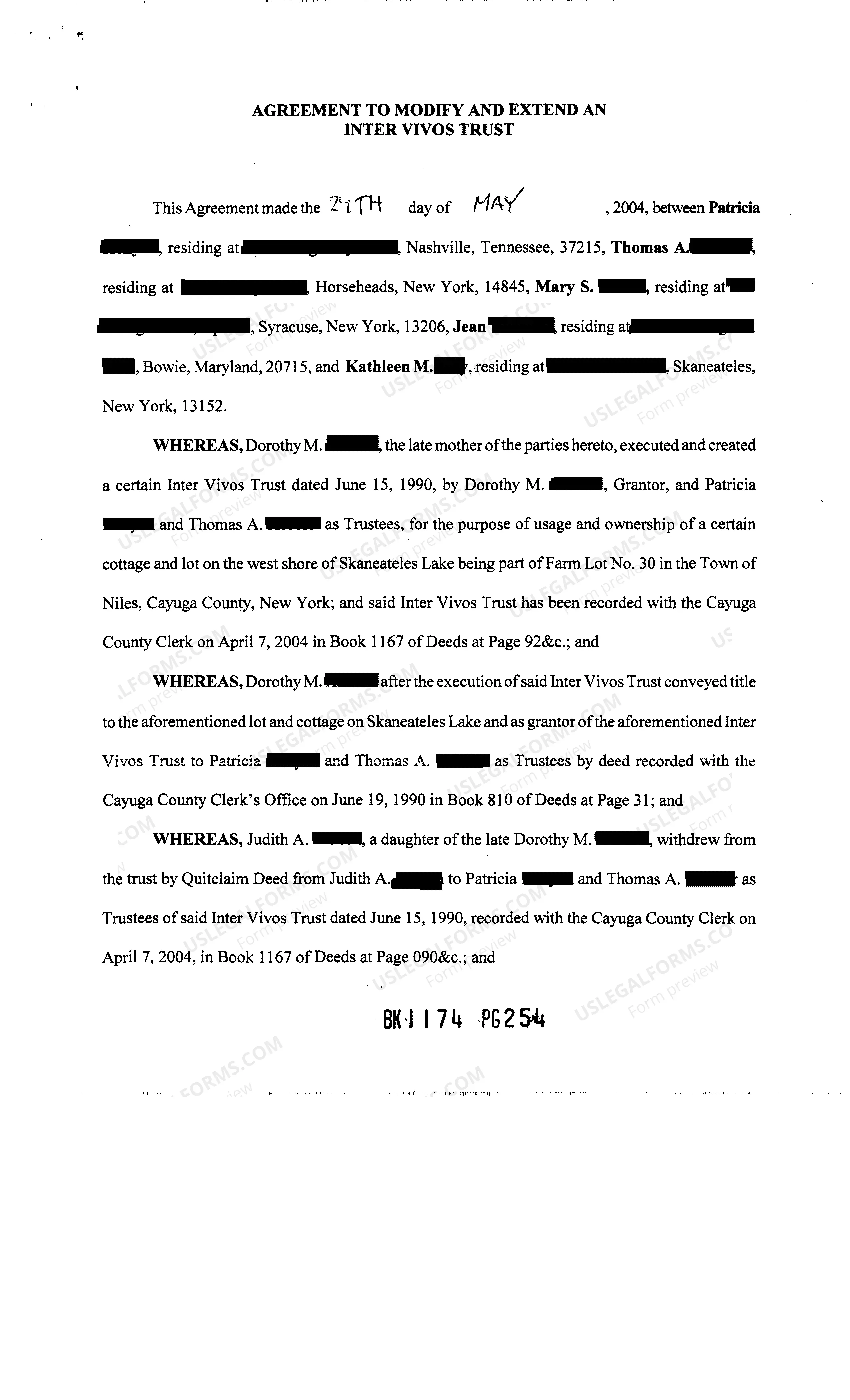

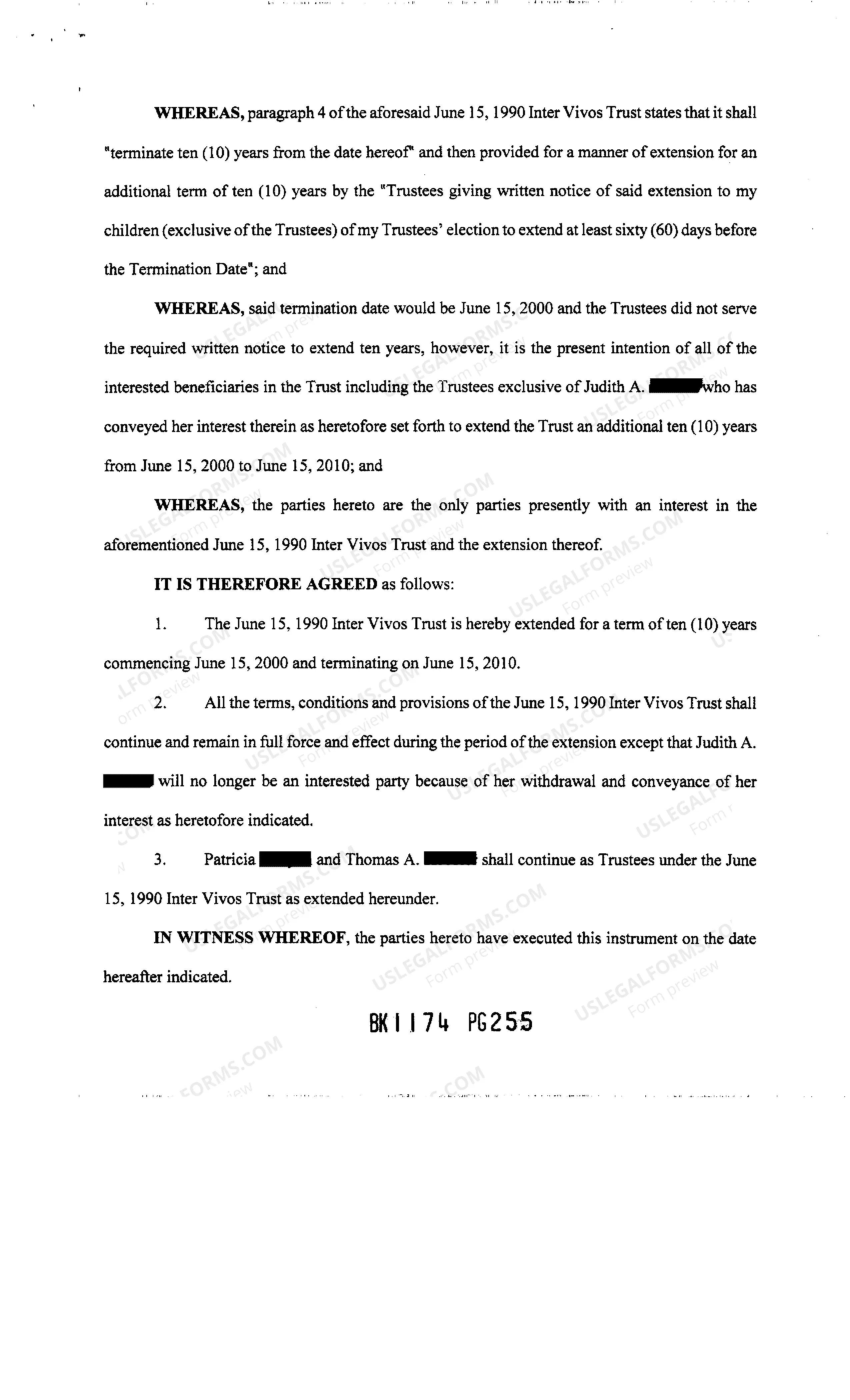

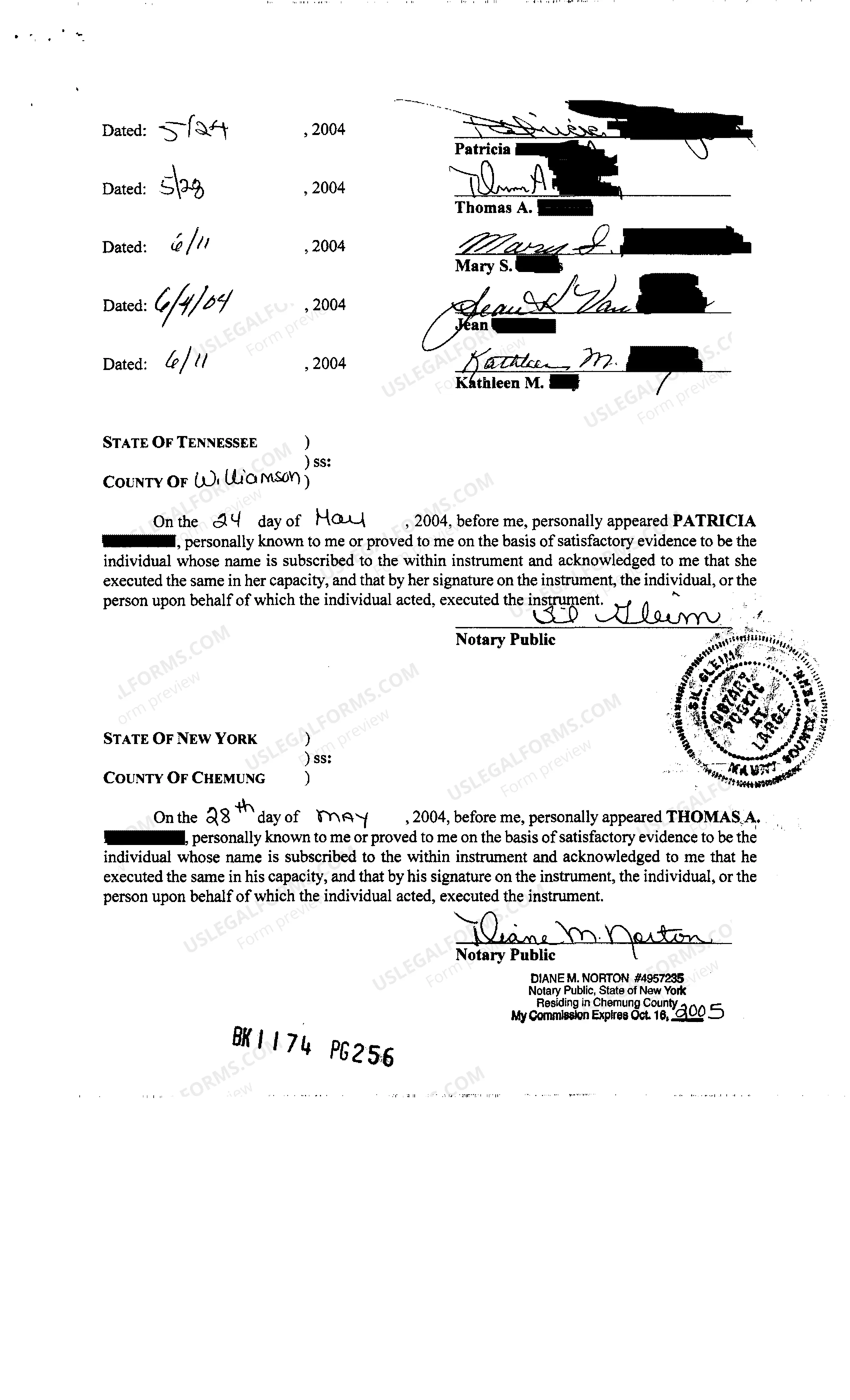

A Syracuse New York Inter Vivos Trust Agreement is a legally binding document that establishes a trust during the settler's (the person creating the trust) lifetime. This type of trust allows assets to be transferred to a trustee for the benefit of one or more beneficiaries. Syracuse New York refers to the jurisdiction where the trust is established. Inter Vivos means "between the living," indicating that this trust is effective during the settler's lifetime. There are different types of Syracuse New York Inter Vivos Trust Agreements, each tailored to meet specific objectives. Let's explore some common types: 1. Revocable Inter Vivos Trust: Also known as a living trust, this agreement can be modified, revoked, or amended by the settler at any time during their lifetime. The assets placed in this trust remain fully accessible to the settler, and it provides flexibility in managing and distributing the assets while avoiding probate. 2. Irrevocable Inter Vivos Trust: Unlike the revocable trust, this type cannot be changed, modified, or revoked once established, except under exceptional circumstances. The assets in this trust are considered permanently transferred, which can have distinct tax advantages and asset protection benefits. 3. Special Needs Trust: This type of inter vivos trust is designed to provide for the ongoing needs and support of a beneficiary who has significant physical, emotional, or mental disabilities. It safeguards the beneficiary's eligibility for government benefits, such as Medicaid, while supplementing their care and quality of life. 4. Charitable Remainder Trust: This trust allows the settler to donate assets to a charitable organization while receiving income from the trust during their lifetime. After the settler's passing, the remaining assets are then transferred to the designated charity, resulting in potential tax benefits for the settler. 5. Qualified Personnel Residence Trust (PRT): This trust is specifically designed to transfer one's primary residence or vacation home to heirs while minimizing estate taxes. The settler retains the right to live in the property for a predetermined period, after which it passes to the beneficiaries. By establishing a Syracuse New York Inter Vivos Trust Agreement, individuals can ensure the efficient management and distribution of their assets while optimizing tax advantages and protecting beneficiaries' interests. Consulting with an experienced estate planning attorney is crucial when considering the establishment of any trust type to ensure it aligns with your specific goals and circumstances.

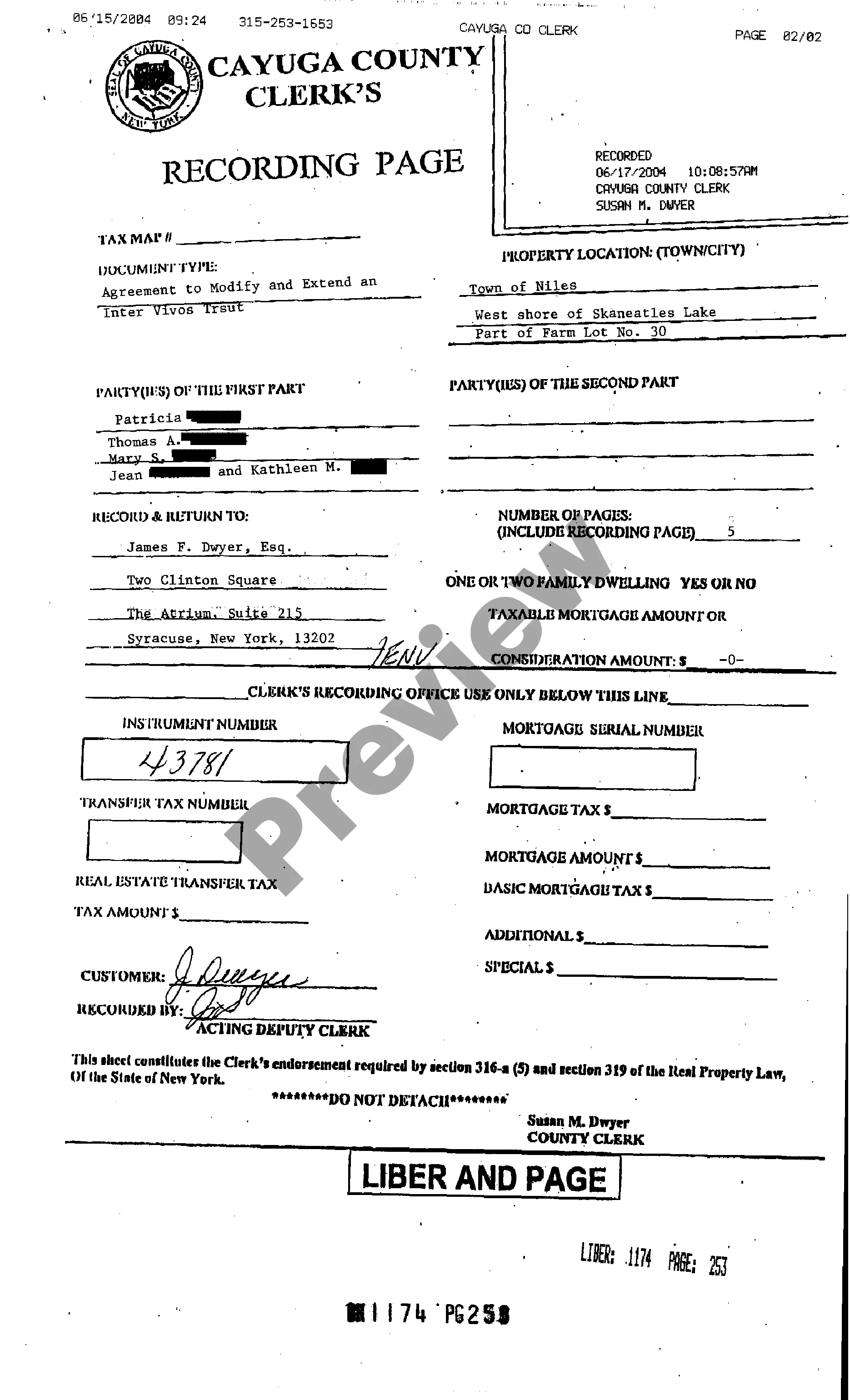

Syracuse New York Inter Vivos Trust Agreement

Description

How to fill out Syracuse New York Inter Vivos Trust Agreement?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone with no legal background to create this sort of paperwork cfrom the ground up, mostly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms can save the day. Our service provides a massive catalog with more than 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you need the Syracuse New York Inter Vivos Trust Agreement or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Syracuse New York Inter Vivos Trust Agreement quickly using our reliable service. If you are already a subscriber, you can go ahead and log in to your account to get the needed form.

However, in case you are a novice to our library, ensure that you follow these steps prior to obtaining the Syracuse New York Inter Vivos Trust Agreement:

- Ensure the form you have found is suitable for your area since the rules of one state or county do not work for another state or county.

- Preview the document and read a brief outline (if available) of scenarios the paper can be used for.

- In case the one you selected doesn’t meet your requirements, you can start over and search for the suitable form.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account login information or register for one from scratch.

- Select the payment method and proceed to download the Syracuse New York Inter Vivos Trust Agreement as soon as the payment is done.

You’re good to go! Now you can go ahead and print the document or fill it out online. In case you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.