their lifetime. This agreement specifically applies to residents of Nassau County, New York, and it adheres to the laws and regulations specific to the state. The purpose of an Inter Vivos Trust Agreement is to protect and manage assets for the benefit of designated beneficiaries while the trust or is alive. It enables individuals to have control over their assets, choose how they are distributed, and minimize estate taxes and probate costs. There are several types of Nassau New York Inter Vivos Trust Agreements available, each tailored to meet specific needs and circumstances: 1. Revocable Living Trust Agreement: This is the most common type of Inter Vivos Trust Agreement, allowing the trust or to maintain control and make changes to the trust during their lifetime. Assets transferred into this trust avoid probate upon the trust or's death, ensuring a smoother and private transfer of assets to the beneficiaries. 2. Irrevocable Living Trust Agreement: With this type of trust, the trust or relinquishes control over the assets transferred. Once established, the trust terms cannot be modified, ensuring that assets are protected and not subject to estate taxes upon the trust or's death. This type of trust is often used for Medicaid planning or to minimize taxes. 3. Granter Retained Annuity Trust Agreement (GREAT): This trust allows the trust or to transfer assets while retaining an annuity payment for a specified period. At the end of the term, the assets pass on to the beneficiaries without incurring gift or estate taxes. Grants are commonly utilized for estate tax planning and asset protection. 4. Qualified Personnel Residence Trust Agreement (PRT): This type of trust specifically aims to transfer ownership of a primary residence or vacation home to the beneficiaries while allowing the trust or to continue living on the property for a predetermined period. This trust provides estate tax savings and asset protection benefits. Each type of Nassau New York Inter Vivos Trust Agreement has its own advantages and considerations, making it crucial for individuals to consult with a qualified attorney or estate planner to determine the most suitable type of trust for their unique circumstances.

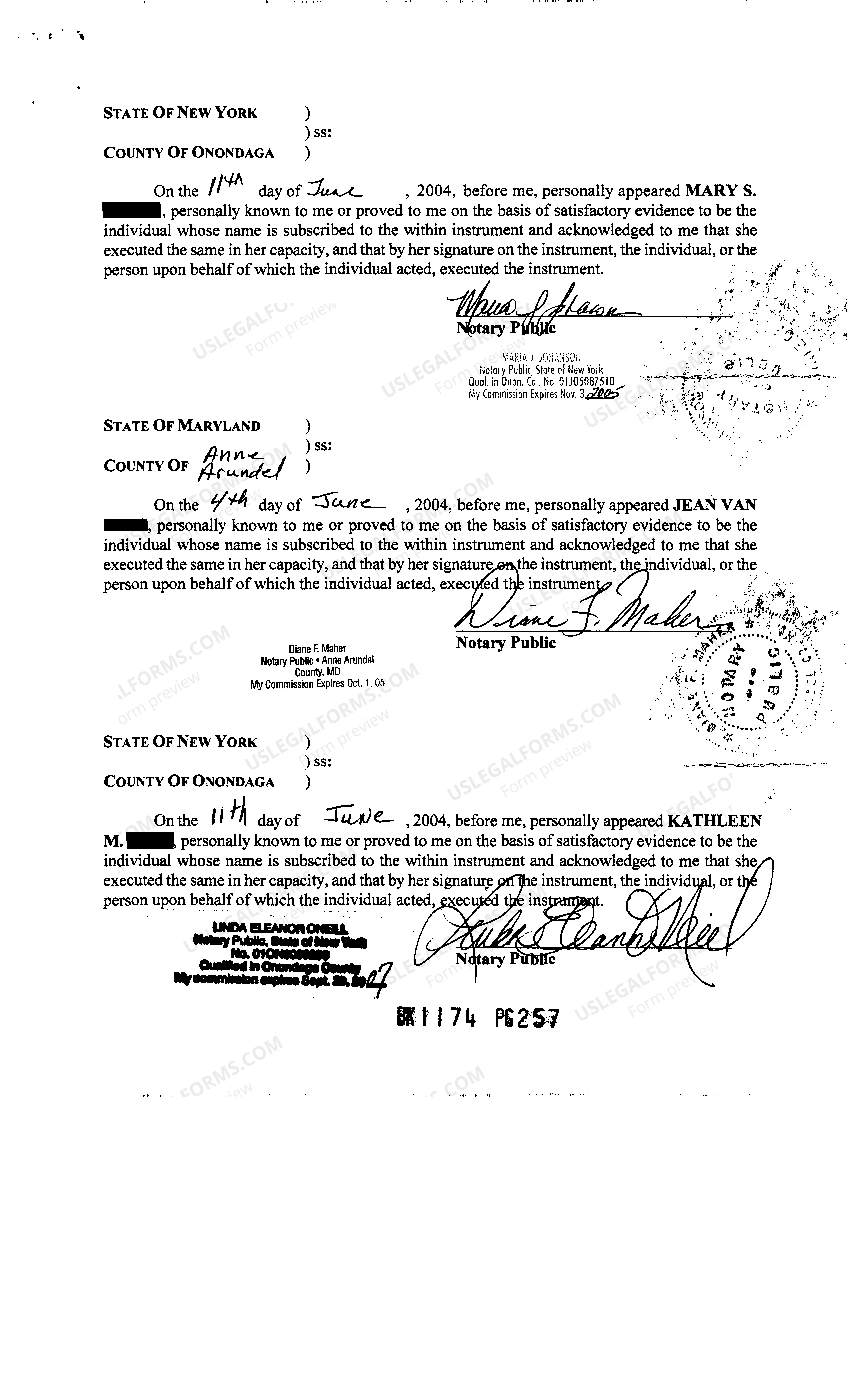

Free preview

How to fill out Nassau New York Inter Vivos Trust Agreement?

If you’ve already used our service before, log in to your account and save the Nassau New York Inter Vivos Trust Agreement on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Nassau New York Inter Vivos Trust Agreement. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!