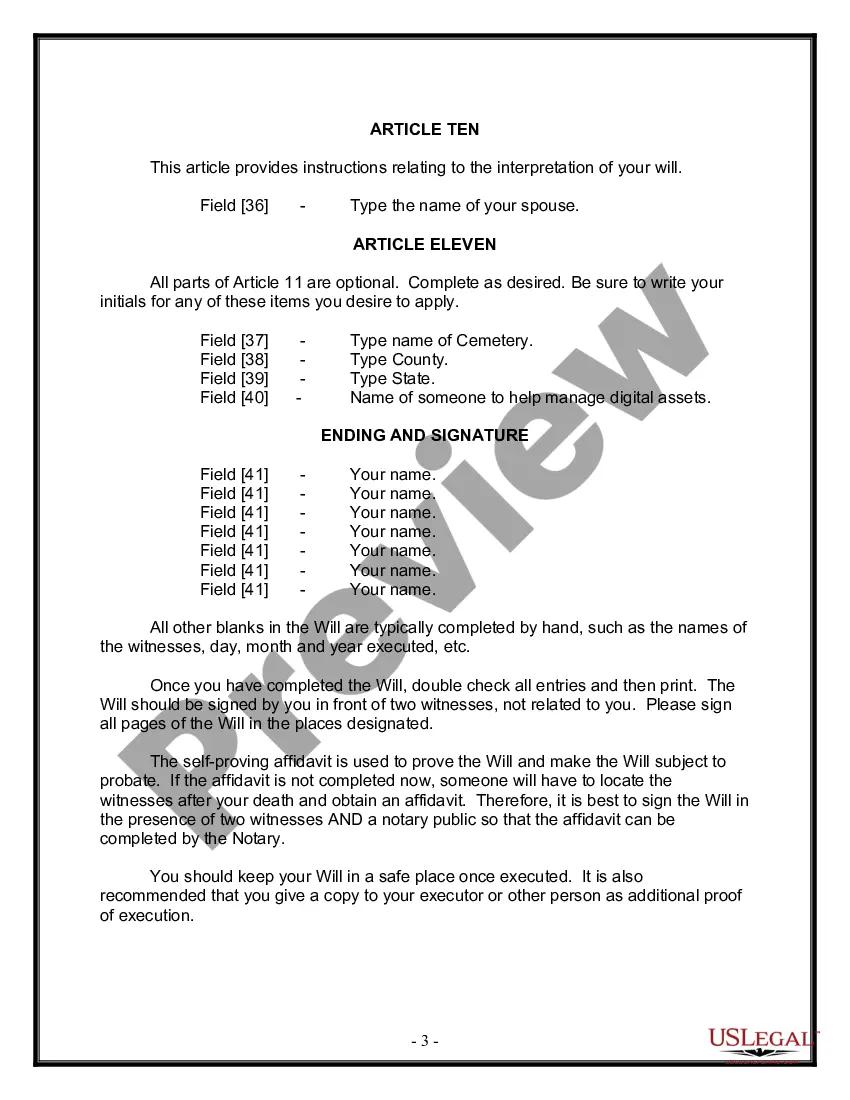

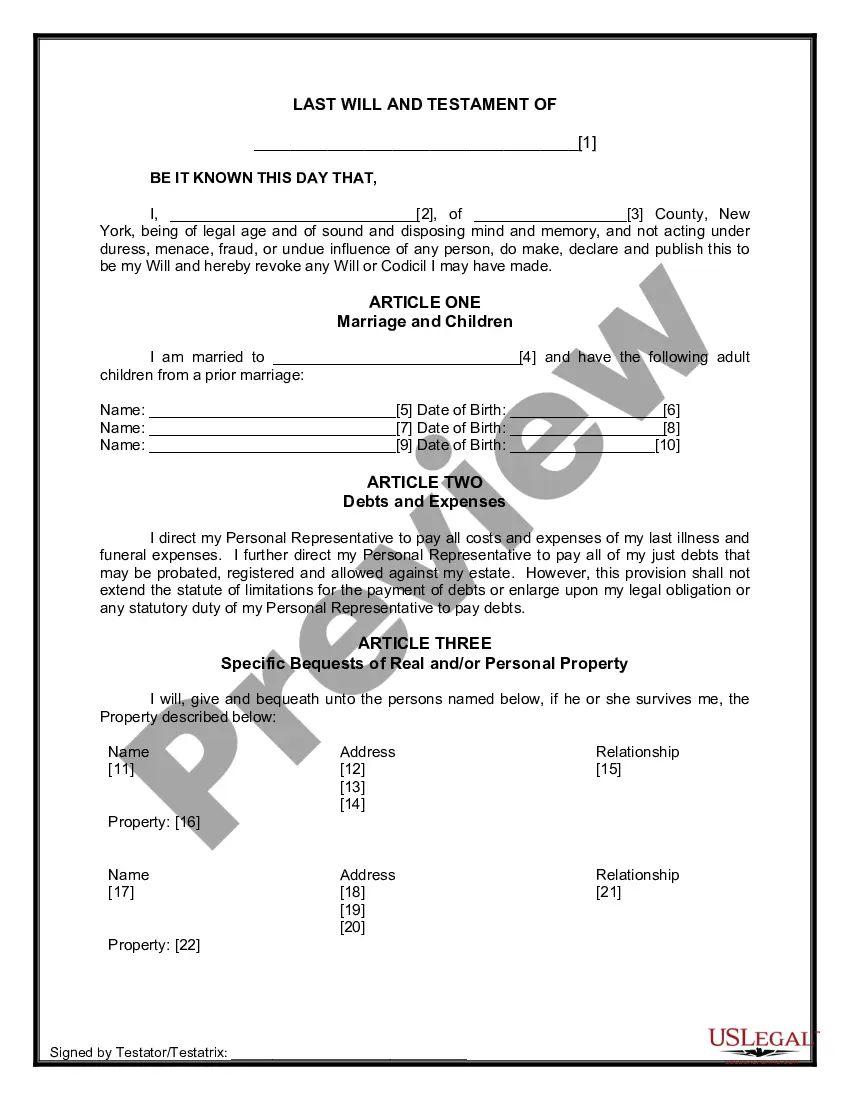

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

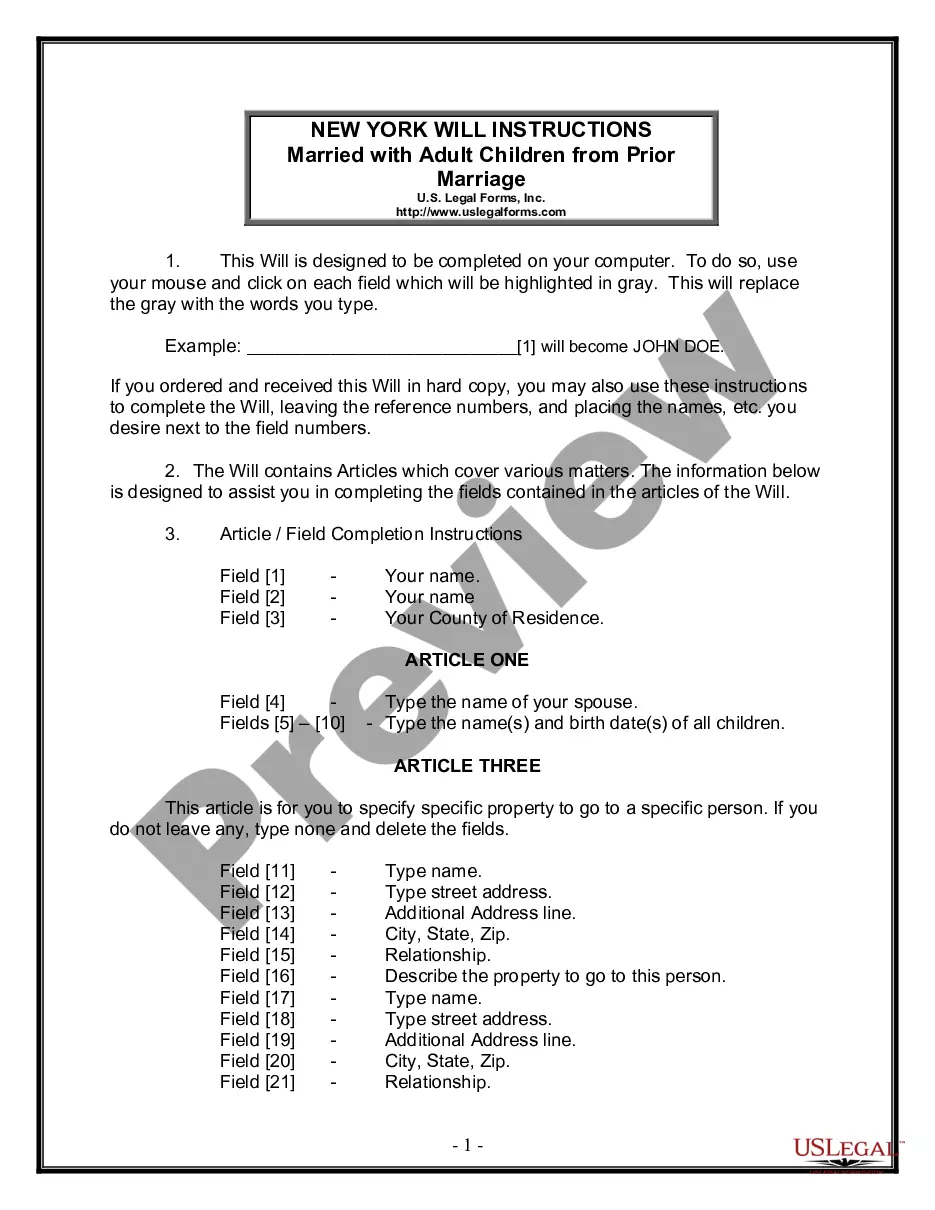

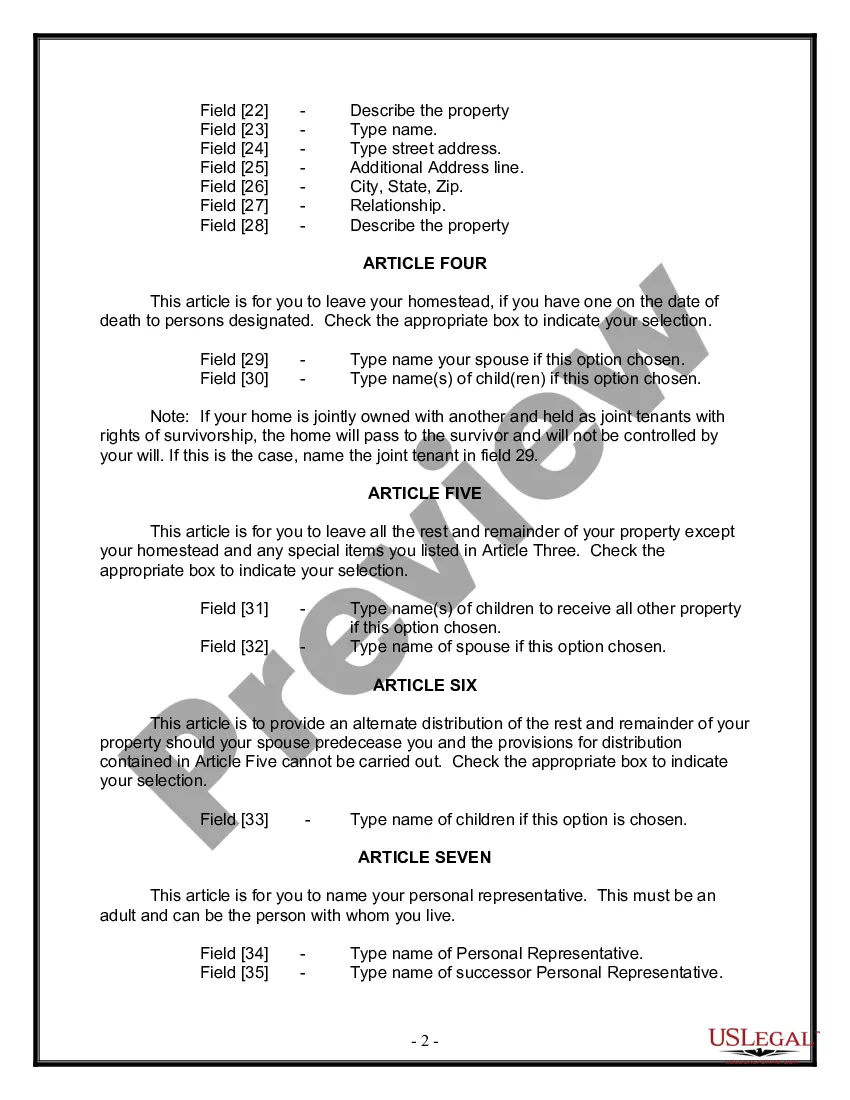

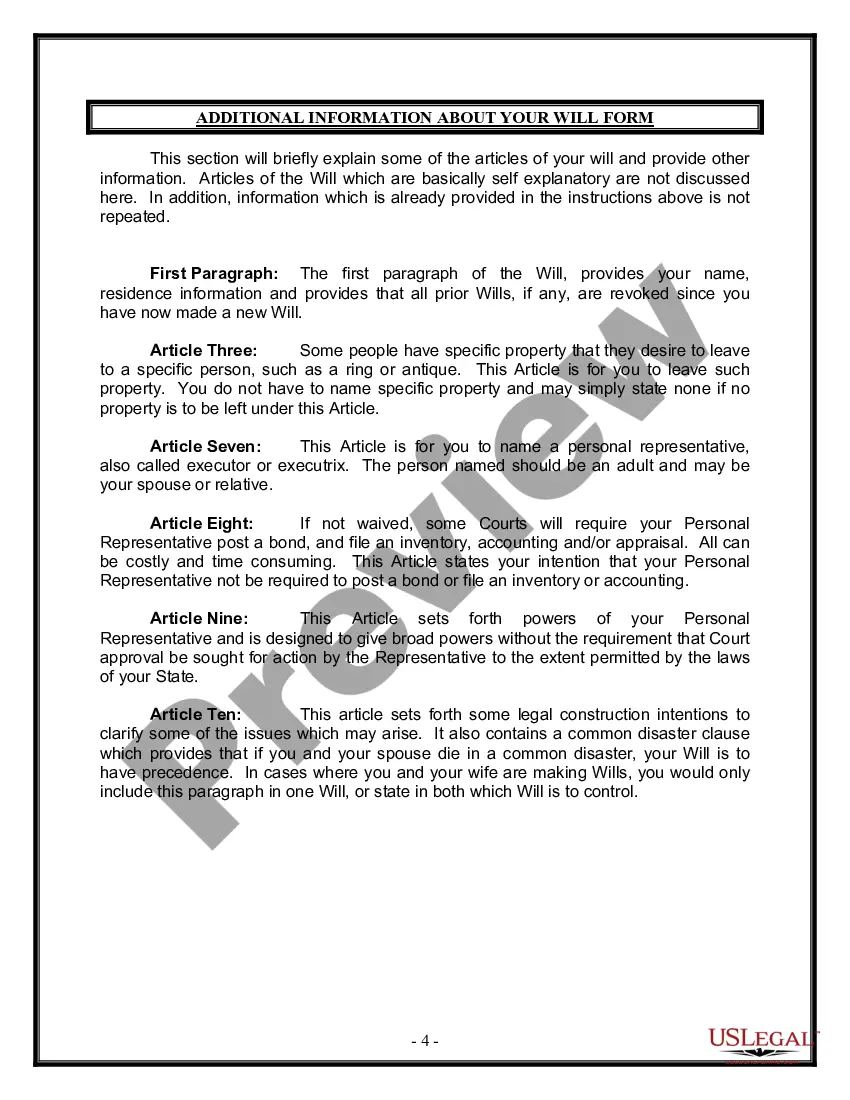

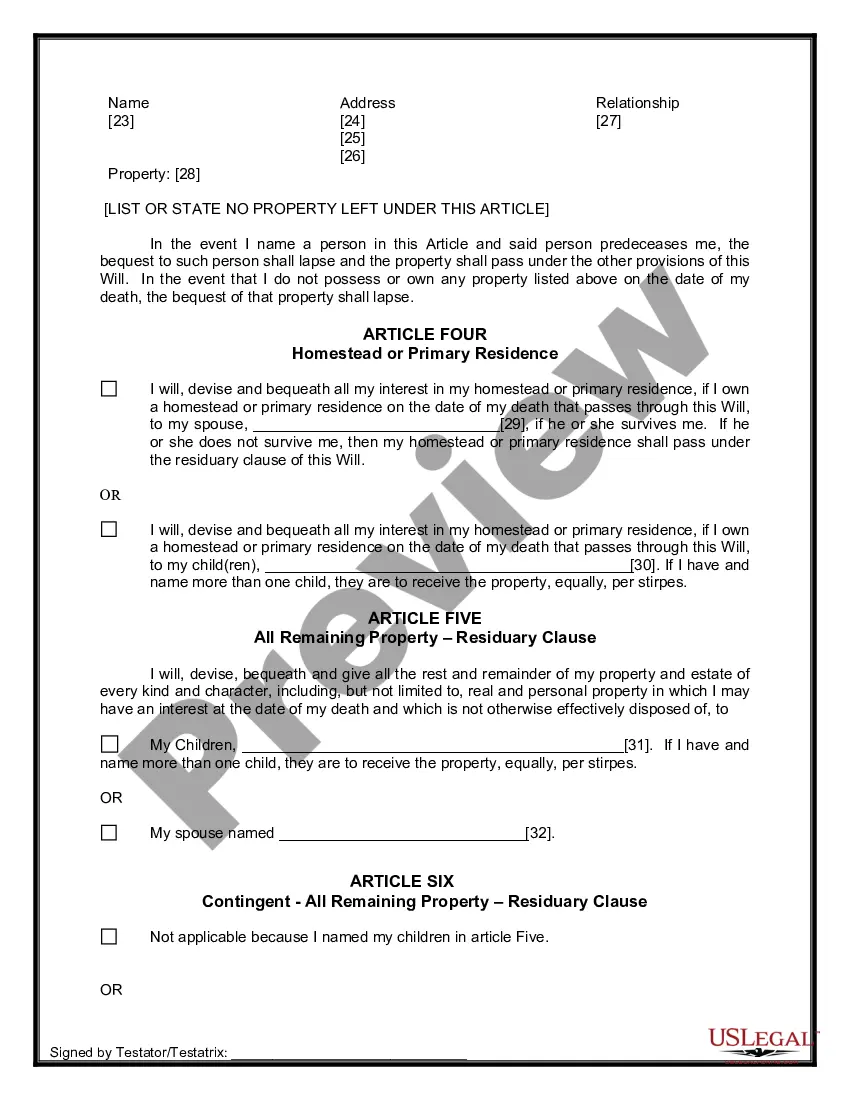

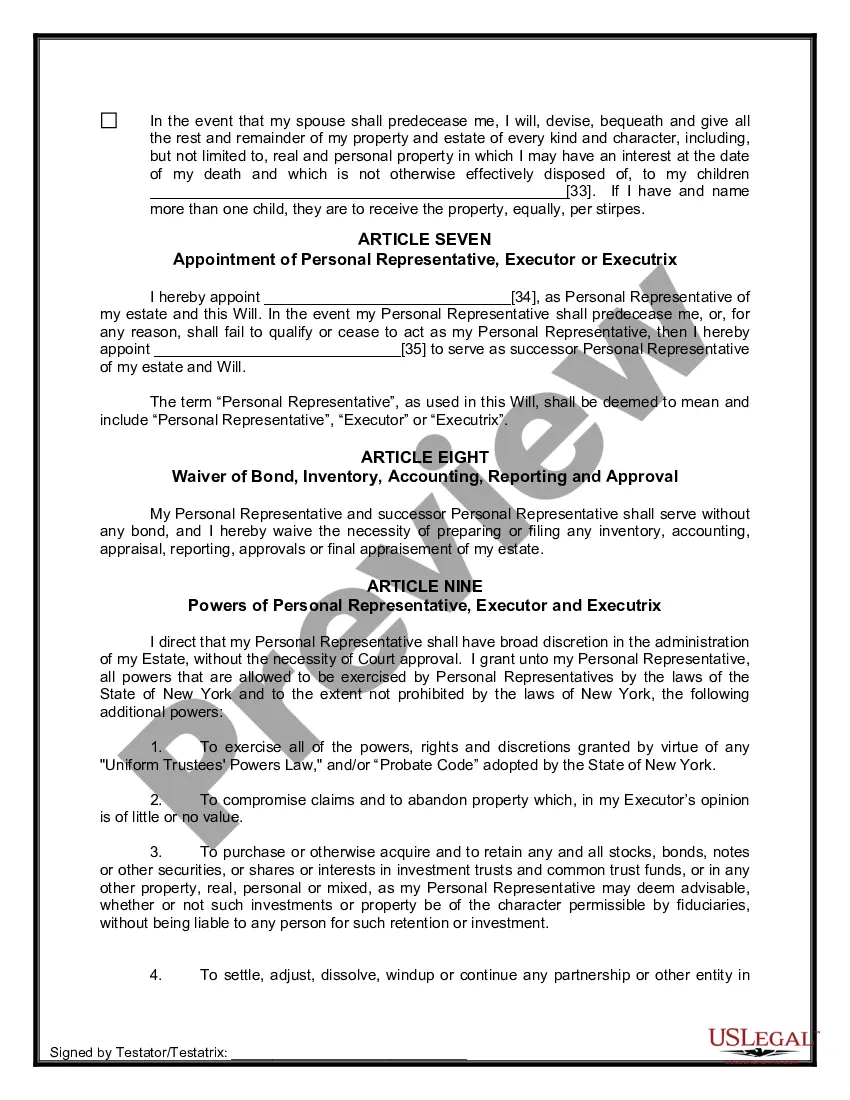

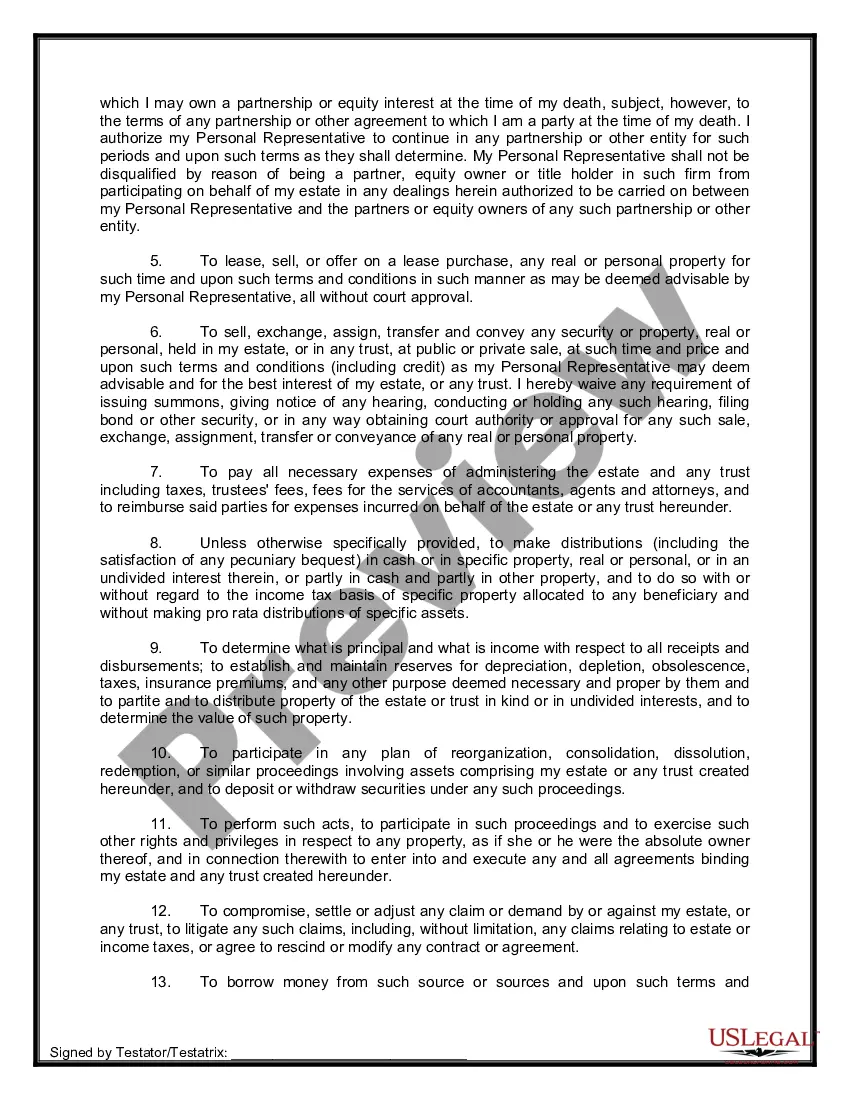

The Kings New York Legal Last Will and Testament Form for Married person with Adult Children from Prior Marriage is a legally binding document that outlines the wishes of individuals who are married and have adult children from a previous marriage. This specific form caters to individuals residing in Kings County, New York. A Last Will and Testament is a vital legal instrument that allows individuals to dictate how their assets, properties, and other belongings should be distributed upon their death. In the case of a married person with adult children from a prior marriage, this form ensures that their assets are appropriately allocated to their chosen beneficiaries. Key features of the Kings New York Legal Last Will and Testament Form for a married person with adult children from a prior marriage include: 1. Property Distribution: This section enables the individual to allocate their assets among their spouse, adult children from a previous marriage, and potentially other beneficiaries. It allows for a clear and organized distribution of properties, which may include real estate, financial assets, personal belongings, and sentimental items. 2. Guardianship: In the event that both parents pass away, this form enables married individuals to designate a guardian for their minor children or any dependents from a prior relationship. This provision ensures that the children's well-being and upbringing remain in capable hands. 3. Executor Appointment: The person creating the will (known as the testator) can appoint an executor who will be responsible for overseeing the will's administration, including the proper distribution of assets, paying debts and taxes, and handling legal matters. The executor should be a trusted individual capable of carrying out these duties. 4. Alternate Beneficiaries: In case any chosen beneficiary predeceases the testator or is unable or unwilling to accept the designated assets, this section allows for the selection of alternate beneficiaries, ensuring that the assets are not left unallocated. While there may not be different types of Kings New York Legal Last Will and Testament Forms specifically tailored to married individuals with adult children from prior marriages, variations of this form may exist to accommodate specific circumstances or desires within the testator's estate plan. It is recommended to consult with an attorney, who can assist in drafting a personalized last will and testament that addresses the unique needs and concerns of a married person with adult children from a prior marriage in Kings County, New York.

The Kings New York Legal Last Will and Testament Form for Married person with Adult Children from Prior Marriage is a legally binding document that outlines the wishes of individuals who are married and have adult children from a previous marriage. This specific form caters to individuals residing in Kings County, New York. A Last Will and Testament is a vital legal instrument that allows individuals to dictate how their assets, properties, and other belongings should be distributed upon their death. In the case of a married person with adult children from a prior marriage, this form ensures that their assets are appropriately allocated to their chosen beneficiaries. Key features of the Kings New York Legal Last Will and Testament Form for a married person with adult children from a prior marriage include: 1. Property Distribution: This section enables the individual to allocate their assets among their spouse, adult children from a previous marriage, and potentially other beneficiaries. It allows for a clear and organized distribution of properties, which may include real estate, financial assets, personal belongings, and sentimental items. 2. Guardianship: In the event that both parents pass away, this form enables married individuals to designate a guardian for their minor children or any dependents from a prior relationship. This provision ensures that the children's well-being and upbringing remain in capable hands. 3. Executor Appointment: The person creating the will (known as the testator) can appoint an executor who will be responsible for overseeing the will's administration, including the proper distribution of assets, paying debts and taxes, and handling legal matters. The executor should be a trusted individual capable of carrying out these duties. 4. Alternate Beneficiaries: In case any chosen beneficiary predeceases the testator or is unable or unwilling to accept the designated assets, this section allows for the selection of alternate beneficiaries, ensuring that the assets are not left unallocated. While there may not be different types of Kings New York Legal Last Will and Testament Forms specifically tailored to married individuals with adult children from prior marriages, variations of this form may exist to accommodate specific circumstances or desires within the testator's estate plan. It is recommended to consult with an attorney, who can assist in drafting a personalized last will and testament that addresses the unique needs and concerns of a married person with adult children from a prior marriage in Kings County, New York.