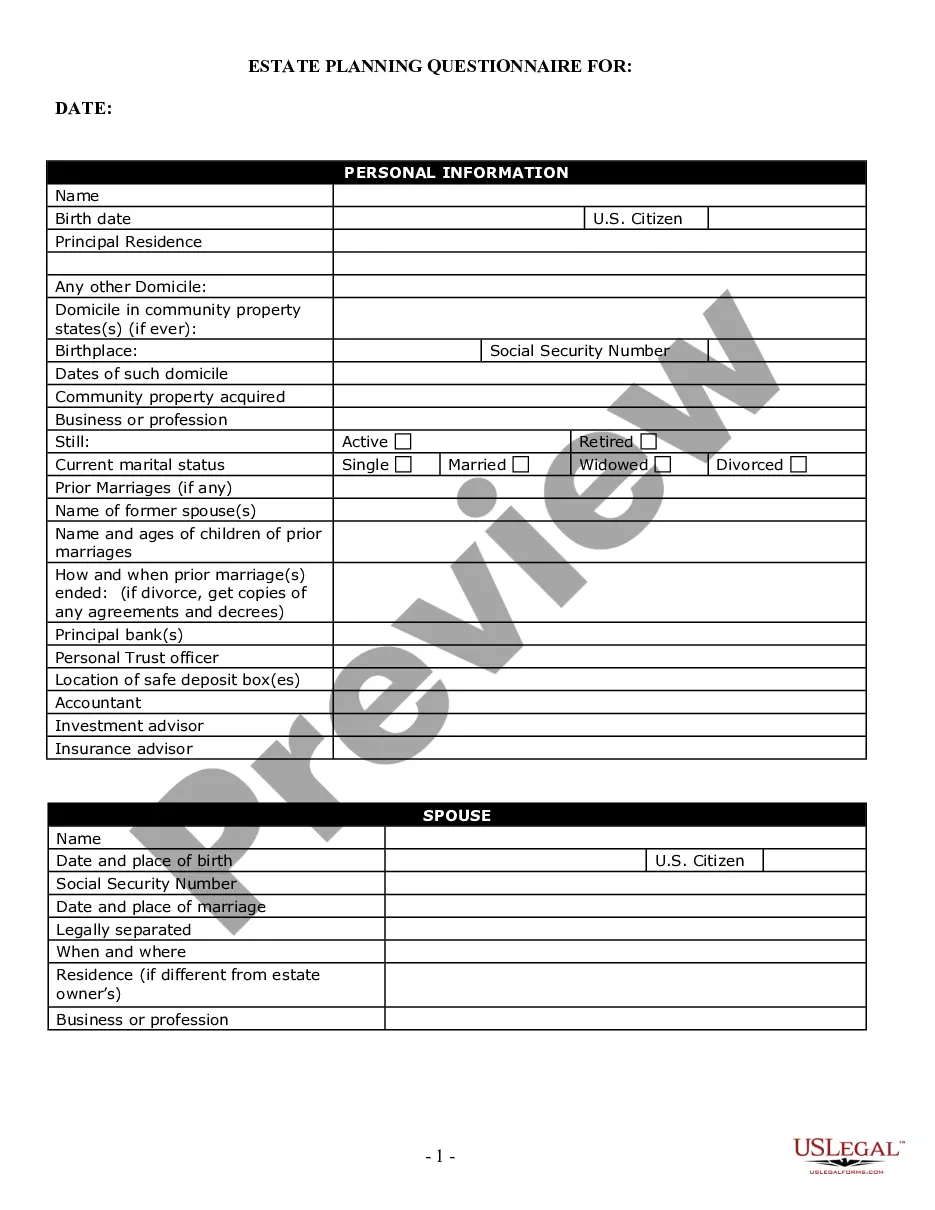

Kings New York Estate Planning Questionnaire and Worksheets are comprehensive tools designed to gather crucial information necessary for the estate planning process in the state of New York. These questionnaires and worksheets serve as an organized framework to help individuals and families establish their wishes and preferences regarding the management and distribution of assets and other affairs after their passing. The primary purpose of the Kings New York Estate Planning Questionnaire and Worksheets is to assist estate planning professionals, such as lawyers and financial advisors, in thoroughly understanding a client's unique circumstances, goals, and desires. By collecting in-depth details about a person's assets, liabilities, beneficiaries, healthcare preferences, and other essential factors, these documents offer a comprehensive snapshot of one's financial and personal situation, thus enabling the creation of a tailored estate plan. These questionnaires and worksheets cover a wide range of topics, each serving its purpose in the estate planning process. Some key areas covered may include: 1. Personal Information: This section collects vital details about the client, such as their full legal name, date of birth, contact information, and marital status. It may also inquire about any previous marriages and children from different relationships. 2. Beneficiaries and Heirs: Here, individuals can specify the individuals or organizations that should receive their assets upon their passing. They can name primary beneficiaries, alternate beneficiaries, and contingent beneficiaries, as well as assign specific assets or percentages of their estate to each. 3. Asset Inventory: This section allows individuals to create an inventory of their assets, including real estate, investments, bank accounts, life insurance policies, retirement accounts, business interests, and personal belongings. Detailed descriptions of each asset, along with their approximate values and ownership details, are typically requested. 4. Debts and Liabilities: Individuals will be prompted to disclose any outstanding debts, loans, mortgages, or other liabilities they have, allowing estate planners to make necessary arrangements for their payment or resolution. 5. Funeral and Burial Wishes: Kings New York Estate Planning Questionnaire and Worksheets often include a section for individuals to outline their preferences regarding funeral arrangements, burial or cremation options, and other related instructions. By providing a complete overview of a person's financial standing, obligations, and end-of-life preferences, these questionnaires and worksheets are instrumental in crafting legally valid and customized estate plans tailored to the client's needs. Different variations or versions of these questionnaires may exist, depending on the specific estate planning firm or lawyer utilizing them, but the overall objectives and content remain relatively consistent.

Kings New York Estate Planning Questionnaire and Worksheets

Description

How to fill out Kings New York Estate Planning Questionnaire And Worksheets?

If you are searching for a valid form template, it’s impossible to find a better place than the US Legal Forms website – probably the most extensive libraries on the internet. With this library, you can find a large number of document samples for business and individual purposes by categories and states, or key phrases. Using our advanced search option, getting the latest Kings New York Estate Planning Questionnaire and Worksheets is as elementary as 1-2-3. In addition, the relevance of each record is proved by a team of expert attorneys that on a regular basis review the templates on our platform and revise them in accordance with the newest state and county demands.

If you already know about our system and have an account, all you should do to get the Kings New York Estate Planning Questionnaire and Worksheets is to log in to your user profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the instructions below:

- Make sure you have opened the form you want. Look at its explanation and use the Preview function to explore its content. If it doesn’t suit your needs, use the Search option near the top of the screen to find the proper record.

- Affirm your choice. Select the Buy now option. Next, choose your preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Make use of your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Select the file format and save it on your device.

- Make adjustments. Fill out, revise, print, and sign the obtained Kings New York Estate Planning Questionnaire and Worksheets.

Each template you save in your user profile does not have an expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to receive an extra duplicate for enhancing or creating a hard copy, you may come back and save it again at any moment.

Take advantage of the US Legal Forms professional catalogue to gain access to the Kings New York Estate Planning Questionnaire and Worksheets you were looking for and a large number of other professional and state-specific samples on a single platform!