Suffolk New York UCC1 Financing Statement

Description

How to fill out New York UCC1 Financing Statement?

If you’ve previously utilized our service, Log In to your account and store the Suffolk New York UCC1 Financing Statement on your device by selecting the Download button. Ensure that your subscription is active. If it isn’t, renew it based on your payment plan.

If this is your first time using our service, follow these straightforward steps to acquire your document.

You have continual access to every document you have purchased: you can locate it in your profile under the My documents section whenever you need to access it again. Utilize the US Legal Forms service to swiftly find and download any template for your personal or professional requirements!

- Confirm you’ve selected the correct document. Review the description and use the Preview option, if available, to verify if it fulfills your needs. If it doesn’t meet your criteria, utilize the Search tab above to find the suitable one.

- Obtain the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process the payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Suffolk New York UCC1 Financing Statement. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

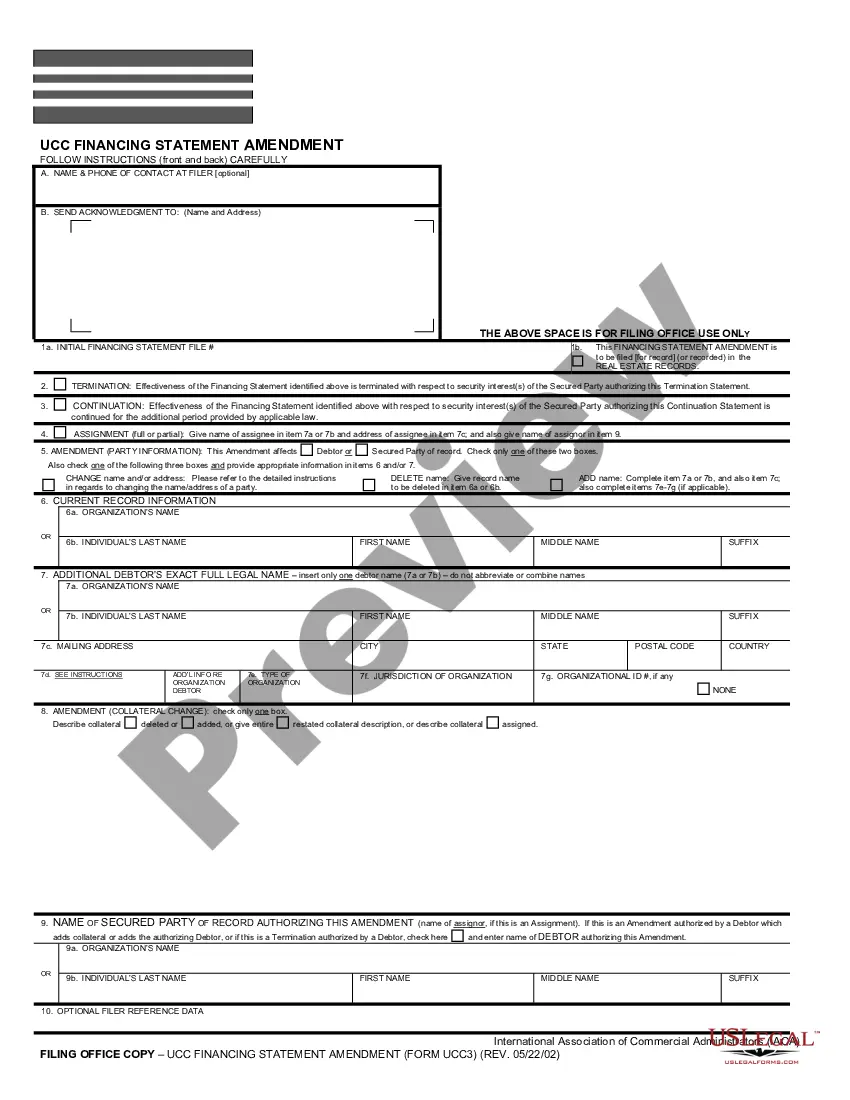

Filling out a UCC-1 financing statement involves several steps. Begin by collecting all required information, such as the debtor's details and a description of the collateral. Accurately complete the form, ensuring that you follow the provided instructions carefully, especially if you're preparing a Suffolk New York UCC1 Financing Statement. Finally, review the form for mistakes before filing it with the appropriate state authority to secure your legal rights.

Filing a UCC-1 on yourself could help secure personal loans or credit by officially documenting your assets. This can strengthen your credibility as a borrower since it indicates that you have collateral backing your obligations. Moreover, a Suffolk New York UCC1 Financing Statement can provide transparency to potential lenders, thereby facilitating easier access to funding. Using platforms like uSlegalforms can simplify the filing process.

You should file your UCC financing statement in the state where the debtor is located. For a Suffolk New York UCC1 Financing Statement, this means filing in New York specifically. It's essential to ensure that you are filing in the correct jurisdiction to protect your interests. If you're unsure, consider using uSlegalforms for guidance on proper filing locations.

To fill out a Suffolk New York UCC1 Financing Statement, start by gathering relevant information such as the debtor's name, address, and any collateral involved. Next, complete the official UCC-1 form by providing this information in the designated fields. Remember to double-check all entries for accuracy before signing and dating the document. Once completed, you can file the UCC-1 with the appropriate state office.

Yes, UCC financing statements are recorded and serve as public notices of secured interests in collateral. Filing a Suffolk New York UCC1 Financing Statement helps protect your rights by notifying other creditors of your claim. This recorded information is essential in establishing priority among creditors and can be accessed through official state resources or platforms like USLegalForms for added convenience.

To file a Suffolk New York UCC1 Financing Statement, you must provide essential details including the debtor's name and address, the secured party's name and address, and a description of the collateral. Incorrect or missing information can lead to delays or rejection of the filing. Make sure to follow the guidelines closely, and utilizing USLegalForms can streamline the process, helping you ensure that your statement meets all necessary requirements.

You can locate your Suffolk New York UCC1 Financing Statement through your local county clerk's office or the New York Secretary of State's website. These resources allow you to search for recorded UCC filings electronically or in person. If you prefer a more convenient option, consider using platforms like USLegalForms, which simplify the process of searching and filing UCC documents online.

UCCs need to be filed in the state where the debtor is located. If the debtor is an individual, this often means their residential address, while for businesses, it means their state of incorporation. Filing in the correct office ensures that your claim is protected. Utilize resources like US Legal Forms to help you navigate the filing process for your Suffolk New York UCC1 Financing Statement successfully.

You file a UCC-1 in the jurisdiction where the debtor is located, which can include the state of residency for individuals or the state of incorporation for businesses. It's crucial to know this, as it determines where your security interest is recognized. Filing in the wrong jurisdiction can lead to complications in enforcement. With US Legal Forms, you can ensure your Suffolk New York UCC1 Financing Statement is filed correctly in the appropriate jurisdiction.

You can file a UCC financing statement at the Secretary of State's office in the debtor's state of residence or incorporation. In some states, local county offices may accept filings as well. Filing accurately is vital to securing your interest in the collateral. Simplify this task with the help of US Legal Forms, where you can find everything needed for your Suffolk New York UCC1 Financing Statement.