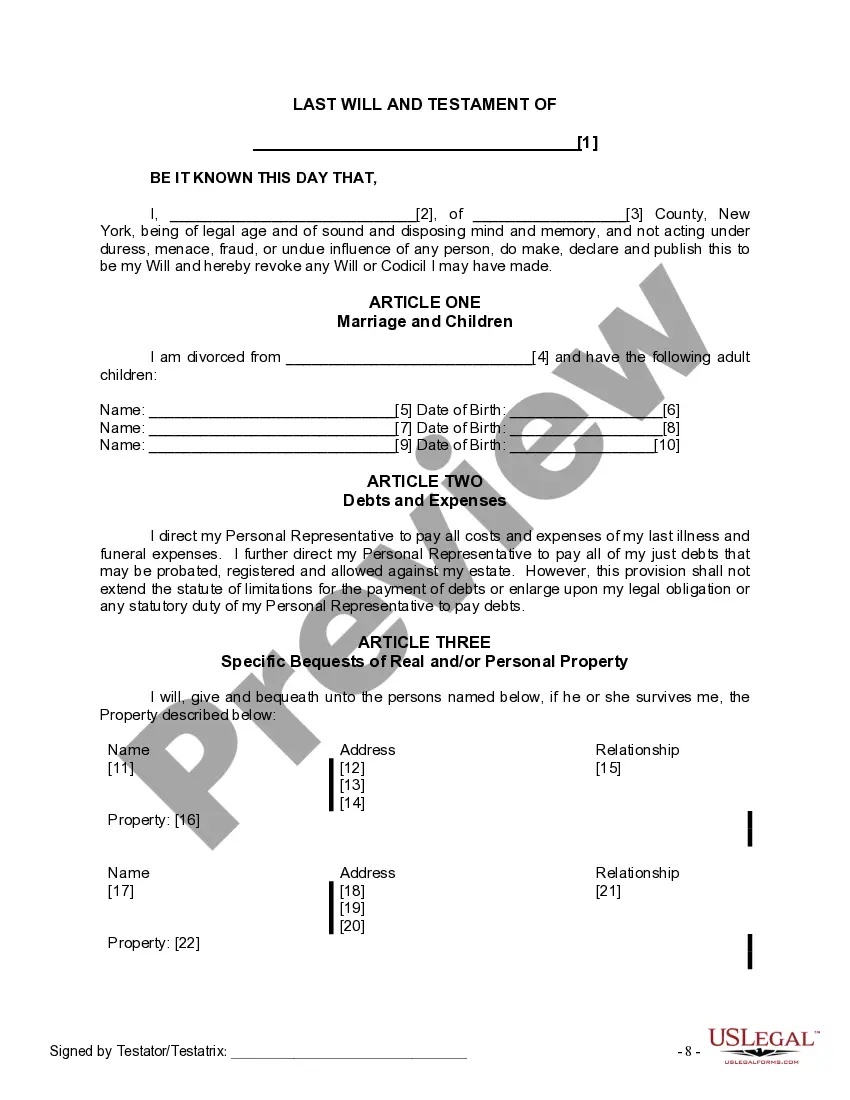

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. A Suffolk New York Legal Last Will and Testament Form for a Divorced Person Not Remarried with Adult Children is a legally binding document that allows individuals in Suffolk County, New York, who have been divorced and not remarried, to outline their final wishes regarding the distribution of their assets, care for their adult children, appointment of executors, and other important matters after their demise. This form provides a structured template to ensure that the individual's wishes are clearly stated and legally recognized. The Suffolk New York Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children typically encompasses various sections and clauses, tailored to meet the specific needs of a divorced individual who has adult children. Some key elements covered in this form include: 1. Personal Information: This section prompts the individual to provide their full name, address, and other identifying information. 2. Revocation of Previous Wills: The form includes a provision for revoking any previously made wills or codicils, ensuring that the new will takes precedence. 3. Executor Appointment: Here, the individual can designate an executor — the person responsible for carrying out the wishes outlined in the will. This may be a trusted family member, friend, or even a professional executor. 4. Distribution of Assets: The will allows the individual to specify how their property, assets, and investments should be distributed among their adult children. They can indicate specific bequests, percentages, or even create trusts. 5. Care of Minor or Dependent Children: As the will is designed for individuals with adult children, this section may not be applicable. However, if any minor or dependent children exist, the form enables the individual to name a guardian who will be responsible for their care and upbringing. 6. Provision for Debts and Taxes: This section allows the individual to address their outstanding debts, funeral expenses, and any potential tax liabilities from their estate. 7. Alternate Beneficiaries: In case one or more named beneficiaries predecease the individual or decline their inheritance, the form allows the designation of alternate beneficiaries to ensure that assets are not left unclaimed. If there are different types of Suffolk New York Legal Last Will and Testament forms specifically tailored for Divorced persons not Remarried with Adult Children, differentiating factors could include variations in clauses related to asset distribution, appointment of executors, or specific provisions for blended families. However, generally, a single comprehensive form can be used to address the unique circumstances of this category of individuals.

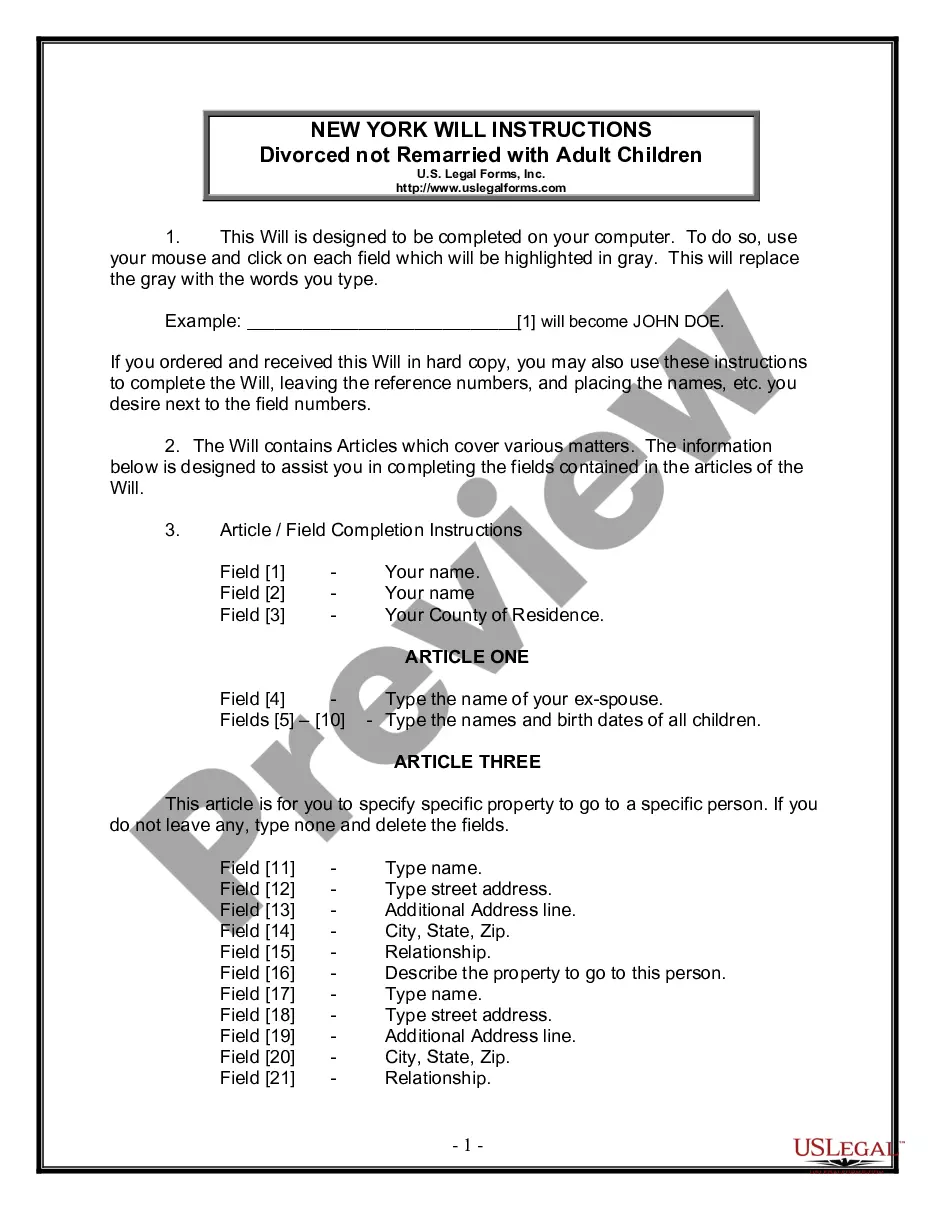

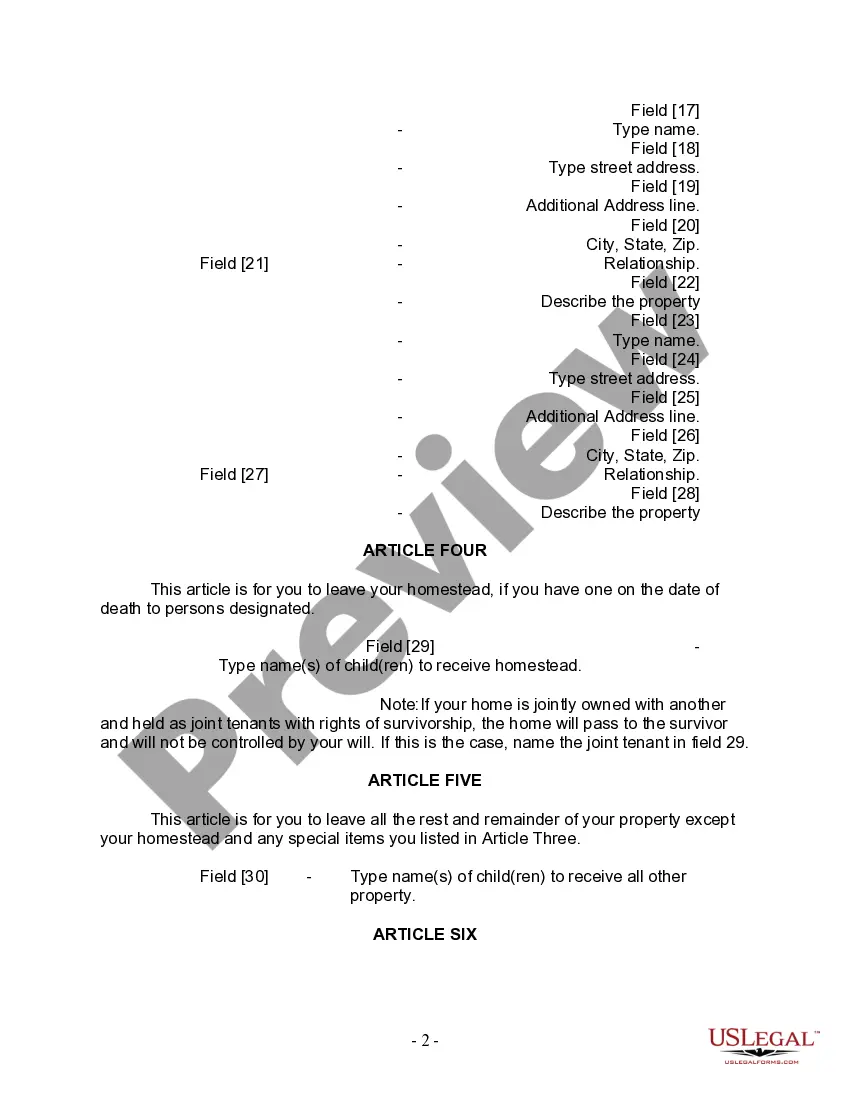

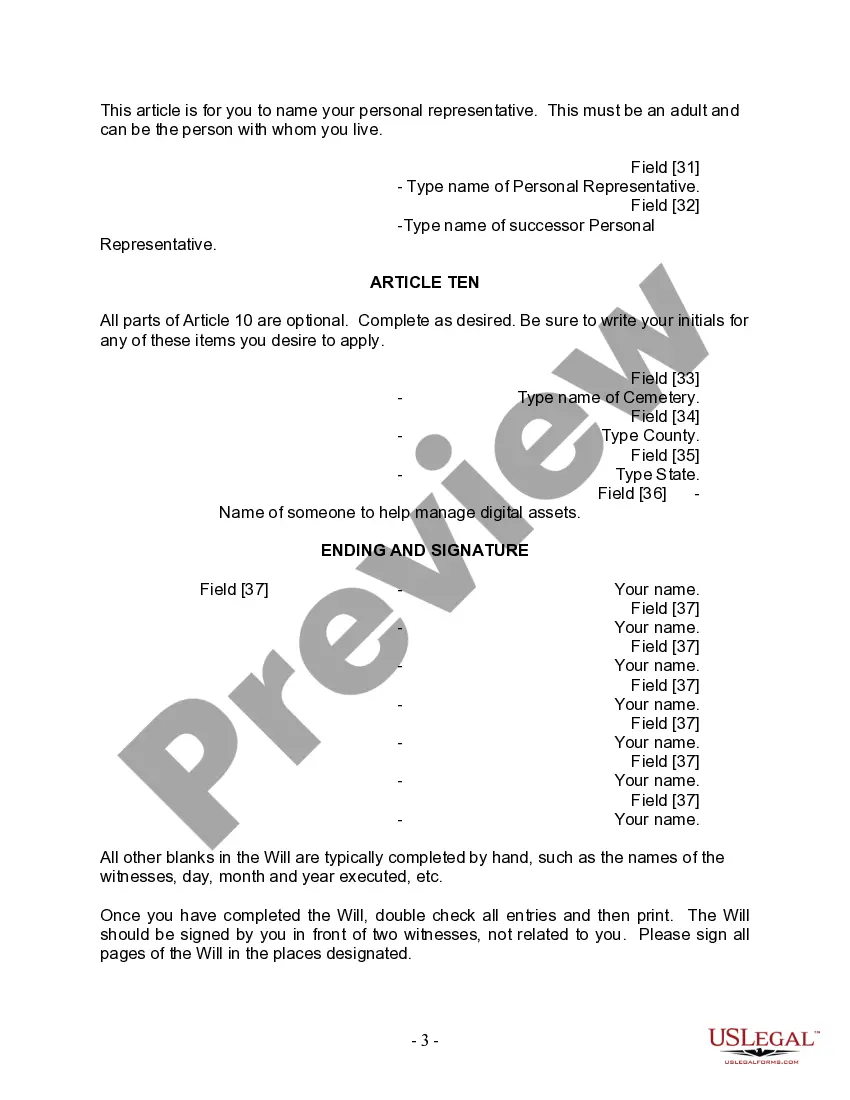

A Suffolk New York Legal Last Will and Testament Form for a Divorced Person Not Remarried with Adult Children is a legally binding document that allows individuals in Suffolk County, New York, who have been divorced and not remarried, to outline their final wishes regarding the distribution of their assets, care for their adult children, appointment of executors, and other important matters after their demise. This form provides a structured template to ensure that the individual's wishes are clearly stated and legally recognized. The Suffolk New York Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children typically encompasses various sections and clauses, tailored to meet the specific needs of a divorced individual who has adult children. Some key elements covered in this form include: 1. Personal Information: This section prompts the individual to provide their full name, address, and other identifying information. 2. Revocation of Previous Wills: The form includes a provision for revoking any previously made wills or codicils, ensuring that the new will takes precedence. 3. Executor Appointment: Here, the individual can designate an executor — the person responsible for carrying out the wishes outlined in the will. This may be a trusted family member, friend, or even a professional executor. 4. Distribution of Assets: The will allows the individual to specify how their property, assets, and investments should be distributed among their adult children. They can indicate specific bequests, percentages, or even create trusts. 5. Care of Minor or Dependent Children: As the will is designed for individuals with adult children, this section may not be applicable. However, if any minor or dependent children exist, the form enables the individual to name a guardian who will be responsible for their care and upbringing. 6. Provision for Debts and Taxes: This section allows the individual to address their outstanding debts, funeral expenses, and any potential tax liabilities from their estate. 7. Alternate Beneficiaries: In case one or more named beneficiaries predecease the individual or decline their inheritance, the form allows the designation of alternate beneficiaries to ensure that assets are not left unclaimed. If there are different types of Suffolk New York Legal Last Will and Testament forms specifically tailored for Divorced persons not Remarried with Adult Children, differentiating factors could include variations in clauses related to asset distribution, appointment of executors, or specific provisions for blended families. However, generally, a single comprehensive form can be used to address the unique circumstances of this category of individuals.