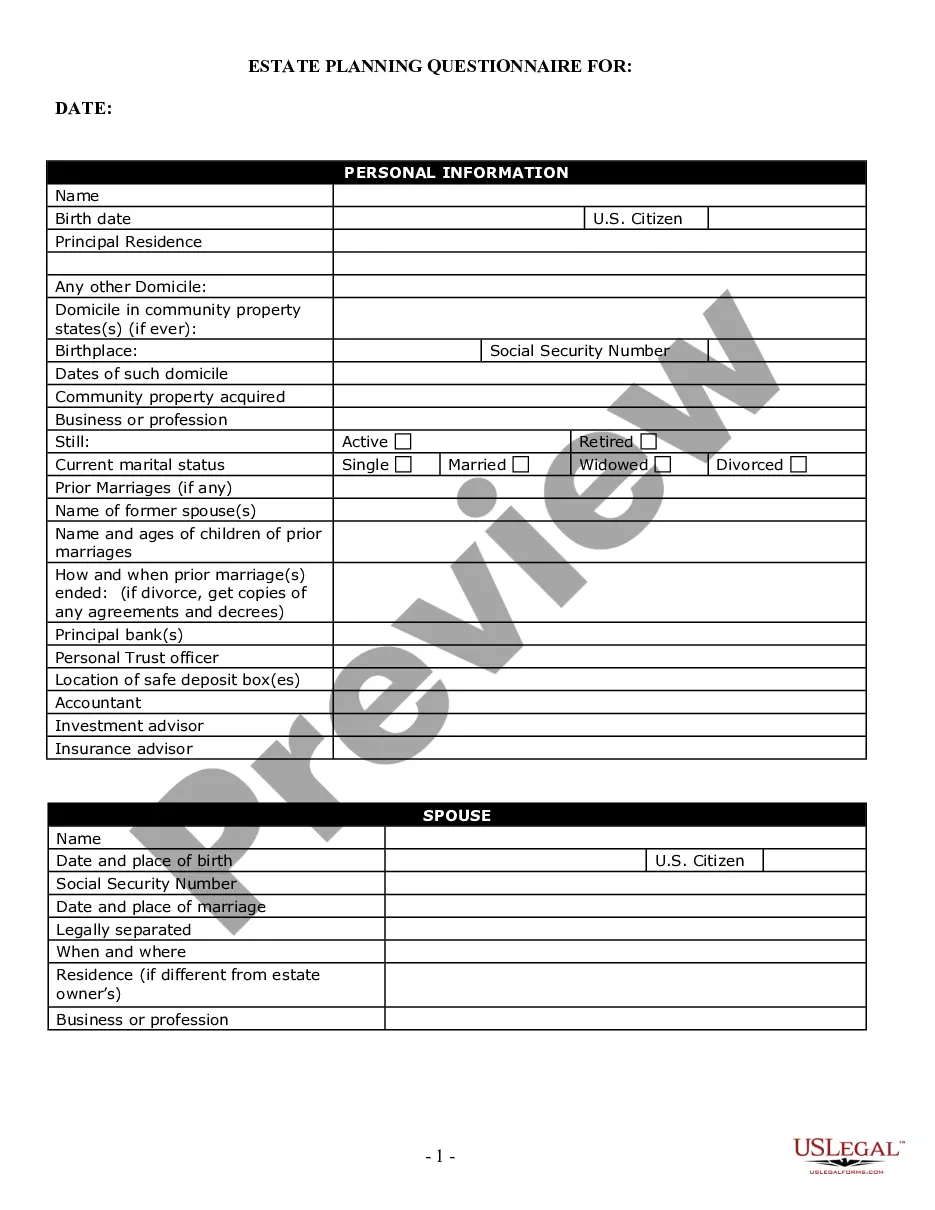

Syracuse New York Estate Planning Questionnaire and Worksheets play a crucial role in the estate planning process by providing individuals with a comprehensive tool to organize their assets, financial information, and key decisions for the future. These documents aim to assist both legal professionals and individuals in creating customized estate plans that align with their unique circumstances and wishes. The Syracuse New York Estate Planning Questionnaire and Worksheets typically encompass various sections covering important aspects of estate planning. These may include: 1. Personal Information: This section requires details such as the individual's name, contact information, marital status, and family members. It may also inquire about beneficiaries, guardians for minor children, and individuals appointed to handle different roles within the estate plan. 2. Assets and Liabilities: The questionnaire enables individuals to list and describe their assets, including real estate, investments, bank accounts, retirement accounts, life insurance policies, and personal property. Individuals are also prompted to record any outstanding debts or liabilities. 3. Estate Distribution: This section allows individuals to outline their desired distribution of assets after their passing. They can specify specific bequests, charitable donations, or the distribution among beneficiaries according to their preferences. 4. Health Care Proxy and Living Will: These documents focus on an individual's medical preferences in case they become incapacitated. Such provisions allow individuals to appoint someone to make medical decisions on their behalf and express their desires regarding life-sustaining treatments. 5. Power of Attorney: This section covers the appointment of an agent with legal authority to act on the maker's behalf in financial, business, and legal matters. It outlines the scope of authority granted and any restrictions or special instructions. 6. Trusts: Individuals may have the opportunity to detail any intended trusts for the management and distribution of assets, including revocable living trusts or special needs trusts. 7. Funeral and Burial Instructions: This section allows individuals to express their preferences regarding funeral arrangements, burial or cremation, and any specific instructions or wishes related to their final arrangements. The Syracuse New York Estate Planning Questionnaire and Worksheets are designed to be flexible and adaptable to meet the specific needs of individuals. Variations may exist based on different law firms, attorneys, or estate planning services. However, the primary objective remains to gather comprehensive information required for creating a well-structured and personalized estate plan tailored to an individual's wishes and goals.

Syracuse New York Estate Planning Questionnaire and Worksheets

Description

How to fill out Syracuse New York Estate Planning Questionnaire And Worksheets?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Syracuse New York Estate Planning Questionnaire and Worksheets gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Syracuse New York Estate Planning Questionnaire and Worksheets takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Syracuse New York Estate Planning Questionnaire and Worksheets. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!