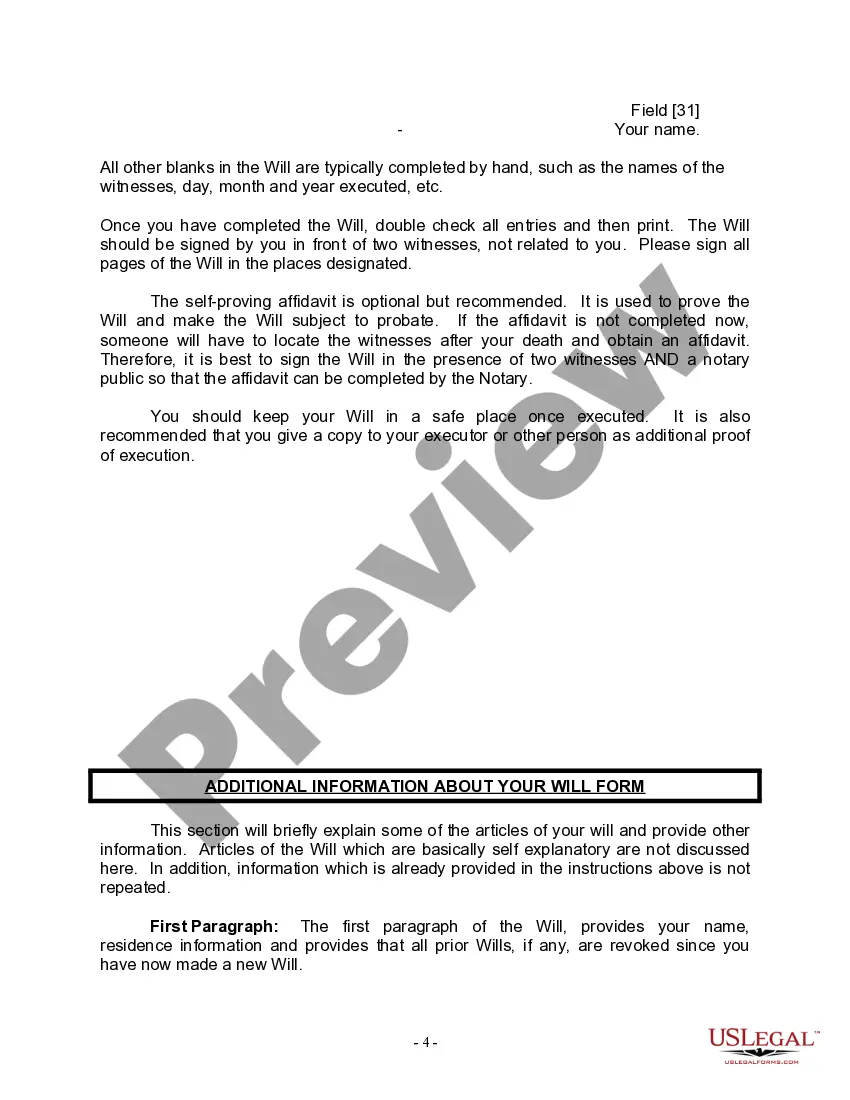

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. A Bronx New York Legal Last Will Form for a Widow or Widower with no Children is a crucial legal document that allows individuals to outline their final wishes and ensure the proper distribution of their assets upon their demise. This type of form specifically caters to unmarried individuals who have lost their spouse and do not have any children. By creating a Last Will, individuals can make important decisions regarding the transfer of their property, appoint an executor to oversee the process, and designate beneficiaries. The Bronx, being a borough of New York City, has specific laws and regulations related to estate planning. Therefore, it is essential to utilize a legally recognized Last Will form that complies with the local jurisdiction. Some common types of Bronx New York Legal Last Will Forms for a Widow or Widower with no Children could include: 1. Simple Last Will: A standard form that allows individuals to name an executor, designate beneficiaries, and specify how their assets and properties should be distributed after their demise. This form is suitable for those with uncomplicated estate plans. 2. Living Will: Also known as an advance healthcare directive, a living will enables individuals to express their healthcare preferences and end-of-life decisions. While not directly related to asset distribution, it is often recommended creating a living will alongside a Last Will form. 3. Testamentary Trust Will: This type of Last Will form establishes a trust for beneficiaries, usually minor children, and outlines the conditions for the assets to be transferred to the trust. It allows greater control over the distribution of assets and offers additional protection for beneficiaries. 4. Pour-Over Will: This document works in conjunction with a Revocable Living Trust, where the trust acts as the primary estate planning tool. The pour-over will ensure that any assets inadvertently not transferred to the trust during an individual's lifetime are ultimately "poured over" into it upon their death. When creating a Bronx New York Legal Last Will Form for a Widow or Widower with no Children, it is highly advisable to consult a qualified attorney familiar with local estate planning laws. They can provide personalized guidance, ensure the form adheres to legal requirements, and help tailor the Last Will to an individual's specific needs and circumstances.

A Bronx New York Legal Last Will Form for a Widow or Widower with no Children is a crucial legal document that allows individuals to outline their final wishes and ensure the proper distribution of their assets upon their demise. This type of form specifically caters to unmarried individuals who have lost their spouse and do not have any children. By creating a Last Will, individuals can make important decisions regarding the transfer of their property, appoint an executor to oversee the process, and designate beneficiaries. The Bronx, being a borough of New York City, has specific laws and regulations related to estate planning. Therefore, it is essential to utilize a legally recognized Last Will form that complies with the local jurisdiction. Some common types of Bronx New York Legal Last Will Forms for a Widow or Widower with no Children could include: 1. Simple Last Will: A standard form that allows individuals to name an executor, designate beneficiaries, and specify how their assets and properties should be distributed after their demise. This form is suitable for those with uncomplicated estate plans. 2. Living Will: Also known as an advance healthcare directive, a living will enables individuals to express their healthcare preferences and end-of-life decisions. While not directly related to asset distribution, it is often recommended creating a living will alongside a Last Will form. 3. Testamentary Trust Will: This type of Last Will form establishes a trust for beneficiaries, usually minor children, and outlines the conditions for the assets to be transferred to the trust. It allows greater control over the distribution of assets and offers additional protection for beneficiaries. 4. Pour-Over Will: This document works in conjunction with a Revocable Living Trust, where the trust acts as the primary estate planning tool. The pour-over will ensure that any assets inadvertently not transferred to the trust during an individual's lifetime are ultimately "poured over" into it upon their death. When creating a Bronx New York Legal Last Will Form for a Widow or Widower with no Children, it is highly advisable to consult a qualified attorney familiar with local estate planning laws. They can provide personalized guidance, ensure the form adheres to legal requirements, and help tailor the Last Will to an individual's specific needs and circumstances.