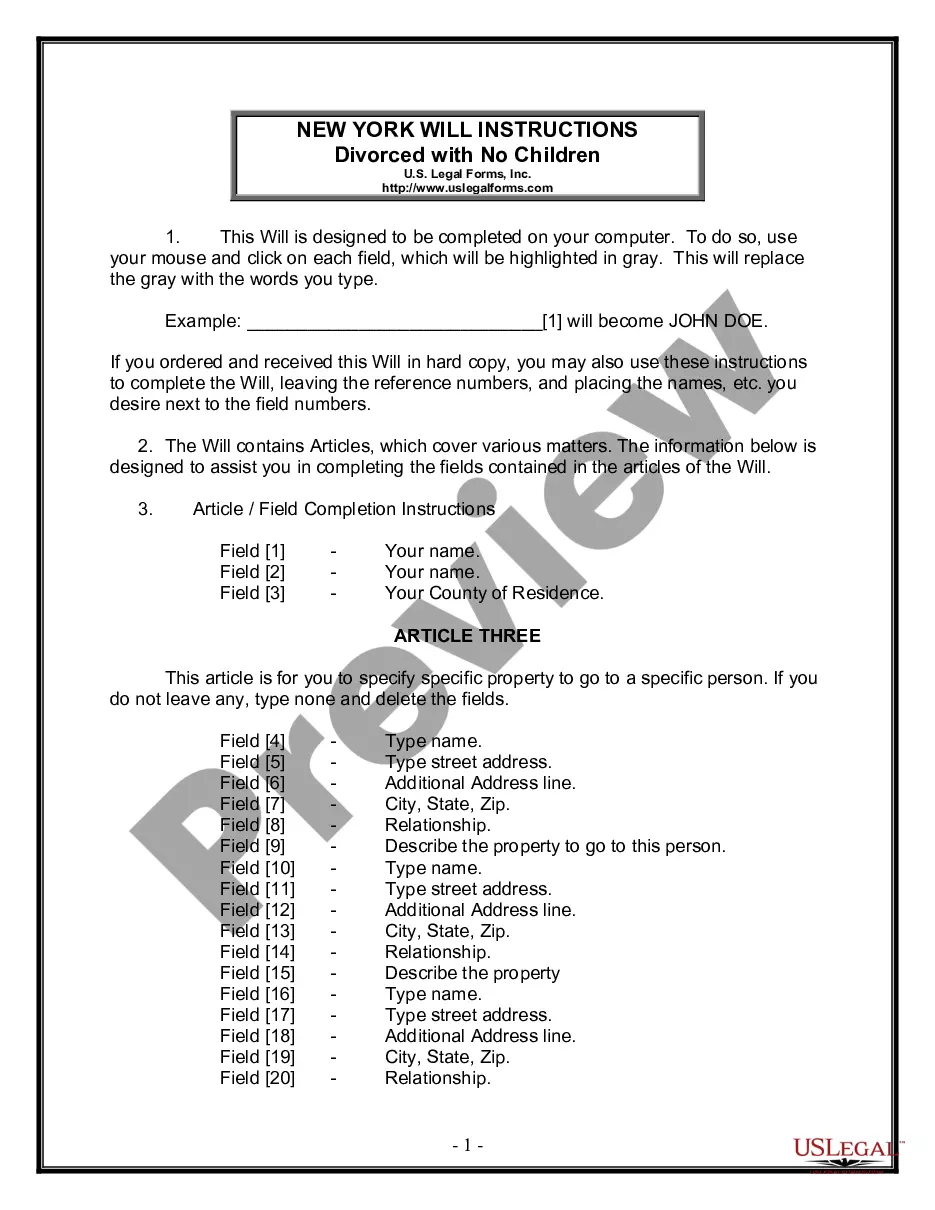

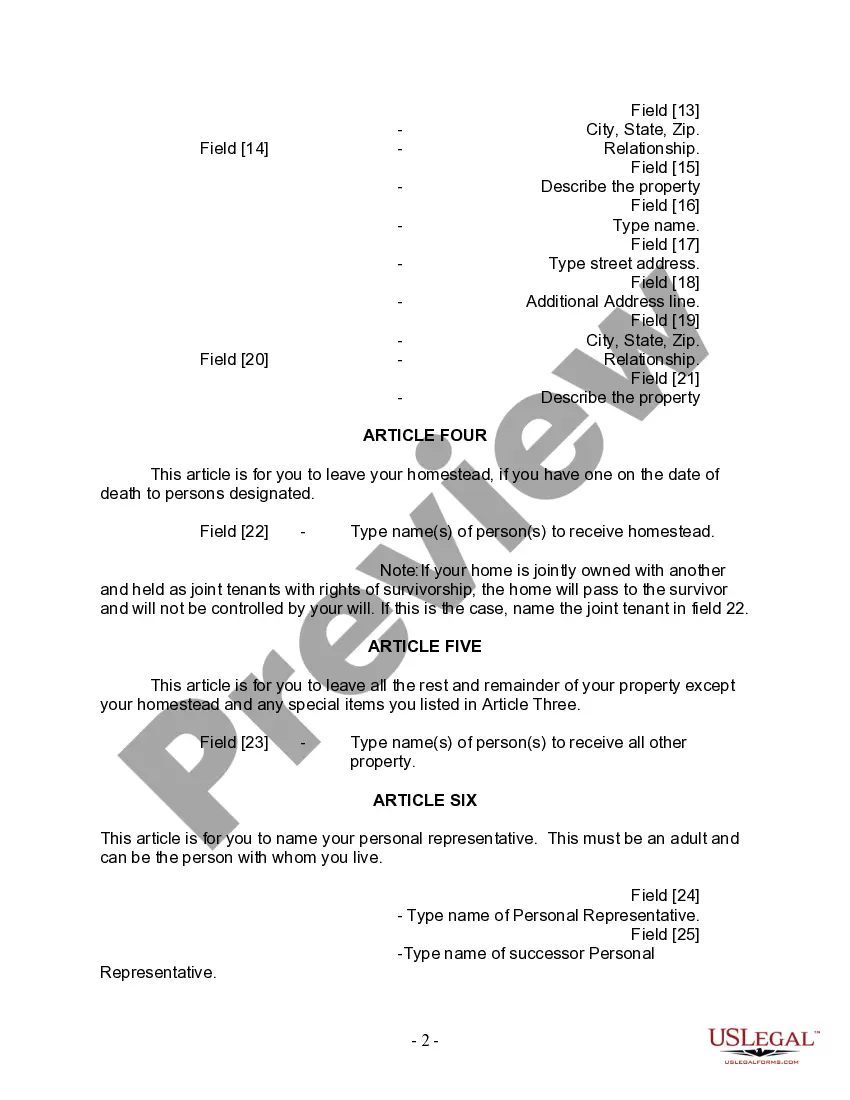

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. Queens New York Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a specific legal document that allows individuals who are divorced and not remarried, with no children, to outline their final wishes and distribute their assets upon their death. This testamentary form ensures that the individual's estate is handled in accordance with their preferences and in compliance with the laws of Queens, New York. This Queens New York Legal Last Will and Testament Form is tailored specifically for divorced individuals who have not remarried and do not have any children. It addresses the unique circumstances and concerns of this group, ensuring their assets are protected and allocated as desired. The contents of the Queens New York Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children typically include the following: 1. Introduction: The document will begin with an introduction stating that it is the Last Will and Testament of the individual filing the form. It may also restate their full name, address, and other personal details to establish their identity. 2. Appointment of Executor: The individual will appoint an executor, a person who will be responsible for managing the distribution of their assets and ensuring that their final wishes are carried out. The executor's name, address, and contact information will be included. 3. Revocation of Prior Wills: The individual will declare that any previous wills or codicils they may have made are hereby revoked, ensuring that the most current version of their will is considered legally binding. 4. Distribution of Assets: The form will outline how the individual's assets should be distributed upon their death. This can include specific bequests, such as leaving certain possessions or monetary gifts to specific individuals or organizations. 5. Residual Estate: In the absence of specific bequests, the individual will determine how the residual estate (remaining assets) should be divided among beneficiaries. This section may also include alternate beneficiaries in case the primary choices are unable to receive the assets. 6. Guardian Designation: If the individual has any dependents or incapacitated family members, they may use this section to designate a guardian who will be responsible for their care in the individual's absence. 7. Signatures and Witnesses: The Queens New York Legal Last Will and Testament Form requires the individual's signature, as well as the signatures of two witnesses who must be present during the signing. This is to ensure the document's validity. It's important to note that there may be variations of the Queens New York Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children depending on the specific requirements of the individual and their needs. Some individuals may choose to consult with an attorney to create a custom will that addresses their unique circumstances more comprehensively.

Queens New York Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a specific legal document that allows individuals who are divorced and not remarried, with no children, to outline their final wishes and distribute their assets upon their death. This testamentary form ensures that the individual's estate is handled in accordance with their preferences and in compliance with the laws of Queens, New York. This Queens New York Legal Last Will and Testament Form is tailored specifically for divorced individuals who have not remarried and do not have any children. It addresses the unique circumstances and concerns of this group, ensuring their assets are protected and allocated as desired. The contents of the Queens New York Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children typically include the following: 1. Introduction: The document will begin with an introduction stating that it is the Last Will and Testament of the individual filing the form. It may also restate their full name, address, and other personal details to establish their identity. 2. Appointment of Executor: The individual will appoint an executor, a person who will be responsible for managing the distribution of their assets and ensuring that their final wishes are carried out. The executor's name, address, and contact information will be included. 3. Revocation of Prior Wills: The individual will declare that any previous wills or codicils they may have made are hereby revoked, ensuring that the most current version of their will is considered legally binding. 4. Distribution of Assets: The form will outline how the individual's assets should be distributed upon their death. This can include specific bequests, such as leaving certain possessions or monetary gifts to specific individuals or organizations. 5. Residual Estate: In the absence of specific bequests, the individual will determine how the residual estate (remaining assets) should be divided among beneficiaries. This section may also include alternate beneficiaries in case the primary choices are unable to receive the assets. 6. Guardian Designation: If the individual has any dependents or incapacitated family members, they may use this section to designate a guardian who will be responsible for their care in the individual's absence. 7. Signatures and Witnesses: The Queens New York Legal Last Will and Testament Form requires the individual's signature, as well as the signatures of two witnesses who must be present during the signing. This is to ensure the document's validity. It's important to note that there may be variations of the Queens New York Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children depending on the specific requirements of the individual and their needs. Some individuals may choose to consult with an attorney to create a custom will that addresses their unique circumstances more comprehensively.