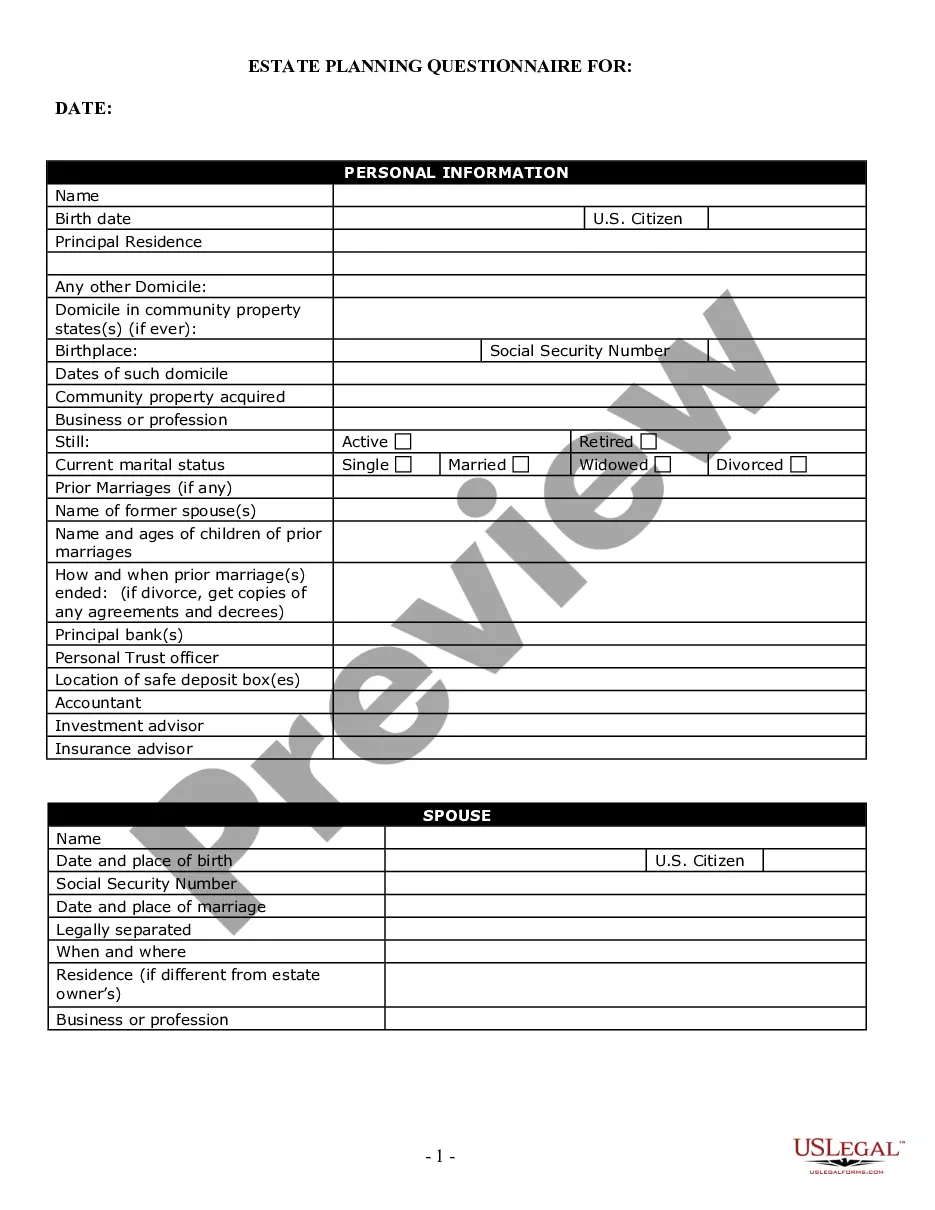

The Suffolk New York Estate Planning Questionnaire and Worksheets are comprehensive tools designed to assist individuals and families in planning their estates according to their specific needs and wishes. These documents play a crucial role in ensuring that one's assets and properties are distributed as desired and that their loved ones are adequately provided for after their passing. The questionnaire and worksheets consist of a series of in-depth questions and prompts that cover various aspects of estate planning. These include: 1. Personal information: The questionnaire collects personal details such as name, address, contact information, and social security number. This enables the creation of a personalized estate planning strategy. 2. Family background: These worksheets inquire about immediate family members, including spouses, children, and grandchildren. This information is crucial in determining the distribution of assets and determining beneficiaries. 3. Asset inventory: The questionnaire prompts the individual to list all their assets, including real estate, investments, bank accounts, retirement accounts, life insurance policies, and other valuable possessions. This comprehensive inventory allows for a precise distribution plan. 4. Debts and liabilities: It is essential to ascertain any outstanding debts, mortgages, loans, or other financial obligations. Identification of these liabilities helps in crafting strategies to minimize their impact on estate planning. 5. Healthcare preferences: The Suffolk New York Estate Planning Questionnaire and Worksheets cover healthcare directives, consent for medical treatment, and end-of-life care decisions. This ensures that personal healthcare choices are respected and fulfilled in case of incapacity. 6. Guardianship arrangements: Individuals with minor children need to address guardianship arrangements. The questionnaire prompts parents to name preferred guardians who will take care of their children in the event of their untimely demise. 7. Charitable contributions: Many individuals wish to leave a lasting legacy through charitable donations. The document assists in identifying preferred charities and specifying contributions. Variations of the Suffolk New York Estate Planning Questionnaire and Worksheets may be tailored to specific purposes: — Estate Planning for Business Owners: This specialized version includes additional sections related to business succession planning, ensuring the smooth transfer of ownership and management to chosen individuals or entities. — Medicaid Planning: This variant focuses on helping individuals structure their assets and income to meet eligibility requirements for Medicaid long-term care benefits. — Elder Law Planning: This version is designed to address the unique challenges faced by older individuals, covering topics such as long-term care, guardianship, and healthcare decision-making. In summary, the Suffolk New York Estate Planning Questionnaire and Worksheets provide a comprehensive and structured approach to estate planning. They cover various aspects, including personal and family information, asset inventory, healthcare preferences, and guardianship arrangements. Different versions may cater to specific needs, such as business owners, Medicaid planning, and elder law planning.

Suffolk New York Estate Planning Questionnaire and Worksheets

Description

How to fill out Suffolk New York Estate Planning Questionnaire And Worksheets?

Make use of the US Legal Forms and get instant access to any form sample you want. Our helpful website with thousands of documents makes it easy to find and obtain almost any document sample you need. You can export, complete, and certify the Suffolk New York Estate Planning Questionnaire and Worksheets in a matter of minutes instead of surfing the Net for hours attempting to find the right template.

Utilizing our collection is a great way to increase the safety of your document filing. Our professional legal professionals regularly check all the records to ensure that the templates are appropriate for a particular region and compliant with new acts and regulations.

How do you obtain the Suffolk New York Estate Planning Questionnaire and Worksheets? If you already have a subscription, just log in to the account. The Download button will appear on all the samples you view. Furthermore, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the tips listed below:

- Open the page with the template you need. Make certain that it is the form you were seeking: verify its headline and description, and utilize the Preview option if it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the saving procedure. Select Buy Now and choose the pricing plan you like. Then, create an account and pay for your order using a credit card or PayPal.

- Download the file. Choose the format to obtain the Suffolk New York Estate Planning Questionnaire and Worksheets and modify and complete, or sign it according to your requirements.

US Legal Forms is one of the most significant and trustworthy document libraries on the internet. Our company is always happy to help you in any legal process, even if it is just downloading the Suffolk New York Estate Planning Questionnaire and Worksheets.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!