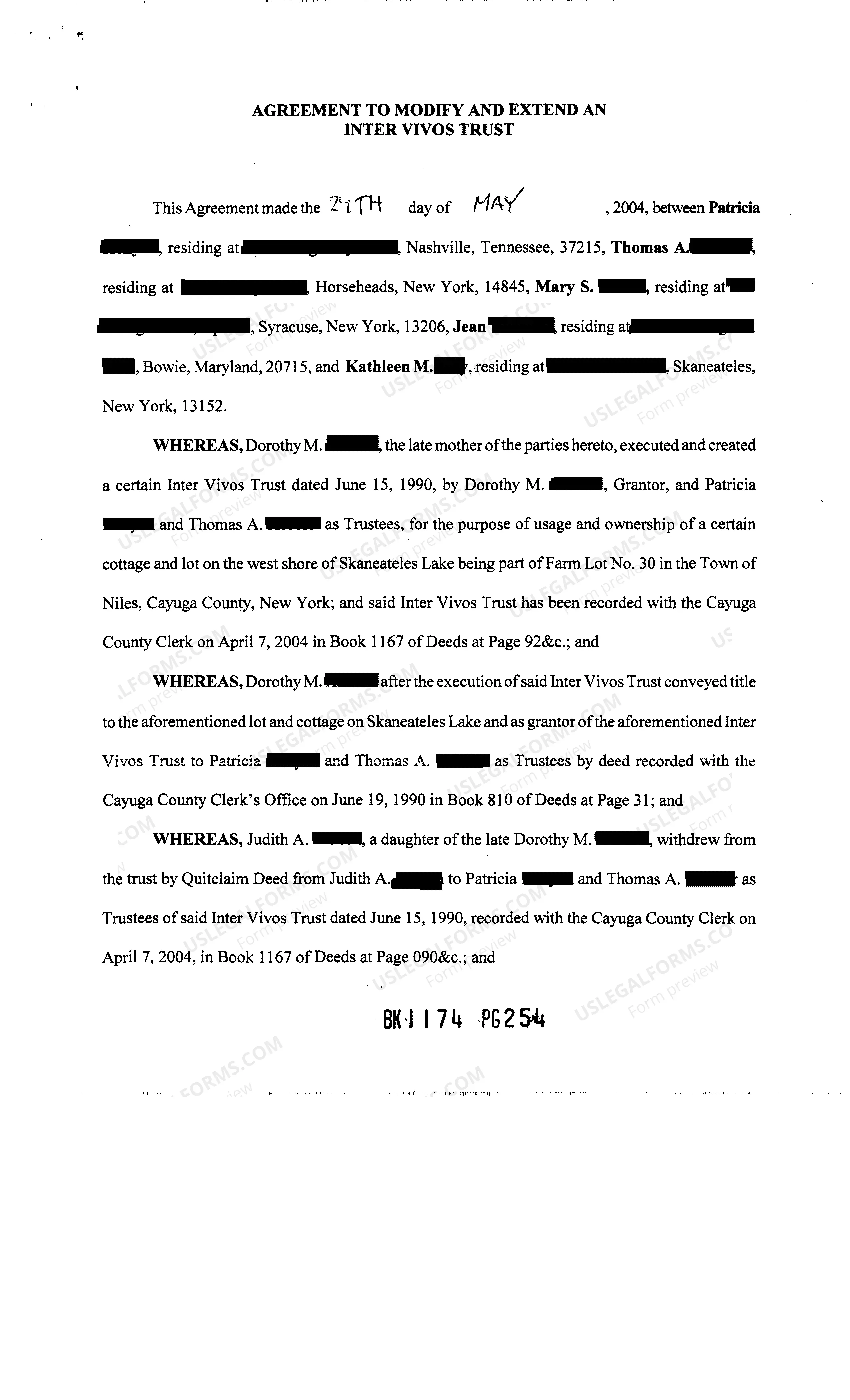

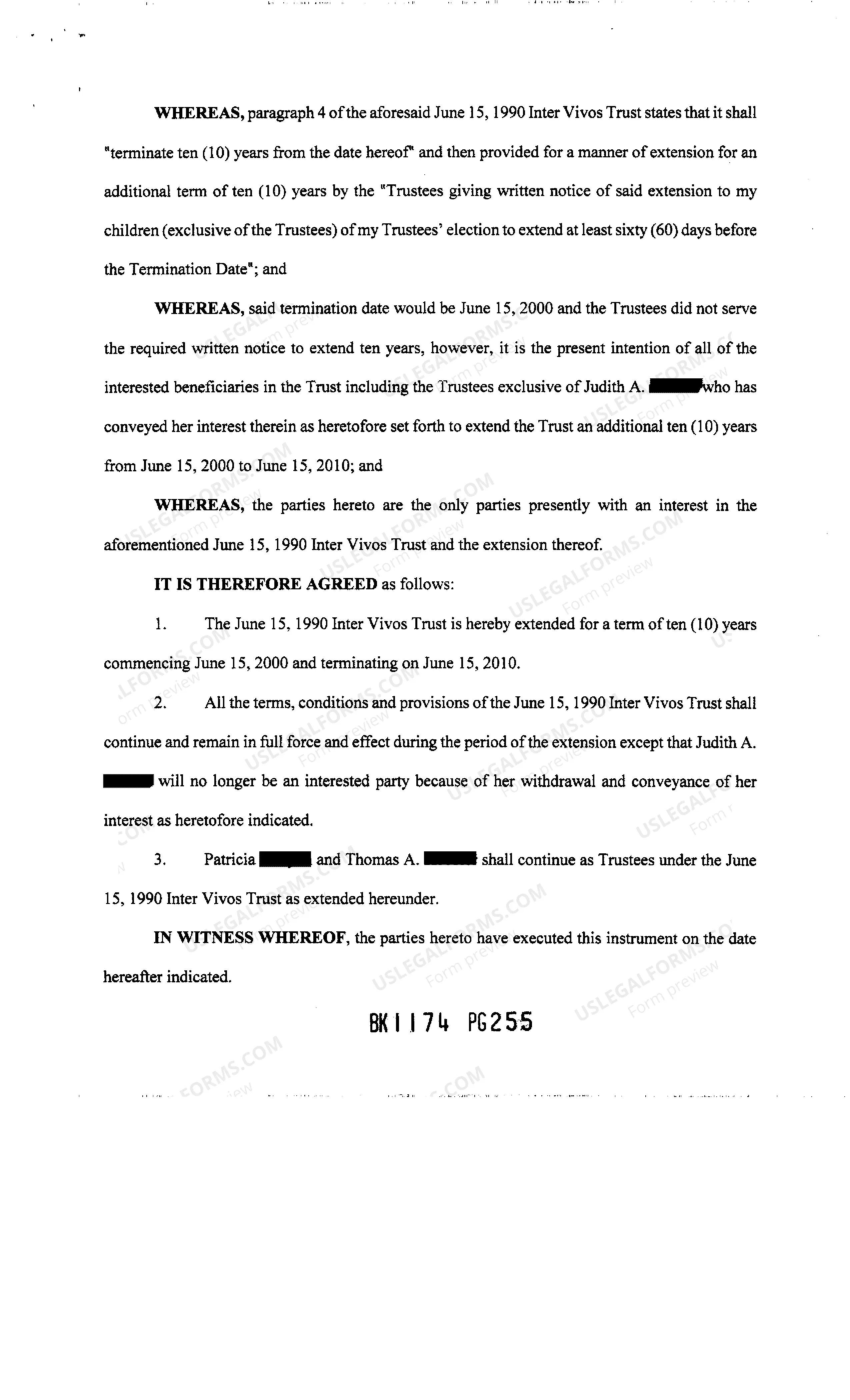

A Suffolk New York Inter Vivos Trust Agreement is a legal document that allows an individual, known as the granter, to transfer ownership of their assets to a trust during their lifetime. This trust agreement is established in Suffolk County, New York, and follows the specific requirements outlined by the state's laws. The purpose of an inter vivos trust agreement is to ensure the smooth transfer of assets to designated beneficiaries while avoiding the potential complications and delays of probate. By creating this trust while still alive, the granter can maintain control over their assets and appoint a trustee who will manage and distribute them according to the granter's wishes. Certain types of Suffolk New York Inter Vivos Trust Agreements include: 1. Revocable Inter Vivos Trust: This is the most common type of inter vivos trust agreement. The granter retains the right to modify, amend, or revoke the trust during their lifetime. Assets placed inside the trust are subject to estate taxes upon the granter's death. 2. Irrevocable Inter Vivos Trust: In this type of trust, the granter gives up the right to modify or revoke the trust once it is established. By doing so, the granter effectively removes those assets from their estate, potentially reducing estate taxes. This type of trust offers more asset protection as well. 3. Charitable Inter Vivos Trust: Created for philanthropic purposes, this trust allows the granter to transfer assets to a charitable organization or foundation of their choice. The charity receives the income generated by the trust during the granter's lifetime, and upon the granter's death, the remaining assets are distributed to the charity as specified in the trust agreement. 4. Special Needs Inter Vivos Trust: This type of trust is designed to support individuals with disabilities or special needs. It allows the granter to provide for the ongoing care and financial needs of a loved one without jeopardizing their eligibility for government benefits. 5. Medicaid Asset Protection Trust: This trust is specifically created to protect assets from being counted when determining Medicaid eligibility for long-term care. By transferring assets into this trust, the granter may still potentially qualify for Medicaid benefits, while ensuring their assets are protected for their beneficiaries. It is important to consult with an experienced attorney specializing in estate planning and trust laws, particularly in Suffolk County, New York, to create a Suffolk New York Inter Vivos Trust Agreement that meets the granter's specific objectives and complies with all legal requirements.

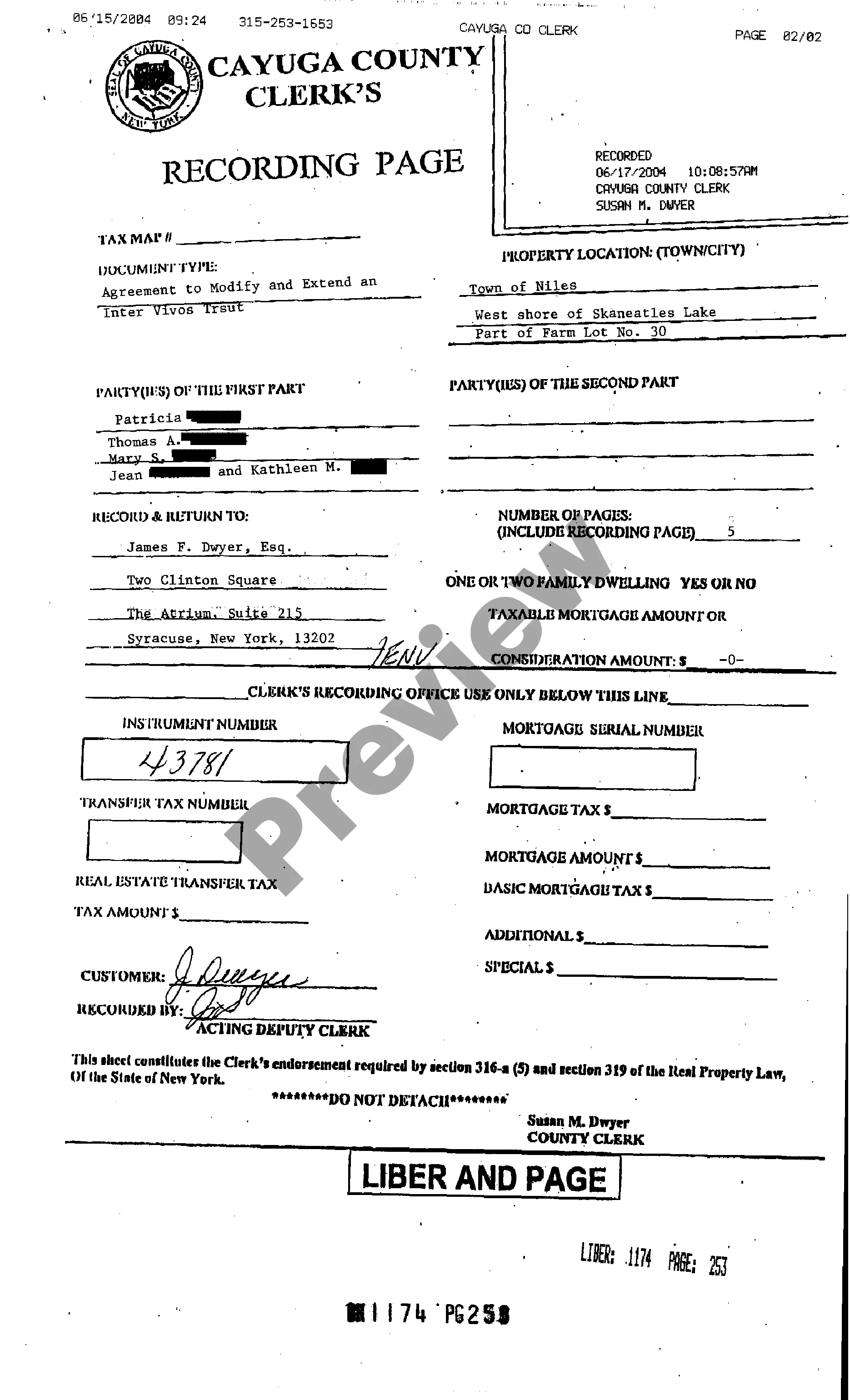

Suffolk New York Inter Vivos Trust Agreement

Description

How to fill out Suffolk New York Inter Vivos Trust Agreement?

Do you need a trustworthy and affordable legal forms provider to buy the Suffolk New York Inter Vivos Trust Agreement? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set rules for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of specific state and county.

To download the document, you need to log in account, locate the required template, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Suffolk New York Inter Vivos Trust Agreement conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the document is good for.

- Restart the search in case the template isn’t good for your specific scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Suffolk New York Inter Vivos Trust Agreement in any available format. You can get back to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time researching legal paperwork online for good.

Form popularity

FAQ

Trusts are created by settlors (an individual along with a lawyer) who decide how to transfer parts or all of the individual's assets to trustees. These trustees hold on to the assets for the beneficiaries of the trust.

What does Inter vivos trust mean? A trust created to take effect in the lifetime of the settlor. An inter vivos trust is to be distinguished from a trust declared by will, known as a testamentary trust.

There are two main types of inter vivos trusts also known as Living Trusts ? revocable and irrevocable. The first type of trust is a Revocable Trust. With this, a donor maintains complete control over the trust and may amend, revoke, or terminate it at any time.

A copy of any trust must be given to all beneficiaries named in the document within 60 days of approval from the probate court.

There is no registry that you can look at. In New York, trusts are not filed with the court even after the death of the person who made it. So it's unlikely that the trust is in a public place where anyone would have access to it. The best place to find a trust document is by a trustee.

In New York, there is no requirement to record a trust. Part of the idea of a trust is to maintain privacy. When you are transferring a property to a trust, you are allowed to not disclose the ownership of the property to the public.

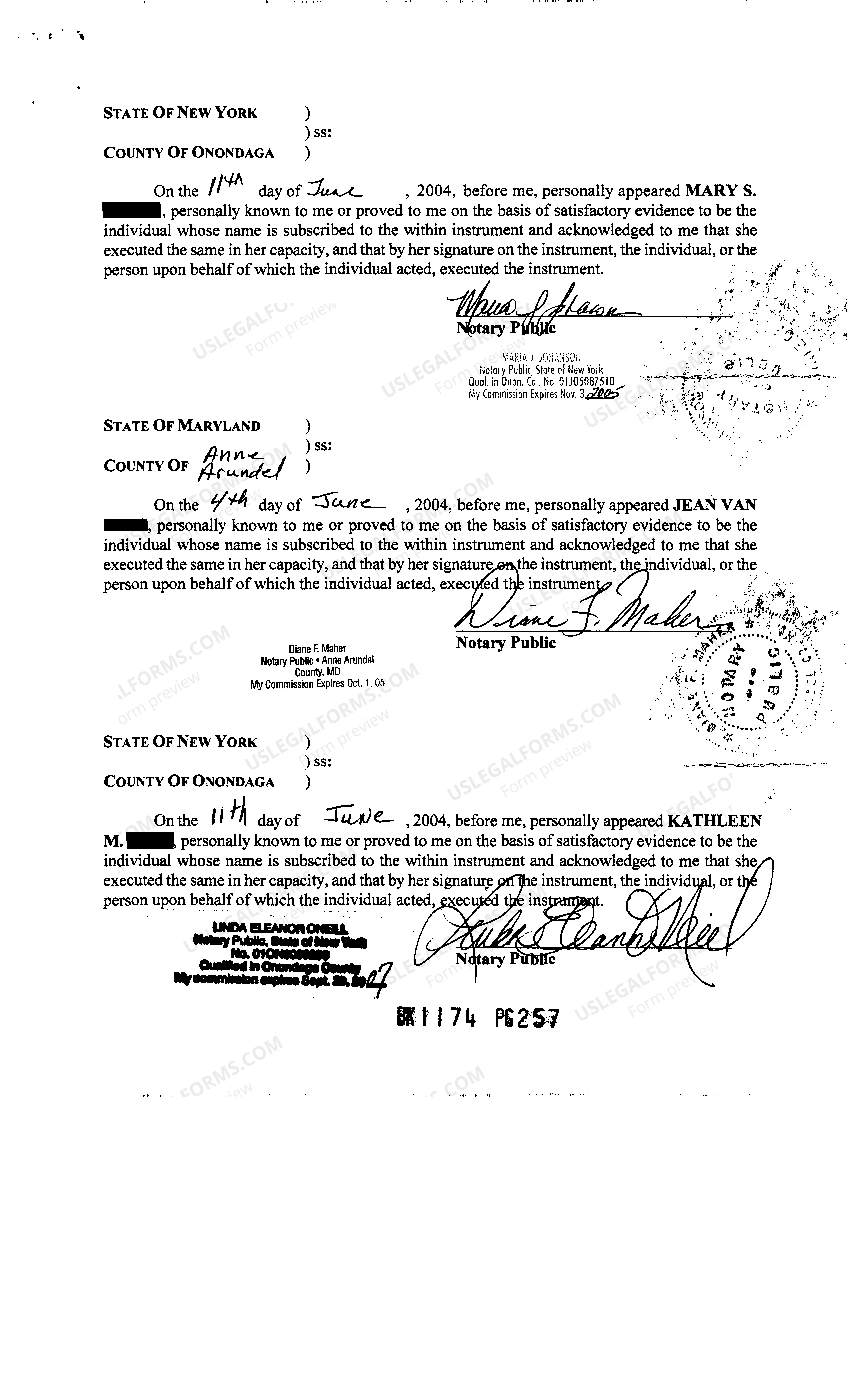

Before giving consent to the transfer of mortgaged property, the mortgagee typically requires that the living trust document be recorded, with the deed, at the office of the county clerk.

No. It is a private document which is not recorded. However, if you own any interest in real estate, the new deeds showing trust ownership will be recorded by the law firm for you.

An ?inter vivos trust? is created during the lifetime of a person by way of an agreement (contract) between the founder and the trustee(s). A ?testamentary trust? is set up in terms of the will of a person and comes into effect after their death.

Interesting Questions

More info

Our fitness and sports coaches use Personalists to individualize each plan to our users. The Personalists we provide for you, however, are not designed to replace a professional coach (who is expensive and can only be used if necessary) or a nutritionist (who is expensive and can only be used if necessary×. Personalists are for each plan to be used for its own unique needs. Your Personalist's purpose Your Personalist's purpose is to meet your needs and meet individual needs. We have found that many Personalists have had very little training or experience and can only help you to make the most positive change. By using a Personalist, you will not be stuck in “one size fits all” thinking. Using the information that we send to you when you receive a Personalist, you will make your own plan to meet your needs. Learn More About Personalists A Personalist is not a substitute for proper education, advice or medical care. A Professional is needed to assist you in reaching your goals.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.