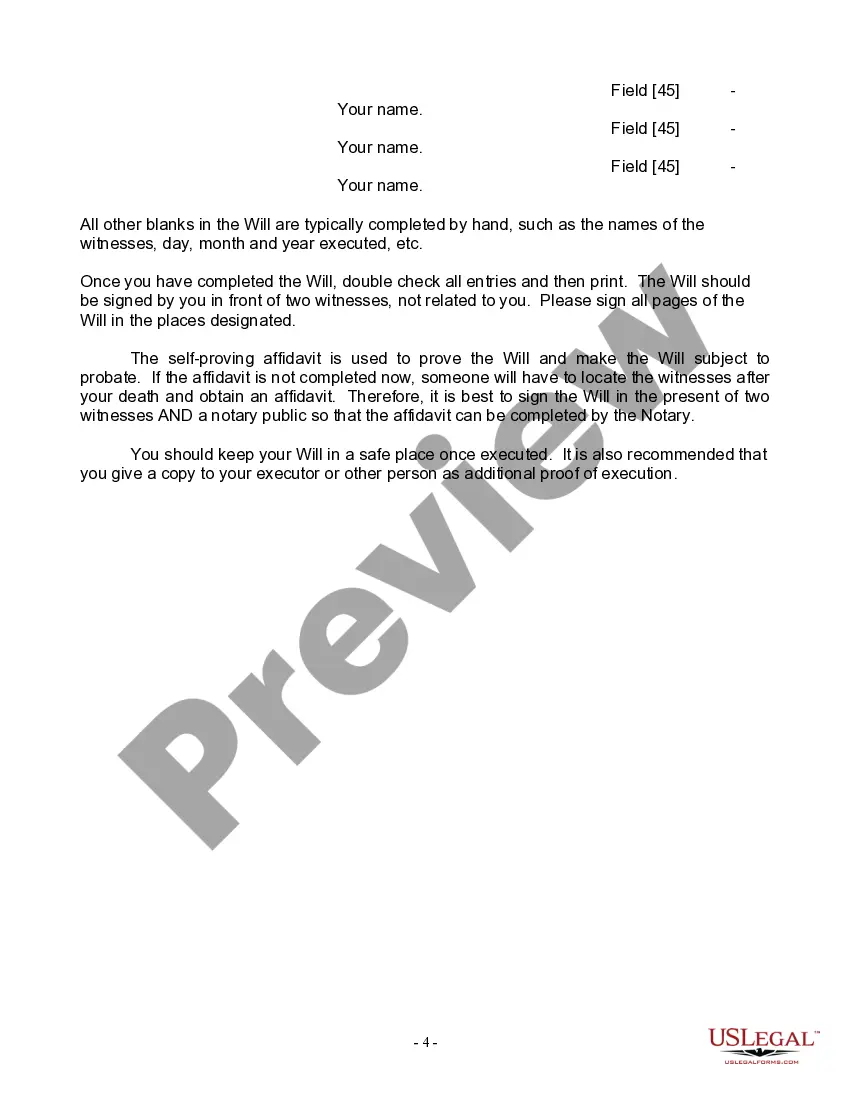

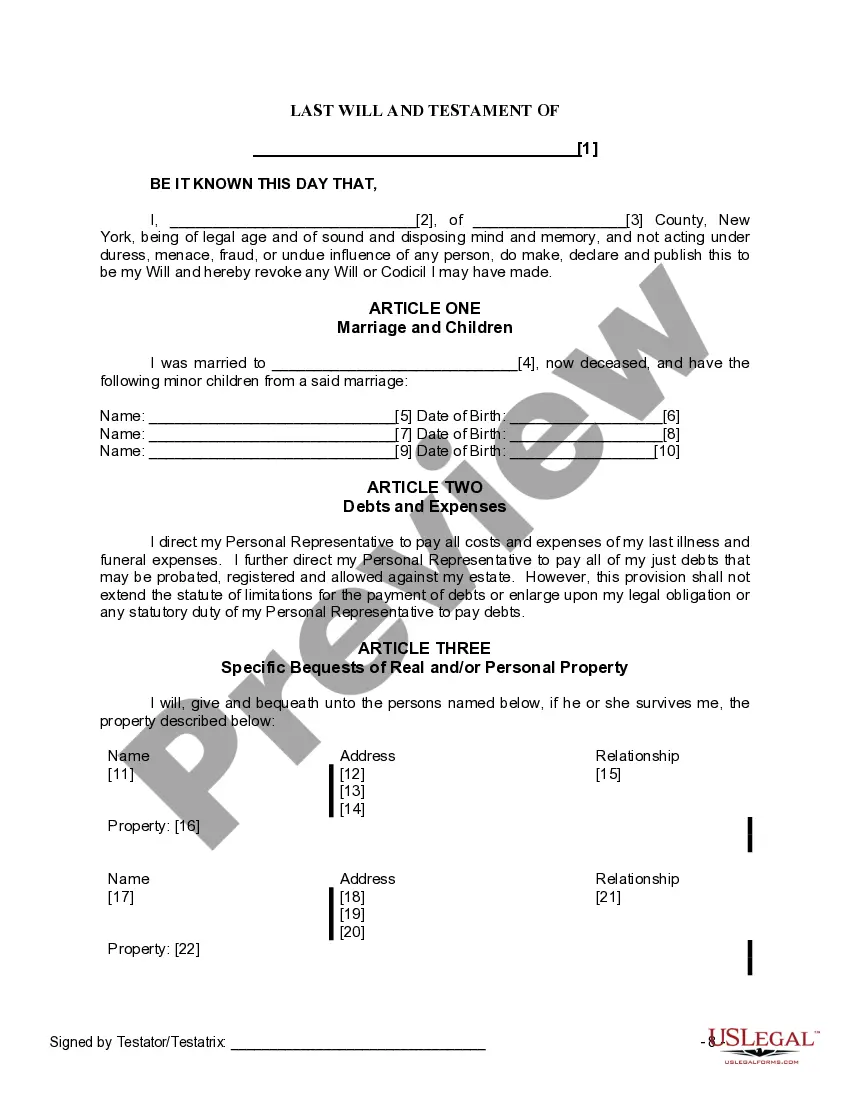

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Kings New York Last Will and Testament for Widow or Widower with Minor Children

Description

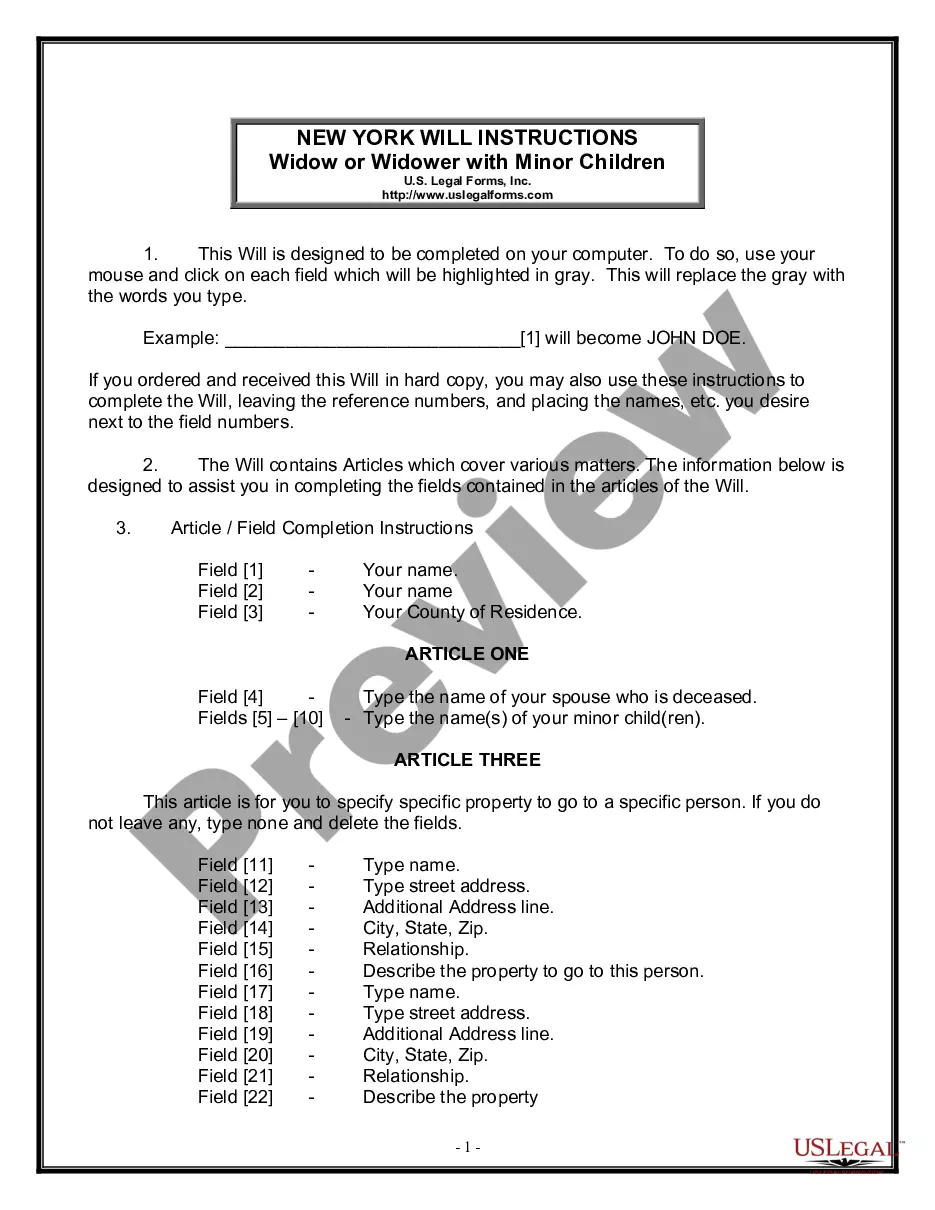

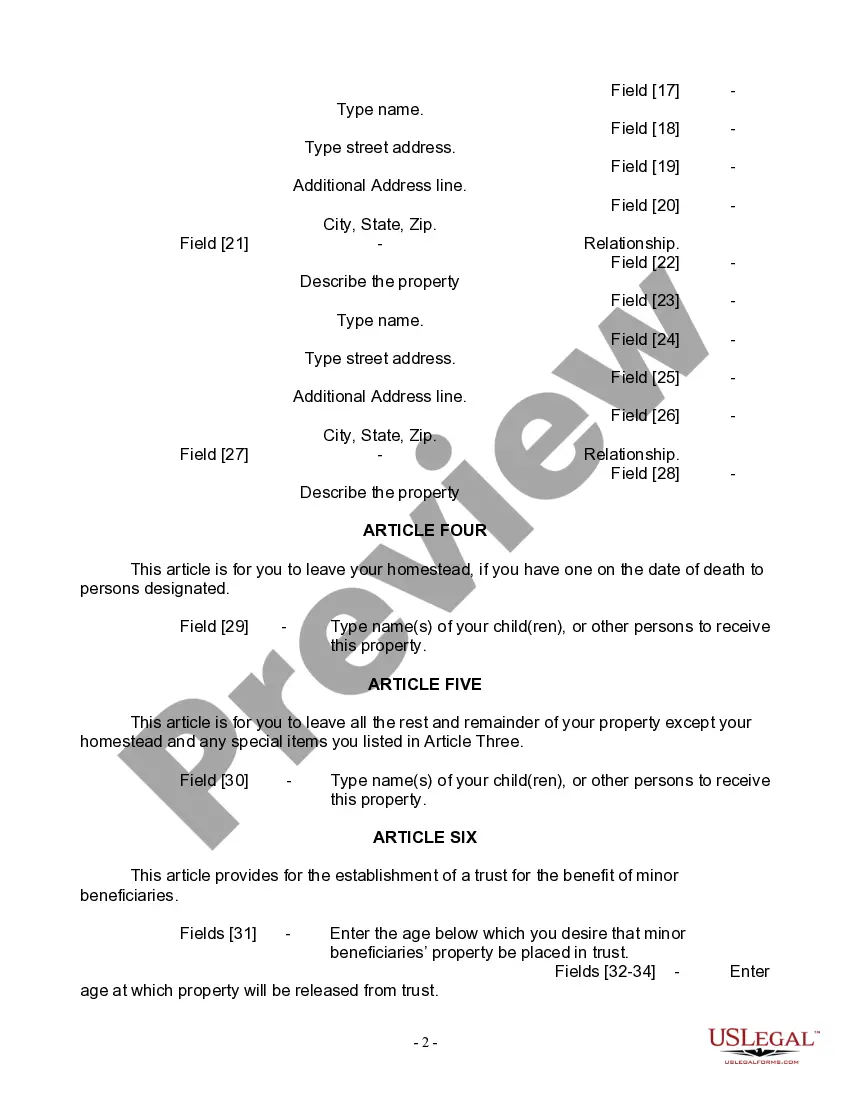

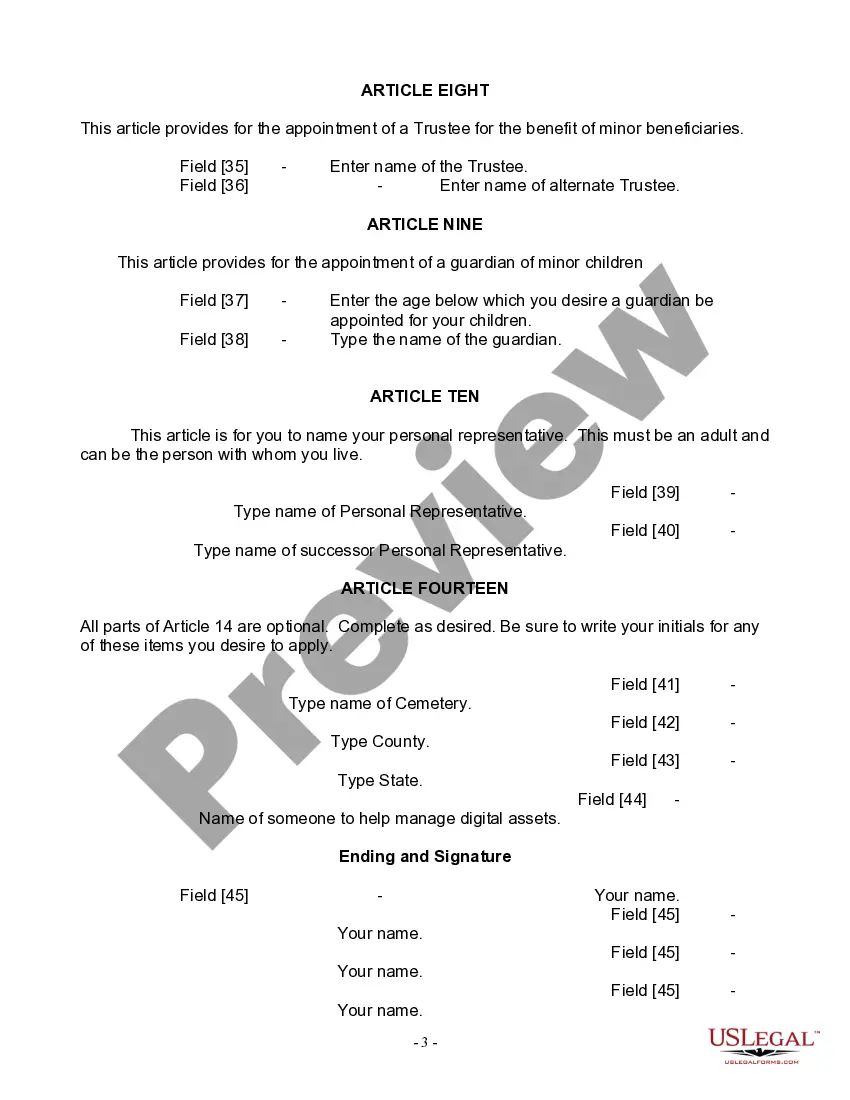

How to fill out New York Last Will And Testament For Widow Or Widower With Minor Children?

Leverage the US Legal Forms and gain instant access to any form example you require.

Our valuable website with a vast selection of document templates enables you to locate and acquire nearly any document example you need.

You can save, complete, and authenticate the Kings New York Legal Last Will and Testament Form for a Widow or Widower with Minor Children in just a few minutes instead of scouring the internet for many hours seeking a suitable template.

Utilizing our repository is an excellent approach to enhance the security of your form submission.

If you do not have an account yet, follow the steps outlined below.

Navigate to the page with the template you need. Ensure that it is the template you were searching for: verify its title and description, and utilize the Preview option when it's available. If not, make use of the Search bar to find the suitable one.

- Our knowledgeable legal experts routinely review all documents to confirm that the templates are appropriate for a specific state and comply with updated laws and regulations.

- How can you acquire the Kings New York Legal Last Will and Testament Form for a Widow or Widower with Minor Children.

- If you have a subscription already, simply sign in to your account.

- The Download option will be available on all the examples you review.

- Moreover, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

Yes, New York law establishes a time limit of seven years for claiming an inheritance. This limit is crucial for widows or widowers with minor children, as it influences their rights under a Kings New York Last Will and Testament for Widow or Widower with Minor Children. It is essential for beneficiaries to act swiftly to ensure their claims are recognized and secured.

In New York, wills must be filed with the court for them to be validated and recognized. This legal step is critical for ensuring that all provisions are enforceable, particularly for those drafting a Kings New York Last Will and Testament for Widow or Widower with Minor Children. Filing a will also provides transparency and helps in the settlement process.

New York's inheritance laws dictate how an estate is divided among heirs, particularly if there is a valid will. For widows or widowers with minor children, it’s significant to understand the roles of both parents in these laws, and how the Kings New York Last Will and Testament for Widow or Widower with Minor Children protects their interests. Consulting with experts or services like uslegalforms is invaluable in navigating these laws.

Yes, you can create a will without a lawyer in New York, as long as you meet specific legal requirements. However, for best results, especially for those looking to establish a Kings New York Last Will and Testament for Widow or Widower with Minor Children, it's advisable to utilize resources or platforms that ensure all legal standards are met. While DIY wills are possible, legal guidance can help avoid pitfalls.

To file a will in New York, you need the original will, a completed petition form, and a death certificate. For widows or widowers with minor children, additional documentation may be required to ensure the provisions in the Kings New York Last Will and Testament for Widow or Widower with Minor Children are honored. This process is crucial for using a legal platform like uslegalforms to streamline the complexity of estate management.

If a beneficiary does not claim their inheritance in a timely manner, the inheritance may revert to the estate. This can complicate matters for widows or widowers with minor children, as they might miss benefits specified in the Kings New York Last Will and Testament for Widow or Widower with Minor Children. Additionally, the timeframe to claim the inheritance is important to be aware of, as beneficiaries could lose their portion if they wait too long.

In New York, an heir typically has seven years to claim their inheritance from the date of the estate's distribution. This period allows widows or widowers with minor children to secure their rights under the Kings New York Last Will and Testament for Widow or Widower with Minor Children. It's essential to understand that this timeframe helps ensure that all claims are settled fairly.

Yes, in New York state, a spouse typically inherits the marital home upon the death of their partner, especially if there's no will stating otherwise. This automatic inheritance provides security for surviving spouses, particularly in families with minor children. To ensure everything is in order and plan appropriately, a Kings New York Last Will and Testament for Widow or Widower with Minor Children can be a vital tool. It helps clarify ownership and support your intentions.

In New York, you can disinherit a child, meaning you can choose not to include them as a beneficiary in your will. However, it is essential to document this decision clearly within your Kings New York Last Will and Testament for Widow or Widower with Minor Children to avoid potential disputes later. Keep in mind that disinheriting a child might lead to legal challenges, so it's wise to seek professional advice. Using a service like uslegalforms could simplify this process.

When a husband dies in New York, his wife maintains significant rights under state law. She is entitled to a share of the estate and may also claim a right of election if the will provides for less than her statutory share. In many scenarios, this ensures that she receives appropriate support, especially when minor children are involved. For comprehensive details, consult a Kings New York Last Will and Testament for Widow or Widower with Minor Children.