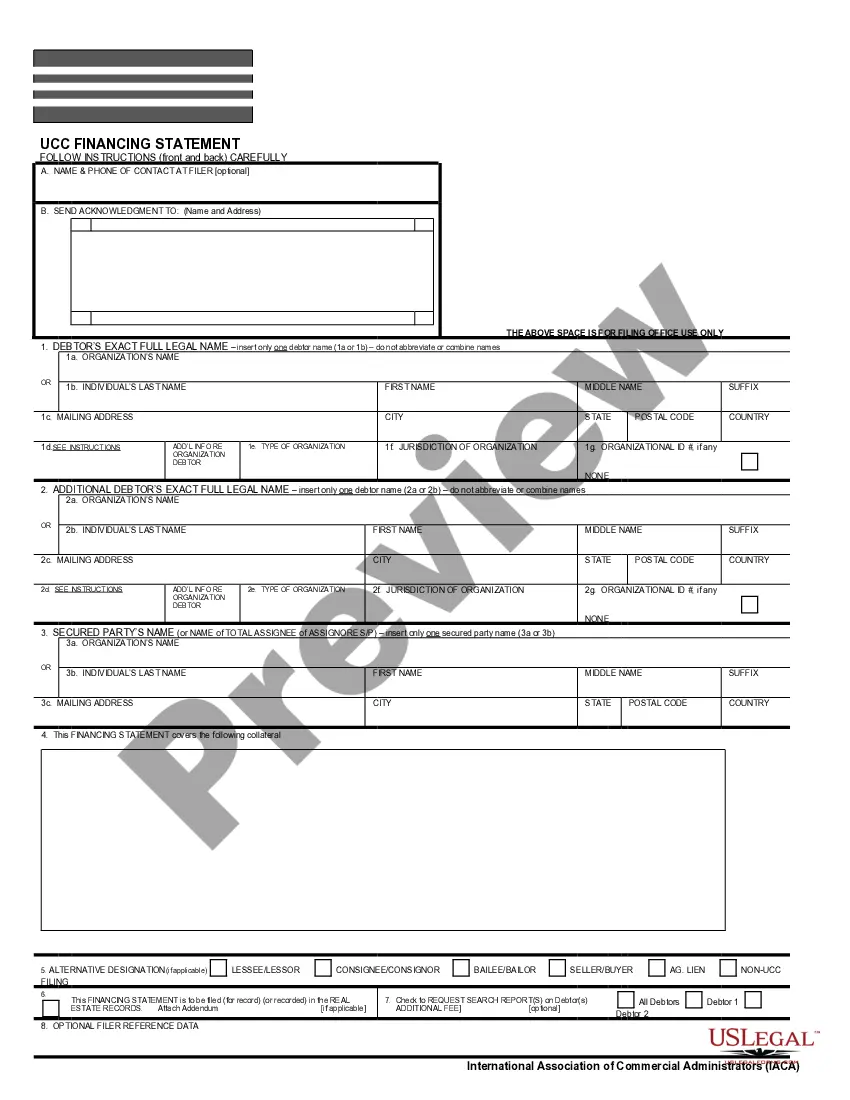

Financing Statement form for use when collateral includes a Cooperative Interest. Filed with the New York filing office.

Rochester New York UCC1 Financing Statement Cooperative Addendum

Description

How to fill out New York UCC1 Financing Statement Cooperative Addendum?

If you are in search of an authentic form template, it’s hard to find a more user-friendly service than the US Legal Forms platform – likely the most comprehensive collections available online.

With this collection, you can discover numerous document examples for both business and personal use by category and region, or via keywords.

Utilizing our advanced search feature, locating the most recent Rochester New York UCC1 Financing Statement Cooperative Addendum is as simple as 1-2-3.

Complete the payment. Utilize your credit card or PayPal account to finalize the registration procedure.

Obtain the form. Choose the file format and save it to your device.

- Additionally, the relevance of each document is verified by a team of qualified attorneys who routinely examine the templates on our site and refresh them according to the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to do to acquire the Rochester New York UCC1 Financing Statement Cooperative Addendum is to Log In to your profile and select the Download option.

- If you are utilizing US Legal Forms for the first time, just adhere to the steps outlined below.

- Ensure you have selected the form you desire. Verify its details and use the Preview option (if accessible) to review its content. If it does not meet your requirements, use the Search option located at the top of the screen to locate the file you need.

- Affirm your choice. Click on the Buy now option. Subsequently, choose the preferred subscription plan and provide credentials to register for an account.

Form popularity

FAQ

A UCC3 termination in New York is a form filed to formally terminate a previously filed UCC1 Financing Statement, such as your Rochester New York UCC1 Financing Statement Cooperative Addendum. This filing indicates that the secured party no longer has a claim to the collateral described in the UCC1. Completing this process is important to keep your records current and to clarify ownership of the assets. You can rely on platforms like US Legal Forms to streamline this procedure.

To cancel your UCC in New York, you need to file a UCC3 termination statement with the appropriate state authority. This action officially removes your UCC1 Financing Statement Cooperative Addendum from the state's records, effectively releasing your secured interest. Doing this promptly is vital to ensure no misunderstandings occur regarding your secured assets. Services like US Legal Forms can guide you through the cancellation process easily.

In New York, UCC filings remain effective for five years from the date of filing, unless they are renewed or terminated. This means that if you file a Rochester New York UCC1 Financing Statement Cooperative Addendum, you must keep track of this timeframe for your business interests. If needed, you can file a continuation statement to extend this period. US Legal Forms can assist you with managing renewals effectively.

Yes, New York follows the Uniform Commercial Code (UCC), which provides a consistent framework for handling commercial transactions. In Rochester, New York, UCC laws govern the filing of documents like the UCC1 Financing Statement Cooperative Addendum. It is important to understand these laws to secure your financial interests effectively. Consulting resources like US Legal Forms can enhance your understanding of these regulations.

UCC filings in Rochester, New York, must be submitted to the New York Department of State, Division of Corporations. This state-specific filing process is crucial for ensuring the legal validity of the Rochester New York UCC1 Financing Statement Cooperative Addendum. Timely submission can help protect your interests in collateral. Utilizing a service like US Legal Forms can simplify the filing process and provide guidance.

1 filing in New York is effective for five years from the date of filing. This time frame ensures that creditors remain informed about the security interests involving the borrower’s property. If the security interest needs to be maintained beyond five years, a continuation statement is necessary to extend the effectiveness, playing a vital role in managing the Rochester New York UCC1 Financing Statement Cooperative Addendum.

To terminate a UCC filing in New York, the secured party must file a UCC-3 termination statement with the appropriate filing office. This document officially cancels the UCC-1 filing and releases the security interest in the specified assets. Doing this can help clear your financial records and is a crucial step in managing your security interests under the Rochester New York UCC1 Financing Statement Cooperative Addendum.

An initial UCC-1 in New York is a document that a lender files to secure an interest in a borrower's personal property. By filing this statement, the lender establishes priority over other creditors regarding the assets listed in the statement. Essentially, it serves as public notice of the security interest, making it an essential part of the Rochester New York UCC1 Financing Statement Cooperative Addendum process.

A UCC statement in Texas is a legal document that secures a creditor’s interest in a debtor’s assets under the Uniform Commercial Code. This statement provides public notice of the secured party's rights and helps avoid disputes over collateral. If you need assistance with a UCC statement in Texas or are looking for a Rochester New York UCC1 Financing Statement Cooperative Addendum, US Legal Forms has the necessary resources and templates to support you.

The TX UCC statement service refers to the process of filing UCC financing statements in Texas. This service allows creditors to establish their rights to collateral when extending credit or loans. Using the US Legal Forms platform, you can access templates and guidance specifically tailored for Texas UCC statements, facilitating a smoother filing experience and enhancing your understanding of the process.