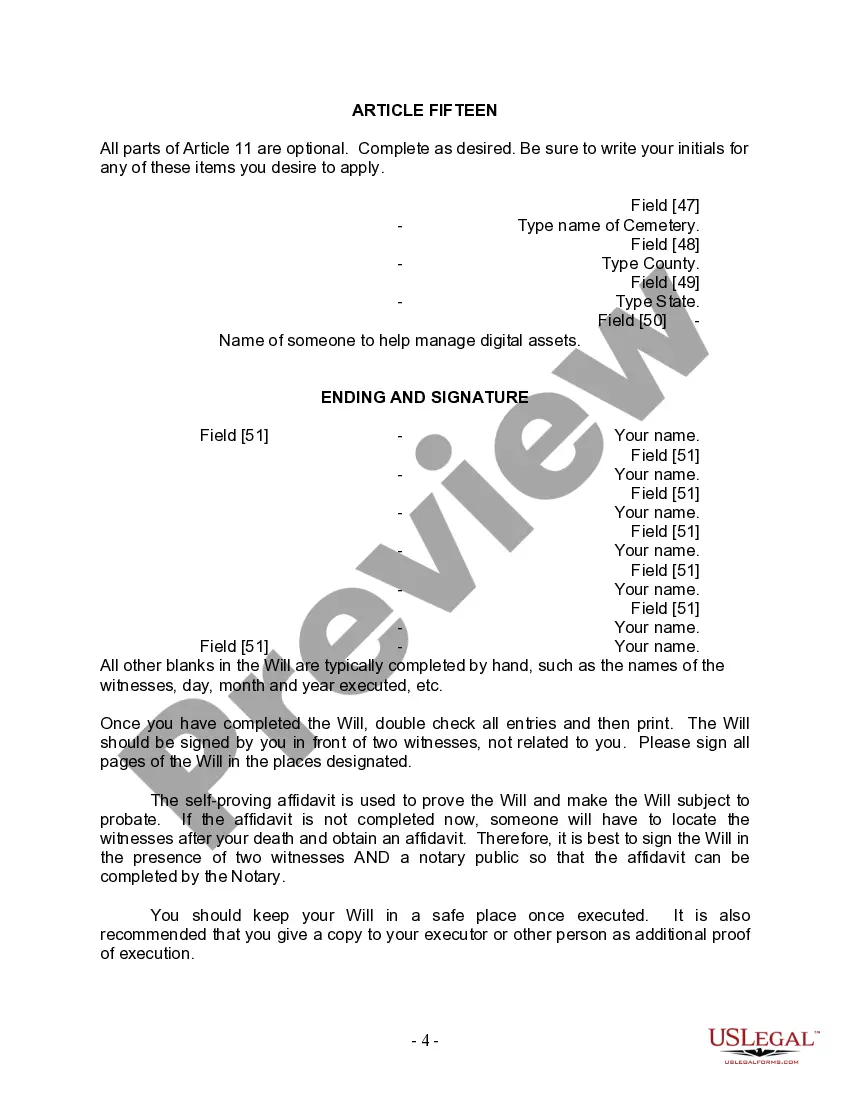

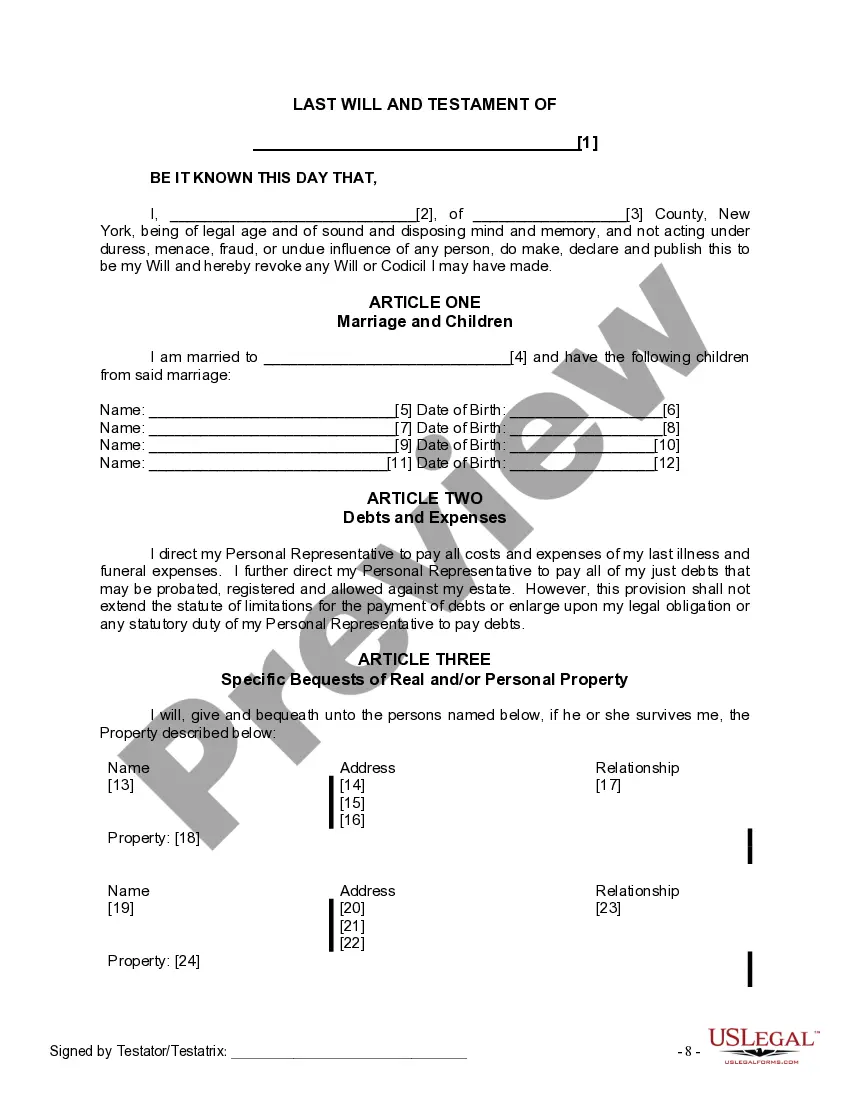

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Bronx New York Last Will and Testament for Married person with Minor Children

Description

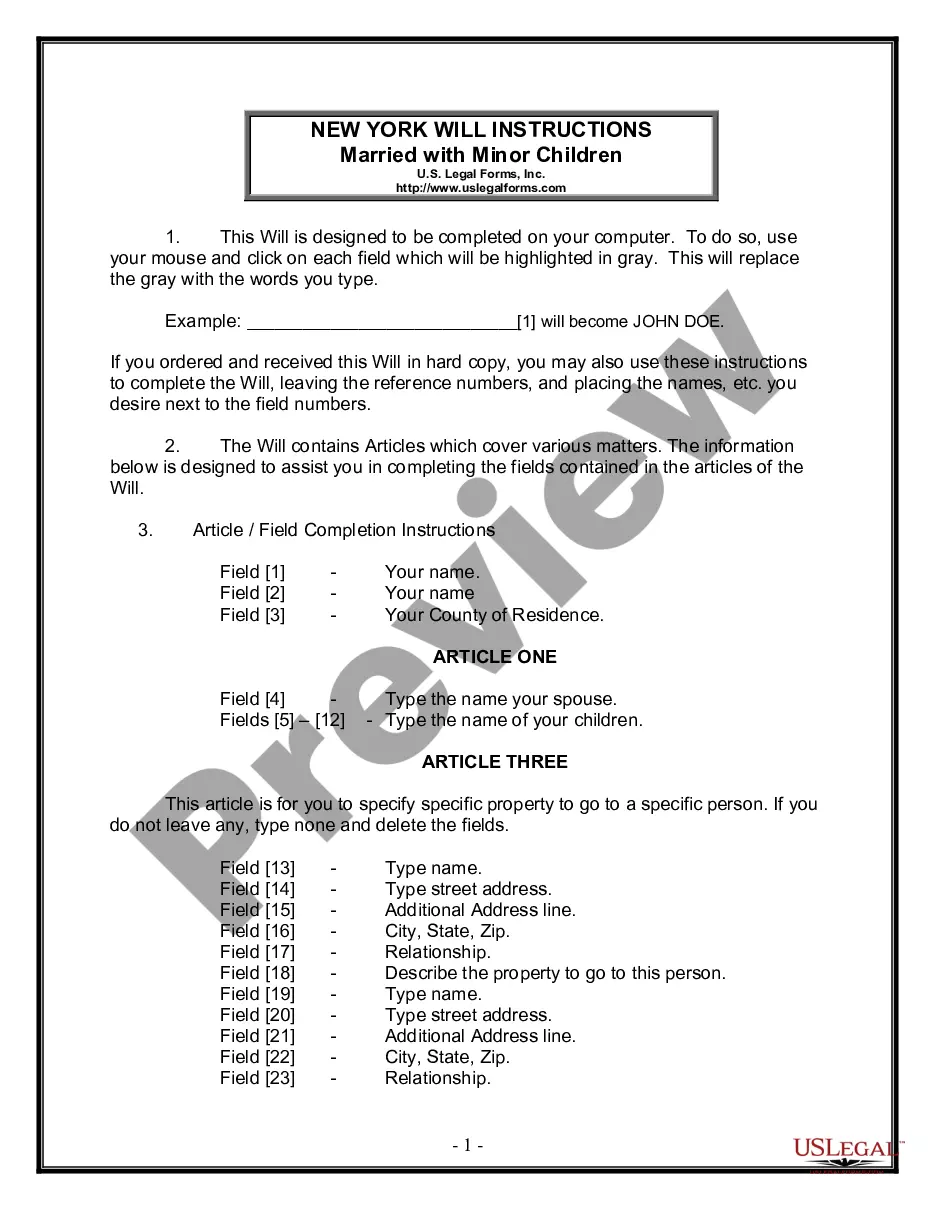

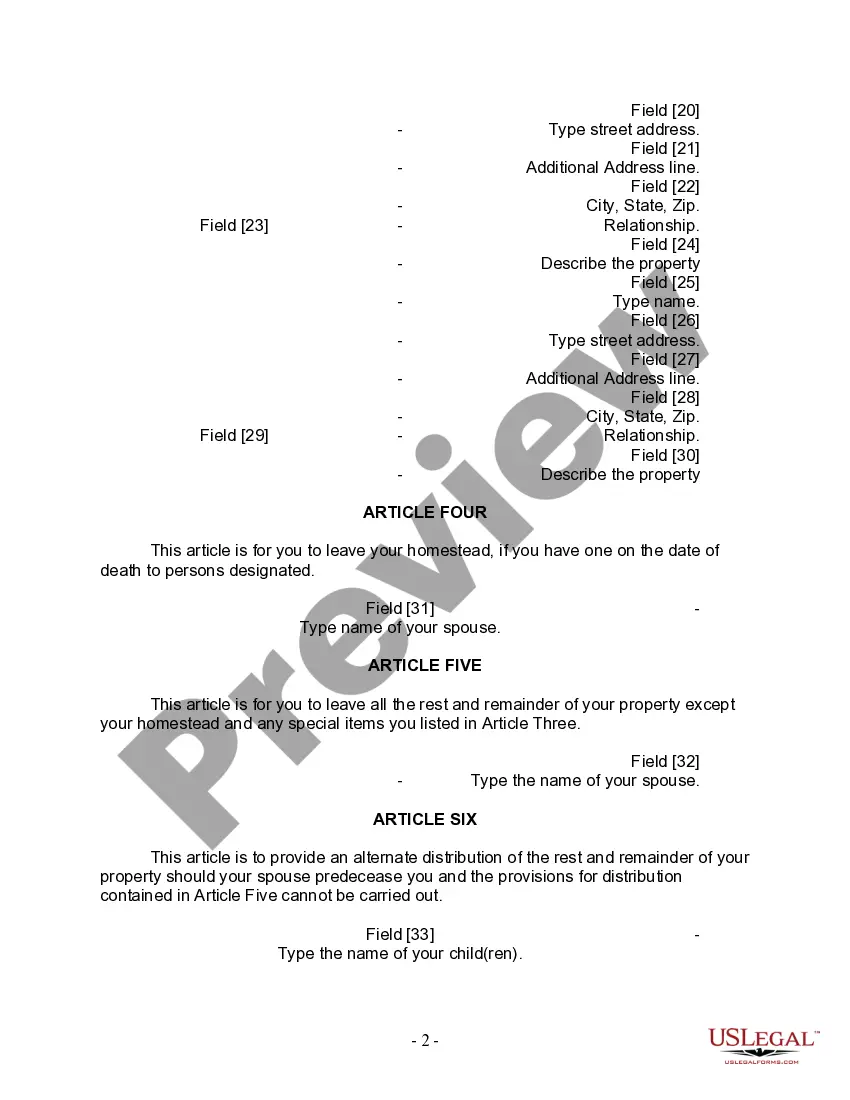

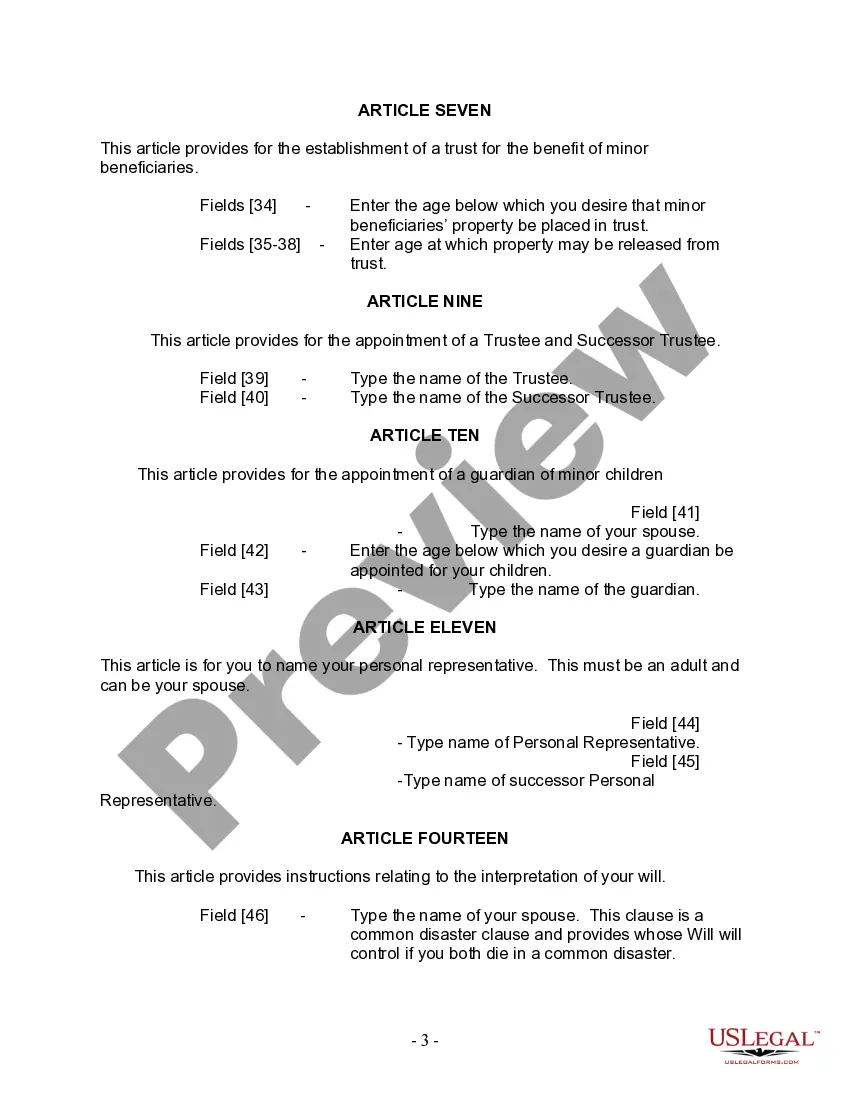

How to fill out New York Last Will And Testament For Married Person With Minor Children?

If you have previously utilized our service, sign in to your account and download the Bronx New York Legal Last Will and Testament Template for Married individuals with Minor Children onto your device by clicking the Download button. Confirm that your subscription is active. If it is not, renew it according to your payment schedule.

If this is your first time using our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have procured: you can find it in your profile under the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to conveniently locate and save any template for your personal or professional requirements!

- Ensure you’ve located an appropriate document. Review the description and use the Preview feature, if available, to verify if it fulfills your requirements. If it doesn’t fit your needs, utilize the Search tab above to find the right one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process your payment. Use your credit card information or the PayPal choice to finalize the purchase.

- Obtain your Bronx New York Legal Last Will and Testament Template for Married individuals with Minor Children. Choose the file format for your document and save it to your device.

- Complete your sample. Print it or leverage professional online editors to fill it out and sign electronically.

Form popularity

FAQ

In New York, you do not need to register a Bronx New York Last Will and Testament for a married person with minor children for it to be valid. However, filing it with the court after your passing can simplify the probate process. It is wise to keep your will in a safe place and inform trusted individuals about its location. This approach can help streamline matters for your loved ones in the future.

Determining the validity of a Bronx New York Last Will and Testament for a married person with minor children involves several factors. Key elements include the testator's age, mental competency, and execution with the proper formalities, such as signatures and witnesses. New York courts will closely examine these aspects if disputes arise. Understanding these factors can help ensure your will is respected.

Several factors can render a Bronx New York Last Will and Testament for a married person with minor children invalid. For instance, if the document lacks proper signatures or witnesses, it may not hold up in court. Additionally, if the testator was under duress, not of sound mind, or underage, the will could also be challenged. To avoid these pitfalls, consider using reliable resources to create your will.

A Bronx New York Last Will and Testament for a married person with minor children becomes legal when it meets New York's legal standards. This includes being in writing, signed by the testator, and witnessed by two individuals who are not beneficiaries. By adhering to these regulations, you can help ensure your will is executed as you intend. Taking time to understand these stipulations is vital for your peace of mind.

To create a valid Bronx New York Last Will and Testament for a married person with minor children, you must meet a few basic requirements. Firstly, you need to be at least 18 years old, of sound mind, and writing the will voluntarily. It also must be signed in the presence of two witnesses who understand the significance of the document. Following these steps can help ensure your will’s validity.

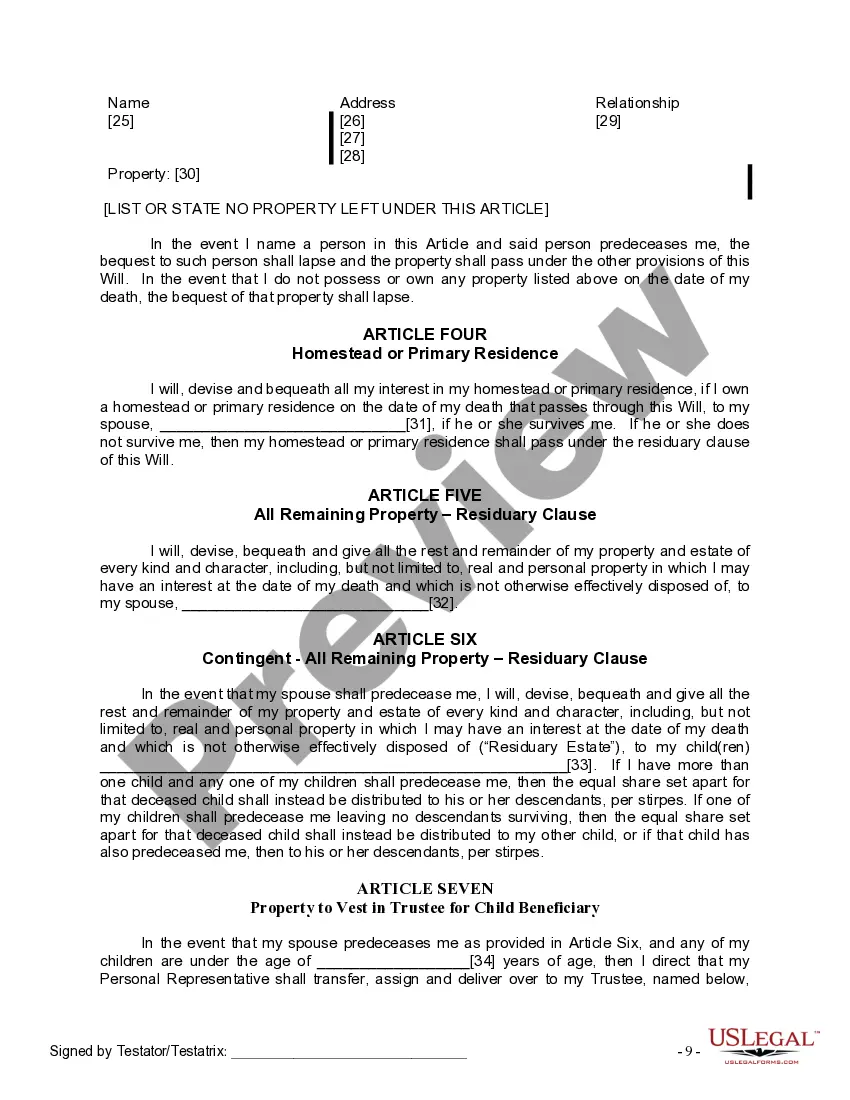

In New York, you can disinherit a minor child, but it requires careful planning. The law does not automatically favor a person over their children in inheritance matters. However, if you choose to exclude a minor child in your Bronx New York Last Will and Testament for a married person with minor children, it’s essential to state your intentions clearly. Consider discussing this with a legal professional to ensure your wishes are honored.

You should update your Bronx New York Last Will and Testament for a married person with minor children if your daughter gets married. This change can impact her inheritance rights and family dynamics. Keeping your will current ensures that your intentions reflect your family's situation accurately. It’s a good idea to review your will regularly after significant life events.

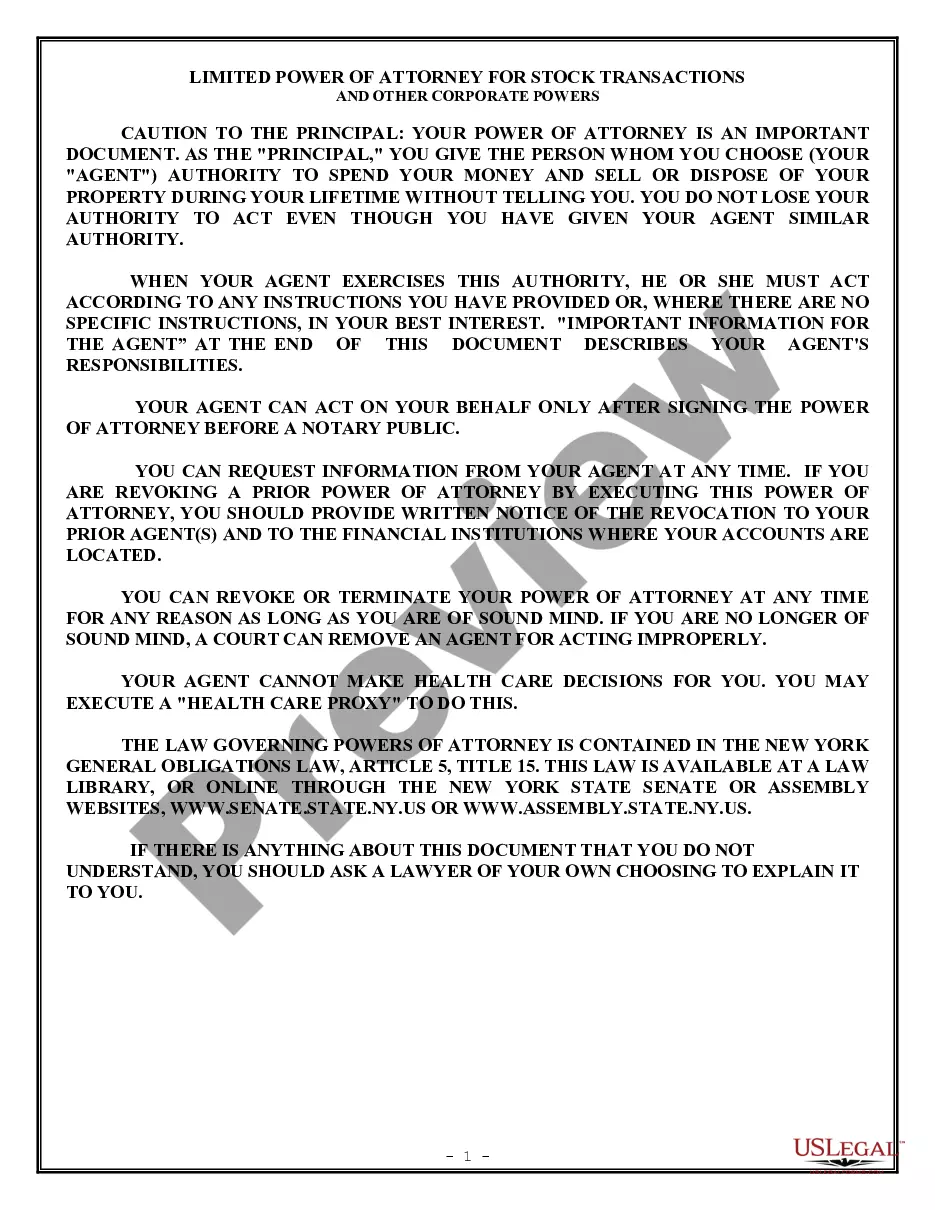

No, a will in New York does not have to be notarized, but it must be signed by two witnesses who are present at the same time. Adding a notarization can be valuable if you want to make the probate process more straightforward. A Bronx New York Last Will and Testament for Married persons with Minor Children can be executed effectively by meeting these witness requirements. Platforms like US Legal Forms offer assistance in creating a compliant will tailored to your needs.

In New York, a last will and testament does not need to be notarized to be valid. However, signing a will in the presence of witnesses can provide additional legal protection. Consider including a self-proving affidavit that is notarized, which can expedite the probate process later. Utilizing services from US Legal Forms can help you understand the best practices to create a Bronx New York Last Will and Testament for Married persons with Minor Children.

Yes, you can write your own will in New York State. It's crucial to ensure that your homemade will meets the legal requirements for a Bronx New York Last Will and Testament for Married persons with Minor Children. Include necessary information like your intentions regarding your assets and guardians for your children. To avoid common pitfalls, consider using tools from US Legal Forms that help ensure your will complies with state laws.