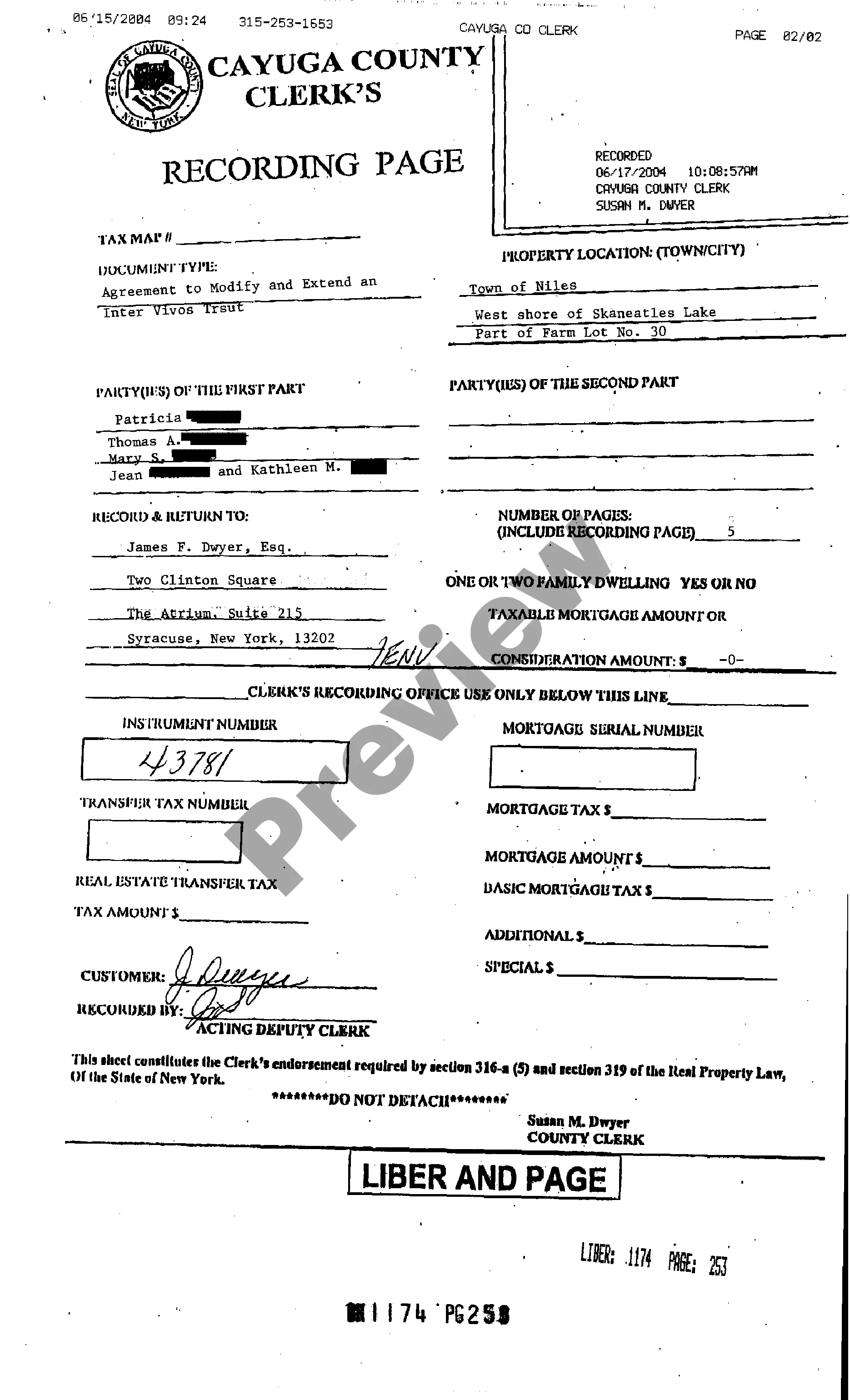

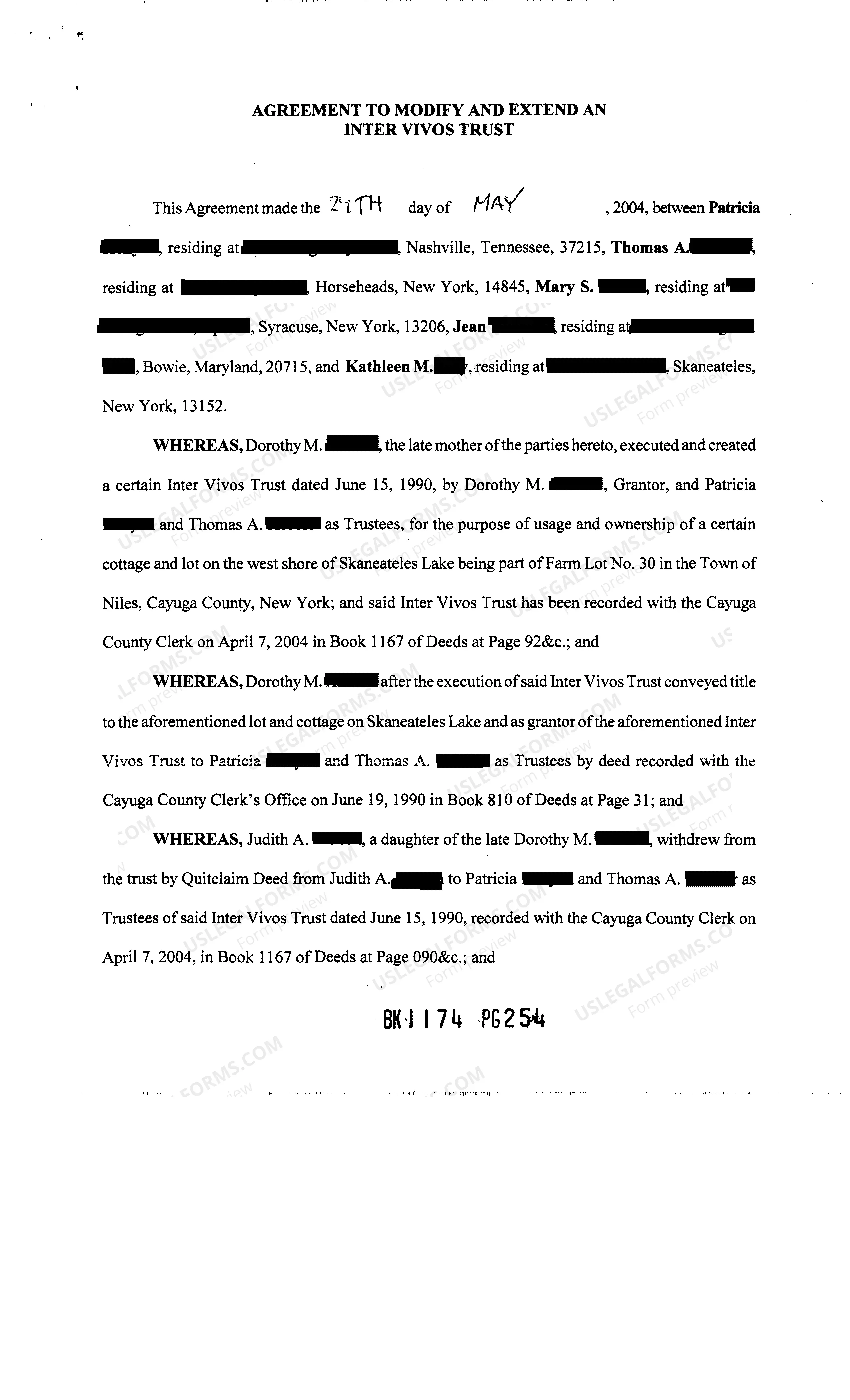

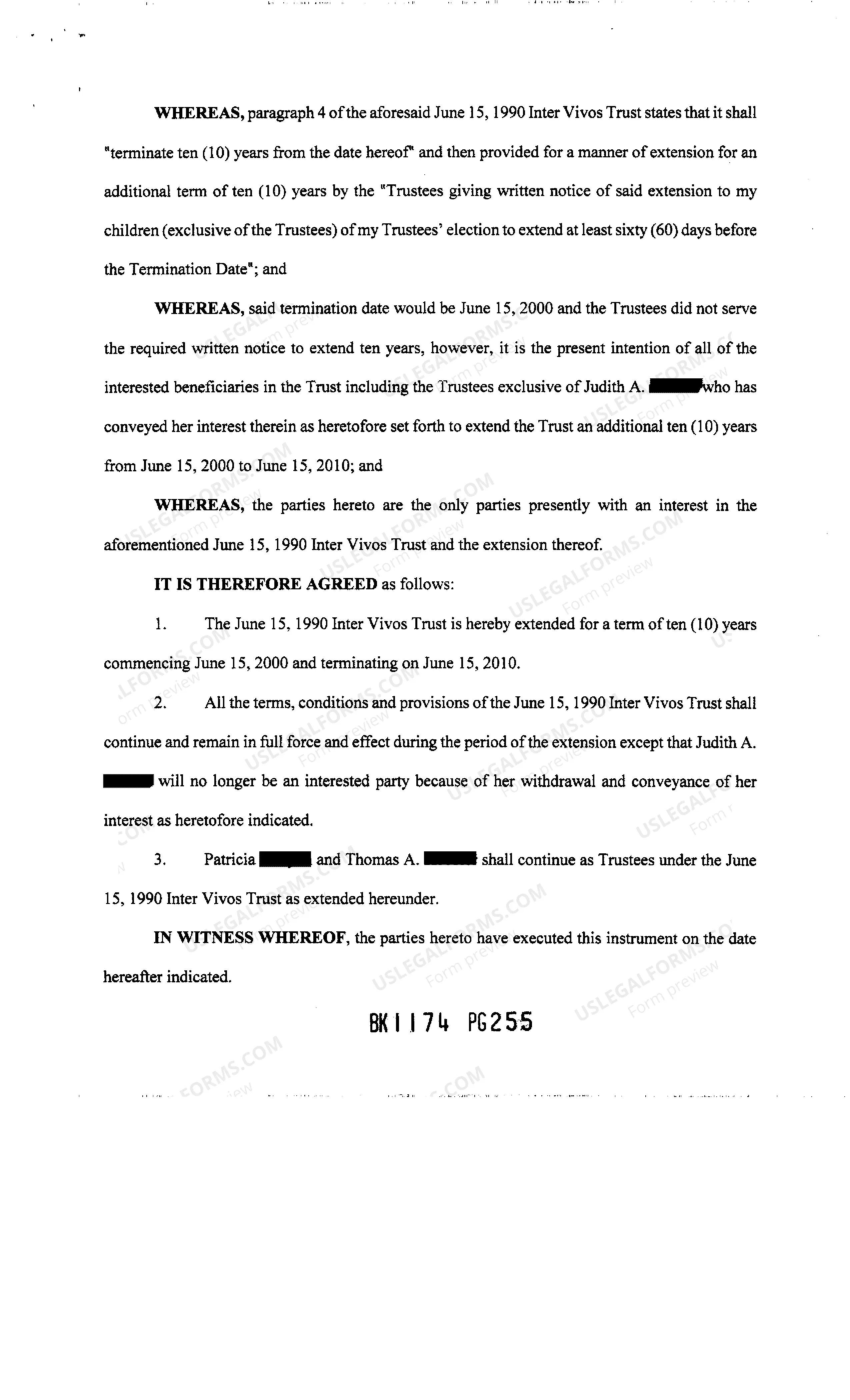

The Yonkers New York Inter Vivos Trust Agreement is a legally binding document that allows individuals in Yonkers, New York, to transfer their assets into a trust while maintaining control over them during their lifetime. This type of trust is created during the granter's lifetime and is commonly used for estate planning purposes. The Yonkers New York Inter Vivos Trust Agreement offers several benefits for individuals who wish to protect their assets and ensure their distribution according to their wishes. By transferring assets into the trust, the granter can avoid probate, which can be a lengthy and expensive process. Additionally, the trust provides a high level of privacy as it does not become public record, unlike a will. There are various types of Yonkers New York Inter Vivos Trust Agreements available based on the specific needs and preferences of the granter. Some different types include: 1. Revocable Inter Vivos Trust: This allows the granter to retain control over the trust assets and make changes or revoke the trust entirely. 2. Irrevocable Inter Vivos Trust: Once assets are transferred into this trust, the granter relinquishes control and cannot make changes or revoke the trust without the consent of the beneficiaries. 3. Asset Protection Trust: This type of trust is designed to protect the assets from creditors and lawsuits. It shields the assets from potential risks, providing security for the granter and beneficiaries. 4. Special Needs Trust: This trust is specifically created for individuals with disabilities. It ensures that the beneficiary's special needs are met while preserving their eligibility for government assistance programs. 5. Charitable Remainder Trust: This type of trust allows the granter to donate assets to a charitable organization while retaining an income stream from the trust during their lifetime. When creating a Yonkers New York Inter Vivos Trust Agreement, it is essential to consult with an experienced attorney specializing in estate planning to ensure it aligns with one's specific goals and needs. This legal professional will provide guidance on the appropriate trust type and assist in drafting the trust document in compliance with New York state laws.

Yonkers New York Inter Vivos Trust Agreement

Description

How to fill out Yonkers New York Inter Vivos Trust Agreement?

We consistently endeavor to minimize or evade legal complications when addressing intricate legal or financial issues.

To achieve this, we seek legal remedies that are generally very expensive.

Nonetheless, not all legal concerns are equally intricate. A majority can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button adjacent to it. If you happen to misplace the form, you can always download it again from the My documents section. The procedure is just as straightforward if you’re a newcomer to the site! You can create your account in just a few minutes.

- Our library empowers you to manage your affairs without needing a lawyer.

- We offer access to legal document templates that are not always available to the public.

- Our templates are tailored to specific states and regions, significantly streamlining the search process.

- Utilize US Legal Forms whenever you require to locate and download the Yonkers New York Inter Vivos Trust Agreement or any other document swiftly and securely.

Form popularity

FAQ

Yes, a Yonkers New York Inter Vivos Trust Agreement can help you avoid probate in New York. When you create a trust, your assets are transferred to the trust, bypassing the probate process upon your passing. This feature not only expedites the distribution of your assets but also maintains your privacy, as the trust does not go through public probate court. For those seeking a streamlined estate plan, utilizing uslegalforms can simplify the creation of your trust and ensure compliance with New York laws.

The primary purpose of a Yonkers New York Inter Vivos Trust Agreement is to manage and protect your assets during your lifetime and distribute them after your death. This type of trust allows you to maintain control over your assets while providing clear instructions for distribution, thus avoiding probate. Additionally, it can help reduce estate taxes and protect your wealth from potential creditors. Ultimately, it serves to safeguard your family's financial future.

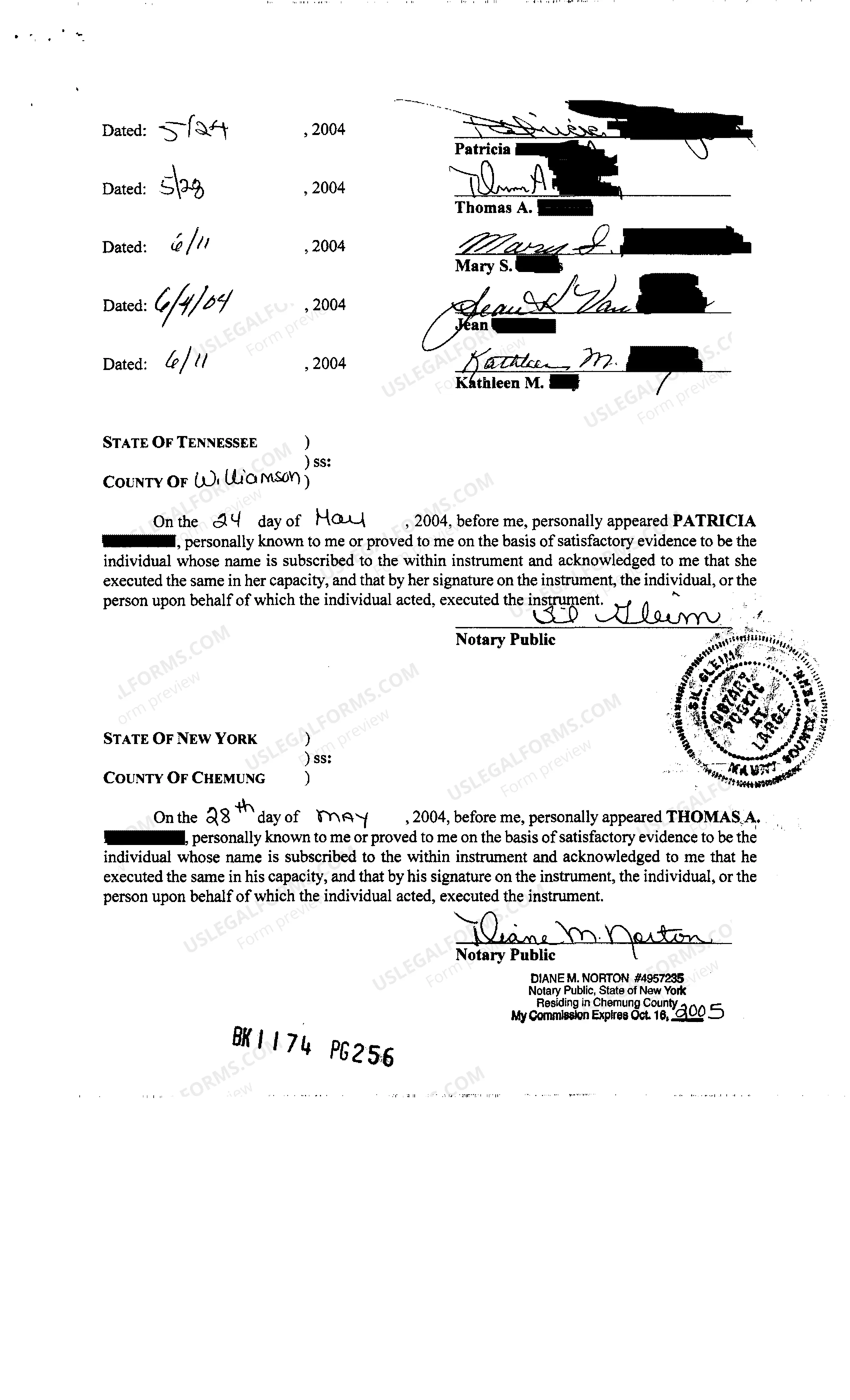

To create a Yonkers New York Inter Vivos Trust Agreement, start by assessing your assets and determining your goals. Next, you can consult with a legal expert who specializes in trust law to guide you through the process. Typically, it involves drafting a trust document that outlines your wishes and appointing a trustee. Using a platform like uslegalforms can simplify the process, providing essential forms and guidance tailored to your needs.

When the settlor of a Yonkers New York Inter Vivos Trust Agreement dies, the trust generally becomes irrevocable. This means that the assets within the trust are distributed according to the terms established by the settlor, without the need for probate. The appointed successor trustee will manage the trust and ensure the distribution occurs as per the settlor's wishes. This process simplifies asset transfer and can significantly benefit your beneficiaries.

Suze Orman emphasizes the importance of a living trust, particularly the Yonkers New York Inter Vivos Trust Agreement, in ensuring your assets are distributed according to your wishes. She advocates for this type of trust to avoid probate and ensure a smoother transition for heirs. According to her, a living trust provides peace of mind and financial security for your loved ones. Her perspective encourages people to consider the long-term benefits of setting up such a trust.

One significant pitfall of setting up a trust is not adequately understanding the legal obligations involved. Families may also face challenges regarding asset funding and management of the trust if not properly organized through a Yonkers New York Inter Vivos Trust Agreement. It's beneficial to work with experienced advisors to navigate these pitfalls and ensure the trust accomplishes its intended goals.

While the focus here is on the Yonkers New York Inter Vivos Trust Agreement, a common mistake in the UK involves underestimating the complexity of tax implications. Parents may also neglect to regularly review and update their trust, leading to outdated provisions. It’s crucial to consult with financial experts to ensure the trust remains relevant and compliant with current laws.

The biggest mistake parents often make is failing to communicate their intentions to their beneficiaries. This can lead to confusion and disputes later on, undermining the goals of the Yonkers New York Inter Vivos Trust Agreement. Clearly discussing the purpose and expectations surrounding the trust can foster understanding and cohesion among family members.

Trust funds can present dangers if not managed correctly, including the potential for family disputes over the assets. Another risk is failing to update the Yonkers New York Inter Vivos Trust Agreement, which can lead to unintended consequences for heirs. It's essential to work with a knowledgeable advisor to navigate these challenges and ensure your trust remains effective and beneficial.

To set up an inter vivos trust, first evaluate your assets and decide which ones you wish to place into the trust. Next, you can create a Yonkers New York Inter Vivos Trust Agreement that outlines how the trust will operate and how assets will be distributed. After drafting the trust document, you should fund the trust by transferring ownership of your chosen assets into it, ensuring the trust functions as intended.