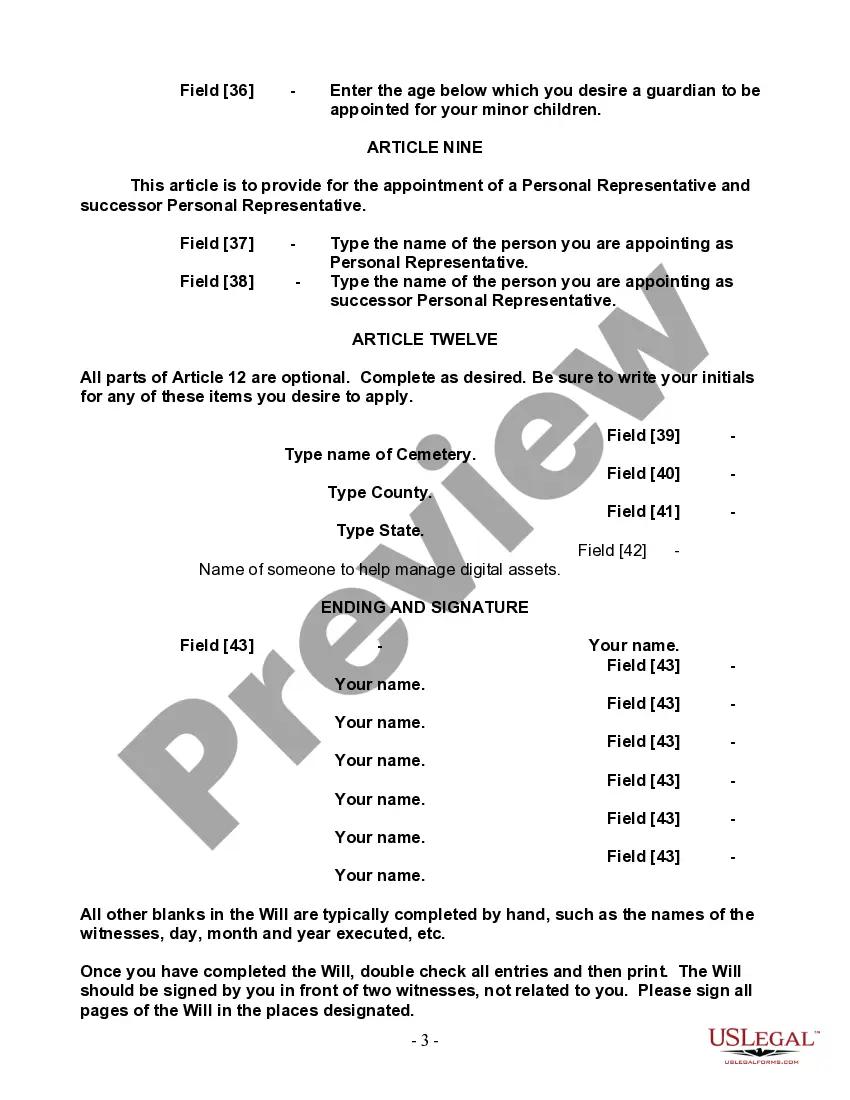

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

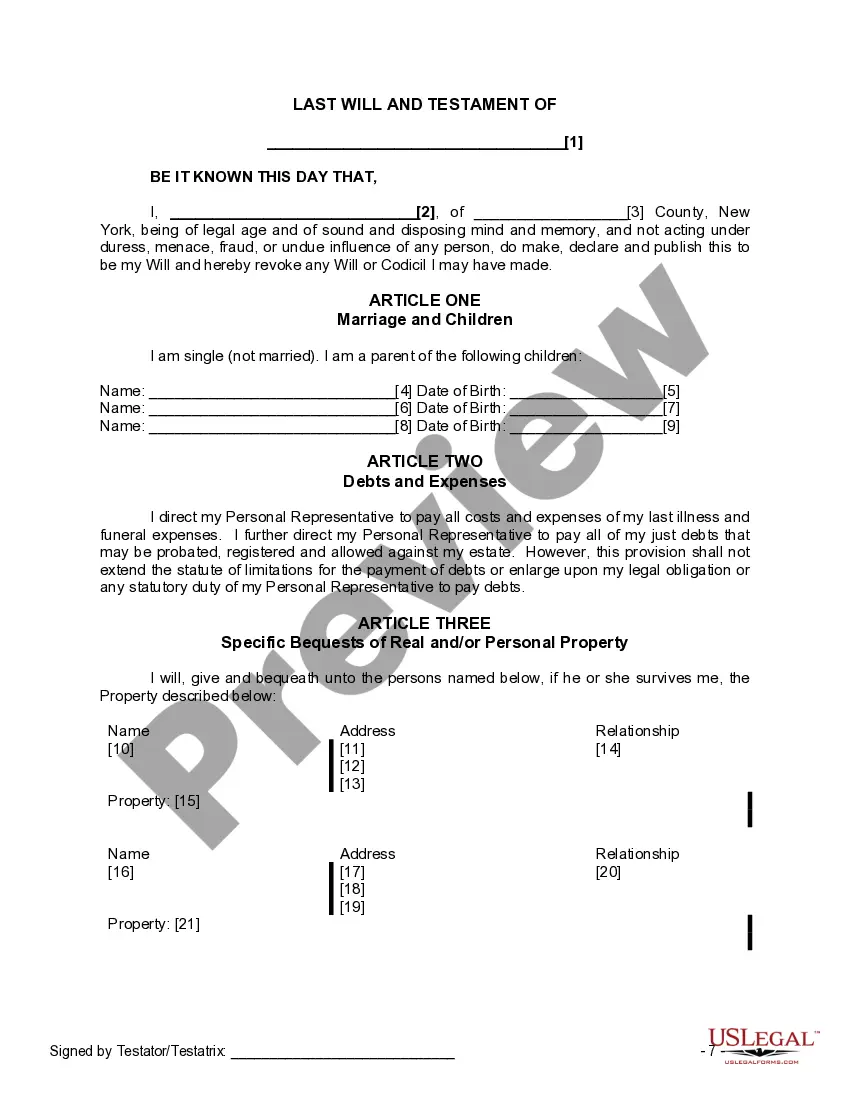

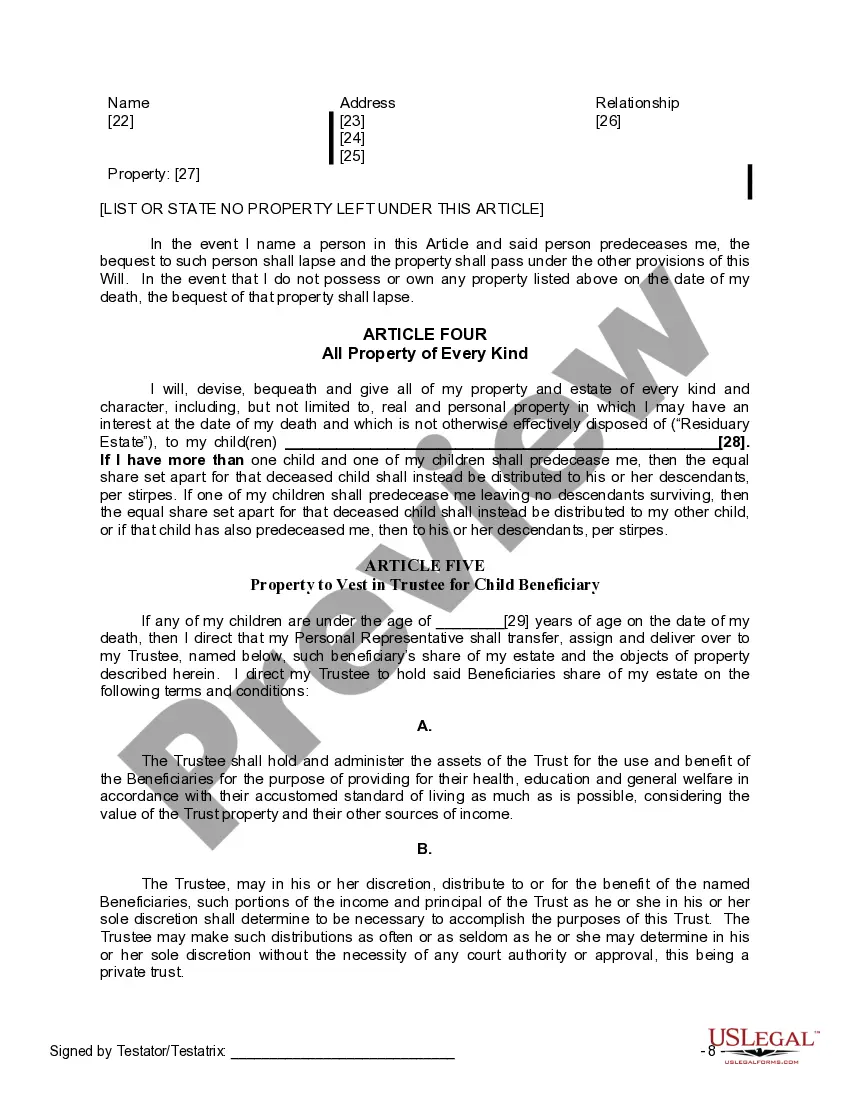

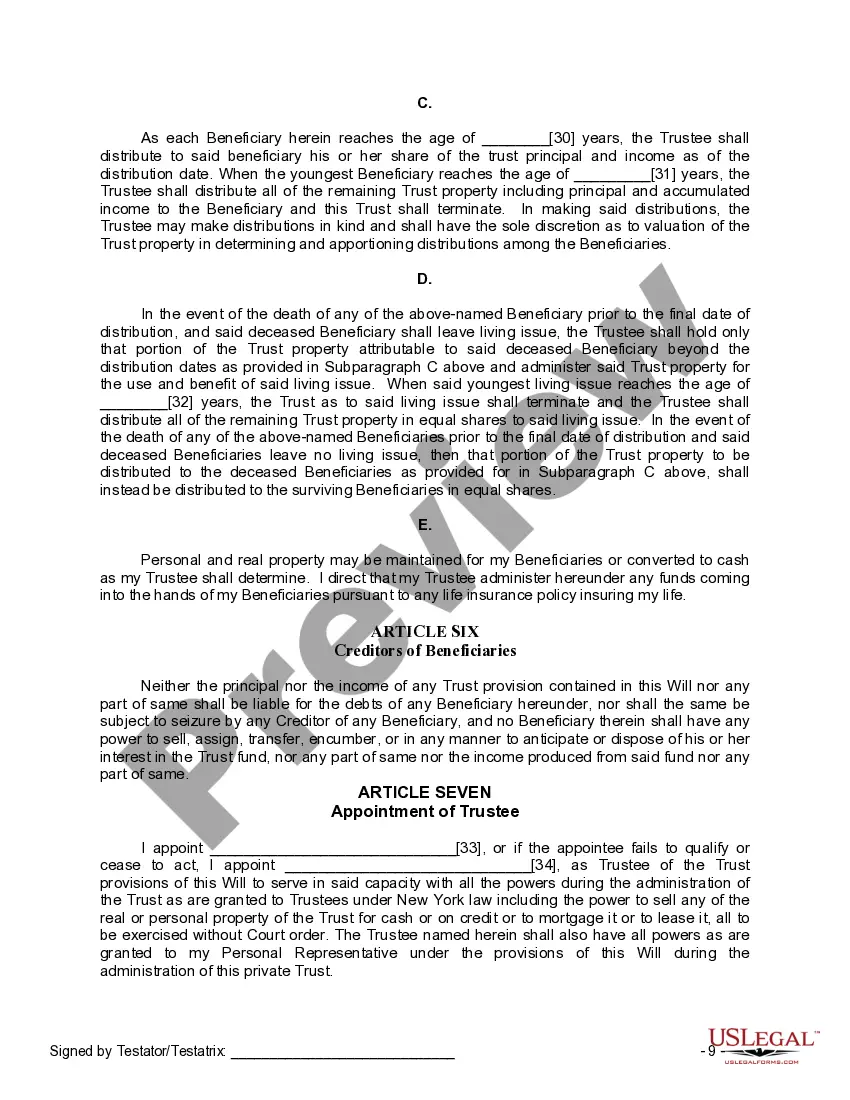

Queens New York Last Will and Testament for a Single Person with Minor Children

Description

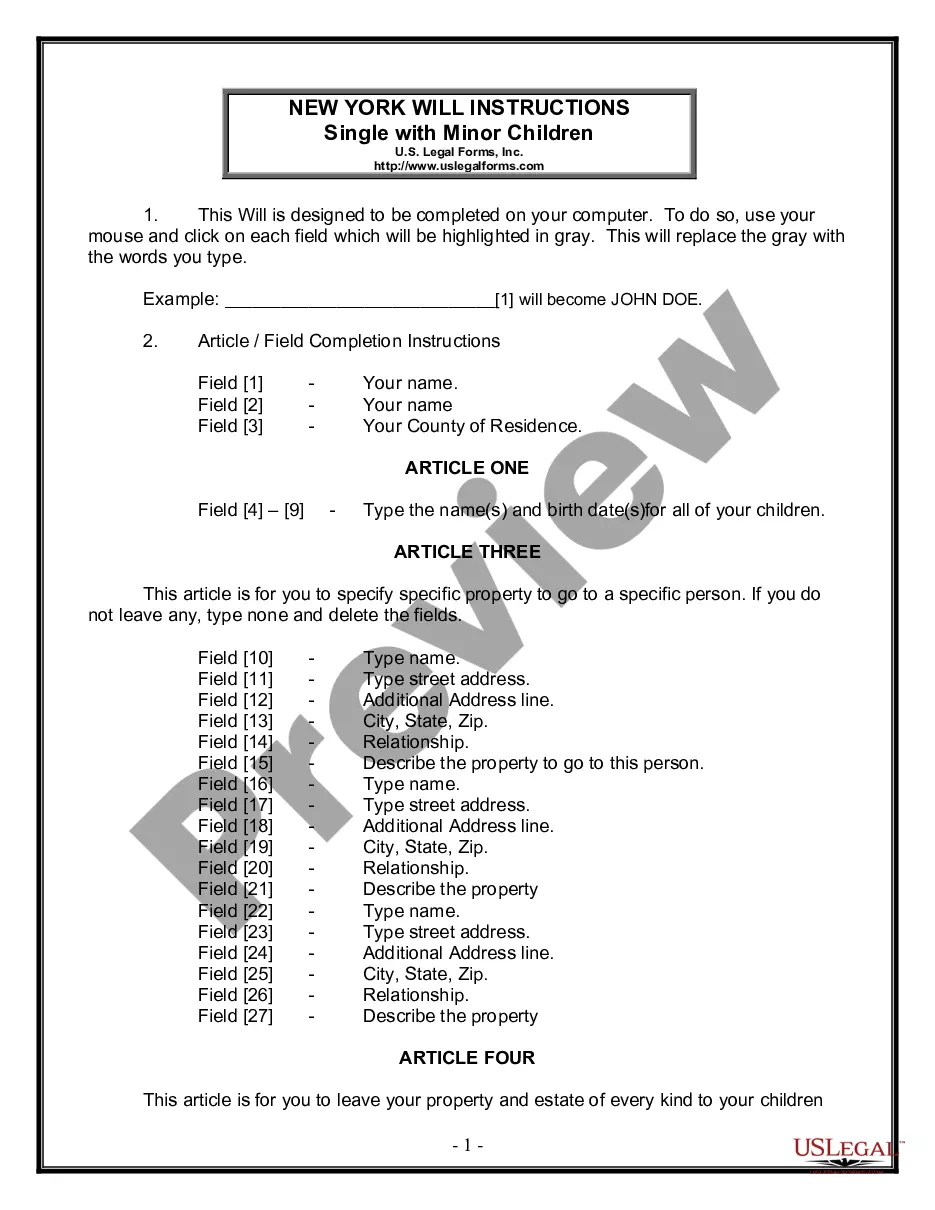

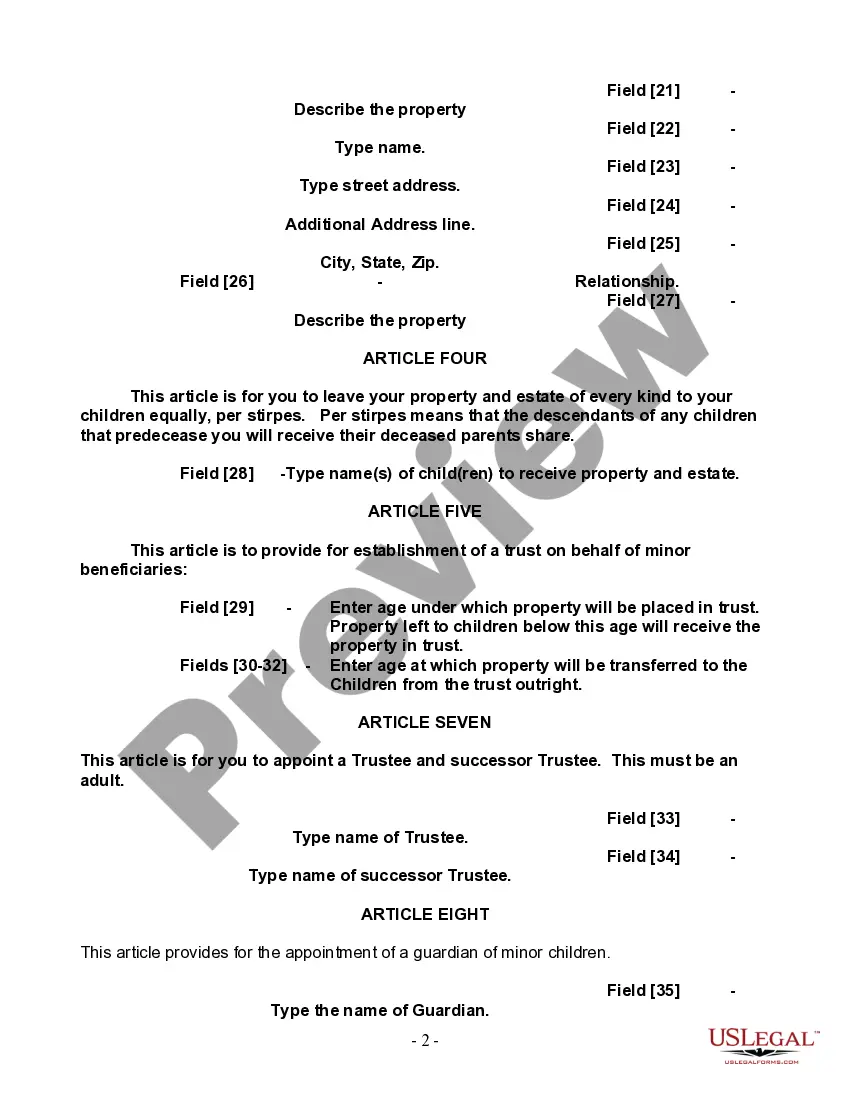

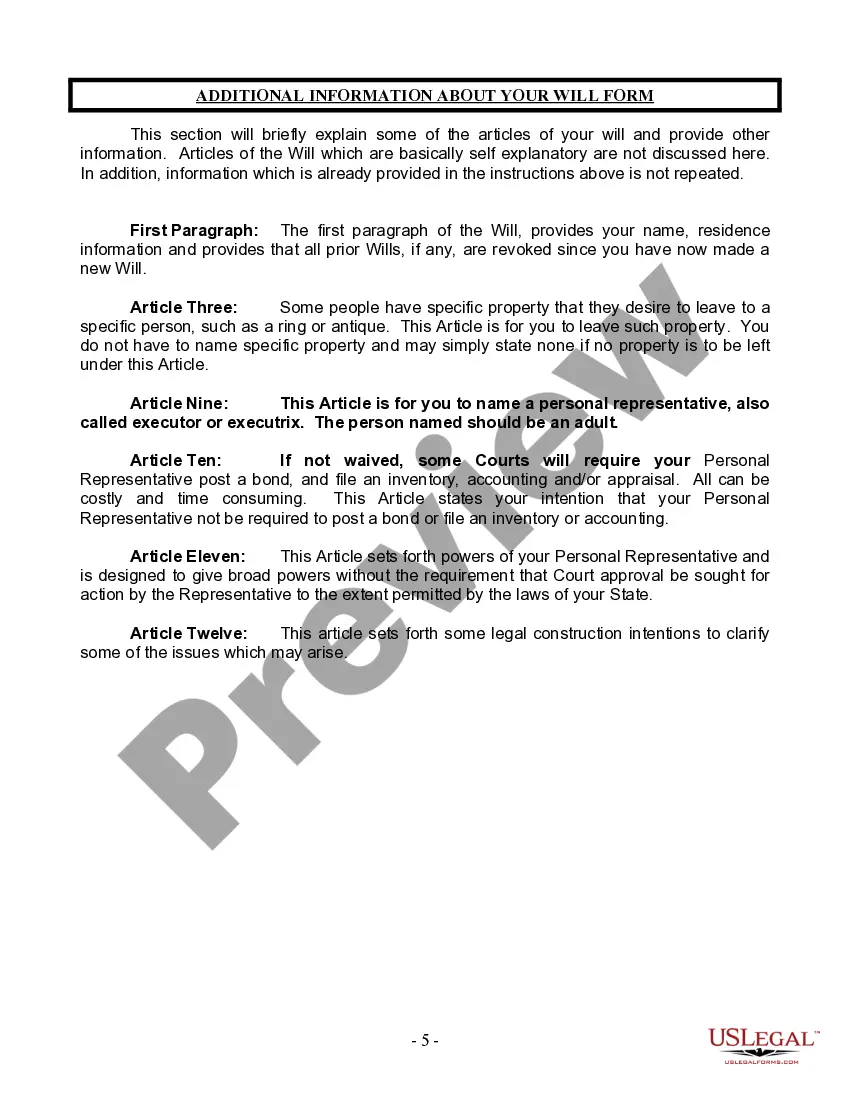

How to fill out New York Last Will And Testament For A Single Person With Minor Children?

Regardless of one's social or professional position, filling out legal documents is a regrettable requirement in today’s society.

Too frequently, it’s nearly impossible for an individual without legal training to draft such documents from scratch, primarily due to the complex language and legal nuances they entail.

This is where US Legal Forms steps in to assist.

Ensure that the form you have selected is appropriate for your locality, as the laws of one state or county do not apply to another.

Preview the document and review a brief summary (if available) of scenarios for which the form can be utilized.

- Our platform provides an extensive collection with more than 85,000 ready-to-use state-specific forms that are suitable for nearly any legal situation.

- US Legal Forms also acts as an excellent tool for associates or legal advisors looking to conserve time by utilizing our DIY forms.

- Whether you require the Queens New York Legal Last Will and Testament Form for a Single Person with Minor Children or any other documentation applicable to your region or county, everything is easily accessible with US Legal Forms.

- Here’s how to obtain the Queens New York Legal Last Will and Testament Form for a Single Person with Minor Children in a matter of minutes using our reliable platform.

- If you're currently a subscriber, you can proceed to Log In to your account to retrieve the appropriate form.

- However, if you are new to our platform, be sure to follow these steps before downloading the Queens New York Legal Last Will and Testament Form for a Single Person with Minor Children.

Form popularity

FAQ

Yes, making a will is necessary, even for parents with one child. A Queens New York Last Will and Testament for a Single Person with Minor Children ensures your wishes regarding asset distribution and guardianship for your child are legally documented. It provides clarity and security for your child's future.

Disinheriting a minor child in New York is legally possible but requires careful planning. A Queens New York Last Will and Testament for a Single Person with Minor Children should explicitly outline your intentions to prevent any confusion or legal disputes. It’s crucial to consult with legal experts to navigate this sensitive issue effectively.

While a trust can be beneficial, it is not mandatory if you have just one child. However, considering a Queens New York Last Will and Testament for a Single Person with Minor Children can simplify the process of asset transfer. You may also explore how a trust could provide added protection for your child’s inheritance.

Yes, having a will is crucial even if you have one heir. A Queens New York Last Will and Testament for a Single Person with Minor Children guarantees that your assets will transfer smoothly and according to your wishes. It also provides clarity and peace of mind during a difficult time for your family.

Creating a will is highly recommended, even if you have just one child. A Queens New York Last Will and Testament for a Single Person with Minor Children can provide guidance on asset distribution and guardianship decisions. This legal document ensures your child's future is secure and reflects your personal wishes.

In New York, when a parent passes away without a will, an only child inherits the entire estate. However, if you want to ensure your child's inheritance aligns with your wishes, it's essential to create a Queens New York Last Will and Testament for a Single Person with Minor Children. This document allows you to specify how your assets will be distributed, avoiding any uncertainty.

Recording a will at the courthouse is part of the probate process in New York. Specifically, you file the will with the Surrogate's Court, which validates it as the official guide for managing the deceased's estate. If you created a Queens New York Last Will and Testament for a Single Person with Minor Children, filing ensures that the court acknowledges your wishes regarding guardianship and asset distribution. This step is vital in preventing disputes among beneficiaries and helps clarify the intentions laid out in the will.

Yes, a will must be filed in New York state for the probate process to proceed. This requirement ensures that the instructions within the will, such as those in a Queens New York Last Will and Testament for a Single Person with Minor Children, are formally recognized and enforced. Not filing the will can lead to complications in settling the estate, including potential delays and disputes. By filing, you protect the interests of your children and ensure a smooth transition of assets.

If a will is not filed in New York, the estate may go through intestate succession laws, potentially disregarding the wishes of the deceased. This can create complications, especially if the deceased had a Queens New York Last Will and Testament for a Single Person with Minor Children that designated specific guardianship or asset distribution. It's essential to file the will promptly to avoid legal disputes among relatives and ensure that the estate is settled according to the deceased's wishes. Utilizing a service like UsLegalForms can help you navigate this process successfully.

When filing a will in New York, you will need the original will along with a petition for probate. Additionally, you may need to provide a death certificate and information about the decedent's assets and debts. If your will is a Queens New York Last Will and Testament for a Single Person with Minor Children, including details about the guardianship of those children will also be beneficial. Preparing these documents ahead of time can streamline the filing process.