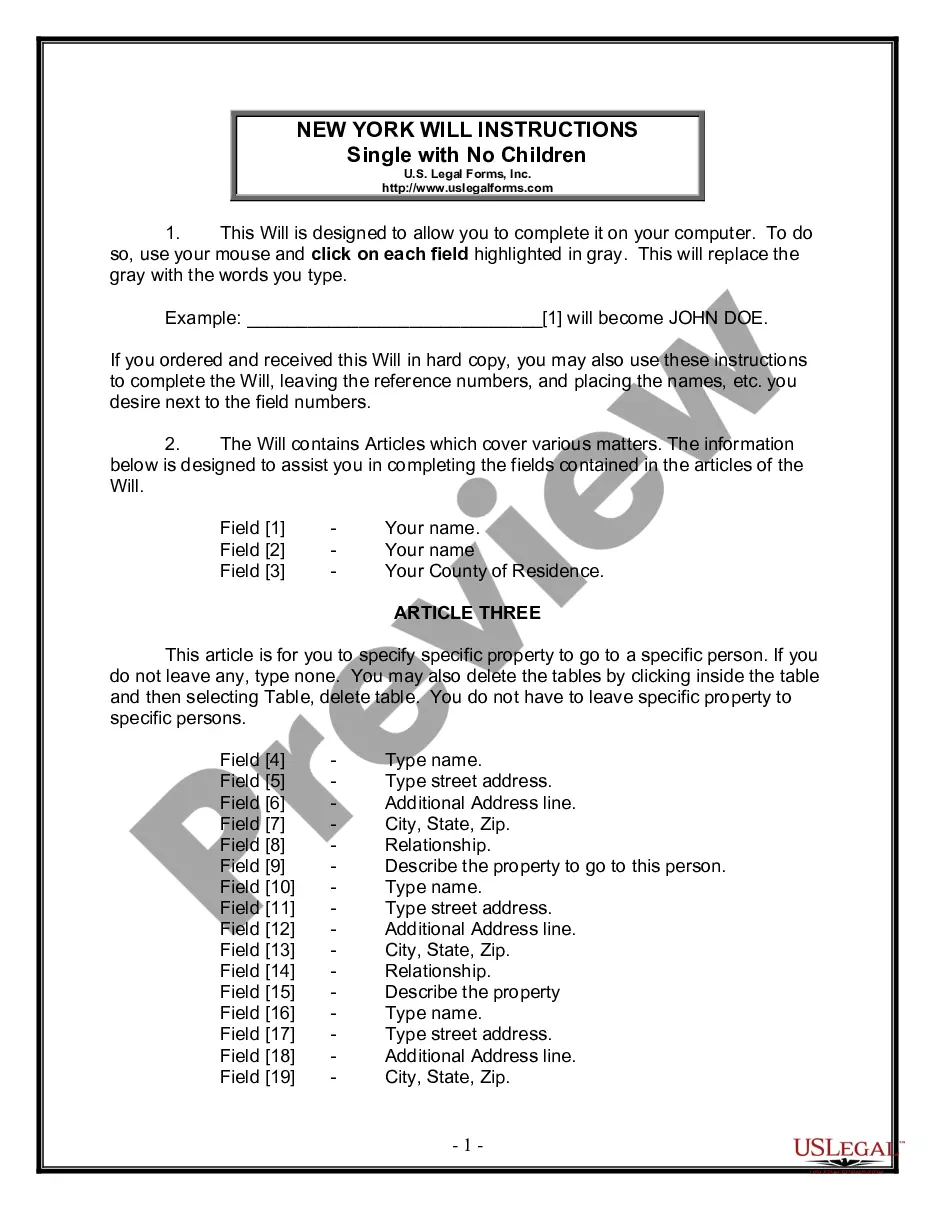

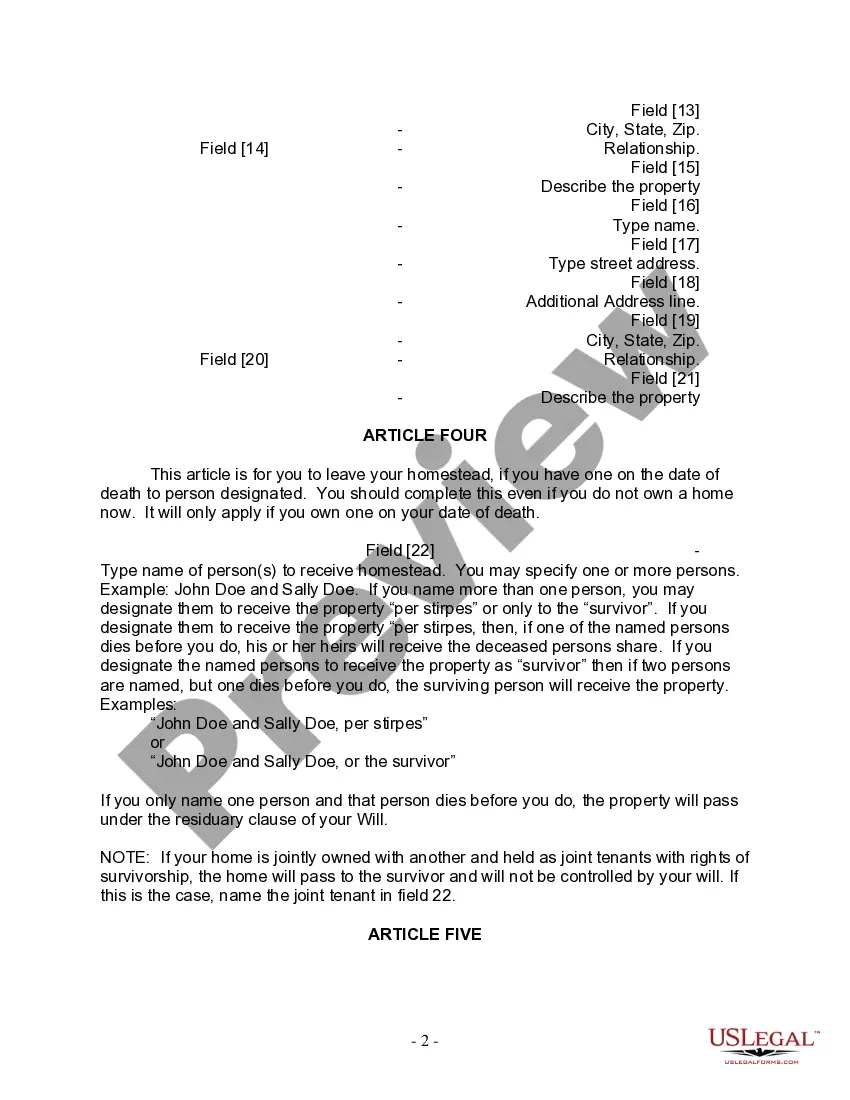

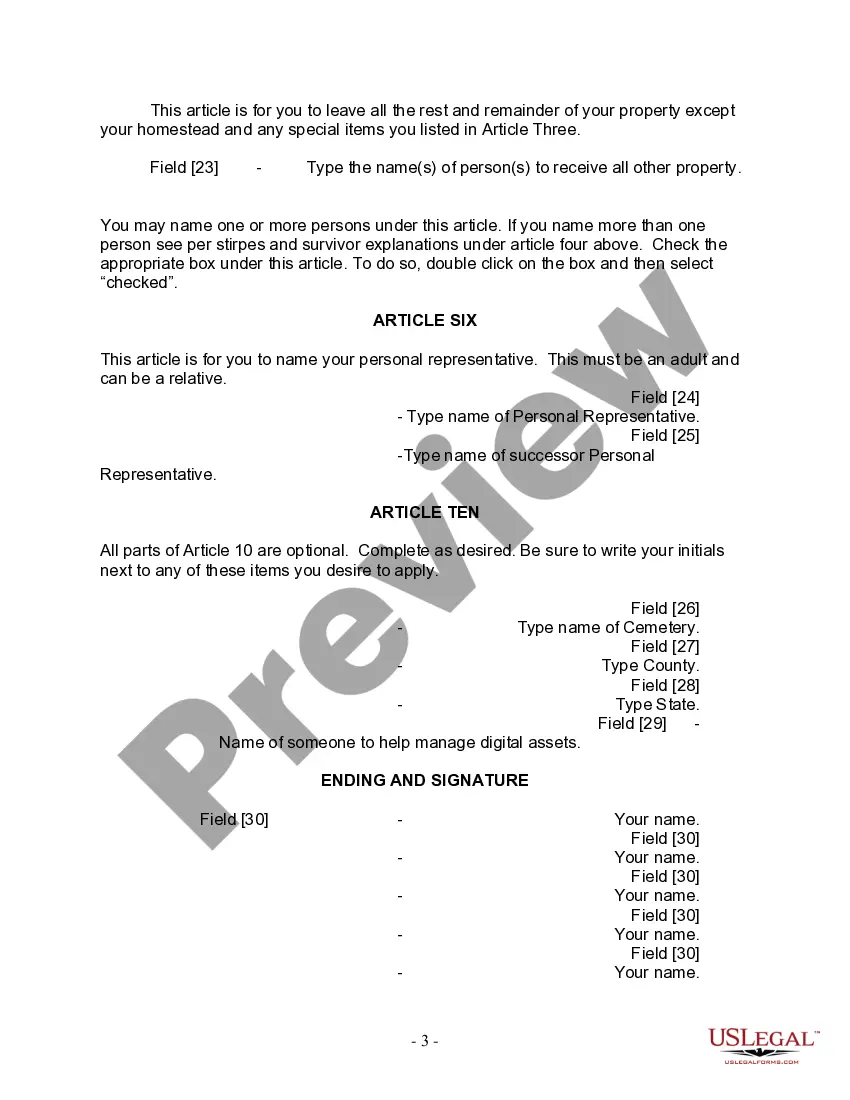

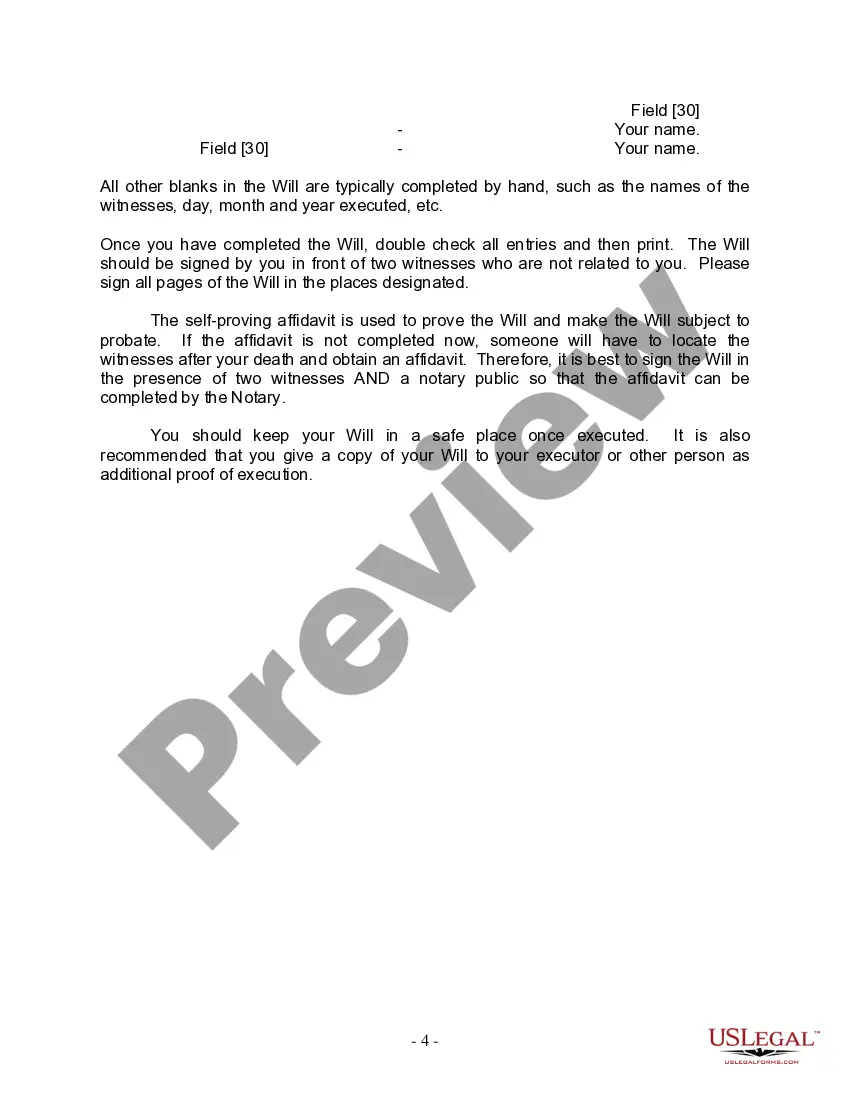

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Nassau New York Legal Last Will and Testament Form for Single Person with No Children is a legal document that outlines how a person's assets and estate should be distributed after their passing. This document is specifically designed for individuals residing in Nassau County, within the state of New York, who are single and have no children. The purpose of this legally binding form is to ensure that the wishes of the single individual without children are carried out accurately and according to applicable laws. By carefully drafting this last will and testament, individuals can have peace of mind, knowing that their assets are properly distributed to their chosen beneficiaries. The Nassau New York Legal Last Will and Testament Form for Single Person with No Children typically contains several key sections and clauses. These include: 1. Personal Information: This section requires the individual to provide their full legal name, address, and contact details. It is crucial to provide accurate information to avoid any potential issues during the probate process. 2. Executor: The individual must appoint an executor who will be responsible for managing the estate and ensuring that the wishes outlined in the will are carried out. An executor can be a trusted family member, friend, or even a professional legal representative. 3. Distribution of Assets: In this section, the individual specifies how their assets, including real estate, bank accounts, investments, personal possessions, and any other property, should be distributed among their chosen beneficiaries. It is essential to clearly identify each beneficiary and their relationship to the individual. 4. Alternate Beneficiaries: To account for unforeseen circumstances, the individual may include alternate beneficiaries. These individuals would inherit the assets in case the primary beneficiaries are unable to receive them. 5. Specific Bequests: This section allows the individual to leave specific items or amounts of money to designated beneficiaries. This could include sentimental items, family heirlooms, or financial gifts to friends, charities, or organizations. 6. Guardianship: If the single individual has minor siblings or relatives, they can express their preference for a guardian to take care of them in the event of their untimely demise. Some variations of the Nassau New York Legal Last Will and Testament Form for Single Person with No Children may include additional provisions, such as: — No Contest Clause: This clause discourages beneficiaries from challenging the validity of the will, stating that if any beneficiary contests the will, they will forfeit their inheritance. — Trust Creation: If the individual wishes to create a trust to manage and distribute their assets, they can include provisions outlining the creation, administration, and beneficiaries of the trust within the will. — Digital Assets: With the advent of the digital age, some wills may incorporate provisions for the management and distribution of digital assets, such as online accounts, social media profiles, and cryptocurrency. Remember, it is crucial to consult with an experienced attorney when creating a Nassau New York Legal Last Will and Testament Form for Single Person with No Children. They can ensure that the document complies with all relevant laws and accurately reflects the individual's intentions.

The Nassau New York Legal Last Will and Testament Form for Single Person with No Children is a legal document that outlines how a person's assets and estate should be distributed after their passing. This document is specifically designed for individuals residing in Nassau County, within the state of New York, who are single and have no children. The purpose of this legally binding form is to ensure that the wishes of the single individual without children are carried out accurately and according to applicable laws. By carefully drafting this last will and testament, individuals can have peace of mind, knowing that their assets are properly distributed to their chosen beneficiaries. The Nassau New York Legal Last Will and Testament Form for Single Person with No Children typically contains several key sections and clauses. These include: 1. Personal Information: This section requires the individual to provide their full legal name, address, and contact details. It is crucial to provide accurate information to avoid any potential issues during the probate process. 2. Executor: The individual must appoint an executor who will be responsible for managing the estate and ensuring that the wishes outlined in the will are carried out. An executor can be a trusted family member, friend, or even a professional legal representative. 3. Distribution of Assets: In this section, the individual specifies how their assets, including real estate, bank accounts, investments, personal possessions, and any other property, should be distributed among their chosen beneficiaries. It is essential to clearly identify each beneficiary and their relationship to the individual. 4. Alternate Beneficiaries: To account for unforeseen circumstances, the individual may include alternate beneficiaries. These individuals would inherit the assets in case the primary beneficiaries are unable to receive them. 5. Specific Bequests: This section allows the individual to leave specific items or amounts of money to designated beneficiaries. This could include sentimental items, family heirlooms, or financial gifts to friends, charities, or organizations. 6. Guardianship: If the single individual has minor siblings or relatives, they can express their preference for a guardian to take care of them in the event of their untimely demise. Some variations of the Nassau New York Legal Last Will and Testament Form for Single Person with No Children may include additional provisions, such as: — No Contest Clause: This clause discourages beneficiaries from challenging the validity of the will, stating that if any beneficiary contests the will, they will forfeit their inheritance. — Trust Creation: If the individual wishes to create a trust to manage and distribute their assets, they can include provisions outlining the creation, administration, and beneficiaries of the trust within the will. — Digital Assets: With the advent of the digital age, some wills may incorporate provisions for the management and distribution of digital assets, such as online accounts, social media profiles, and cryptocurrency. Remember, it is crucial to consult with an experienced attorney when creating a Nassau New York Legal Last Will and Testament Form for Single Person with No Children. They can ensure that the document complies with all relevant laws and accurately reflects the individual's intentions.