Kings New York Annual Income Worksheet is a comprehensive financial document that helps individuals or businesses track and analyze their yearly income. This worksheet provides a detailed breakdown of various income sources and allows for easy calculation of total annual earnings. The Kings New York Annual Income Worksheet comes in different versions to cater to various needs, including personal income worksheet, small business income worksheet, and rental property income worksheet. Each variant is tailored to fit specific financial scenarios and provides detailed sections for relevant income sources. With the Kings New York Annual Income Worksheet, individuals or businesses can accurately and efficiently record their earnings from different sources such as salary, dividends, capital gains, rental income, freelance work, and more. The worksheet offers separate sections for each source, ensuring meticulous tracking of income and preventing any oversight. Moreover, the Kings New York Annual Income Worksheet includes essential financial information such as deductions, expenses, and adjustments, helping users calculate their net income accurately. It also includes sections for recording non-taxable income, ensuring users have a complete financial overview. Using the Kings New York Annual Income Worksheet can provide numerous benefits. Firstly, it simplifies the process of annual income calculation, saving users considerable time and effort. Secondly, it acts as an invaluable tool for financial planning and budgeting, allowing individuals or businesses to identify trends and make informed decisions based on their income data. In conclusion, the Kings New York Annual Income Worksheet is a versatile and detailed financial tool designed for individuals and businesses to track and analyze their annual income comprehensively. Its different types cater to various financial scenarios, ensuring accuracy and efficiency in income calculation. By utilizing this worksheet, users can gain a better understanding of their financial situation and make informed decisions based on their income data.

Kings New York Annual Income Worksheet

Description

How to fill out Kings New York Annual Income Worksheet?

If you’ve already used our service before, log in to your account and download the Kings New York Annual Income Worksheet on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

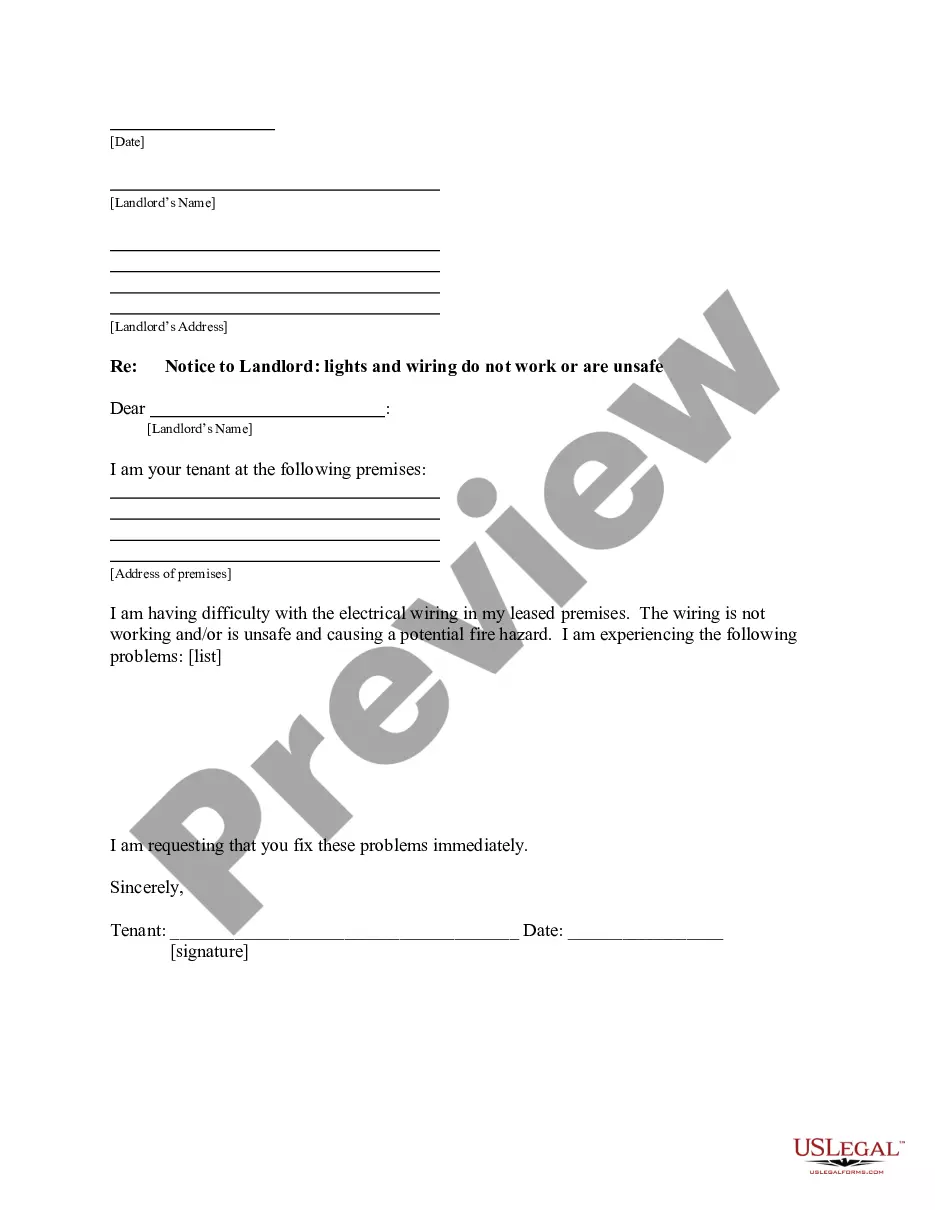

- Make certain you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Kings New York Annual Income Worksheet. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!

Form popularity

FAQ

For marriages from 0 to 15 years, it is 15-30% of the duration of the marriage. If you've got a 10-year marriage, it would be 1.5 to 3 years of maintenance. If you have a 15-20-year marriage, it is 30-40% of the duration of the marriage. And more than 20 years, it is 35-50% of the duration of the marriage.

The 2022 poverty income guidelines amount for a single person as reported by the United States Department of Health and Human Services is $13,590 and the 2022 self-support reserve is $18,347.

Income is the first criteria used to calculate child support payments, with the child support being calculated as a percentage of gross income. This amount is usually taken from the latest tax return filed.

17% for one child. 25% for two children. 29% for three children. 31% for four children.

Spousal support is money paid to one spouse from the other as long as they are married and there is no time limit to how long spousal support is paid. Spousal support cases are started with a spousal support petition in Family Court. There is no filing fee in Family Court.

The range here is 1.5-2%, times the income difference between the spouse's gross income, times the years of cohabitation to a maximum of 50% of that income difference. Finally, multiply these final numbers by the years of cohabitation: 94 12 = $1128.

The three-step formula for calculating NY child support is: Calculate the combined income and each parent's pro-rata share of the same. Use the correct percentage of total income CSSA says should be devoted to child support: 17% for one child. 25% for two children.Calculate each parent's share thereof.

For one child, you take 17% of the parents' combined income, for two children you take 25%, for three children you take 29%, for four children you take 31% and for five children you take no less than 35% of the parents' combined income and this percentage amount represents the basic child support obligation.

17% of the combined parental income for one child. 25% of the combined parental income for two children. 29% of the combined parental income for three children. 31% of the combined parental income for four children, and.

On the basic rate, if you're paying for: one child, you'll pay 12% of your gross weekly income. two children, you'll pay 16% of your gross weekly income. three or more children, you'll pay 19% of your gross weekly income.

Interesting Questions

More info

It's worth noting that your intern will also have to pay the property taxes and utility costs of their own home if you have one. A house that you build should save you from all of these and make you better off, too. How Much Money Does a Private Student Really Make? Paying an Intern How much did I earn? Did the work I did on my internship have any real-life implications in my own life? Do I need to submit the employer to the New York State Labor Department? Does the employer have to have the employee file a worker's compensation claim? Is the employer responsible for the worker's insurance policy? Can I use my tax return to help me get an answer? Why Are Interns so Cheap? I just heard an intern at my company is making 18 an hour. Is this true? Can an intern really make 18 an hour? Can an intern who's working off campus be paid what an outside employee could be paid? Does it matter that we're doing work off-site? Should You Provide Pay? When should I send in my salary?

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.