The Suffolk New York UCC11 Request for Information is a crucial legal process that allows interested parties to obtain details and records about specific Uniform Commercial Code (UCC) filings within Suffolk County, New York. This request ensures transparency and accessibility to important information regarding secured transactions, liens, and financial dealings involving personal property. The UCC11 Request for Information in Suffolk New York serves as a valuable tool for various individuals and entities such as lenders, borrowers, buyers, and potential investors who wish to explore the validity and lien status of collateral associated with a certain UCC filing. It allows them to conduct due diligence, make informed decisions, and assess potential risks before entering into transactions or business agreements. Keywords: Suffolk New York, UCC11 Request for Information, legal process, Uniform Commercial Code, Suffolk County, transparency, secured transactions, liens, financial dealings, personal property, lenders, borrowers, buyers, potential investors, validity, lien status, collateral, due diligence, informed decisions, potential risks, transactions, business agreements. Different types of Suffolk New York UCC11 Request for Information include: 1. Individual UCC11 Request: This type of request is made by individuals who want to obtain detailed information about a specific UCC filing related to their personal interests or concerns. It could be individuals seeking information about a potential lien on their property or any other personal property-related issues. 2. Corporate UCC11 Request: Corporations and business entities often utilize this type of request to gather information regarding UCC filings associated with their business transactions, contracts, or loan agreements. They may use it to verify liens on collateral or assess the financial standing of potential business partners. 3. Financial Institution UCC11 Request: Financial institutions like banks, credit unions, or lending agencies may file UCC11 requests to access information on relevant UCC filings before approving loans or extending credit. This assists them in evaluating the risk involved in financing against certain collateral and ensuring the interests of the institution are protected. 4. Investor UCC11 Request: Potential investors who want to ensure the security of their investment may utilize this type of request to examine UCC filings pertaining to the assets or property of a business or individual. This helps investors assess the financial health and potential risks associated with the investment opportunity. In summary, the Suffolk New York UCC11 Request for Information is an important legal process that enables individuals, businesses, lenders, and investors to obtain essential information regarding UCC filings in Suffolk County. It ensures transparency and assists in making informed decisions related to personal or business interests, collateral, and financial transactions.

Suffolk New York UCC11 Request for Information

Description

How to fill out Suffolk New York UCC11 Request For Information?

Take advantage of the US Legal Forms and obtain immediate access to any form you require. Our helpful platform with thousands of document templates makes it simple to find and obtain almost any document sample you need. You are able to save, complete, and sign the Suffolk New York UCC11 Request for Information in just a couple of minutes instead of surfing the Net for several hours attempting to find a proper template.

Using our catalog is a wonderful strategy to raise the safety of your document filing. Our professional attorneys on a regular basis review all the records to ensure that the templates are relevant for a particular state and compliant with new laws and polices.

How do you get the Suffolk New York UCC11 Request for Information? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. In addition, you can find all the previously saved records in the My Forms menu.

If you don’t have an account yet, follow the instruction below:

- Find the template you need. Make sure that it is the template you were seeking: verify its name and description, and use the Preview feature if it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order with a credit card or PayPal.

- Export the file. Pick the format to obtain the Suffolk New York UCC11 Request for Information and edit and complete, or sign it for your needs.

US Legal Forms is among the most significant and trustworthy form libraries on the internet. Our company is always happy to help you in virtually any legal procedure, even if it is just downloading the Suffolk New York UCC11 Request for Information.

Feel free to benefit from our platform and make your document experience as straightforward as possible!

Form popularity

FAQ

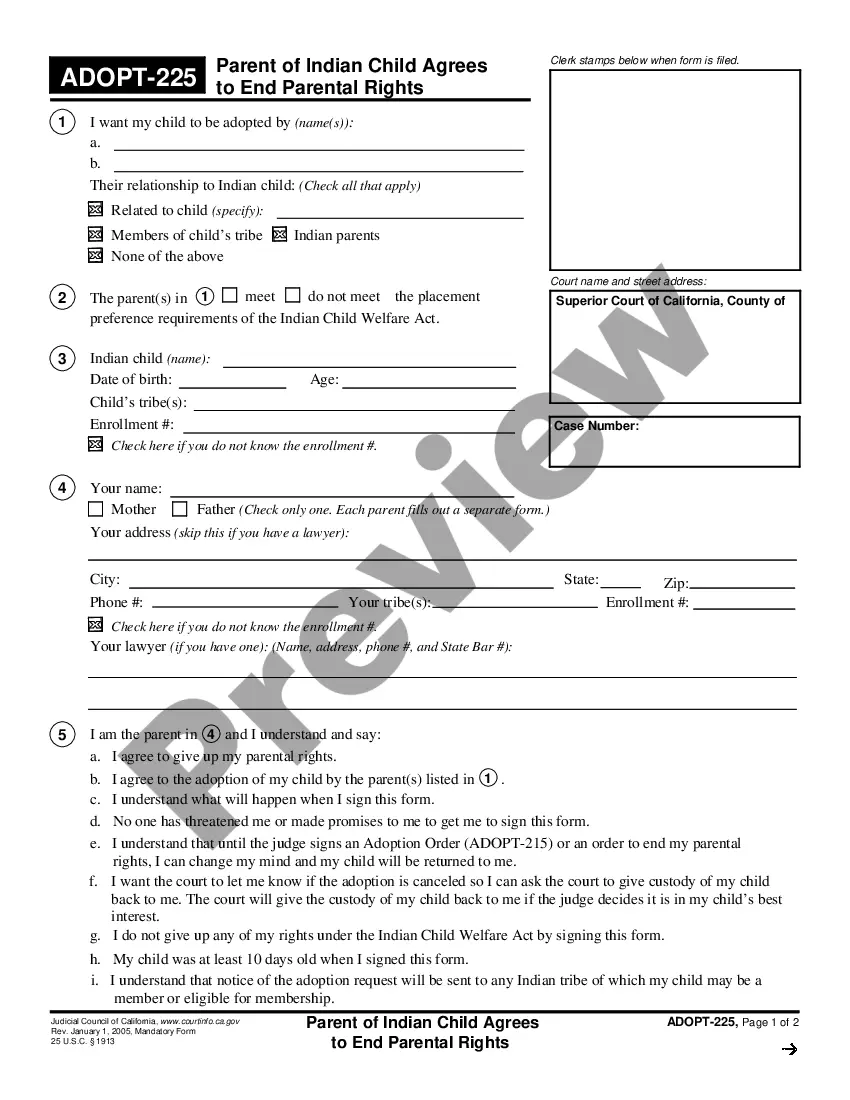

The court noted that the California Commercial Code provides that a person may file a UCC-1 only if the debtor authorizes the filing by (1) authenticating a security agreement; (2) becoming bound as debtor by a security agreement; or (3) acquiring collateral in which a security interest is attached.

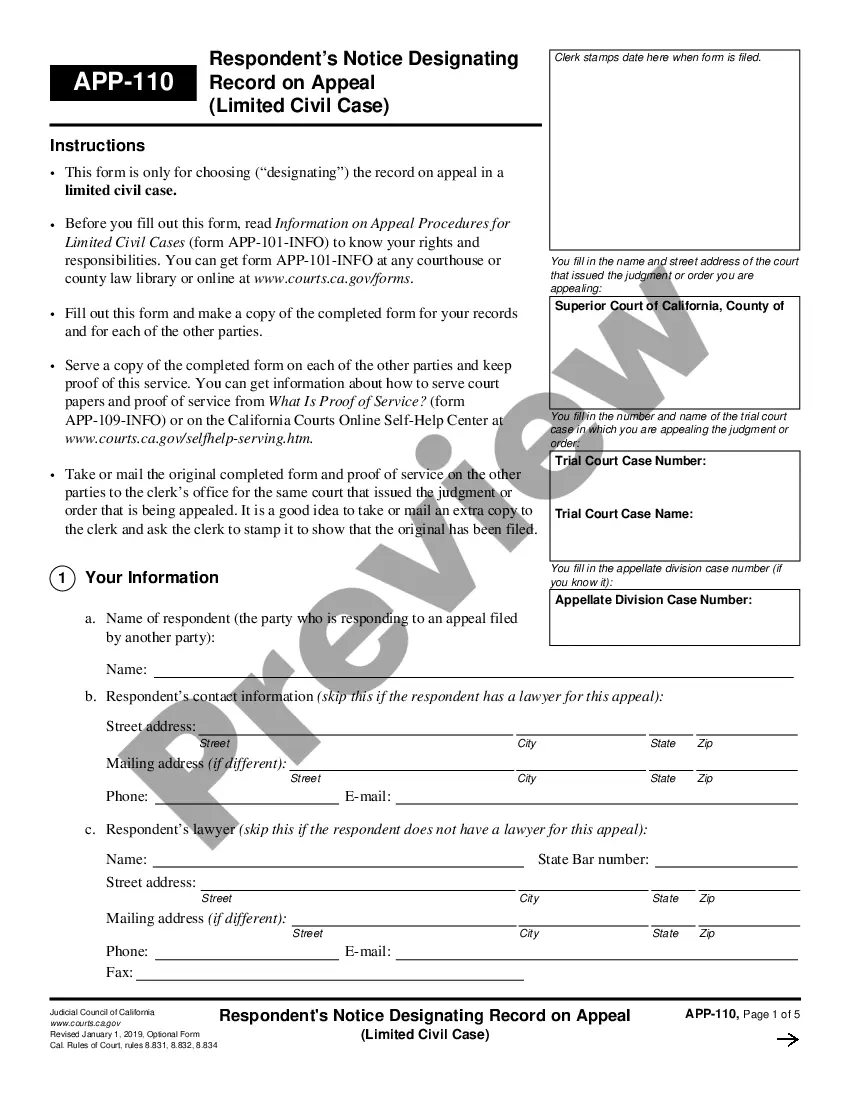

UCC-11 Information Request (California) Form. This is a California form and can be use in Uniform Commercial Code Secretary Of State.

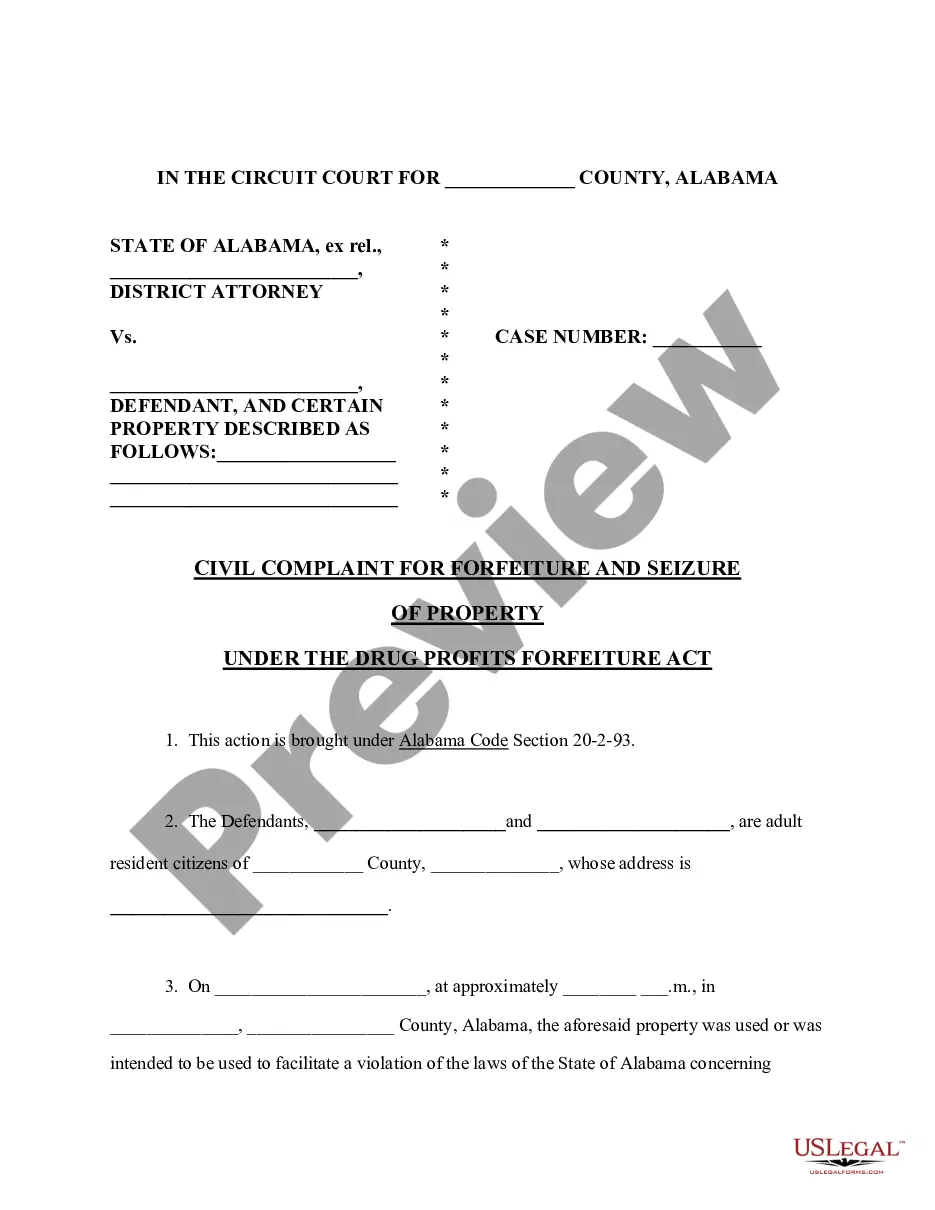

A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

UCC lien filing is a part of everyday business and is common in lending. However, a UCC filing can impact your ability to obtain business funding and assets, so it's important to familiarize yourself with how the process works.

A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

A uniform commercial code (UCC) filing is a notice registered by a lender when a loan is taken out against a single asset or a group of assets. A UCC filing creates a lien against the collateral a borrower pledges for a business loan. The uniform commercial code is a set of rules governing commercial transactions.

The UCC's general rule is that a financing statement remains valid for a period of five years from the date of filing. Unless a continuation statement is properly filed before expiration of the five year period, the effectiveness of the financing statement will lapse.

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

A Uniform Commercial Code filing?or UCC filing?is a form of notice that lenders use when securing a borrower's loan with an asset or group of assets. This enables lenders to seize the listed property as a way of recouping loan funds in the case of borrower default.